Alabama State Tax Return 40A Template

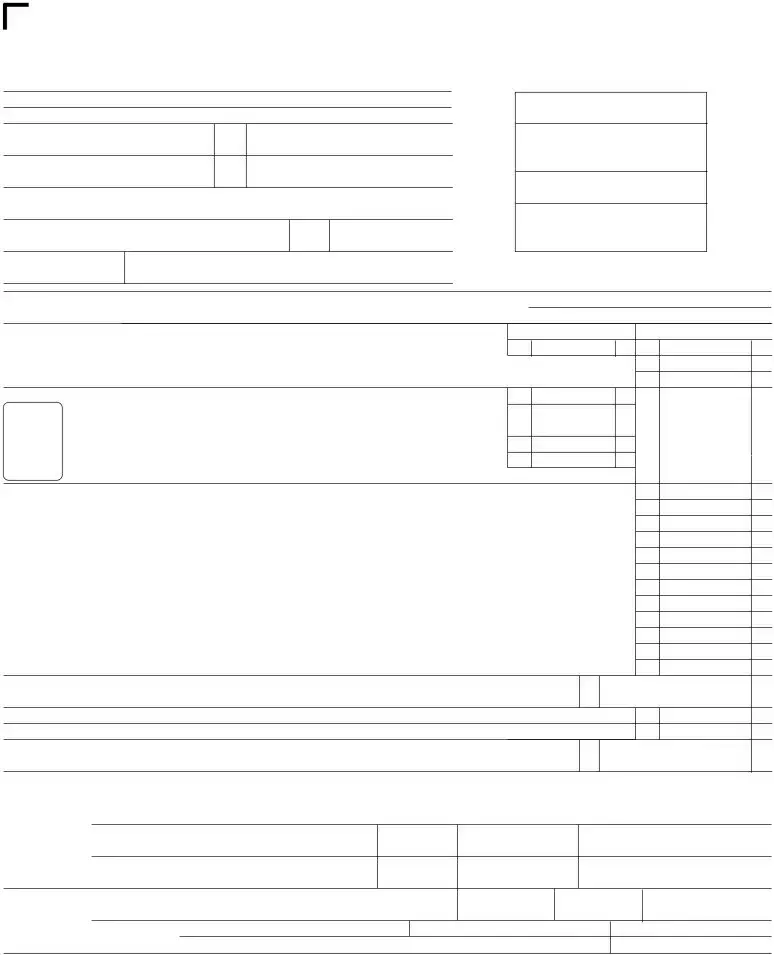

Navigating the intricacies of tax forms can be daunting for even the most financially savvy individual. The Alabama State Tax Return 40A form, designated specifically for the year 2004, serves as the structure through which full-year residents report their individual income to the state. Its layout begins with personal identification details, followed by key sections that include filing status, counting of exemptions, and thorough breakdowns of income, deductions, and calculated tax liabilities. Interestingly, the form also provides space for voluntary contributions to political entities or charitable causes, reflecting the state's engagement with its residents' interests. Each section demands careful attention; from the basic information of wages and interest or dividend incomes, adjustments, to the more complex realms of standard or potential deductions, encapsulated within a system designed to ensure both accuracy and fairness in tax reporting. Moreover, specific line items require attachment of supporting federal tax return documents, illuminating the interdependence of state and federal tax systems. This blend of personal detail, financial reporting, and the option for charitable contribution captures the essence of civic duty as it intersects with fiscal responsibility.

Alabama State Tax Return 40A Example

FORM |

|

*2100014A* |

40A |

2021 |

ALABAMA INDIVIDUAL INCOME TAX RETURN

FULL YEAR RESIDENTS ONLY

For the year Jan. 1 - Dec. 31, 2021, or other tax year: Beginning: |

|

Ending: |

|

|

Your first name |

|

Initial |

Last name |

|

Spouse’s first name |

|

Initial |

Last name |

|

Present home address (number and street or P.O. Box number) |

|

|

|

|

City, town or post office |

|

|

State |

ZIP code |

Check if address |

Foreign Country |

|

|

|

6 is outside U.S. |

|

|

|

|

Your social security number

6Check if primary is deceased Primary’s deceased date (mm/dd/yy)

