Alabama Eoo Template

In today's digital era, the process of filing tax returns has seen significant shifts, aiming to enhance efficiency, accuracy, and security. The Alabama Department of Revenue has instituted regulations to keep pace with these advancements, specifically targeting the manner in which tax preparers and taxpayers interact with the state's tax system. A pivotal component of this regulatory framework is the Alabama EOO (Electronic Opt-Out) form, which plays a crucial role for individuals and tax preparers navigating the digital filing requirements. The form is designed for taxpayers who are served by preparers mandated to file electronically—those who prepare 50 or more individual income tax returns annually. It serves as a formal election for taxpayers to file their returns via paper instead of electronically, an option that, while less common, is necessary under certain circumstances. The directive, established by Alabama Rule 810-3-27-.09, signifies a clear transition from paper returns with 2D barcode technology to mandatory electronic submissions, with the EOO form offering a structured opt-out mechanism. This choice to opt-out requires completion of the form, which must be attached to the taxpayer's paper return, complete with a 2D barcode, thereby ensuring compliance while also catering to personal or logistical preferences for paper submissions. In addition to detailing this process, the form also encapsulates guidelines for tax preparers, reiterating their responsibilities in cases where taxpayers choose not to file electronically. Through its detailed stipulations, the Alabama EOO form underscores the evolving landscape of tax administration, aiming to marry the convenience and speed of electronic filing with accommodations for traditional paper filings.

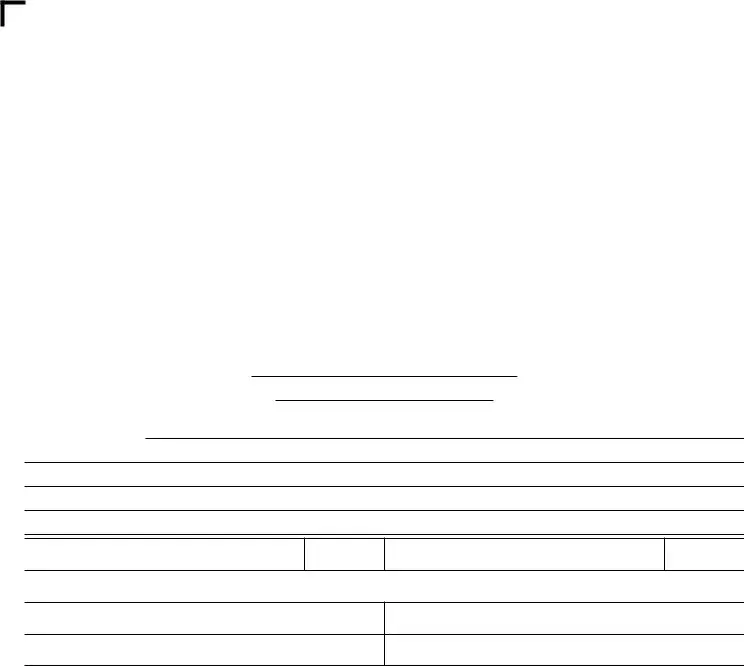

Alabama Eoo Example

FORM |

ALABAMA DEPARTMENT OF REVENUE |

2011 |

|

EOO |

|||

INDIVIDUAL & CORPORATE TAX DIVISION |

|||

|

|

Taxpayer

General Information

Tax preparers who prepare 50 or more individual income tax returns in any calendar year, are required by Alabama Rule

As a taxpayer receiving services from a tax preparer who is required by Alabama law to file all acceptable Alabama indi- vidual income tax returns using electronic medium you may elect to “Opt Out.” That is, you may elect to not file your return using an electronic medium. Returns submitted electronically are processed faster, more accurately, and at a lower cost to the Department. If you elect to “Opt Out,” you are required to complete this form, which must be attached to your original paper individual income tax return. The paper return must have a 2D barcode on it when submitted to the Department with this form.

By signing this form, you have elected to:

NOT file your return electronically.

