Irp Alabama Template

Navigating the complexities of fuel tax reporting in Alabama is simpler with the International Fuel Tax Agreement (IFTA) Quarterly Fuel Use Tax Schedule, IFTA-101-MN. This form plays a crucial role for licensees operating commercial vehicles across state lines, serving as a comprehensive document to report fuel usage by type—be it Diesel, Motor Fuel Gasolina, Ethanol, or Propane. Designed to streamline the process of calculating taxes due for operations within and outside of IFTA jurisdictions, the form demands careful input of miles traveled, fuel purchases, and tax payments. Precision in completing these sections, from identifying the fuel type to calculating the average fleet miles per gallon (MPG), is essential. Each fuel type requires a separate schedule, and for extensive operations, additional sheets may be added. Not only does the form facilitate a clear presentation of taxable gallons and the resulting tax credits or dues by jurisdiction, but it also requires meticulous attention to rate codes and interest calculations, should they apply. With the necessity of transferring subtotal amounts from multiple schedules to the main IFTA-100-MN tax return, accuracy in completing this form not only aids in compliance but also ensures that companies can effectively manage their fuel tax liabilities.

Irp Alabama Example

Check only one fuel type: |

|

|

|

|

Alabama Department of Revenue |

|

|

|

|

|

|

|

|

||||||||||||

|

|

Code |

Fuel Type |

|

|

IFTA Quarterly Fuel Use Tax Schedule |

|

|

|

||||||||||||||||

|

|

|

|

Attach this schedule to Form |

|

|

|

|

|

||||||||||||||||

Tax on: |

D |

(Diesel) |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

IFT A Quarterly Fuel U se T ax Return. |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

G |

(Motor fuel gasoline) |

|

|

|

|

|

Use this form to report operations for the |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Prepare a separate schedule for each fuel type. Use |

|

||||||||||||||||||||||

|

|

E |

(Ethanol) |

|

|

|

|

|

quarter ending |

|

|

|

|||||||||||||

|

|

|

|

|

additional sheets if necessary. Make a copy for your records. |

|

|

|

|

. |

|||||||||||||||

|

|

P |

(Propane) |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

Year |

||||

|

|

__ |

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Licensee IFTA identification number |

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

AL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter credits in brackets ( ). Round to the nearest whole gallon or mile. |

Read instructions (IFTA- 101- I- MN) carefully. |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MPG Calculation |