Spouse’s social security number

6Check if spouse is deceased Spouse’s deceased date (mm/dd/yy)

V CHECK BOX IF AMENDED RETURN 6

1 |

6 |

$1,500 Single |

3 |

6 |

$1,500 Married filing separate. Complete Spouse SSN |

|

|

|

|||||

2 |

6 |

$3,000 Married filing joint |

4 |

6 |

$3,000 Head of Family (with qualifying person). |

|

|

|

|

||||

5a Alabama Income Tax Withheld (from Schedule |

. . . |

. . . . . |

. . . |

. . . . |

A — Alabama tax withheld |

|

B — Income |

||||||

5b Wages, salaries, tips, etc. (from Schedule |

. . . |

. . . . . |

. . . |

. . . . |

5a |

00 |

5b |

00 |

|||||

6 |

Interest and dividend income. If over $1,500.00, use Form 40 |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

6 |

00 |

||||

7 |

Total income. Add lines 5b and 6 (column B) . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

7 |

00 |

||

8 |

Standard Deduction (enter amount from table on page 9 of instructions) |

. . . |

. . . . . |

. . . |

. . . . |

8 |

00 |

|

|

||||

9 |

Federal tax deduction (see instructions) . . . |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

|

|

|

|

|

|

DO NOT ENTER THE FEDERAL TAX WITHHELD FROM YOUR FORM |

|

|

|

|

9 |

00 |

|

|

||||

10 |

Personal exemption (from line 1, 2, 3, or 4) |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

10 |

00 |

|

|

|

11 |

Dependent exemptions (from page 2, Part II, line 2). |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

11 |

00 |

|

|

|||

12 |

Total deductions. Add lines 8, 9, 10, and 11 . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

12 |

00 |

||

13 |

Taxable income. Subtract line 12 from line 7. Enter the result |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

13 |

00 |

||||

14 |

Find the tax for the amount on line 13. Use the tax table in the Instruction Booklet. . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

14 |

00 |

||||

15 |

Consumer Use Tax (see instructions). If you certify that no use tax is due, check box |

6 . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

15 |

00 |

|||||

16 |

You may make a voluntary contribution to: |

a Alabama Democratic Party |

6 |

$1 |

6 |

$2 |

6 none |

. . . |

16a |

00 |

|||

|

|

|

b Alabama Republican Party |

6 |

$1 |

6 |

$2 |

6 none |

. . . |

16b |

00 |

||

17 |

Total tax liability and voluntary contribution. Add lines 14, 15, 16a, and 16b |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

17 |

00 |

||||

18 |

Alabama income tax withheld (from column A, line 5a) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

18 |

00 |

||||

19 |

Automatic Extension Payment |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

19 |

00 |

|

20 |

Amended Returns Only — Previous payments (see instructions) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

20 |

00 |

||||

21 |

Total payments. Add lines 18, 19 and 20 . |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

21 |

00 |

|

22 |

Amended Returns Only – Previous refund (see instructions) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

22 |

00 |

||||

23 |

Adjusted Total Payments. Subtract line 22 from line 21 |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

23 |

00 |

||||

24If line 17 is larger than line 23, subtract line 23 from line 17, and enter AMOUNT YOU OWE.

|

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.) |

24 |

|

00 |

25 |

If line 23 is larger than line 17, subtract line 17 from line 23 and enter amount OVERPAID |

. . . . . . . . . . . |

25 |

00 |

26 |

Total Donation |

. . . . . . . . . . . |

26 |

00 |

27 |

REFUNDED TO YOU. Subtract line 26 from line 25. |

|

|

|

|

(You MUST SIGN this return before your refund can be processed.) |

27 |

|

00 |

6I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature |

Date |

Daytime telephone number |

Your occupation |

|

|||

v |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s signature (if joint return, BOTH must sign) |

