Alabama Ppt Template

Navigating the complexities of the Alabama Business Privilege Tax Return and Annual Report (Form PPT) is essential for entities operating within the state. This document serves as a critical tool for reporting and calculating the privilege tax due from businesses, marking their contribution to state revenue based on a variety of factors including net worth and federal taxable income apportioned to Alabama. Specifically designed for the 2021 taxable year, the form caters to different types of taxpayers such as S Corporations, Limited Liability Entities, and Disregarded Entities, among others. It meticulously guides the reporting of crucial financial details, calculation of taxes due, deductions, and any applicable exemptions. For corporations, it also entails the completion and attachment of the Alabama Schedule AL-CAR. Moreover, the form outlines the procedures for amended returns, ensuring businesses can rectify previously submitted data. With penalties for late or incorrect filings, understanding every aspect of this form becomes imperative for businesses aiming to comply with Alabama's tax regulations. Ensuring accuracy in the completion of this form not only fulfills a legal obligation but also avoids potential penalties and interest due to errors or omissions.

Alabama Ppt Example

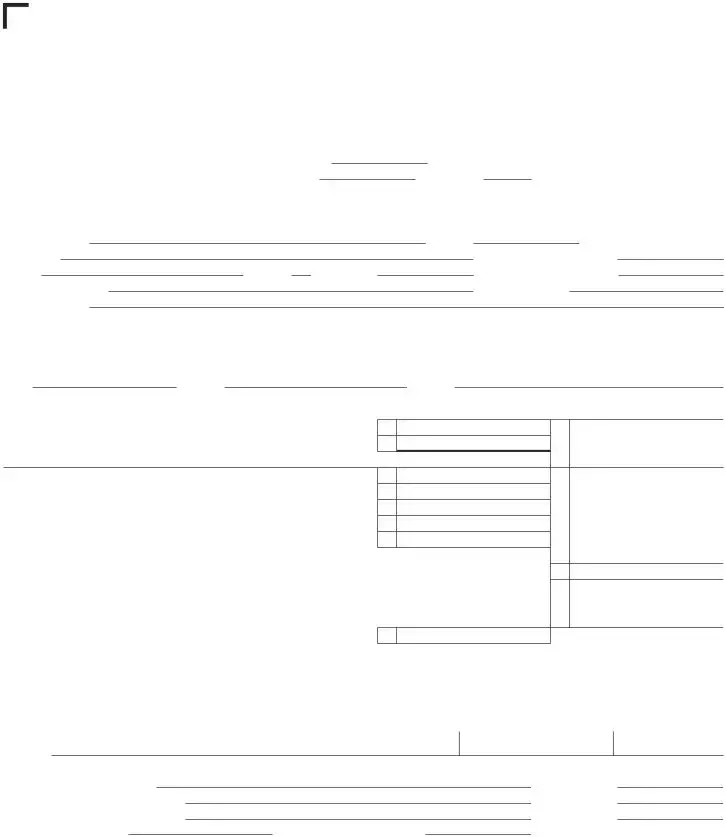

FORM

PPT 2022 *220001PP*

Alabama Department of Revenue

Alabama Business Privilege Tax Return

and Annual Report

1a |

6 Calendar Year (Taxable Year 2022 – determination period beginning |

and ending 12/31/2021) |

|

||

1b |

6 Fiscal Year (Taxable Year 2022 – determination period beginning |

|

and ending |

/2022) |

|

1c |

6 Amended Return (Attach Supporting Documentation) |

1d |

6 52/53 Week Filer |

|

|

Type of taxpayer (check only one): 2a |

6 S Corporation |

2b |

6 Limited Liability Entity |

2c 6 Disregarded Entity |

2d |

6 LLE taxed as S Corporation |

|||

TAXPAYER INFORMATION |

|

|

|

|

|

|

|

|

|

3a LEGAL NAME OF |

|

|

|

|

|

|

6 |

FEIN NOT REQUIRED |

|

BUSINESS ENTITY |

|

|

|

|

3b FEIN |

|

(SEE INSTRUCTIONS) |

||

3c MAILING |

|

|

|

|

3d BPT ACCOUNT NO. |

|

|

||

ADDRESS |

|

|

|

|

(SEE INSTRUCTIONS) |

|

|

||

|

|

|

|

|