|

|

|

|

|

(E) |

Average Fleet MPG |

|||||

(A) Total IFTA Miles |

+ (B) Total Non- IFTA Miles |

= (C) Total Miles |

|

: |

|

(D) Total Gallons |

= |

||||||||||||||||||

(A) |

|

|

|

|

(B) |

|

|

|

(C) |

|

|

|

|

|

(all IFTA and |

|

(2 decimal places) |

||||||||

|

|

|

+ |

|

|

= |

|

|

: |

|

(D) |

|

|

|

= |

(E) |

___ ___ |

. ___ ___ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

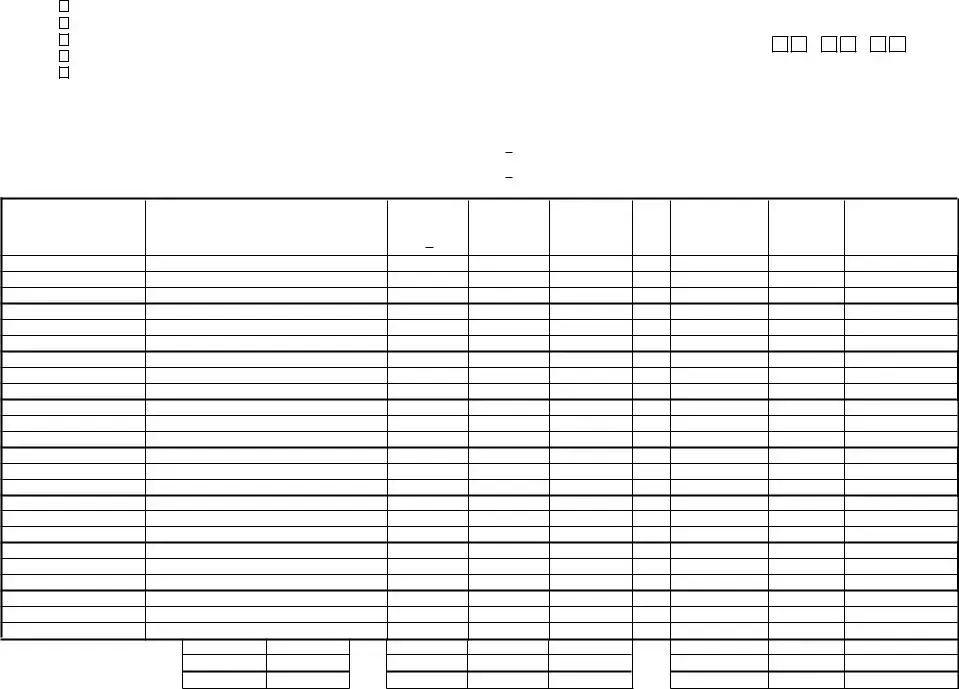

F

Jurisdiction

G

Rate Code

H |

I |

J |

Total IFTA |

Taxable |

MPG |

Miles |

Miles |

from E |

(See Instructions) |

(See Instructions) |

above |

|

|

|

K

Taxable Gallons

(col. I : J)

L

Tax Paid

Gallons

(See Instructions)

M

Net Taxable

Gallons

(col. K - L)

N

Tax Rate

O

Tax (Credit) Due

(col. M x N (Tax) ) (col. K x N (Surch) )

P

Interest

Due

Q

Total Due

(col. O + P)

Subtotals

Subtotals from back

Totals

Important Note: When listing additional jurisdictions and more space is needed, use the back of this form.

For Diesel, Motor fuel gasoline, Ethanol andPropane reported, transfer the total |

|

|

amount in Column Q from each schedule to the corresponding line on |

|

|

Form |

|

|

the total amount of Column Q from each schedule to Column S of the worksheet on the |

IFTA- 101- MN (4/08) |

|

back of Form |

||

|

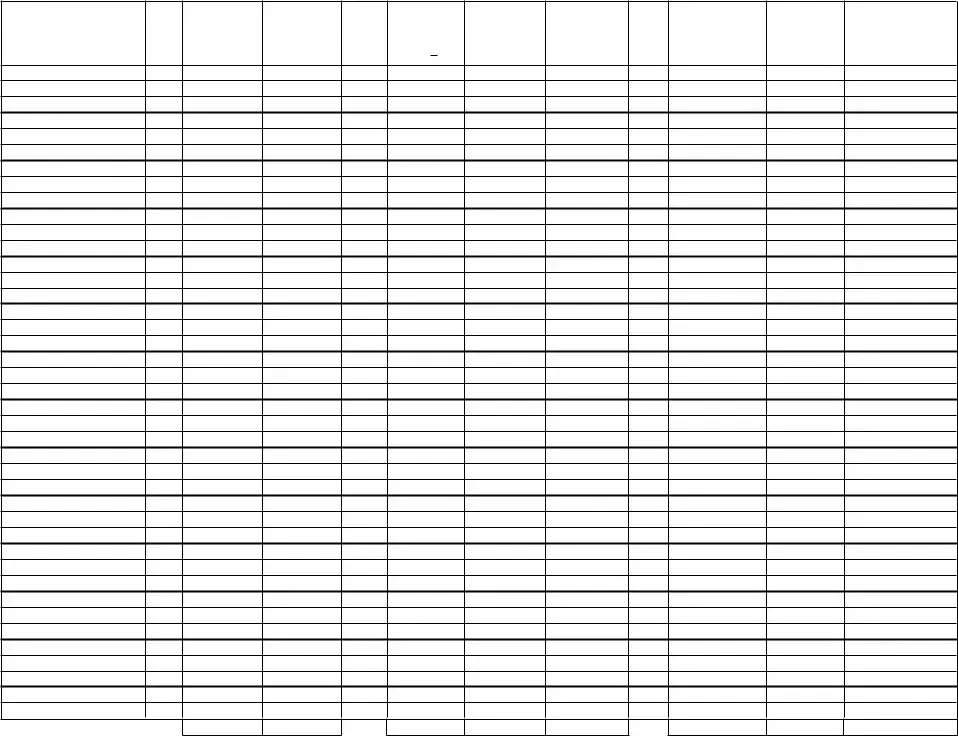

F

Jurisdiction

G

Rate Code

H |

I |

Total IFTA |

Taxable |

Miles |

Miles |

(See Instructions) (See Instructions)

J

MPG

from E on front

K

Taxable

Gallons

(col. I : J)

L

Tax Paid

Gallons

(See Instructions)

M

Net Taxable

Gallons

(col. K - L)

N

Tax Rate

O

Tax (Credit) Due

(col. M x N (Tax)) (col. K x N (Surch))

P

Interest

Due

Q

Total Due

(col. O + P)

Transfer the subtotal am ounts Subtotals

to the front of this schedule.