Date |

Daytime telephone number |

Spouse’s occupation |

|

|||

v |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

Date |

|

Check if |

Preparer’s SSN or PTIN |

|

|

|

|

|

|

|

|||

v signature |

|

|

|

6 |

C |

||

Firm’s name (or yours |

|

Daytime telephone no. ( |

) |

|

E.I. No. |

|

|

v if |

|

|

|

|

|

ZIP Code |

|

and address |

|

|

|

|

|

|

|

ADOR

*2100024A*

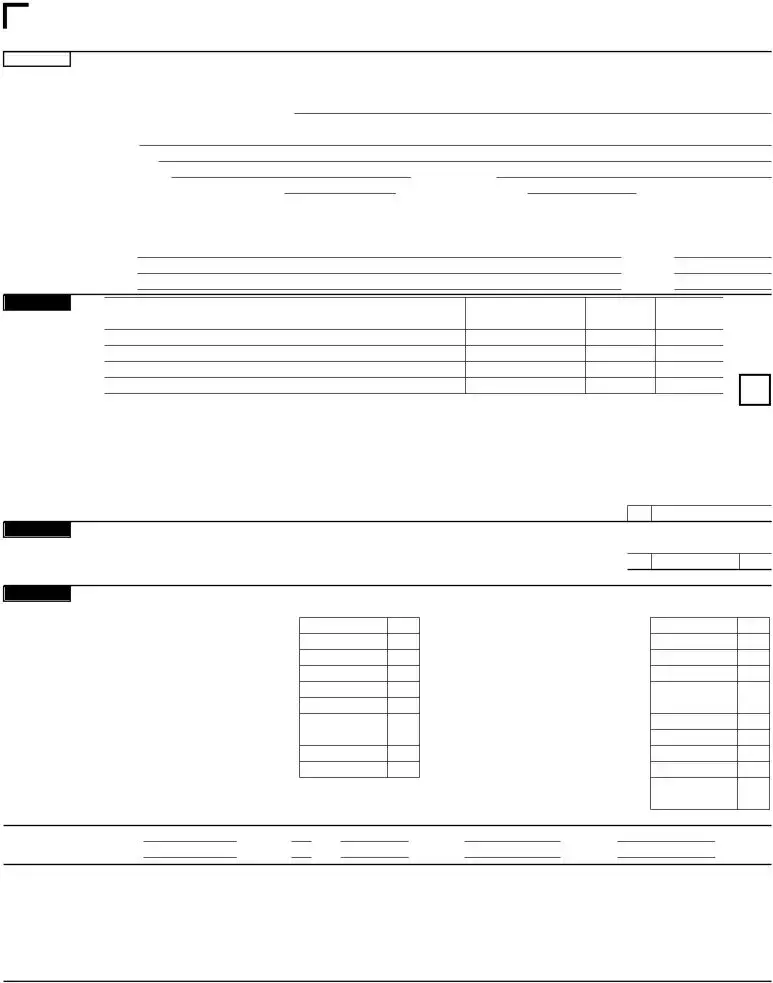

Form 40A (2021) |

|

|

|

|

Page 2 |

||

|

|

|

|

|

6 Yes |

6 No |

|

PART I |

1 |

Were you (and your spouse, if married filing jointly) a resident of Alabama for the entire year 2021? |

. . . . . . . . . |

. . . . |

|||

|

|

If you checked no, DO NOT COMPLETE THIS FORM. See “Which Form To File” on page 5 of instructions. |

|

|

|

|

|

|

2 |

Did you file an Alabama income tax return for the year 2020? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . |

6 Yes |

6 No |

|

|

If you checked no, state the reason for not filing. |

|

|

|

|

|

|

3 |

Give name and address of your present employer: |

|

|

|

|

|

General |

|

Yourself |

|

|

|

|

|

|

Your Spouse |

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

4 |

Your occupation |

Spouse’s occupation |

|

|

|

|

|

|

|

|

|

|

|||

All Taxpayers |

5 |

Enter the Federal Adjusted Gross Income $ |

and Federal Taxable Income $ |

as reported on your |

|

||

Must Complete |

|

2021 Federal Individual Income Tax Return. |

|

|

|

|

|

This Section |

6 |

Do you have income which is reported on your Federal return, but not reported on your Alabama return?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Yes |