|

3h FEDERAL BUSINESS CODE NO. |

|

||

3e CITY |

3f |

STATE |

3g ZIP CODE |

|

(NAICS) (SEE WWW.CENSUS.GOV) |

|

|||

3i CONTACT PERSON |

|

|

|

|

3j CONTACT PERSON’S |

|

|

||

CONCERNING THIS FORM |

|

|

|

|

PHONE NO. |

|

|

|

|

3k TAXPAYER’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

RETURN INFORMATION |

|

|

|

|

|

|

|

|

|

4a |

6 S Corporation President Information Change on attached Schedule |

|

|

|

|||||

4b |

6 S Corporation Secretary Information Change on attached Schedule |

|

|

|

|||||

5a |

Date of Incorporation or Organization |

5b State of Incorporation or Organization |

|

5c County of Incorporation or Organization |

|

||||

COMPUTATION OF AMOUNT DUE OR REFUND DUE |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Amount Due |

6 Secretary of State corporate annual report fee $10 (corporations only) |

6 |

|

|

|

|

||||

7 Less: Annual report fee previously paid for the taxable year . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

7 |

|

|

|

|

||

8 Net annual report fee due (line 6 less line 7) |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

8 |

|

|

||

9 |

Privilege tax due (Page 2, Part B, line 19) |

. . . . . . |

. . . . . . . . . . . . . . . . . |

9 |

|

|

|

|

|

10 |

Less: Privilege tax previously paid for the taxable year |

. . . . . . |

. . . . . . . . . . . . . . . . . |

10 |

|

|

|

|

|

11 |

Net privilege tax due (line 9 less line 10) |

. . . . . . |

. . . . . . . . . . . . . . . . . |

11 |

|

|

|

|

|

12 |

Penalty due (see instructions) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

12 |

|

|

|

|

13 |

Interest due (see instructions) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

13 |

|

|

|

|

14 |

Total privilege tax due (add lines 11, 12 and 13) |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

14 |

|

|

|

15 |

Net tax due (add lines 8 and 14) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

15 |

|

|

16Payment due with return if line 15 is positive. (Form

Full payment of any amount due for a taxable year is due by the original due date of the return (without

|

consideration of any filing extensions in place) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 |