Form Specs

| # | Fact | Detail |

|---|---|---|

| 1 | Form Name | IFTA Quarterly Fuel Use Tax Schedule IFTA-101-MN |

| 2 | Purpose | To report quarterly fuel use tax for IFTA licensees |

| 3 | Administering Body | Alabama Department of Revenue |

| 4 | Fuel Types Covered | Diesel, Motor Fuel Gasoline, Ethanol, Propane |

| 5 | Attachment Requirement | Attach to Form IFTA-100-MN, IFTA Quarterly Fuel Use Tax Return |

| 6 | Separate Schedule Requirement | Prepare a separate schedule for each fuel type |

| 7 | Average Fleet MPG is calculated and used for reporting | |

| 8 | Record Keeping | Maintain a copy for your records |

| 9 | Governing Law | International Fuel Tax Agreement (IFTA) |

| 10 | Additional Sheets | Use additional sheets if necessary for reporting |

Detailed Guide for Writing Irp Alabama

Completing the IRP Alabama Form requires careful attention to detail and accuracy. This process is essential for reporting fuel use by commercial vehicles that travel across state lines, under the International Fuel Tax Agreement (IFTA). Whether you're reporting for diesel, motor fuel gasoline, ethanol, or propane, the steps are designed to ensure that the correct tax amount is calculated and reported. Here's a step-by-step guide to help you navigate through the form without any hassles. Remember, maintaining accurate records and calculations is vital, as this document plays a crucial role in compliant interstate operations.

- Select the fuel type being reported by checking the appropriate box: Diesel (D), Motor Fuel Gasoline (G), Ethanol (E), or Propane (P).

- Enter the quarter's ending date (Month, Day, Year) you are reporting for.

- Provide the Licensee IFTA identification number and Name at the designated spots.

- In the MPG Calculation section, calculate the Average Fleet MPG by:

- Adding Total IFTA Miles (A) and Total Non-IFTA Miles (B).

- Dividing the combined miles (C) by the Total Gallons (D).

- Rounding the result to two decimal places to find the Average Fleet MPG (E).

- For each jurisdiction, fill in the columns from F to Q as follows:

- Jurisdiction (F)

- Rate Code (G)

- Total IFTA Taxable Miles (H)

- Total MPG Miles from E (I)

- Taxable Gallons, calculated by dividing column I by J (K)

- Tax Paid Gallons (L)

- Net Taxable Gallons (M), which is column K minus L

- Tax Rate (N)

- Tax (Credit) Due, calculated by multiplying M by N (O)

- Interest Due (if applicable) (P)

- Total Due (Q), the sum of columns O and P

- Transfer subtotal amounts from the back of the schedule to the front for each fuel type.

- For each fuel type reported, transfer the total amount in Column Q to the corresponding line on Form IFTA-100-MN, IFTA Quarterly Fuel Use Tax Return. For other fuel types, move the total of Column Q to Column S on the worksheet of the IFTA-101-MN back side.

After filling out the form, double-check all entries for accuracy to ensure compliance with IFTA requirements. Make a copy for your records before submitting the original to the designated authority. Remember, this process not only adheres to regulatory standards but also optimizes your operation's fuel tax management. Each step is crucial, so take your time to fill out each section correctly to avoid potential issues.

Common Questions

What is the IRP Alabama form?

The IRP Alabama form is a document used by the Alabama Department of Revenue for trucking businesses to report and pay fuel use taxes under the International Fuel Tax Agreement (IFTA). This form helps businesses to report operations based on the type of fuel used by their fleets, including diesel, motor fuel gasoline, ethanol, and propane.

Who needs to fill out this form?

The form is required for any trucking business or owner-operator that operates commercial vehicles across state lines and is registered under the IFTA. If your vehicles use diesel, gasoline, ethanol, or propane and travel in Alabama and other states, you need to submit this form.

How often do I need to submit the IRP Alabama form?

The IRP Alabama form must be submitted quarterly. Each quarter ends on the last day of March, June, September, and December, and the form should be filed following these periods to report your fuel use for each quarter.

