Alabama Irp 44 Template

Managing a fleet involves understanding and completing a myriad of forms, among which the Alabama IRP-44 form stands out for those operating within Alabama or across state lines. This form, formally known as the Individual Vehicle Distance and Fuel Record, serves a pivotal role for carriers tracking distance and fuel usage for each vehicle under their operation. It requires detailed documentation, including the carrier's name, address, Federal Employer Identification Number (FEIN) or Social Security Number (SSNT), alongside specific journey details such as trip numbers, fleet and trailer numbers, and the truck unit. Moreover, it captures the essence of every trip made - routes taken, fuel types used, starting and ending odometer readings, fuel purchases, and total distance traveled per state or jurisdiction. The form also emphasizes the importance of the driver's acknowledgment through a signature. By breaking down journeys into such detailed records, the Alabama IRP-44 form not only ensures compliance with the International Registration Plan (IRP) and the International Fuel Tax Agreement (IFTA) but also aids in the accurate allocation of fuel taxes across states, making it indispensable for carriers seeking streamlined operations and compliance.

Alabama Irp 44 Example

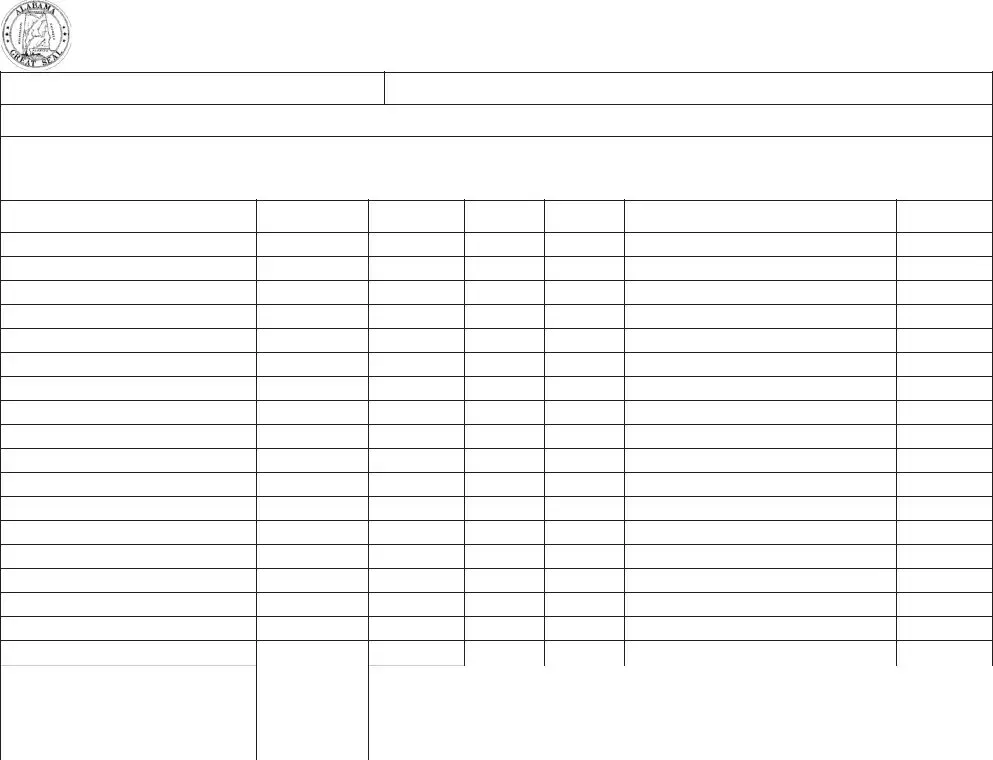

ALABAMA DEPARTMENT OF REVENUE

Individual Vehicle Distance and Fuel Record (IVDR)