|

17 |

Amount to be refunded if line 15 is negative |

17 |

|

18 |

Family LLE Election attached |

6 (Signature required below) |

|

19 |

Check here if paid electronically |

6 |

|

Please

Sign

Here

6I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Title |

Date |

Ownerʼs/Officerʼs |

|

Signature |

|

Paid |

Preparerʼs signature |

|

|

Date |

Preparer’s |

Firmʼs name (or yours, if |

|

|

E.I. No. |

Use Only |

|

|

ZIP Code |

|

|

|

|

||

|

|

|

|

|

|

Phone No. |

Preparerʼs SSN/PTIN |

||

If you are not making a payment, mail your return to: |

If you are making a payment, mail your return, Form |

|||

Alabama Department of Revenue |

Alabama Department of Revenue |

|||

Business Privilege Tax Section |

Business Privilege Tax Section |

|||

P.O. Box 327431 |

P.O. Box 327320 |

|||

Montgomery, AL |

Montgomery, AL |

|||

Telephone Number: (334) |

Web site: www.revenue.alabama.gov |

|||

|

|

|

|

|

ADOR

|

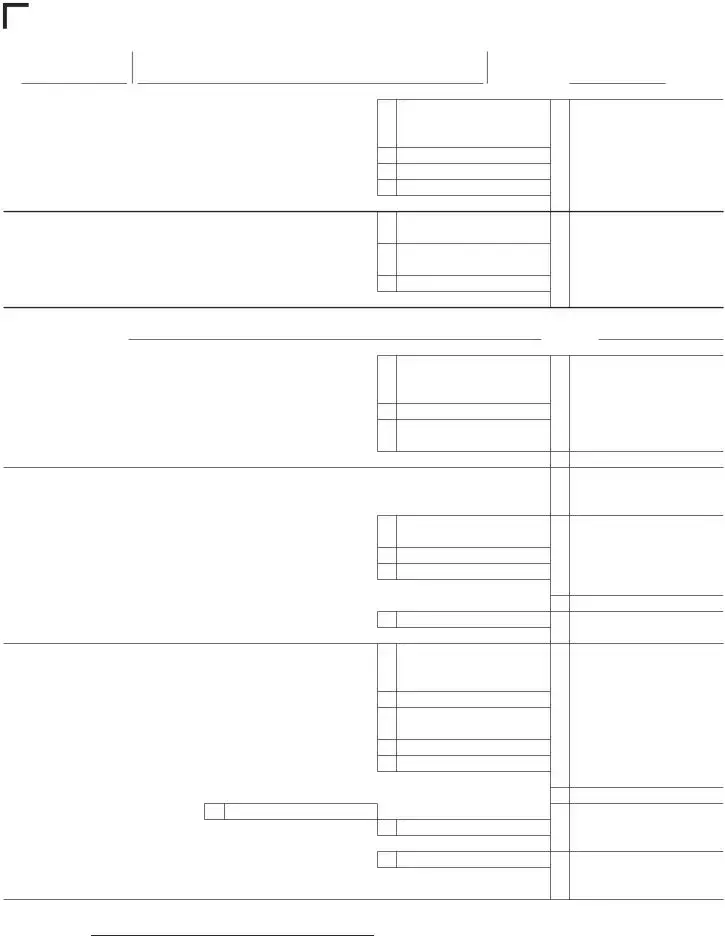

FORM |

BUSINESS PRIVILEGE |

*220002PP* |

Alabama Department of Revenue |

|

PPT |

TAXABLE/FORM YEAR |

Alabama Business Privilege Tax |

|

|

PAGE 2 |

2022 |

|

Privilege Tax Computation Schedule |

1a. |

FEIN |

1b. LEGAL NAME OF BUSINESS ENTITY |

1c. DETERMINATION PERIOD END DATE (BALANCE SHEET DATE) |

|

V |

|

|

(MM/DD/YYYY) |

|

PART A – NET WORTH COMPUTATION |

|

|

||

I. |

|

|

|

|

1 |

Issued capital stock and additional paid in capital (without reduction for treasury stock) |

|

||

|

but not less than zero |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

|

2 |

Retained earnings, but not less than zero, including dividends payable |

2 |

||

3 |

Gross amount of related party debt exceeding the sums of line 1 and 2 |

3 |

||

4 |

All payments for compensation, distributions, or similar amounts in excess of $500,000. . . . |

4 |

||

5 |

Total net worth (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 |

||

II. Limited Liability Entities (LLE's) |

|

|

||

6 |

Sum of the partners’/members’ capital accounts, but not less than zero |

6 |

||

7All compensation, distributions, or similar amounts paid to a partner/member in

|

excess of $500,000 |

7 |

8 |

Gross amount of related party debt exceeding the amount on line 6 |

8 |

9 |

Total net worth (add lines 6, 7 and 8). Go to Part B, line 1 |

9 |

III. Disregarded Entities |

|

|

10 |

Single Member Name: |

FEIN/SSN: |

11If a disregarded entity has as its single member a taxpayer that is subject to the privilege tax, then the disregarded entity pays the minimum tax. (Go to Part B, line 19.)