Reason for election:

TAXPAYER’S SIGNATURE

DATE

SPOUSE’S SIGNATURE (IF FILING JOINT RETURN)

DATE

TAXPAYER NAME(S) (PLEASE PRINT)

PRIMARY SSN

PREPARER’S OR FIRM’S NAME

SPOUSE’S SSN (IF FILING JOINT RETURN)

PREPARER’S FEIN / PTIN / SSN |

DATE |

|

|

Instructions for Paid Tax Preparers

If you are complying with Alabama Rule

If you are complying with Alabama Rule

ADOR

Form Specs

| Fact Name | Detail |

|---|---|

| E-filing Requirement for Tax Preparers | Tax preparers who prepare 50 or more individual income tax returns in any calendar year must file all acceptable Alabama individual income tax returns using electronic medium as per Alabama Rule 810-3-27-.09. |

| Opt-Out Option for Taxpayers | Taxpayers receiving services from preparers who are required to file electronically have the option to "Opt Out" and not use the electronic medium for filing, requiring them to complete the EOO form and submit a paper return. |

| Paper Return Requirements | When opting out of electronic filing, the taxpayer’s paper return must include a 2D barcode and be accompanied by the completed EOO form. |

| Opt-Out Impact | Electronically submitted returns are processed faster, more accurately, and at a lower cost to the Alabama Department of Revenue, indicating the benefits forfeited by choosing to "Opt Out" of electronic filing. |

Detailed Guide for Writing Alabama Eoo

Electing to opt out of electronic filing for your Alabama individual income tax return can be an important decision for those who prefer or require a paper submission for any number of reasons. This choice necessitates completing the Alabama Department of Revenue (ADOR) EOO (Electronic Opt-Out) form. Designed to ensure that taxpayers have the option to submit their returns in paper form, this process is straightforward but requires attention to detail to ensure that your tax return is processed correctly and without delay. Before you can submit your paper return, you must fill out the EOO form correctly, attaching it to your return with the necessary 2D barcode. Follow these outlined steps to accurately complete the form.

- Read the General Information: Start by carefully reading the "General Information" section at the top of the form to understand why and when to use this form.

- Select Your Choice: Indicate your decision to opt out of electronic filing by acknowledging that you elect "NOT to file your return electronically." This is indicated through the signing of the form.

- Fill Out Taxpayer Information: Enter the names of the taxpayer and spouse (if filing jointly) as well as the primary Social Security Number (SSN) and, if applicable, the spouse’s SSN in the designated fields. Ensure the information is clear and legible.

- Sign and Date: The taxpayer (and spouse, if filing a joint return) must sign and date the form to validate the election to opt out of electronic filing.

- Preparer’s Information: If a tax preparer is completing this form on behalf of a taxpayer, they must include their name or the firm’s name along with their Preparer Tax Identification Number (PTIN), Federal Employer Identification Number (FEIN), or SSN. The preparer must also sign and date the form.

- Attach to Your Tax Return: After completing the form, attach it to the front of your Alabama individual income tax return. Make sure your return includes a 2D barcode.

- Review: Before submitting, review the entire form and attached tax return for accuracy and completeness. Errors or omissions could delay processing.

- Submit: Mail the completed form along with your paper tax return to the address specified for paper submissions by the Alabama Department of Revenue.

After you've completed and submitted the form along with your paper tax return, the Alabama Department of Revenue will process your return in due course. Keep in mind, returns filed on paper may take longer to process than those submitted electronically. Ensuring the accuracy of the information on your EOO form and tax return can help minimize any processing delays. Remember to keep copies of all submitted forms and documentation for your records.

Common Questions

What is the Alabama EOO form and who needs to use it?

The Alabama EOO form, which stands for "Elect Out of electronic filing Option," is a document provided by the Alabama Department of Revenue. It is specifically designed for taxpayers whose tax preparers are required to file Alabama individual income tax returns electronically. This requirement applies to tax preparers who prepare 50 or more individual income tax returns in a year. If a taxpayer wishes to submit their return in paper form instead of electronically, they must complete the EOO form. By signing this form, taxpayers officially elect not to file their return using an electronic medium.

Why would someone choose to opt out of electronic filing?

There are several reasons why someone might choose to opt out of electronic filing for their Alabama individual income tax return. While electronic filing is generally faster, more accurate, and cost-effective for the Department of Revenue, some individuals may prefer paper filing due to personal preference, lack of access to necessary technology, concerns over data security, or complexity in their tax situation that they feel is better handled through a paper return. By completing the EOO form, taxpayers can ensure their filing preferences are respected.

What requirements must be met if choosing to file a paper return with the EOO form?