CARRIER’S NAME

ADDRESS

REMARKS

FEIN / SSN |

ACCOUNT NO. |

TRIP NO. |

FLEET NO. |

TRAILER NO. |

TRUCK NO. |

|

DRIVER’S SIGNATURE |

|

|

|

FUEL TYPE |

|

|

|

|

||

|

|

|

|

|

|

TRIP ORIGIN – STATE / JURISDICTION LINES – |

|

DISTANCE BY STATE / |

HIGHWAY |

DATE STARTING |

|

GALLONS |

|

ODOMETER |

JURISDICTION AND |

OR ROUTE |

NAME AND ADDRESS OF FUEL STOP |

||||

TOWNS – TRIP DESTINATION |

AND ENDING |

PURCHASED |

|||||

|

FROM POINT TO POINT |

TRAVELED |

|

||||

|

|

|

|

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

|

ENDING ODOMETER |

|

TOTAL DISTANCE PER STATE / JURISDICTION |

TOTAL FUEL PURCHASED |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BEGINNING ODOMETER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL TRIP DISTANCE |

|

|

|

|

|

|

|

|

TOTAL TRIP DISTANCE |

TOTAL TRIP DISTANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

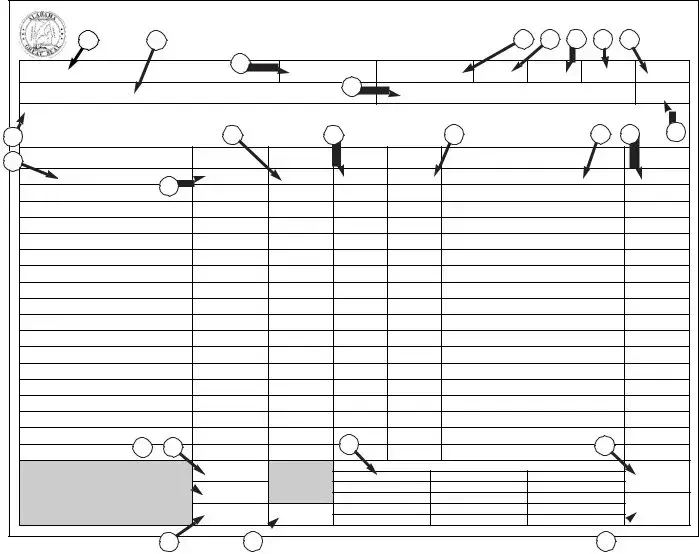

Sample Individual Vehicle Distance and Fuel Record (IVDR) With Instructions

|

|

|

|

ALABAMA DEPARTMENT OF REVENUE |

|

|

|

||||||

|

|

|

|

|

|

|

(6/95) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

3 Individual Vehicle Distance and Fuel Record (IVD4R) |

5 6 |

7 |

8 |

|

|||||||

CARRIER’S NAME |

|

|

2 |

FEIN / SSN |

|

|

ACCOUNT NO. |

TRIP NO. |

FLEET NO. |

TRAILER NO. |

TRUCK NO. |

||

Jones Trucking Co. |

|

|

|

|

9999 |

134 |

01 |

T477 |

|

156 |

|||

ADDRESS |

|

|

|

|

10 |

DRIVER’S SIGNATURE |

BOB SMITH |

|

|

FUEL TYPE |

|||

1415 Main Street, Birmingham, AL 36109 |

|

|

|

|

|

Diesel |

|||||||

REMARKS |

|

|

|

|

|

|

|

|

|

|

|

|

|

5/6 pickup load in B'ham |

|

|

5/9 deliver to Jackson & load |

|

|

|

|

||||||

5/7 deliver to Jackson & load |

|

5/9 return to B'ham |

|

16 |

|

17 |

18 |

11 |

|||||

9 5/8 deliver to Dallas & load |

|

14 |

15 |

|

|

|

|

|

|||||

|

TRIP ORIGIN – STATE / JURISDICTION LINES – |

|

|

DISTANCE BY STATE / |

HIGHWAY |

|

DATE STARTING |

|

|

|

|

GALLONS |

|

12 |

|

ODOMETER |

JURISDICTION AND |

OR ROUTE |

|

NAME AND ADDRESS OF FUEL STOP |

|

|

|||||

TOWNS – TRIP DESTINATION |

|

|

|

AND ENDING |

|

|

PURCHASED |

||||||

|

|

|

FROM POINT TO POINT |

TRAVELED |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

1 |

Birmingham, AL |

13 |

45,997 |

|

|

|

|

|

|

||||

2 |

AL state line |

46,129 |

132 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

3 |

Jackson, MS |

|

46,241 |

112 |

|

Browns Truck Stop |

|

|

120 |

||||

4 |

MS state line |

|

46,285 |

44 |

|

Jackson, MS |

|

|

|

|

|||

5 |

LA state line |

|

46,471 |

186 |

|

|

|

|

|

|

|||

6 |

Dallas, TX |

|

46,634 |

163 |

|

|

|

|

100 |

||||

7 |

LA state line |

|

46,797 |

163 |

|

Dallas, TX |

|

|

|

|

|||

8 |

MS state line |

|

46,983 |

186 |

|

|

|

|

|

|

|||

9 |

Jackson, MS |

|

47,027 |

44 |

|

|

|

|

|

|

|||

10 |

AL state line |

|

47,139 |

112 |

|

|

|

|

|

|

|||

11 |

Birmingham, AL |

|

47,271 |

132 |

|

|

|

|

80 |

||||

12 |

|

|

|

|

|

|

|

|

Birmingham, AL |

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

20 |

19 |

|

|

|

23 |

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENDING ODOMETER |

|

|

|

TOTAL DISTANCE PER STATE / JURISDICTION |

|

TOTAL FUEL PURCHASED |

|||||

|

|

|

47,271 |

|

AL - 264 |

|

|