What information is required on the IRP Alabama form?

You need to provide your IFTA identification number, name, fuel type used, miles traveled within and outside IFTA jurisdictions, total gallons of fuel consumed, and calculate your fuel taxes due. The form requires detailed operations per fuel type and jurisdiction.

How do I calculate my average fleet MPG on the form?

To calculate your average fleet MPG, you need to sum up all the miles traveled (IFTA and non-IFTA miles) and divide this number by the total gallons of fuel consumed. This calculation helps in determining the fuel efficiency of your fleet.

What if I operate with more than one type of fuel?

If your fleet operates with more than one type of fuel, you need to prepare a separate IRP Alabama form for each type of fuel used. This ensures accurate reporting and tax calculation for each fuel type.

Can I claim credits on this form?

Yes, you can claim credits on the IRP Alabama form. If you've paid more in fuel taxes than what you owe for the quarter, you can enter these credits in brackets on the form. Make sure to provide documentation for these credits.

What happens if I need more space to list additional jurisdictions?

If you run out of space on the form while listing additional jurisdictions, you are allowed to use the back of the form to continue providing the necessary information. Ensure all jurisdictions where you've traveled and owe taxes are listed.

Where do I send the completed IRP Alabama form?

Once completed, the form should be attached to Form IFTA-100-MN, Tax Return, and sent to the Alabama Department of Revenue. Check the department’s website for the most current mailing address or electronic filing options.

What should I do if I make a mistake on the form?

If you make a mistake on the IRP Alabama form, it's important to correct it as soon as possible. If you've already submitted the form, you should contact the Alabama Department of Revenue for guidance on how to submit a corrected form.

Common mistakes

When filling out the IRP Alabama form, it's common to encounter various areas that can be confusing, leading to mistakes. These inaccuracies can result in processing delays or incorrect tax calculations. Understanding these potential pitfalls can save time and ensure that the document is filed correctly.

One major area of confusion is the selection of the correct fuel type. The form clearly states, "Check only one fuel type," yet individuals often mistakenly check multiple boxes or overlook this section entirely. It's essential to select just one from the options provided (Diesel, Motor fuel gasoline, Ethanol, Propane) for accurate processing.

- Not attaching the required schedules is a frequent mistake. The form instructs to attach the IFTA Quarterly Fuel Use Tax Schedule (IFTA-101-MN) to Form IFTA-100-MN. Neglecting this step can cause incomplete submissions.

- A common numerical error occurs during the MPG Calculation (E). It's crucial to add Total IFTA Miles (A) and Total Non-IFTA Miles (B) to get Total Miles (C) and then divide by Total Gallons (D) to get the Average Fleet MPG (E). Missteps in this calculation can affect the tax calculation significantly.

- Another area where errors commonly occur is in listing the Jurisdiction and Rate Code. Accurate entry in these fields is vital for correct tax computation. Each jurisdiction has a specific rate, and mixing these up can result in incorrect tax calculations.

- Failing to transfer totals correctly to the IFTA-100-MN form or additional sheets poses problems as well. For instance, for Diesel, Motor fuel gasoline, Ethanol, and Propane, the total amount in Column Q from each schedule should match the corresponding line on Form IFTA-100-MN.

It's also not uncommon for filers to round incorrectly or enter credits improperly. The instructions specify to round to the nearest whole gallon or mile and to enter credits in brackets. Ignoring these directions can lead to discrepancies in tax owed.

- Ensure only one fuel type is selected and correctly identified on the form.

- Double-check the attachment of all the required schedules and additional sheets.

- Precisely complete the MPG Calculation section and review it for accuracy.

- Verify the Jurisdiction and Rate Codes to ensure they match the official rates.

- Accurately transfer all totals to the main IFTA-100-MN form and additional sheets where required.

By paying close attention to these common mistakes and adhering to the detailed instructions provided on the form, individuals can accurately complete the IRF Alabama form. This careful approach helps in avoiding unnecessary delays or corrections, streamlining the tax filing process.

Documents used along the form

When businesses handle their commercial trucking operations across state lines, it's crucial to stay informed about necessary documentation, especially for International Registration Plan (IRP) participants in Alabama. The IRP Alabama form is pivotal, but it's just one of several documents needed. Together, these forms ensure compliance, facilitate accurate tax reporting, and help manage fleet operations efficiently.