To file a paper return using the EOO form, taxpayers must adhere to specific requirements. Firstly, the EOO form must be completed and attached to the original paper individual income tax return. Additionally, the paper return must include a 2D barcode when submitted to the Alabama Department of Revenue. This helps streamline the processing of paper returns. It’s worth noting that opting out of electronic filing does not exempt taxpayers from fulfilling any other normal tax obligations and deadlines.

Are there special instructions for tax preparers when a taxpayer decides to opt out of electronic filing?

Yes, there are specific instructions for tax preparers when a taxpayer decides to file a paper return using the EOO form. Tax preparers must still comply with Alabama Rule 810-3-27-.10, which mandates the offering of electronic filing to clients. If a taxpayer opts out, the preparer must attach the completed EOO form to the taxpayer's Alabama individual income tax return. Furthermore, the return must have a 2D barcode printed on it to be processed. These steps ensure that both taxpayers and tax preparers are in compliance with Alabama tax filing requirements while respecting the taxpayer’s choice to file on paper.

Common mistakes

Filling out the Alabama EOO form might seem straightforward, but it's easy to make mistakes that could complicate your tax filing process. Here are nine common errors that people make:

- Not consulting the tax preparer first: If your tax preparer is required by Alabama law to file all acceptable Alabama individual income tax returns using an electronic medium, it's essential to discuss your decision to opt out with them before filling out this form.

- Omitting the reason for electing to “Opt Out”: It’s critical to specify your reason for not filing your return electronically directly on the form. Failure to do so can lead to processing delays.

- Forgetting to attach the form to the paper return: Simply completing this form is not enough; it must be attached to your original paper individual income tax return, which must also have a 2D barcode on it when submitted.

- Missing signatures: Both the taxpayer and the spouse, if filing a joint return, need to sign the form. Overlooking either signature can invalidate your opt-out election.

- Incorrectly filling out personal information: Taxpayer name(s), Social Security Numbers (SSNs), and other personal details must be accurately filled out to ensure your paper return is properly processed.

- Leaving preparer’s information blank: If a tax preparer is responsible for your filing, their name and identification numbers such as FEIN/PTIN/SSN are required on the form.

- Not including a 2D barcode on the paper return: The Department of Revenue requires a 2D barcode for paper returns. Forgetting this crucial detail can result in processing issues.

- Misunderstanding the electronic filing requirements: Tax preparers who prepare 50 or more individual income tax returns in any calendar year are affected by this rule. Being unaware could lead to unintended non-compliance.

- Assuming paper returns are faster: Many people opt out believing that paper returns process quicker. However, electronic submissions are actually faster, more accurate, and cheaper for the Department to process.

To avoid these mistakes, carefully review the form instructions and requirements. Accurate and complete submissions not only comply with Alabama law but also ensure a smoother, more efficient tax filing process. Paying attention to the details can save time and prevent unnecessary headaches during tax season.

Documents used along the form

When it comes to managing your tax obligations in Alabama, particularly if you're making the decision to opt out of electronic filing as outlined in the Alabama Eoo (Electronic Opt-Out) form, understanding the additional forms and documents you might need is essential. Each form has its unique purpose and requirements, serving as a building block towards ensuring your tax filing is both comprehensive and compliant with state regulations. Here's a guide to other documents that are often used in conjunction with the Alabama EOO form:

- Form 40: The Alabama Individual Income Tax Return form is the basic form used by Alabama residents to report their income and calculate state income tax owed.

- Form 40A: This is a simplified version of the Form 40 for residents with straightforward tax situations, often involving only wages and few deductions.

- Form 40NR: Non-residents or part-year residents of Alabama use this form to report income earned within the state, ensuring they meet their tax obligations for income sourced from Alabama.

- Schedule A, B, & DC: These schedules accompany Form 40, allowing taxpayers to detail deductions, interest and dividend income, and donations to colleges, respectively, which can affect the total tax liability.

- Schedule E: Used for reporting income from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in Real Estate Mortgage Investment Conduits (REMICs).

- Form 4952A: If you're looking to deduct investment interest expense, this form is necessary for detailing and calculating the allowable amount for your state taxes.

- Form AL8453: The Alabama Individual Income Tax Electronic Filing Declaration is required when you file electronically, serving as a way to authorize e-filed returns although not applicable if opting-out via the EOO form, it's often prepared in case of a change in filing decision.