|

|

300 |

|||

|

|

|

|

|

|

MS - 312 |

|

|

|

|

|||

|

|

BEGINNING ODOMETER |

|

|

|

|

|

|

|||||

|

|

|

45,997 |

|

LA - 372 |

|

|

|

TOTAL TRIP DISTANCE |

||||

|

|

TOTAL TRIP DISTANCE |

TOTAL TRIP DIISTANCE |

TX - 326 |

|

|

|

|

1,274 |

||||

|

|

|

|

1,274 |

1,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

21 |

|

22 |

|

|

|

|

|

|

25 |

|

|

Instructions

1.Carrier’s name.

2.Federal ID number or social security number.

3 Carrier’s address.

4.IFTA/IRP account number.

5.Trip number.

6.Fleet number.

7.Trailer unit number.

8.Truck unit number.

9.Comments or additional information.

10.Driver’s signature.

11.Type of fuel used in the vehicle, i.e. diesel, propane, gas.

12.Trip origin, state/jurisdiction lines crossed, loading/unloading points, trip destination.

13.Odometer readings for each entry in No. 12.

14.Mileage between each entry in No. 12.

15.Road, highway, or interstate traveled.

16.Date trip started, date trip ended, and in between.

17.Vendor name and address where fuel pur- chased.

18.Number of gallons purchased.

19.Ending odometer reading for trip.

20.Beginning odometer reading for trip.

21.Difference between No. 19 and No. 20 equals total trip miles.

22.Add miles in No. 14 – Miles By State/ Jurisdiction And From Point To Point. (This should match the miles you have in No. 21.)

23.Add miles in No. 14 by state and enter total for each state.

24.Add gallons purchased in No. 18 and enter total here.

25.Add all miles for each state/jurisdiction in No. 23 and enter total here. (This should match the miles in No. 21 and No. 22.)

Form Specs

| Fact Name | Detail |

|---|---|

| Form Title | Alabama Department of Revenue Individual Vehicle Distance and Fuel Record |

| Form Numbers | IRP-44 / IFTA-20 |

| Version Date | May 2013 |

| Purpose | To document the distance traveled and fuel purchased by commercial vehicles for tax reporting purposes. |

| Required Information | Carrier’s name, FEIN/SSN, account number, trip details, fuel details, and vehicle information. |

| Governing Laws | Alabama statutes related to the International Registration Plan (IRP) and International Fuel Tax Agreement (IFTA). |

| User | Carriers operating commercial vehicles in Alabama and other jurisdictions. |

| Key Sections | Carrier and vehicle information, trip origin and destination, distance by state, fuel purchases. |

| Importance of Accuracy | Ensures compliance with tax obligations and prevents penalties for inaccurate reporting. |

| Submission Requirement | Form must be submitted to the Alabama Department of Revenue as part of the IFTA and IRP reporting process. |

| Instructions | Instructions for completing the form are provided to assist carriers in accurately recording necessary information. |

Detailed Guide for Writing Alabama Irp 44

When individuals or businesses need to accurately report the distance and fuel usage of their vehicles, they turn to forms like the Alabama Individual Vehicle Distance and Fuel Record (IVDR) IRP-44. This document plays a crucial role in ensuring compliance with state reporting requirements. Its completion is key for maintaining accurate records of vehicle operation across state lines and managing fuel tax obligations. The following steps aim to guide you through the process, making it straightforward and manageable.

- Carrier’s name: Enter the full legal name of the carrier or company.