12Assets minus liabilities for all disregarded entities that have as a single member an entity that is not subject to the privilege tax, but not less than zero (supporting

documentation required). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Gross amount of related party debt exceeding the amount on line 12 . . . . . . . . . . . . . . . . . 13

14For disregarded entities, all compensation, distributions,

|

or similar amounts paid to a member in excess of $500,000 |

14 |

|

|

15 Total net worth (sum of lines 12, 13 and 14). Go to Part B, line 1 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 15 |

|

PART B – PRIVILEGE TAX EXCLUSIONS AND DEDUCTIONS |

|

|

|

|

Exclusions (Attach supporting documentation) (SEE INSTRUCTIONS) |

|

|

|

|

1 |

Total net worth from Part A – line 5, 9, or 15 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 1 |

2 |

Book value of the investments by the taxpayer in the equity of other taxpayers |

2 |

|

|

3 |

Unamortized portion of goodwill resulting from a direct purchase |

3 |

|

|

4 |

Unamortized balance of properly elected |

4 |

|

|

5 |

Total exclusions (sum of lines |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 5 |

6 |

Net worth subject to apportionment (line 1 less line 5) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 6 |

7 |

Apportionment factor (see instructions) |

7 |

. |

% |

8 |

Total Alabama net worth (multiply line 6 by line 7) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 8 |

Deductions (Attach supporting documentation) (SEE INSTRUCTIONS)

9Net investment in bonds and securities issued by the State of Alabama or

political subdivision thereof, when issued prior to January 1, 2000. . . . . . . . . . . . . . . . . . . .

10 Net investment in all air, ground, or water pollution control devices in Alabama. . . . . . . . . .

11Reserves for reclamation, storage, disposal, decontamination, or retirement

|

associated with a plant, facility, mine or site in Alabama |

11 |

|

|

12 |

Book value of amount invested in qualifying low income housing projects (see instructions) |

12 |

|

|

13 |

30 percent of federal taxable income apportioned to Alabama, but not less than zero |

13 |

|

|

14 |

Total deductions (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 14 |

15 |

Taxable Alabama net worth (line 8 less line 14) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 15 |

|

16a |

Federal Taxable Income Apportioned to AL . . |

16a |

|

|

16b |

Tax rate (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

16b |

. |

17 |

Gross privilege tax calculated (multiply line 15 by line 16b) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 17 |

|

18 |

Alabama enterprise zone credit (see instructions) |

18 |

|

|

19Privilege Tax Due (line 17 less line 18) (minimum $100, for maximum see instructions)

Enter also on Form PPT, page 1, line 9, Privilege Tax Due (must be paid by the original due date of the return) . . . . . . . . . . . . . . . . 19

|

|

Other (noncorporate) |

|

are not required to file an Alabama Schedule |

ADOR |

|

Form Specs

| Fact Name | Description |

|---|---|

| Type of Tax | Alabama Business Privilege Tax |

| Governing Body | Alabama Department of Revenue |

| Applicable Entities | S Corporations, Limited Liability Entities, Disregarded Entities, and LLEs taxed as S Corporations |

| Key Form Sections | Taxpayer Information, Return Information, Computation of Amount Due or Refund Due |

| Minimum Privilege Tax | $100 |

| Governing Law | State of Alabama Tax Legislation |

Detailed Guide for Writing Alabama Ppt

Filling out the Alabama Business Privilege Tax Return and Annual Report (Form PPT) is a requirement for businesses operating within the state. This form helps determine the amount of business privilege tax owed by a company for a given tax year. It includes sections for taxpayer information, tax calculation, and various adjustments and credits. The following steps are designed to guide taxpayers through the process of completing the form accurately. Remember, careful attention to detail and thorough review are essential to ensure compliance and avoid potential penalties.

- Begin by determining the taxable year for your return. Mark the appropriate box for Calendar Year or Fiscal Year under section 1, and specify the determination period.

- If filing an amended return, check the box under section 1c and attach the required supporting documentation.

- Identify the type of taxpayer from the options provided in section 2. Check the one box that applies to your business structure, such as S Corporation, Limited Liability Entity, Disregarded Entity, or LLE taxed as S Corporation.

- Under TAXPAYER INFORMATION (section 3), provide the legal name of the business entity and the Federal Employer Identification Number (FEIN) in sections 3a and 3b. If a FEIN is not required, note this as per the instructions.

- Fill in the mailing address, including city, state, zip code, and the North American Industry Classification System (NAICS) federal business code number in sections 3c through 3h.

- Provide the contact person’s name, phone number, and the taxpayer’s email address in sections 3i, 3j, and 3k, respectively.