6 No |

|

|||

|

|

If yes, enter source(s) and amount(s) below (other than state income tax refund): |

|

|

|

|

|

|

|

Source |

|

Amount |

$ |

|

|

|

|

Source |

|

Amount |

$ |

|

|

|

|

Source |

|

Amount |

$ |

|

|

PART II

Dependents

Do not include yourself or your spouse

1a |

Dependents: |

|

(2) Dependent’s social security |

(3) Dependent’s |

(4) Did you provide |

|

more than |

||||

(1) First name |

Last name |

number. |

relationship to you. |

||

|

|

|

|

|

dependent's support? |

b Total number of dependents claimed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2Amount allowed. (Multiply the total number of dependents claimed on line 1b by the amount from the dependent chart below.) Use the following chart to determine the

(See page 10)

PART III

Federal

Tax Liability

Deduction

PART IV

Donation

Amount on Line 7, Page 1 |

Dependent Exemption |

||

0 |

– 20,000 |

|

1,000 |

20,001 |

– 100,000 |

|

500 |

Over 100,000 |

|

300 |

|

Enter amount here and on page 1, line 11 . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

||

1 Enter the Federal Income Tax Liability from worksheet (see instructions) here and on line 9, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  1

1

1You may donate all or part of your overpayment. (Enter the amount in the appropriate boxes.)

a |

Senior Services Trust Fund |

1a |

00 |

j Alabama Firefighters Annuity and Benefit Fund |

b Alabama Arts Development Fund |

1b |

00 |

k Alabama Breast & Cervical Cancer Program |

|

c Alabama Nongame Wildlife Fund |

1c |

00 |

l Victims of Violence Assistance |

|

d Child Abuse Trust Fund |

1d |

00 |

m Alabama Military Support Foundation |

|

e |

Alabama Veterans Program |

1e |

00 |

n Alabama Veterinary Medical Foundation |

f Alabama State Historic Preservation Fund |

1f |

00 |

||

g Alabama State Veterans Cemetery at |

|

|

o Cancer Research Institute |

|

|

Spanish Fort Foundation, Incorporated |

1g |

00 |

p Alabama Association of Rescue Squads |

h |

Foster Care Trust Fund |

1h |

00 |

q USS Battleship Commission |

i |

Mental Health |

1i |

00 |

r Children First Trust Fund |

00

00

00

1j |

00 |

1k |

00 |

1l |

00 |

1m |

00 |

1n |

00 |

1o |

00 |

1p |

00 |

1q |

00 |

1r |

00 |

2 Total Donations. Add lines 1a, b, c, d, e, f, g, h, i, j, k, l, m, n, o, p, q, and r. Enter here and on page 1, line 26 |

2 |

00 |

Drivers License Info

DOB |

|

|

Iss date |

Exp date |

(mm/dd/yyyy) |

Your state |

DL# |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

DOB |

|

|

Iss date |

Exp date |

(mm/dd/yyyy) |

Spouse state |

DL# |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

WHERE TO

FILE

FORM 40A

If you are receiving a refund, Form 40A, line 27, mail your return to: Alabama Department of Revenue, P.O. Box 154, Montgomery, AL

If you are not receiving a refund or making a payment, mail your return to: Alabama Department of Revenue, P.O. Box 327469, Montgomery, AL

Mail only your 2021 Form 40A to one of the above addresses. Prior year returns, amended returns, and all other correspondence should be mailed to Alabama Department of Revenue, P.O. Box 327464, Montgomery, AL

ADOR

Form Specs

| Fact | Detail |

|---|---|

| Form Designation | 2004 FORM 40A |

| Applicant Requirement | Full Year Residents Only |

| Purpose | Alabama Individual Income Tax Return |

| Filing Status Options | Single, Married filing joint return, Married filing separate return, Head of family |

| Income Types | Wages, salaries, tips, interest, and dividend income |

| Deductions and Exemptions | Standard Deduction, Personal exemption, Dependent exemptions |

| Governing Law | Alabama State Law |

Detailed Guide for Writing Alabama State Tax Return 40A

Filing your Alabama State Tax Return 40A form is an important step to meet your tax responsibilities as a full-year resident of Alabama. This form helps you report your income, calculate your tax, and determine any refund or additional payment required. To ensure a smooth process, it’s crucial to gather all necessary documentation ahead of time, including your social security number, any applicable income statements like W-2s or 1099s, and your federal tax return. Follow the steps below carefully to complete your form accurately.