- Federal ID number or social security number (FEIN / SSN): Provide the applicable tax identification number.

- Carrier’s address: Fill in the address of the carrier, including street, city, state, and ZIP code.

- IFTA/IRP account number: Enter the account number associated with the International Fuel Tax Agreement (IFTA) or International Registration Plan (IRP).

- Trip number: Assign a unique number to this trip for internal tracking.

- Fleet number:: Input the number that identifies the fleet to which the vehicle belongs.

- Trailer unit number: If applicable, provide the identifying number of the trailer.

- Truck unit number: Enter the identifying number of the truck or tractor.

- Comments or additional information (Remarks): Input any relevant notes or observations about the trip, including load details or special circumstances.

- Driver’s signature: Have the driver print and sign their name to certify the accuracy of the report.

- Type of fuel used in the vehicle: Specify the type of fuel the vehicle uses, e.g., diesel, propane, gas.

- Trip origin, state/jurisdiction lines crossed, loading/unloading points, trip destination: Detail the trip's origin point, the states or jurisdictions crossed, significant loading and unloading locations, and the final destination.

- Odometer readings for each entry in No. 12: Record the vehicle's odometer reading at each point listed in step 12.

- Mileage between each entry in No. 12: Calculate and enter the mileage between each point listed in step 12.

- Road, highway, or interstate traveled: Document the specific roads, highways, or interstates used for the trip.

- Date trip started, date trip ended, and in between: Note the start date, end date, and any significant dates between that are relevant to the trip.

Vendor name and address where fuel purchased: Provide the details of where fuel was purchased including the vendor's name and address.- Number of gallons purchased: Enter the total number of gallons of fuel purchased during the trip.

- Ending odometer reading for trip: Record the odometer reading at the conclusion of the trip.

- Beginning odometer reading for trip: Enter the odometer reading at the start of the trip.

- Difference between No. 19 and No. 20 equals total trip miles: Calculate the total miles traveled during the trip based on the starting and ending odometer readings.

- Add miles in No. 14 – Miles By State/ Jurisdiction And From Point To Point: Compile the miles traveled in each state or jurisdiction as listed in step 14.

- Add miles in No. 14 by state and enter total for each state: Sum the miles for each state or jurisdiction traveled and enter the totals.

- Add gallons purchased in No. 18 and enter total here: Sum the total gallons of fuel purchased during the trip.

- Add all miles for each state/jurisdiction in No. 23 and enter total here: Summarize the total miles covered in each state or jurisdiction during the trip. This should match the figures entered in steps 21 and 22.

Filling out the Alabama IRP-44 form thoroughly and accurately not only aids in regulatory compliance but also facilitates efficient fleet management and financial accountability. By following these detailed instructions, carriers can ensure that their records reflect the true extent of their vehicle's operations and fuel consumption, thereby aligning with the essential requirements of tax and regulatory bodies.

Common Questions

What is the Alabama IRP-44 form used for?

The Alabama IRP-44 form, also known as the Individual Vehicle Distance and Fuel Record, is used by carriers to record and report the distance their vehicles travel and the fuel purchased within each jurisdiction. It's a crucial document for businesses involved in interstate transportation, as it aids in the accurate calculation of fuel tax obligations under the International Fuel Tax Agreement (IFTA) and the International Registration Plan (IRP).

Who needs to fill out the IRP-44 form?

Any carrier operating commercial vehicles across state lines that are registered under the IRP and/or are part of the IFTA program needs to fill out the IRP-44 form. This includes carriers who operate trucks, trailers, or buses that travel in Alabama and other states or jurisdictions. Keeping accurate records on this form is essential for tax reporting and compliance purposes.

How often should the IRP-44 form be completed and submitted?

The IRP-44 form should be filled out and maintained regularly for each trip made by a vehicle. While the form itself is not submitted on a regular schedule, the information recorded on it must be compiled and reported quarterly to the Alabama Department of Revenue for IFTA purposes, and annually for IRP purposes. It’s important to keep these forms on file, as they may be requested during an audit or review process.

What information is required on the IRP-44 form?

The form requires detailed trip information, including the carrier’s name, Federal ID number or social security number, address, IFTA/IRP account number, trip number, fleet number, trailer and truck unit number, driver’s signature, type of fuel, trip origin and destination, odometer readings at the start and end of the trip, mileage by state, highways or routes traveled, dates of travel, and details of fuel purchased (including vendor name and address, number of gallons, etc.). This comprehensive data helps calculate the total distance traveled and fuel used per jurisdiction.