- For S Corporations, indicate any president or secretary information changes on the attached Schedule AL-CAR as directed in section 4.

- Enter the Date of Incorporation or Organization, State, and County of Incorporation or Organization in section 5 (5a, 5b, 5c).

- Proceed to COMPUTATION OF AMOUNT DUE OR REFUND DUE, starting from section 6, and carefully calculate the amounts following the instructions for each line. Do not forget to include the Secretary of State corporate annual report fee if applicable.

- In "Payment due with return if line 15 is positive," calculate and enter the total payment due based on the tax and any applicable penalties and interest.

- If applicable, check whether a Family LLE Election is attached in section 18.

- Indicate whether payment was made electronically in section 19.

- Complete the signature area, authorizing the Department of Revenue to discuss your return with your preparer. Have the owner or an authorized officer sign and date the form.

- If a paid preparer was used, ensure they complete the "Paid Preparer’s Use Only" section.

- Review the entire form for completeness and accuracy. Attach any required schedules or documentation.

- Mail your completed return to the address provided on the form, depending on whether payment is included or not.

Once you mail your completed form, the Alabama Department of Revenue will process your Business Privilege Tax Return. Ensure that you keep a copy of the form and any correspondence for your records. Timely submission is crucial to avoid any late filing penalties or interest charges. For additional guidance or clarification on specific lines of the form, the Alabama Department of Revenue’s website and its resources can be extremely helpful.

Common Questions

What is the Alabama PPT form?

The Alabama PPT form, officially known as the Alabama Business Privilege Tax Return and Annual Report, is a document that certain businesses operating within Alabama must complete annually. It reports and calculates the amount of business privilege tax owed to the state, which is based on the entity's net worth or taxable income within Alabama for the taxable year.

Who needs to file the Alabama PPT form?

This form must be filed by S Corporations, Limited Liability Entities (LLEs), Disregarded Entities, and Limited Liability Entities taxed as S Corporations. The requirement to file applies to entities both formed in Alabama and those that are registered to do business in Alabama.

What is the deadline to file the Alabama PPT form?

The due date for filing the Alabama PPT form is dependent on the tax year type of the entity. For calendar year filers, the form is due by March 15th of the year following the taxable year. Fiscal year filers must submit their returns by the 15th day of the third month following the end of their taxable year. Full payment of the amount due must be made by the original due date of the return, without consideration of any extensions.

How is the Business Privilege Tax calculated on the form?

The Business Privilege Tax is calculated in multiple steps outlined in the Privilege Tax Computation Schedule part of the form. It begins with the computation of the entity’s net worth, followed by adjustments for exclusions and deductions. The taxable Alabama net worth is then determined and multiplied by the appropriate tax rate. Certain credits may also be applicable. A minimum tax amount is due for all entities liable to file.

Are there any penalties for late filing or payment?

Yes, entities that fail to file the form or pay the required amount by the due date may incur penalties and interest. The specific penalty amounts and interest rates can be found in the instructions accompanying the form.

Can the Alabama PPT form be amended?

Yes, if you need to correct or update information after you have already filed your Alabama PPT form, you can submit an amended return. Check the box for an amended return on the form and attach all necessary supporting documentation to explain the changes.

Where can I find more information or get assistance with the Alabama PPT form?

For more information or assistance, you can visit the Alabama Department of Revenue’s website at www.revenue.alabama.gov or contact the Business Privilege Tax Section by phone at (334) 242-1170. The website also provides access to instructions, forms, and additional resources for completing the Alabama PPT form.

Common mistakes

When filling out the Alabama Business Privilege Tax Return and Annual Report, commonly referred to as the Form PPT, there are several common mistakes that people tend to make. Recognizing and avoiding these errors can streamline the process and ensure accuracy and compliance with Alabama Department of Revenue requirements.

Firstly, one of the main errors involves misunderstanding the type of taxpayer category under which the entity falls. The Form PPT provides several options, including S Corporation, Limited Liability Entity, Disregarded Entity, and LLE taxed as S Corporation. Often, filers incorrectly identify their entity type, leading to potential misapplications of tax codes and obligations.