- Start by entering your first name, initial, and last name. If you’re filing a joint return, include your spouse's first name and initial as well.

- Fill in your present home address, including the number, street, P.O. Box number (if applicable), city, town or post office, state, and ZIP code.

- Provide your social security number and your spouse’s social security number if you are filing jointly.

- Choose your filing status by checking the appropriate box for single, married filing jointly, married filing separately, or head of family.

- If applicable, complete line 5 with your spouse’s name and social security number when filing a separate return.

- Report your wages, salaries, tips, etc., on line 6, along with each employer and address. Include Alabama tax withheld and total income amounts.

- Enter any interest and dividend income on line 7. Remember, if this exceeds $1,500.00, you should use Form 40 instead.

- Add up your total income on line 8 by summing lines 6a through 6d and 7 (column B).

- Calculate and enter your standard deduction on line 9. This requires completing Part III of the form for the exact amount.

- Report your federal tax liability on line 10. Attach the second page of your Federal Form 1040, the second page of Form 1040A, or the first page of Form 1040EZ, as applicable.

- Enter your personal exemption amount on line 11, based on your filing status.

- List your dependent exemptions on line 12 after completing the section on Page 2, Part II.

- Total your deductions on line 13 by adding lines 9, 10, 11, and 12.

- Subtract your total deductions (line 13) from your total income (line 8) to find your taxable income, and enter it on line 14.

- Use the tax table in the Instruction Booklet to find the tax for your amount on line 14 and enter it on line 15.

- If applicable, calculate and enter your Consumer Use Tax on line 16.

- Consider making a voluntary contribution to one of the funds listed on lines 17a through 17c.

- Add your total tax liability and any voluntary contributions to determine the amount on line 18.

- Sum your Alabama income tax withheld from lines 6a through 6d (column A) and enter it on line 19.

- Calculate the amount you owe or your overpaid amount by comparing lines 18 and 19 and enter the appropriate figures on lines 20 or 21.

- Decide if you want to donate any part of your overpayment to the causes listed on lines 22a through k, and enter the total donation amount on line 23.

- Calculate your refund amount, subtract line 23 from line 21, and enter this number on line 24.

- Make sure to sign and date the form. If filing jointly, your spouse must also sign.

Once you’ve completed these steps, double-check your form for accuracy. Attach any required documentation, like your W-2 form(s), to your return. If you owe a payment, remember to include Form 40V along with your payment in the mailing envelope. For refunds or non-payment filings, simply mail your form to the appropriate address without Form 40V. Conducting a final review and ensuring everything is correct and properly attached will help avoid processing delays. Your careful attention to detail will contribute to a smooth tax filing process.

Common Questions

1. Who should file the Alabama State Tax Return Form 40A?

The Form 40A is designed for full-year residents of Alabama only. If you (and your spouse, if filing jointly) were residents of Alabama for the entire year of 2004, you should use this form.

2. What income should be reported on the Form 40A?

On the Form 40A, you should report wages, salaries, tips (list each employer and address separately), and interest and dividend income. If your interest and dividend income exceed $1,500.00, you will need to use Form 40 instead.

3. Can I e-file my Alabama State Tax Return Form 40A?

As of the information provided, it does not specify whether you can e-file Form 40A. For the most current filing options, including e-filing, it is advisable to check the official Alabama Department of Revenue website or contact them directly.

4. What are the filing statuses available on Form 40A?

The filing statuses available on Form 40A are Single, Married filing a joint return, Married filing a separate return, and Head of family. You must check only one box that applies to your filing status.