- Form W-2: Wage and Tax Statements from employers provide the necessary information regarding an individual's income and taxes withheld, crucial for accurate tax return preparation.

- Form 1099: These forms report various types of income other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and retirement distributions (1099-R).

- Form 4868: For those who need more time to prepare their state tax return, this form is used to request a six-month extension, allowing for a later filing date without penalty for late submission.

Awareness and proper preparation of these forms, alongside the Alabama Eoo form, are crucial elements in the tax filing process. By being prepared with the right documents, taxpayers can navigate their state tax responsibilities smoothly, ensuring they meet all necessary regulations while possibly maximizing their tax benefits. It's always advisable to consult with a tax professional to ensure that all forms are filled out accurately and submitted correctly, providing peace of mind during tax season.

Similar forms

The Alabama EOO (Electronic Opt-Out) form, designed by the Alabama Department of Revenue, stands out for its specific function but it also mirrors the characteristics and purposes of other tax-related forms and documents across various jurisdictions. Particularly, it can be compared with similar opt-out documents used in other states that also mandate electronic filing under certain conditions.

IRS Form 8948, Preparer's Paper Filing Checklist bears resemblance to the Alabama EOO form in several crucial aspects. Both serve as official documents for taxpayers or tax preparers to declare their decision to file tax returns in paper format, despite the general push towards electronic filing. Where the Alabama EOO form is used for individuals and corporations within Alabama to opt out of electronic filing, IRS Form 8948 applies to a wider audience at the federal level. Each form requires similar information from the taxpayer, including personal identification and the explicit choice to not file electronically, alongside the signature of the taxpayer to validate the opt-out decision.

California Form FTB 8453-OL, Online e-file Return Authorization for Individuals, although not an opt-out form per se, provides interesting parallels with the Alabama EOO form. It is part of the electronic filing process for California state taxes, where the form serves as an authorization for e-filing. However, embedded in its structure is the implication that without such authorization, filing would revert to paper forms, similar to opting out in Alabama. Both forms play pivotal roles in the transition between paper and electronic filing, ensuring that taxpayers’ preferences regarding filing methods are formally recognized and processed accordingly.

Moreover, the essence of the Alabama EOO form is shared with the New York State TR-579-IT e-file Opt-Out Request Form for Individuals. Much like Alabama’s version, this New York state form allows taxpayers to opt out of electronic filing for their state income tax returns. Each of these forms functions as a record of the taxpayer's choice to file in paper form and necessitates the taxpayer's information and reasoning for not filing electronically. They underscore the importance of accommodating individual filing preferences and circumstances, even as states move towards more digital tax processing systems.

Dos and Don'ts

Filling out the Alabama EOO (Electronic Opt-Out) form is a critical process for taxpayers who prefer to submit their tax returns via paper instead of electronically. Here, we provide a concise guide to help you navigate the preparation of this form accurately and effectively. Understanding the dos and don'ts ensures your tax filing meets state requirements without unnecessary delay or complications.

Things You Should Do

Ensure you have a valid reason for opting out of electronic filing. Remember, electronic submissions are processed faster and with fewer errors, but you have the right to choose paper filing if it suits your needs better.

Complete every section of the EOO form clearly and accurately. Your taxpayer information, including your primary SSN (Social Security Number), should match the details on your paper tax return.

If filing a joint return, make sure both you and your spouse sign the EOO form where indicated. Both signatures are necessary for joint filings to confirm the opt-out decision.

Attach the completed EOO form to your original paper income tax return before submission. Check that your paper return includes a 2D barcode, as required.

Consult with your tax preparer to ensure they are aware of your decision to opt out and that they have attached the EOO form to your paper return properly. If they prepared over 50 individual tax returns in the previous year, they must comply with this step.

Things You Shouldn't Do

Do not leave any sections of the EOO form incomplete. An incomplete form may result in your opt-out request being denied, requiring you to file electronically.

Avoid submitting the EOO form without attaching it to your paper tax return. The form itself is not a standalone document and must accompany your return.

Refrain from neglecting the requirement for a 2D barcode on your paper return. Failing to include this barcode can lead to processing delays or the need to resubmit.

Do not ignore the specific filing deadlines for paper returns. Even though you're opting out of electronic filing, you must adhere to the same submission timelines to avoid penalties.