What happens if the IRP-44 form is not accurately filled out?

Failure to accurately complete the IRP-44 form can lead to issues with tax reporting, potentially resulting in audits, fines, and penalties. Inaccuracies on this form can lead to underpayment or overpayment of fuel taxes. Proper and precise record-keeping ensures compliance with tax laws and regulations, preventing legal and financial repercussions for the carrier.

Can the IRP-44 form be filled out digitally, or is a paper form required?

While paper forms are commonly used and may be required in some instances, digital solutions for filling out and storing the IRP-44 form are increasingly available and accepted. Utilizing digital record-keeping methods can enhance accuracy and efficiency in managing trip reports and fuel records. However, carriers should consult with the Alabama Department of Revenue or their compliance provider to ensure that their method of filling out and storing these records meets all regulatory requirements and standards.

Common mistakes

Filling out the Alabama IRP 44 form correctly is crucial for ensuring accurate vehicle distance and fuel records. However, there are common mistakes that can lead to errors in reporting. Understanding these mistakes is key to avoiding them.

Not correctly recording the carrier's name and address. This basic information is critical for identifying the record. Ensure that the carrier's name matches the name registered with the Alabama Department of Revenue and that the address is current and accurate.

Omitting or inaccurately providing the Federal ID number or social security number. This unique identifier ties your records to your account. Double-check this number for accuracy to prevent any mismatch or processing delays.

Failure to include accurate trip details, such as trip origin, state/jurisdiction lines crossed, and trip destination. These details are necessary for calculating taxes and dues accurately. Each trip segment must be documented meticulously.

Incorrect odometer readings at the beginning and end of the trip. Accurate readings are essential for determining total trip distance. An error here can significantly affect fuel efficiency calculations and tax liabilities.

Not listing all fuel purchases during the trip, including the vendor's name, address, and the number of gallons purchased. This information is crucial for verifying fuel tax payments. Remember to retain and submit receipts if required.

Skipping details about loading/unloading points and the route taken (road, highway, or interstate). This data helps in the verification of the log and ensures that the distances claimed are in alignment with the travel routes.

Miscalculating the total distance per state/jurisdiction and the total fuel purchased. Both of these are critical for determining IRP and IFTA dues. Ensure that calculations are done properly and match the odometer readings and fuel receipts.

To avoid these mistakes, it's advisable to double-check all entries for accuracy and completeness before submission. Keeping organized and detailed records throughout the trip can significantly ease the process of filling out the IRP-44 form. Additionally, leveraging digital tools or mobile apps specifically designed for tracking these details can minimize errors and improve reporting accuracy.

Documents used along the form

When transporting goods across state lines, trucking companies in Alabama and their drivers need to maintain accurate and up-to-date documentation. This documentation includes, but is not limited to, the Alabama Department of Revenue Individual Vehicle Distance and Fuel Record, commonly known as the IRP-44 or IFTA-20 form. This form is a crucial document for recording the distances traveled and fuel purchased in different jurisdictions. However, it's not the only document necessary for compliance with regulatory requirements. Several other forms and documents are often used alongside the IRP-44 to ensure smooth and lawful interstate transportation.

- IFTA License and Decals Application: Required for carriers operating across multiple jurisdictions to simplify reporting of fuel use. Carriers receive a license and decals for their vehicles.

- IRP (International Registration Plan) Application: For registering fleets of vehicles traveling in multiple states or provinces, allowing them to pay apportioned fees based on the distance covered in each jurisdiction.

- USDOT Number Application: The USDOT Number serves as a unique identifier when collecting and monitoring a company’s safety information acquired during audits, compliance reviews, and inspections.

- UCR (Unified Carrier Registration) Form: This is required for all operators of commercial motor vehicles that cross state lines, designed to verify active interstate operating authority.

- MC (Motor Carrier) Authority Application: Necessary for carriers that haul commodities across state lines to obtain interstate operating authority.

- Vehicle Maintenance Records: These documents are crucial for ensuring and proving that all vehicles in the fleet are well maintained and safe for operation.

- Driver Qualification Files: Contain records of a driver’s license, medical examiner's certificate, records of violations, and other necessary qualifications.