Another frequent mistake is the incorrect reporting of the entity's legal name and Federal Employer Identification Number (FEIN). This error can lead to misidentification and issues with the state's processing of the return.

The filing deadlines can also be a source of confusion. The Form PPT stipulates different periods for calendar year filers and fiscal year filers. Overlooking these details can result in late submissions, thereby accruing penalties and interest due to late filing.

Misunderstanding the computation of the amount due or refundable also tops the list of errors. This section requires careful attention to details in the computation of the net annual report fee, privilege tax due, and any applicable penalties and interests. This complexity often leads to inaccurate calculations.

The presentation of taxpayer information can also be problematic. Sections dedicated to detailing the taxpayer's mailing address, contact person, and email address are frequently filled out incomprehensively, hindering communication between the taxpayer and the Department of Revenue.

Regarding the Payment Information section, another common error is not including the appropriate Form BPT-V when making a payment by check. This form is crucial for the proper processing of payments.

Misinterpretation of the net worth computation section and associated exclusions and deductions on PAGE 2 can significantly impact the amount of tax due. Failing to accurately report elements such as issued capital stock, retained earnings, and deductions for investments in Alabama can lead to either overpayment or underpayment of taxes.

Incorrectly applying for credits, such as the Alabama enterprise zone credit, without proper documentation or misunderstanding eligibility criteria can also lead to compliance issues.

Finally, a lack of proper authorization for a representative of the Department of Recorder to discuss the return with a preparer is a frequent oversight. Without checking the appropriate box and providing necessary information, this can limit the preparer’s ability to fully assist in the completion and submission of the form.

To summarize, the following are key mistakes to avoid:

- Selecting the incorrect taxpayer category.

- Improper reporting of legal name and FEIN.

- Confusion over filing deadlines.

- Errors in computation of taxes, penalties, and interests.

- Incomplete taxpayer information.

- Omission of Form BPT-V when required.

- Miscalculations in the net worth computation and related exclusions and deductions.

- Incorrect applications for tax credits.

- Failing to authorize communication between the preparer and the Department of Revenue.

By paying attention to these common mistakes and ensuring all information is correctly and thoroughly filled out, filers can avoid potential issues, penalties, or delays in the processing of their Alabama Business Privilege Tax Return and Annual Report.

Documents used along the form

When filing the Alabama PPT form, certain documents and forms often complement the process to ensure comprehensive compliance and record-keeping for businesses. These additional documents assist in providing a thorough overview of a company's fiscal responsibilities and organizational status within the state of Alabama. They are vital for maintaining proper documentation, adhering to legal requirements, and ensuring the business operates smoothly under the state's regulatory framework.

- Form BPT-V (Payment Voucher): Used when making a payment by check, this voucher accompanies the payment to ensure it is correctly applied to the taxpayer's account for the business privilege tax.

- Schedule AL-CAR (Corporation Annual Report): Required for S-corporations, this schedule provides detailed information about changes in corporate officer details and must be attached to the PPT form.

- Alabama Form D (Initial Business Privilege Tax Return): Filed by new businesses during their first year of operation in Alabama, detailing initial tax obligations under the Business Privilege Tax.

- Form BPT-IN (Extension Request): Filed to request an extension for submitting the Form PPT, granting businesses additional time to gather necessary information and documentation.

- Form 20C (Alabama Corporation Income Tax Return): Required for corporations, this return documents the income tax due to the state and provides a record of the financial year's earnings and tax liability.

- Alabama Department of Revenue Power of Attorney (Form 2848A): Allows a business to authorize an individual, such as an accountant or attorney, to represent it in matters related to the state's department of revenue.

- Articles of Incorporation/Organization: Not a form submitted annually like the PPT, but a critical document for businesses that may need to be referenced or updated in relation to the information provided in the PPT and other related forms.

Collectively, these documents facilitate a comprehensive approach to meeting the legal and tax-related requirements for businesses in Alabama. Ensuring that each of these forms is accurately completed and submitted in a timely manner can help businesses avoid penalties, maintain good standing with the state, and contribute to the overall success and compliance of the operation.