Never forget to check with your tax preparer about their compliance with Alabama's electronic filing requirements. Even if you opt out, your preparer must meet certain conditions to submit on your behalf.

Understanding and following these guidelines can streamline your tax filing process and ensure that you comply with Alabama's tax filing regulations. Whether you're technologically savvy or prefer traditional paper filing, the choice is yours—but making it properly is key to a smooth tax season.

Misconceptions

Understanding the nuances of the tax filing process can often lead to misconceptions, particularly when it comes to the Alabama EOO form. This document is fundamental for those who opt out of electronic filing, yet several myths surround its use and purpose. Here, we'll address seven common misconceptions to shed light on the true nature of this form.

- Only the Taxpayer Needs to Sign: A common misconception is that if only one person is filing the tax return, then only their signature is required on the EOO form. However, if the return is for a joint filing, both the taxpayer and their spouse must sign the EOO form, regardless of who earned income during the tax year.

- Electronic Filing is Mandatory for All: While it is true that tax preparers who prepare more than 50 individual income tax returns yearly must file electronically, this doesn’t strictly apply to every taxpayer. You have the right to opt out of electronic filing and submit your return on paper by completing the EOO form and attaching it to your return.

- No Advantages to Electronic Filing: Some might think there are no benefits to electronic filing. However, electronic submissions are processed faster, more accurately, and they are cheaper for the Department of Revenue, potentially leading to quicker refunds and less chance for errors.

- Any Tax Return Can Be Filed with EOO Form: It's essential to understand that the EOO form is specific to individual income tax returns. Not all tax forms or situations are eligible for opting out of electronic filing with this form. For instance, corporate tax filings have different requirements and forms.

- Filing with 2D Barcode Technology is Optional: Since 2011, paper returns must include a 2D barcode when submitted alongside the EOO form. This barcode is crucial for processing the paper return and is not optional as some might believe.

- E-filing Opt-Out Does Not Apply to Tax Preparers: Another misconception is that the EOO form's opt-out clause is available to tax preparers. In reality, the form is designed for taxpayers. Tax preparers must adhere to Alabama Rule 810-3-27-.09, which mandates electronic filing if they prepare 50 or more individual tax returns annually.

- Completing the EOO Form is Complicated: Finally, there’s a notion that completing the EOO form is a complex process. However, the form is straightforward. You simply indicate your choice to opt out of electronic filing, provide the necessary signatures, and attach it to your paper tax return. Detailed instructions are provided to ensure clarity.

By dispelling these misconceptions, taxpayers can navigate their filing responsibilities with confidence, understanding the options available to them regarding the electronic and paper filing processes in Alabama. Whether choosing to file electronically or on paper, it's important to be well-informed to decide that best suits your needs.

Key takeaways

Filling out and using the Alabama EOO form comes with a set of key points that both taxpayers and tax preparers must understand. Here are four essential takeaways:

- Mandatory Electronic Filing for Certain Preparers: Any tax preparer who prepares 50 or more individual income tax returns in any calendar year is mandated by Alabama law to file all those returns electronically. This move aims to streamline the processing, improve accuracy, and reduce costs for the Department of Revenue.

- Opting Out is a Taxpayer's Right: If you, as a taxpayer, decide not to file your return electronically, you have the option to "Opt Out." Exercising this right means completing the EOO form and attaching it to your paper tax return. Remember, your paper return must have a 2D barcode to be accepted along with this form.

- Roles of Tax Preparers: Tax preparers must adhere to the rule by offering electronic filing as an option. If a taxpayer chooses to opt-out, the preparer is responsible for ensuring the completion of the EOO form by the taxpayer. The form, along with the taxpayer’s 2D barcoded paper return, must then be submitted to the Alabama Department of Revenue.

- Benefits of Electronic Filing: Though opting out is available, taxpayers should consider the benefits of filing returns electronically. Electronic submissions are processed faster, are more accurate, and incur lower costs for the Department, which in turn can lead to quicker refunds and fewer errors.

Understanding these key elements ensures that both taxpayers and tax preparers comply with Alabama tax laws efficiently, while also making informed decisions about the filing process.

Check out Popular PDFs

Alabama Mvt 41 1 - Use this form to officially declare a vehicle a salvage, subject to Alabama Department of Revenue's regulations.

New Hire Alabama - Assists in building a foundation for young individuals’ career paths through early work experiences.