5. How do I claim exemptions on the Form 40A?

You can claim personal and dependent exemptions on Form 40A. Personal exemptions are based on your filing status. For dependents, include their name, social security number, and relationship to you in Part II of the form. The total number of dependents claimed affects the amount of your dependent exemption.

6. What deductions are available on Form 40A?

Form 40A allows for the standard deduction, which varies based on your filing status. Additionally, you must attach your federal tax liability information to calculate certain deductions properly, as detailed in Part IV of the form.

7. How do I calculate and report my Alabama income tax liability?

Your Alabama income tax liability is calculated by determining your taxable income, which is your total income minus your deductions, and then applying the tax rates as shown in the tax table in the instruction booklet. You need to use your taxable income to find your tax liability and report it on the form.

8. Can I make a voluntary contribution on my Form 40A?

Yes, Form 40A allows you to make voluntary contributions to various funds, including the Alabama Democratic Party, Alabama Republican Party, and Neighbors Helping Neighbors, among other options listed on the form.

9. Where should I mail my completed Form 40A?

If you are not making a payment with your return, mail it to the Alabama Department of Revenue P.O. Box 327465, Montgomery, AL 36132-7465. If you are making a payment, send your return, Form 40V, and payment to P.O. Box 327477, Montgomery, AL 36132-7477.

Common mistakes

Filling out the Alabama State Tax Return 40A form can be a daunting task. However, avoiding common mistakes can streamline the process, ensuring accuracy and potentially speeding up any refunds owed. Here are some frequent errors:

- Incorrect or missing Social Security Numbers (SSNs) – It is crucial to double-check both the taxpayer's and spouse’s SSNs. An incorrect or missing SSN can delay processing and potentially affect tax liability or refund amounts.

- Inaccurate filing status – Selecting the wrong filing status may lead to incorrect tax calculations. Ensure you’re choosing the proper status that applies to your situation, whether you’re filing singly, jointly, separately, or as head of household.

- Forgetting to include all income sources in section 6. Omitting or inaccurately reporting income, such as wages or dividends, might result in discrepancies that could lead to audits or penalties. Ensure every source of income is reported, and the amounts match those on your W-2s, 1099s, and other relevant forms.

- Miscalculations. Mathematical errors in adding or subtracting line items can significantly affect your tax outcome. Always use a calculator and double-check your math.

- Not claiming all deductions and exemptions – This mistake can result in a higher taxable income than necessary. Review the deductions under sections 9, 11, and 12 to ensure you're not paying more than you owe.

- Forgetting to attach necessary documentation, such as W-2 and 1099 forms. Failing to do so could delay processing as the Alabama Department of Revenue might need to request this missing information.

- Neglecting the Consumer Use Tax (section 16). Many taxpayers overlook this section, but it’s important to report and pay tax on purchases made without paying Alabama sales tax. Review the instructions for details on how to calculate this amount.

- Failure to sign and date the form. An unsigned tax form is considered invalid and will not be processed until corrected, delaying any potential refunds.

Avoiding these common errors can lead to a smoother tax return process. Taxpayers should review their forms carefully before submission, ensuring all information is accurate and complete. Consulting the instruction booklet and utilizing online resources provided by the Alabama Department of Revenue can also assist in avoiding these pitfalls. Remember, accuracy and attention to detail when completing the Form 40A can prevent delays and ensure your tax obligations are met correctly.

Documents used along the form

When submitting the Alabama State Tax Return 40A form, it is crucial to include all necessary documentation to ensure a smooth processing of your tax returns. Here are five forms and documents that are frequently used alongside the Alabama State Tax Return 40A form to provide a comprehensive overview of your financial situation:

- W-2 Form: This document reports your annual wages and the amount of taxes withheld from your paycheck. It is an essential document for verifying your income and tax payments to the state.

- 1099 Form: If you're self-employed, freelancing, or have other income sources apart from your salary, 1099 forms are used to report this income. Various 1099 forms exist depending on the type of income, such as 1099-MISC for independent contractors or 1099-DIV for dividends received.

- Form 40V: This is a payment voucher used when you owe taxes with your return. If you are submitting a payment alongside your tax return, including Form 40V ensures your payment is correctly credited to your account.