- Hours of Service Logs: Required by the Department of Transportation (DOT) to ensure drivers adhere to regulated driving hours, thus preventing fatigue.

- Bill of Lading: Acts as a receipt of freight services, a contract between a freight carrier and shipper, and a document of title. It is essential for the transport of goods.

- Hazardous Material Documentation: Necessary for carriers that transport hazardous materials, providing important information for emergency responders in case of an incident.

The coordination between these documents facilitates not only compliance with state and federal regulations but also contributes to the safety and efficiency of interstate transportation. Drivers and carriers must ensure that they are familiar with each form's requirements and maintain up-to-date records for inspection and auditing purposes. By doing so, they can avoid penalties and contribute to a safer, more efficient transportation network.

Similar forms

The Alabama IRP 44 form, known fully as the Individual Vehicle Distance and Fuel Record, plays a crucial role in documenting vehicle distance and fuel usage for carriers. This form is similar to a variety of other documents employed within the transport and logistics sectors, particularly in compliance with taxation and regulatory reporting. Below, a closer look is taken at some of these documents to understand their functions and how they compare with the Alabama IRP 44 form.

The International Fuel Tax Agreement (IFTA) Quarterly Fuel Use Tax Return is notably similar to the Alabama IRP 44 form. Both documents require detailed reporting of fuel consumption and distance traveled by commercial vehicles. However, the IFTA Quarterly Tax Return is used to calculate and report the fuel taxes owed by interstate motor carriers within the IFTA jurisdictions. By contrast, the Alabama IRP 44 form primarily collects distance and fuel usage data for each vehicle, aiding in the accurate apportionment of tax obligations among states, yet does not directly involve tax calculation.

The U.S. Department of Transportation (DOT) Number Application Form shares certain similarities with the Alabama IRP 44 form, particularly in collecting data on commercial transport activities. The DOT form is crucial for acquiring a DOT number, mandatory for vehicles involved in interstate commerce. While it primarily focuses on identifying commercial vehicles and their operators for safety management and compliance purposes, it indirectly supports regulatory reporting by ensuring vehicles are registered for oversight. Comparatively, the Alabama IRP 44 form has a narrower focus on documenting specific trips, fuel usage, and distance traveled for tax reporting purposes.

The Vehicle Mileage and Fuel Report is another document closely related to the Alabama IRP 44 form. This report is essential for documenting the miles traveled and fuel consumed by a vehicle within a specific time frame. Like the IRP 44, it serves to monitor compliance with state and federal regulations on fuel usage and taxation. However, the Vehicle Mileage and Fuel Report is often used by companies internally to manage fleet operations efficiently and can vary in format by the organization. In contrast, the Alabama IRP 44 form is a standardized document for tax reporting to state authorities, emphasizing its role in regulatory compliance.

Dos and Don'ts

When filling out the Alabama IRP-44 form, an Individual Vehicle Distance and Fuel Record used for reporting the operational specifics of a vehicle over a certain period, it's crucial to ensure accuracy and completeness in the documentation. Below is a list of recommended do's and don'ts that can help in correctly completing the form.

Do:

- Ensure all information is legible and complete: It's essential to fill in every section clearly and thoroughly to avoid any misunderstandings or inaccuracies in the reported data.

- Double-check odometer readings: Confirm that the beginning and ending odometer readings accurately reflect the vehicle's use during the trip to ensure precise calculation of distances traveled.

- Verify fuel purchase records: Keep receipts and carefully record the details of fuel purchases, including the number of gallons and the vendor's name and address, to ensure accurate fuel tax reporting.

- Record the correct trip information: Pay close attention to the trip's origin and destination, including all states/jurisdictions lines crossed, to accurately account for all mileage covered.

- Sign the form: Don’t forget the driver's signature, as this validates the authenticity and accuracy of the reported data.

Don't:

- Leave any fields blank: Every section of the form should be completed. If a section does not apply, enter "N/A" (not applicable) to indicate that the information has been considered and deemed not relevant.

- Estimate readings or amounts: Use actual figures from odometer readings and fuel receipts rather than estimates to ensure the accuracy of the reported data.

- Use pencil: Fill out the form in ink to prevent alterations and ensure the permanence of the information provided.

- Mix trips: Keep records for each trip separate to avoid confusion and inaccuracies in distance and fuel calculations.

- Ignore discrepancies: Should there be any discrepancies in mileage or fuel usage, review and correct them before submitting the form. Accuracy is crucial for compliance and audit purposes.

