The Alabama 40 form is a comprehensive document designed for residents and part-year residents of Alabama to report their individual income taxes for the tax year. It details various components such as income, deductions, tax liability, and potential refunds or...

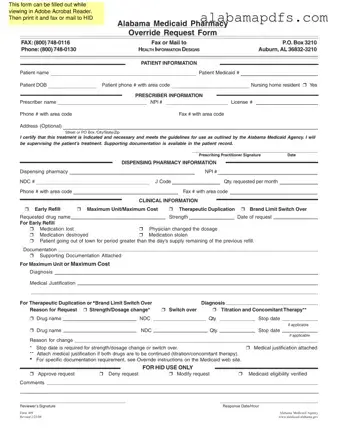

The Alabama 409 form serves as a vital tool for healthcare providers navigating the process of requesting pharmacy overrides within the context of Alabama Medicaid. Structured to be filled out digitally in Adobe Acrobat Reader and then either faxed or...

The Alabama 40ES form is an essential document provided by the Alabama Department of Revenue for calculating and submitting estimated tax payments for both individuals and corporations. Designed as a worksheet, it aids taxpayers in determining their anticipated tax liability...

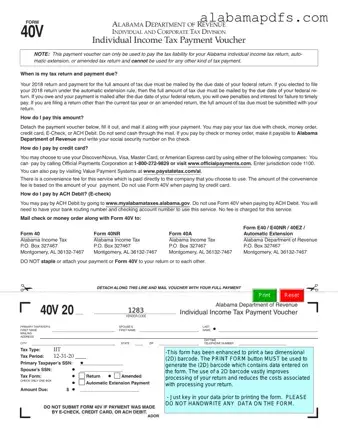

The Alabama 40V form is a vital document designed for taxpayers in Alabama to use when submitting payment for their individual income tax return, any automatic extension, or an amended tax return. It serves a specific purpose and cannot be...

The Alabama 40X form is officially known as the Amended Alabama Individual Income Tax Return or Application For Refund, designated for individuals looking to adjust their previously filed income tax returns within the state. This form caters to both amendments...

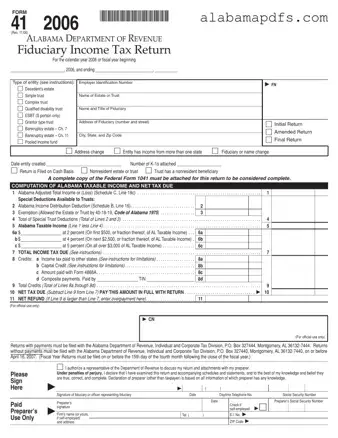

The Alabama 41 form, officially known as the Fiduciary Income Tax Return, is a document required by the Alabama Department of Revenue for reporting income, deductions, and taxes due for estates and trusts. It caters to various entities such as...

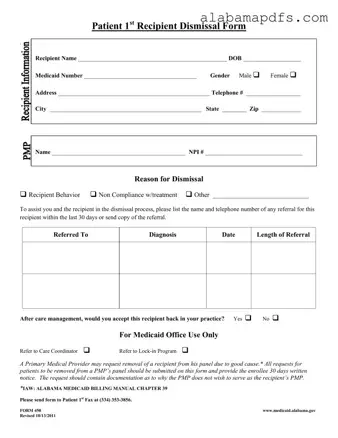

The Alabama 450 form, officially known as the Patient 1st Recipient Dismissal Form, is utilized by primary medical providers (PMPs) who wish to request the removal of a recipient from their panel. This form requires detailed information about the recipient,...

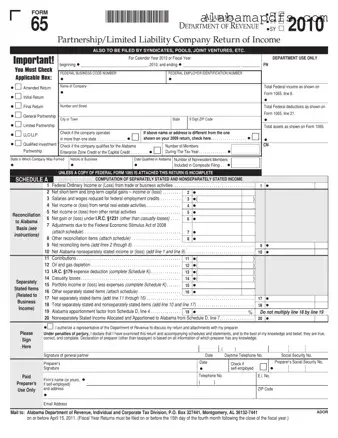

The Alabama 65 form is tailored for partnerships, limited liability companies (LLCs), and other similar entities to report their income to the Alabama Department of Revenue. Necessary for both calendar and fiscal year filings, it's integral for these organizations to...

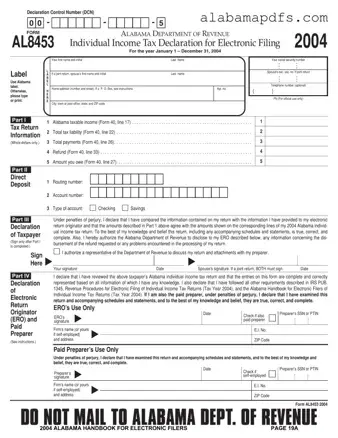

The Alabama 8453 form, officially known as the Individual Income Tax Declaration for Electronic Filing, is a document used by the Alabama Department of Revenue to authenticate the electronic filing of an individual's income tax return for a specific year....

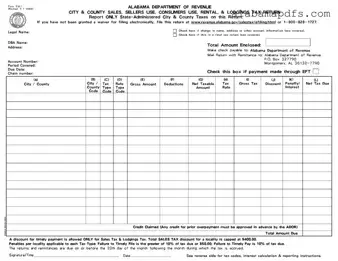

The Alabama 9501 form is a critical document used by businesses to request a direct pay permit for sales and use taxes within the state of Alabama. This form plays a vital role in ensuring businesses can handle their tax...

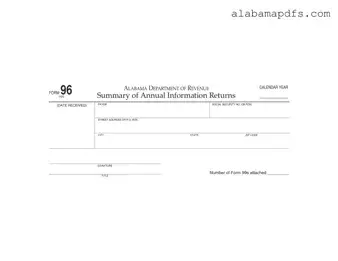

The Alabama 96 form is a critical document released by the Alabama Department of Revenue to summarize annual information returns. It concerns individuals, corporations, and agents responsible for reporting payments above $1,500 excluding interest coupons to taxpayers under the Alabama...

The Alabama A-1 Form serves as the Employer's Quarterly Return of Income Tax Withheld, mandating employers to report and pay withheld state income taxes from employees' wages. It outlines specifics such as the amount of tax withheld, the number of...