- Federal Income Tax Return Copy: A copy of your Federal Income Tax Return (Form 1040 and its variants) is often required to verify income and tax deductions claimed on your state return. It provides a baseline for state tax calculations and ensures consistency between federal and state tax filings.

- Schedule A (Form 40): For residents who choose to itemize deductions instead of taking the standard deduction, Schedule A must be attached. This schedule lists allowable deductions such as medical expenses, taxes paid, interest paid, gifts to charity, and casualty losses.

Each of these documents plays a vital role in painting a full picture of your financial landscape for the tax year. Accurate and complete submission of these forms alongside the Alabama State Tax Return 40A form can help avoid delays or audits, ensuring a smoother tax season.

Similar forms

The Alabama State Tax Return 40A form is similar to other tax documents that require detailed financial information from the taxpayer. Just as the Form 40A asks for income, deductions, and tax credits specific to Alabama residents, similar documents at the federal level, and in other states, require analogous information but tailored to their specific tax laws and requirements. Among these, the most directly comparable forms are the Federal Form 1040 and its simpler counterparts, the 1040A and 1040EZ, which were used prior to 2018 before being consolidated into a single Form 1040.

Federal Form 1040: Before the IRS redesign in tax year 2018, the Federal Form 1040 was the cornerstone of personal tax returns in the United States. It was more comprehensive than the Alabama 40A, designed for taxpayers with more complex financial situations. This included various incomes, deductions, and credits beyond wages, such as investment income, itemized deductions, and credits for education expenses. The structure of Form 40A mirrors the 1040 in that it calculates taxable income after deductions and credits, arriving at a final tax liability or refund. Both forms also require attachments for certain types of deductions or income, like W-2s or schedules for special tax situations.

Federal Forms 1040A and 1040EZ: Prior to their discontinuation, the 1040A and 1040EZ offered simpler alternatives for filing federal taxes, much like the Alabama Form 40A does at the state level. The 1040A allowed for tax credits and adjustments to income but didn't accommodate more complex tax scenarios like self-employment or itemized deductions. The 1040EZ was even more streamlined, intended for single or married taxpayers without dependents and with income solely from wages, salaries, or unemployment. Similarly, the Alabama Form 40A caters to residents with straightforward financial situations, focusing on salary or wage income and basic deductions and credits, making it the state equivalent of these less complicated federal forms.

Dos and Don'ts

When filling out the Alabama State Tax Return 40A form, individuals need to pay close attention to ensure accuracy and compliance with state tax laws. Below are things you should and shouldn't do:

Do:- Check your filing status carefully. Make sure to select the correct filing status that applies to you, as it affects the computation of your tax liability.

- Enter accurate income information. Report all wages, salaries, tips, and other income correctly to avoid discrepancies and potential audits.

- Deduct the correct amount. Only include deductions you're eligible for, ensuring that the standard deduction or itemized deductions are accurately calculated.

- Verify your social security number. Double-check that your social security number and, if applicable, your spouse’s social security number, are correct to prevent processing delays.

- Attach all required documents. Gather and staple to your return all necessary documents, including W-2s, 1099s, and the federal return, if required.

- Review your return before filing. Ensure that all information is complete and accurate to avoid errors that could lead to delays or additional scrutiny from the Department of Revenue.

- Sign and date your return. Your return is not valid unless it is signed. If filing jointly, both spouses must sign.

- Make a copy for your records. Keeping a copy of the return helps with future references and in case there are any questions from the Department of Revenue.

- Forget to report all sources of income. Overlooking or intentionally omitting income can result in penalties and interest on unpaid taxes.

- Claim ineligible deductions or credits. Only claim deductions and credits you are entitled to, as claiming ineligible ones can lead to penalties.

- Ignore instructions for the standard deduction and federal tax liability. Since these can significantly impact your tax owed, follow the instructions carefully to calculate these amounts correctly.

- Mistake your social security number or your spouse's. Incorrect numbers can lead to processing errors or misattribution of your tax records.