- IFTA-100-MN, Tax Return: This form is essential for reporting the total fuel use taxes owed to all member jurisdictions. Trucking companies must file it quarterly to stay in good standing with the International Fuel Tax Association (IFTA).

- MCS-150, Motor Carrier Identification Report: It's a form submitted to the FMCSA to obtain a USDOT number. It includes company identification, classification, cargo, and other safety-related information, which is necessary for legal operation.

- UCR (Unified Carrier Registration): This registration and annual renewal form is necessary for motor carriers, brokers, and freight forwarders. The fees support state motor carrier safety programs.

- SSRS (Single State Registration System) Form: Some states require this for carriers operating interstate to report their fleet and proof of insurance. While federally phased out, a version of it might be required at the state level.

- Form 2290, Heavy Highway Vehicle Use Tax Return: This IRS form is for reporting the federal excise tax on vehicles weighing 55,000 pounds or more, used on public highways. It's a critical financial document for heavy fleet operators.

- Application for Authority: Required for motor carriers to legally operate across state lines. This document, issued by the FMCSA, includes the MC Number (Motor Carrier) and is vital for interstate commerce.

These documents, paired with the main IRP Alabama form, create a comprehensive toolkit for managing the bureaucratic and regulatory aspects of interstate trucking operations. They ensure compliance with tax, safety, and operational regulations, helping carriers avoid penalties and facilitating smooth cross-border transport. Understanding and keeping these forms updated is crucial for the success and legal operation of trucking companies in Alabama and beyond.

Similar forms

The Irp Alabama form is similar to a couple of different documents that are used by trucking companies and owner-operators for reporting and tax purposes. Identifying similarities with these documents can help clarify the purpose and use of the Irp Alabama form.

Firstly, the Irp Alabama form is similar to the International Registration Plan (IRP) application form used by truckers in other states. Both forms require trucking companies to report their mileage and fuel use across different jurisdictions for tax calculation purposes. Like the Irp Alabama form, the IRP application includes sections for identifying the type of fuel used, calculating miles traveled per jurisdiction, and determining fuel tax liabilities. The focus on multi-jurisdictional operations reflects the intent of both forms to streamline tax reporting and payments for interstate commercial vehicle operations. The key difference lies in specific state-related details, with each state's form tailored to its requirements and tax rates.

Secondly, the Irp Alabama form bears resemblance to the International Fuel Tax Agreement (IFTA) quarterly fuel use tax return, specifically the IFTA-100 form and its accompanying schedule, IFTA-101. Both the Irp Alabama form and the IFTA forms are designed to calculate taxes due on fuel used while operating commercial vehicles across states or provinces. They account for different types of fuel, such as diesel and gasoline, and require the operator to list miles traveled and fuel purchased in each jurisdiction. What makes them similar is their functionality in ensuring that the correct amount of fuel taxes are paid to the appropriate jurisdictions, based on where the fuel was used, not just where it was purchased. The introduction of these forms significantly simplifies the process of reporting fuel use and computing tax dues for truckers who operate interregionally.

Dos and Don'ts

When you're filling out the IRP Alabama Form, specifically the IFTA Quarterly Fuel Use Tax Schedule IFTA-101-MN, it's important to follow some do's and don'ts to ensure accuracy and compliance. Here's a helpful guide:

What You Should Do:- Check only one fuel type. Confirm you're reporting for either Diesel, Motor Fuel Gasolen, Ethanol, or Propane, as per the form's requirements.

- Prepare a separate schedule for each fuel type used. If you operated vehicles with different types of fuel during the quarter, complete separate schedules for each.

- Make a copy of the completed form for your records. It’s important to maintain a record of submitted information for future reference or in case of audits.

- Round to the nearest whole gallon or mile, as specified in the form instructions, to maintain consistency and accuracy in your report.

- Transfer totals correctly. Ensure the total amount from Column Q for each fuel type reported is accurately transferred to the corresponding line on Form IFTA-100-MN or Column S of the worksheet on the back of Form IFTA-101-I-MN.

- Don’t skip reading the instructions (IFTA-101-I-MN) carefully. Understanding every requirement and calculation method is crucial for an accurate report.

- Do not mix up fuel types on a single schedule. Each fuel type requires a separate form to avoid confusing calculations and discrepancies.

- Avoid estimating gallons or miles. Use exact numbers from your records for all entries, including total IFTA and non-IFTA miles, as well as gallons used.