Similar forms

The Alabama PPT form, standing for Alabama Business Privilege Tax Return and Annual Report, bears similarities to other tax documents through its structure and the type of information it solicits from taxpayers. While unique in its purpose and specific requirements, understanding its resemblances to other forms can illuminate its function and importance in the realm of tax compliance. Let’s explore a couple of these analogous documents to grasp the Alabama PPT form’s context better.

The IRS Form 1120S is one document that shares similarities with the Alabama PPT form. Form 1120S is used by S corporations for federal tax filing purposes. Like the Alabama PPT form, Form 1120S requires detailed financial and operational information about the entity, including income, losses, deductions, and credits. Both forms necessitate disclosure of the corporation’s officers and an attestation that the information provided is accurate and complete. However, while the Alabama PPT Form focuses on the privilege tax specific to operating within Alabama, Form 1120S concentrates on federal income tax liability. Despite this distinction in purpose, the essence of reporting company operations and financial status is a common thread.

The Form LLC-1 (Limited Liability Company Return of Income), often used in many states, is another document that exhibits characteristics akin to the Alabama PPT form, although tailored to limited liability companies specifically. This form typically gathers information on the LLC’s income, deductions, and tax calculations related to state-level obligations. Both the LLC-1 and the Alabama PPT form include sections for company identification information, such as legal name, FEIN, and business address. Additionally, both forms are integral to a business’s yearly tax and regulatory compliance, albeit at different governmental levels. The primary difference lies in the entities they target and the specific tax details they gather, highlighting the Alabama PPT form’s role in bridging entity-specific tax reporting with state requirements.

Dos and Don'ts

When dealing with the Alabama PPT form, a comprehensive understanding and attention to detail can significantly impact the process's effectiveness and compliance. Below are essential guidelines to follow:

Things You Should Do- Review instructions thoroughly: Before filling out the form, it's crucial to read all accompanying instructions. This ensures accurate and complete submissions that comply with specific requirements.

- Check the correct tax year box: Indicate whether you’re filing for a Calendar Year, Fiscal Year, Amended Return, or as a 52/53 Week Filer to ensure the form aligns with the correct period.

- Include accurate taxpayer information: The Legal Name of Business Entity, FEIN, and mailing address must be correct. This information is vital for proper processing and correspondence.

- Compute amounts due carefully: Use the detailed computation sections to calculate amounts owed or refunds due with precision, reducing the risk of errors and potential penalties.

- Sign and date the form: An unsigned form is considered incomplete. Ensure the Owner’s/Officer’s Signature section is signed, indicating the declaration's truth and accuracy.

- Attach required documentation: If you're filing an amended return or claiming exclusions and deductions, attach supporting documents as required.

- Double-check before mailing: Review the entire form for accuracy and completeness. Verify the correct mailing address, especially if including payment.

- Make assumptions about categories: Don’t guess when selecting the type of taxpayer or other categories. Incorrect classifications can lead to processing delays or incorrect tax assessments.

- Ignore the NAICS code requirement: The Federal Business Code Number (NAICS) is not just a regulatory formality; it's essential for proper business classification and must be included.

- Omit contact information: Failing to provide a contact person and accurate contact details can hinder the Alabama Department of Revenue's ability to reach out if there are questions or issues with your return.

- Leave computation fields blank: Even if you believe certain sections don’t apply, review and confirm that no entry is necessary instead of leaving sections incomplete.

- Miss attaching Schedule AL-CAR: For S-corporations, omitting the required schedule can result in an incomplete submission, delaying processing.

- Disregard filing and payment deadlines: Late submissions can lead to penalties and interest. Mark your calendar with the due date to avoid these unnecessary costs.

- Forget to assemble the form properly: If additional schedules or documentation are required, ensure they are organized and securely attached to avoid loss or misplacement during handling.

Following these guidelines can significantly streamline the submission process, ensure compliance, and avoid common pitfalls associated with the Alabama PPT form filing.