- Overlook the need for all required attachments. Failing to attach necessary documents like W-2s can delay processing.

Submit your return without reviewing it for mistakes. Errors can delay your return, lead to incorrect tax calculations, and attract unnecessary attention from the tax authorities.- Forget to sign and date your return. An unsigned return is considered invalid and will not be processed until corrected.

- Fail to keep a copy of your return. Without a copy, resolving potential issues or questions about your return can be difficult and time-consuming.

Misconceptions

When it comes to the Alabama State Tax Return 40A form, it's easy to fall prey to misconceptions. Here are seven common ones that need clarification:

- Filing Status Confusion: There's a common belief that if you're married, you must file jointly. However, the form allows separate filings for married couples, providing flexibility depending on individual financial situations.

- Standard Deduction Misunderstandings: Some people think the standard deduction is a flat amount for all. In reality, the deduction varies depending on filing status and income, ensuring a more tailored approach to deductions.

- Income Reporting Overlooks: Often, there's an assumption that only Alabama income needs to be reported. The truth is, all income, regardless of the source, must be reported, ensuring a complete and accurate tax return.

- Dependent Exemptions Oversimplification: It's mistakenly believed that claiming dependents is straightforward. The form requires specific information and conditions to be met, highlighting the need for careful consideration when listing dependents.

- Interest and Dividend Income Misconception: A common misconception is that all interest and dividend income is taxable on the 40A form. However, there's a threshold of $1,500, below which Form 40A can still be used, simplifying the process for those with minimal investment income.

- Voluntary Contributions Misinterpretation: Many overlook the section for voluntary contributions, assuming it doesn't apply. In reality, it offers an opportunity to support various causes directly through the tax return, blending civic duty with tax obligations.

- Consumer Use Tax Confusion: The concept of consumer use tax is often misunderstood, with many not realizing it applies to purchases made without paying Alabama sales tax. This section is crucial for compliance and ensuring all applicable taxes are paid.

Understanding these aspects of the Form 40A can guide Alabama residents through a smoother tax filing process, ensuring compliance and potentially optimizing tax outcomes.

Key takeaways

Filling out the Alabama State Tax Return 40A form accurately is essential for all full-year residents to comply with state tax laws. Here are key takeaways to ensure the process is smooth and correct:

- Form 40A is designed exclusively for Alabama residents who were in the state for the entirety of the tax year. If you were not a full-year resident, this form is not applicable to your situation.

- It is crucial to double-check all personal information, including your social security number and address, to prevent processing delays or issues with receiving any potential refunds.

- Choosing the correct filing status is necessary, as this affects the computation of your tax liabilities and entitlements. The options include Single, Married Filing Jointly, Married Filing Separately, and Head of Family.

- Remember to accurately report all sources of income, including wages, salaries, tips, and interest/dividend income. For interest and dividend income over $1,500, Form 40 must be used instead.

- The form allows for standard deductions, personal exemptions, and dependent exemptions. These can significantly impact the taxable income computed.

- Including all necessary attachments, such as your Federal tax return and all W-2s, W-2Gs, and/or 1099 forms, is mandatory for the processing of your state tax return.

- For those who owe taxes, payment instructions are clearly stated, including the requirement to include Form 40V if submitting payment by mail. Credit card payments are also an option.

- If you are entitled to a refund, you have the option to allocate all or part of it to various charitable contributions listed on the form. Ensure to fill out these sections if you wish to donate.

- Before mailing, verify that all information is correct, make a copy for your records, and use the right address. Incorrect information or mailing to the wrong address could delay processing.

By paying attention to these key points, taxpayers can effectively navigate the process of completing and submitting the Alabama State Tax Return 40A form.

Check out Popular PDFs

Medicaid Prior Authorization Form - Pdf - Enable timely and appropriate medication access for Medicaid patients by utilizing the Alabama 409 form to request pharmacy overrides.

Replacement Title Alabama - Facilitates a smoother vehicle registration process for consumers by empowering dealers with specific authorities.

Alabama Mvt 41 1 - It's a requirement for documenting the salvage status change of vehicles within the state's motor vehicle database.