- Don’t forget to enter credits in brackets. If applicable, ensure that credits are clearly indicated as instructed to accurately reflect your tax liabilities.

- Do not disregard rounding rules. It's important to follow the rounding instructions specifically to ensure that your calculations align with state requirements.

Misconceptions

Understanding the requirements and misconceptions surrounding the IRP Alabama form, specifically the IFTA Quarterly Fuel Use Tax Schedule, can help ensure accurate and timely submissions. Here are seven common misconceptions that need clarification:

- All fuel types are reported the same way. While the IFTA Schedule might seem uniform, each fuel type—such as Diesel (D), Motor Fuel Gasoline (G), Ethanol (E), and Propane (P)—requires a separate schedule. It's crucial to prepare distinct reports for each type of fuel used during the quarter.

- The form is only for Alabama-based operations. The IFTA Quarterly Fuel Use Tax Schedule is designed for reporting operations across all IFTA jurisdictions, not just Alabama. This form is part of an agreement that includes multiple states and provinces, aiming to report and allocate fuel use taxes accurately.

- Estimations are acceptable for missing data. Accuracy is key when completing this form. It requires exact figures, such as total miles driven and total gallons of fuel used, to calculate the average fleet miles per gallon (MPG). Estimations can lead to inaccuracies in tax liabilities and potential audits.

- Only taxable miles are to be reported. Actually, the form requires reporting both taxable and non-taxable miles. The distinction is essential for accurately calculating the tax due. Non-IFTA miles, such as personal use or operations in non-IFTA jurisdictions, must also be documented.

- Miles per gallon (MPG) calculations are not critical. The average fleet MPG calculation is a crucial component of the IFTA reporting process. It impacts the tax calculation significantly by demonstrating fuel efficiency across all operations. This calculation must be precise and based on the total miles driven and gallons of fuel consumed.

- Credits are not allowed on the form. Contrary to this belief, credits can and should be reported on the form. These might include overpayments from previous filings or tax-paid fuel purchases that exceed the tax liability. Entering credits properly can reduce the total tax due.

- Interest and penalties only apply for late filings. While late filings do incur interest and penalties, other situations might also trigger these additional costs. Errors, underestimations, and audits can result in additional fees, emphasizing the importance of accuracy and timeliness in submissions.

Navigating the complexities of the IFTA Quarterly Fuel Use Tax Schedule requires attention to detail and an understanding of both state-specific and IFTA-wide requirements. Clearing up these common misconceptions helps mitigate risks of errors and promotes smoother compliance processes.

Key takeaways

Filling out the IRP Alabama form correctly is essential for ensuring accurate reporting and compliance with the International Fuel Tax Agreement (IFTA). Here are some key takeaways for handling this document:

- Select the correct fuel type. Clearly mark whether you are reporting diesel, motor fuel gasoline, ethanol, or propane. Each fuel type must be reported on a separate schedule.

- Keep a copy for your records. After completing the form, make a photocopy. This is vital for your records and any future verifications required by the Alabama Department of Revenue.

- Accurately calculate MPG. Use the formula provided to calculate the average miles per gallon (MPG) for your fleet, including both IFTA and Non-IFTA miles, to ensure precise tax calculations.

- Report all required miles and gallons. Enter the total miles driven and gallons used, distinguishing between IFTA and Non-IFTA jurisdictions.

- Include detailed jurisdiction information. For every jurisdiction where fuel was used, list the rate code, total IFTA taxable miles, taxable gallons, and tax-paid gallons. This information is crucial for accurate tax calculations.

- Calculate taxes due with attention to detail. Utilize the MPG and jurisdiction details to determine net taxable gallons, apply the correct tax rate, and calculate the tax or credit due for each jurisdiction.

- Transfer totals correctly. For different fuel types, ensure that the total due in Column Q for each schedule is transferred to the corresponding section of the IFTA-100-MN or the IFTA-101-MN form, as applicable.

By paying attention to these details, you can complete the IRP Alabama form accurately and ensure compliance with fuel tax reporting requirements.

Check out Popular PDFs

Alabama Architecture - This document outlines the necessary details for businesses operating within the state to ensure compliance with Alabama laws.

Alabama Affidavit Form - Used in Alabama, the C 12 form helps ensure accurate tax reporting and payment by individuals.

Montgomery County Revenue Business Privilege Tax Alabama Online Payment - Detailed contact information for the Alabama Department of Revenue is made available, facilitating easy access for inquiries and clarifications.