Misconceptions

Only trucking companies need to use the Alabama IRP 44 form. This is a misconception because the form is not exclusively for trucking companies. Any individual or company that operates a vehicle for commercial purposes across state lines might need to use the form to report vehicle distance and fuel use as per the International Registration Plan (IRP) and the International Fuel Tax Agreement (IFTA).

The form is complicated and requires a professional to fill it out. While the form does require detailed information, such as trip origin, distances traveled by state, and fuel purchases, the instructions provided with the form guide users through each step. With careful attention to detail, individuals can accurately complete the form without necessarily hiring a professional.

All information fields are mandatory for every trip. Misunderstanding often surrounds which fields must be filled out. Although the form is comprehensive, not every section applies to every trip. For example, if no fuel was purchased during a trip segment, then the fuel-related sections can be left blank. However, documenting mileage and route details accurately across state lines remains crucial.

You only need to submit the Alabama IRP 44 form annually. This is incorrect because the frequency of submission can vary based on the reporting requirements of the IRP and IFTA. Typically, carriers must file quarterly reports to reconcile miles traveled and fuel purchased in different jurisdictions. The Alabama IRP 44 form helps gather necessary information for these reports.

Digital submissions are not accepted; the form must be mailed. This misconception stems from traditional paper filing systems. However, many jurisdictions, including Alabama, have moved towards digital reporting for efficiency and environmental reasons. Carriers should check with the Alabama Department of Revenue for the most current filing methods and options.

Filling out the IRP 44 form exempts you from other reporting requirements. Completing the Alabama IRP 44 form is a step in compliance but does not exempt carriers from other state or federal reporting obligations. For instance, carriers might still need to submit additional documentation for fuel tax purposes or comply with vehicle registration requirements under the IRP separately.

Key takeaways

Filling out and utilizing the Alabama Department of Revenue Individual Vehicle Distance and Fuel Record, also known as the IRP-44 / IFTA-20 form, is essential for accurate tracking and reporting of vehicle mileage and fuel usage for carriers. Here are key takeaways to ensure the process is completed efficiently:

- Correct Identification: It's crucial to accurately provide the carrier's name, Federal ID number or social security number, and address at the beginning of the form, ensuring the responsible party is correctly identified.

- Comprehensive Vehicle & Trip Information: Details such as fleet and trailer unit numbers, truck unit number, trip number, and the driver's signature must be meticulously recorded, linking the document to specific vehicles and trips.

- Fuel Type Specification: Identifying the type of fuel used in the vehicle, such as diesel, propane, or gas, is necessary for proper fuel tax calculations and compliance with regulations.

- Detailed Journey Logging: The form requires a comprehensive log of the trip, including the origin, state or jurisdiction lines crossed, loading and unloading points, and the destination, providing a clear outline of the journey.

- Mileage and Fuel Records: Precise odometer readings at the beginning and end of the trip, mileage between each entry, the highways or roads traveled, the dates of travel, fuel purchased, and the vendors' details are crucial for accurate fuel tax reporting.

- Calculating Mileage and Fuel Consumption: The form guides the user through calculating the total trip distance, total distance per state or jurisdiction, and total fuel purchased, helping in fulfilling tax obligations accurately.

- Ensuring Accuracy: The difference between the starting and ending odometer readings should equal the total trip miles, and the sum of miles per state should match these totals, ensuring the accuracy of the record.

- Documentation: Keeping this record up-to-date and accurate is vital for compliance with the International Fuel Tax Agreement (IFTA) and the International Registration Plan (IRP), preventing penalties and facilitating smooth operations across state lines.

- Audit Preparedness: Maintaining organized and thorough records, as facilitated by the IRP-44 / IFTA-20 form, prepares carriers for potential audits by providing required documentation of mileage and fuel usage.

Adherence to these guidelines not only complies with regulatory requirements but also aids in the efficient management of a fleet's operational costs, ensuring accurate fuel tax reporting and reimbursements where applicable.

Check out Popular PDFs

Alabama Affidavit Form - The use of the C-15 form is a standardized procedure for service of process in Alabama.

Alabama Department of Revenue Forms - Historical filing questions help establish continuity with past state tax filings for residents.

Alabama Affidavit Form - Victims can ask for specific protections, such as restraining the abuser from visiting the victim's workplace or school.