Misconceptions

When it comes to the Alabama Business Privilege Tax Return and Annual Report, commonly referenced by its form number, PPT, there are several misconceptions that can confuse or mislead taxpayers. Understanding the form's details is pivotal in ensuring accurate and compliant filings. Below are seven common misconceptions about the Alabama PPT form:

- Only corporations need to file it. Contrary to common belief, not only corporations are required to file the Alabama PPT form. It applies also to S Corporations, Limited Liability Entities (LLEs), Disregarded Entities, and LLEs taxed as S Corporations. Different entities must accurately identify their status on the form to comply with state tax obligations.

- All businesses must pay the Secretary of State corporate annual report fee. This fee, often thought to be universally applicable, is actually required only for corporations, as indicated on the form. S-corporations are specifically mentioned as needing to attach an Alabama Schedule AL-CAR and enter a $10 fee, while other noncorporate pass-through entities do not have the same requirement.

- The FEIN (Federal Employer Identification Number) is always required. While essential for most businesses, the form clarifies that the FEIN is not required for all entities, emphasizing the need to follow specific instructions regarding taxpayer information provision.

- Payment is always required upon submission. The form outlines circumstances under which payment is due, specifically when the "Net tax due" line is positive. This indicates that scenarios exist where a submission might not necessitate immediate payment, for instance, if deductions or credits reduce the liability to zero or if the return results in a negative amount.

- There's no flexibility in the filing period. Actually, the form accommodates various filing statuses including calendar year, fiscal year, amended return, and special 52/53 week filers, offering businesses flexibility to align the filing with their particular operational timelines.

- All businesses pay the same rate. The computation section of the form highlights that the privilege tax calculation involves various deductions and exclusions that can substantially affect the amount owed, disproving the notion of a flat rate for all entities.

The submitted form is solely for tax computation. In addition to calculating privilege tax dues, the form also functions as an annual report for corporations. This dual purpose underscores the form's significance in both fiscal compliance and corporate governance.

Understanding these nuances helps taxpayers accurately fulfill their obligations and avoid common pitfalls associated with the Alabama PPT form. Accurate and informed compliance supports both the tax administration process and the taxpayer's financial health.

Key takeaways

Filling out and using the Alabama Business Privilege Tax Return and Annual Report (Form PPT) is crucial for businesses operating within the state. Here are four key takeaways to consider when working with this form:

- Select the Correct Tax Year and Filer Type: It's important to indicate the correct taxable year at the top of the form. Businesses must choose whether they are filing for a calendar year, fiscal year, amended return, or as a 52/53 week filer. Additionally, identifying the type of taxpayer—such as an S Corporation, Limited Liability Entity (LLE), Disregarded Entity, or LLE taxed as S Corporation—is essential for accurate processing.

- Provide Detailed Taxpayer Information: Accurately completing the taxpayer information section is critical. This includes the legal name of the business entity, Federal Employer Identification Number (FEIN), mailing address, and contact information. Incorrect or incomplete information can lead to processing delays or issues with the tax return.

- Calculate Payments and Refunds Carefully: The computation part of the form, which includes the privilege tax due, penalties, interest, and total privilege tax due, requires careful attention. Ensuring all calculations are correct is vital to determine the accurate amount due or to identify if a refund is applicable. It's also important to note that full payment of any amount due is required by the original due date of the return, regardless of filing extensions.

- Adhering to Net Worth and Deductions Instructions: When completing the Net Worth Computation Schedule and the Privilege Tax Computation Schedule, it's crucial to follow the instructions carefully. This includes accurately reporting issued capital, retained earnings, partner/member contributions, and deductions such as investments in Alabama bonds, pollution control devices, and low-income housing projects. Proper documentation for exclusions and deductions should be attached as required.

Overall, accurate completion and timely submission of the Alabama Form PPT are fundamental to comply with state tax obligations and to avoid potential penalties. Understanding the form's requirements can help ensure that businesses meet their Alabama Business Privilege Tax responsibilities effectively.

Check out Popular PDFs

P-ebt Alabama - An explanation of the verification process reassures applicants of the program's dedication to fairness and accuracy in determining eligibility.

Alabama Llc Tax Filing Requirements - Applicants must disclose if they have previously owned or operated a business in Alabama.