Alabama Cpt Template

Amidst the intricate tapestry of tax obligations for businesses operating within the United States, the Alabama Business Privilege Tax Return and Annual Report form (CPT) emerges as a critical document for specific entities, notably C-Corporations. Crafted by the Alabama Department of Revenue, the 2005 edition delineates the procedural and financial reporting requirements exclusive to these corporations. It commences with a determination of the taxpayer's identity, including insurance companies, real estate investment trusts, and financial institutions, among others. Critical dates mark the span for which the tax return is applicable, signaling a clear timeframe for reporting. Taxpayer information, from legal names to federal codes, sets the foundational data. Onward, the form navigates through changes in corporate information, emphasizes the distinction between amended and initial returns, and delves into the computation of amounts due or refunds. Crucially, it highlights the necessity of attaching a Schedule BPT-IN for initial filings, underscores penalties and interest for overdue payments, and culminates in a comprehensive C-Corporation Privilege Tax Computation Schedule. This schedule meticulously guides corporations through the intricacies of net worth computation, privilege tax exclusions, deductions, and tax rate determinations, ultimately calculating the privilege tax due. The form mandates a nuanced understanding, prompting corporations to accurately report and potentially mitigate their tax liabilities within Alabama's regulatory framework.

Alabama Cpt Example

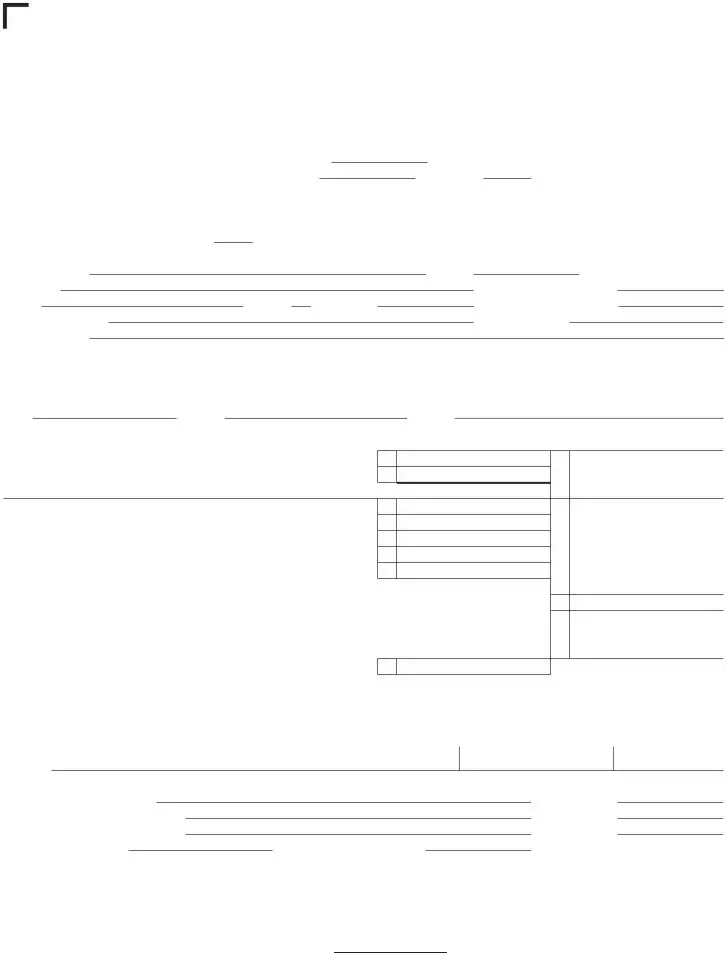

|

FORM |

|

*220001CP* |

|

|

|

|

|

CPT 2022 |

|

|

|

|||

|

Alabama Department of Revenue |

|

|

|

|

||

|

Alabama Business Privilege Tax Return |

|

|

|

|||

|

and Annual Report |

|

|

|

|

||

1a |

6 Calendar Year (Taxable Year 2022 – determination period beginning |

|

and ending 12/31/2021) |

|

|||

1b |

6 Fiscal Year (Taxable Year 2022 – determination period beginning |

|

and ending |

/2022) |

|||

1c |

6 Amended Return (Attach Supporting Documentation) |

6 52/53 Week Filer |

|

|

|||

Type of taxpayer (check only one): |

2a |

6 C Corporation |

|

2b |

6 Insurance Company (See definitions) |

||

2c |

6 LLE Taxed as Corporation |

2d |

6 Financial Institution Group Member |

2e |

6 Real Estate Investment Trust (REIT) |

||

2f |

6 Business Trust |

|

Number of |

|

|||

TAXPAYER INFORMATION

3a |

LEGAL NAME OF |

|

|

|

6 |

FEIN NOT REQUIRED |

|

|

BUSINESS ENTITY |

|

|

3b FEIN |

(SEE INSTRUCTIONS) |

||

3c |

MAILING |

|

|

3d |

BPT ACCOUNT NO. |

|

|

|

ADDRESS |

|

|

|

(SEE INSTRUCTIONS) |

|

|

|

|

|

|

|

3h |

FEDERAL BUSINESS CODE NO. |

|

3e |

CITY |

|

3f STATE |

3g ZIP CODE |

|

(NAICS) (SEE WWW.CENSUS.GOV) |

|

3i |

CONTACT PERSON |

|

|

3j |

CONTACT PERSON’S |

|

|

|

CONCERNING THIS FORM |

|

|

|

PHONE NO. |

|

|

3k |

TAXPAYER’S |

|

|

|

|

|

|

|

|

|

|

|

|

||

RETURN INFORMATION |

|

|

|

|

|

||

4a |

6 Corporation President Information Change on attached Schedule |

|

|

||||

4b |

6 Corporation Secretary Information Change on attached Schedule |

|

|

||||

5a Date of Incorporation or Organization |

5b State of Incorporation or Organization |

5c County of Incorporation or Organization |

|

||||

COMPUTATION OF AMOUNT DUE OR REFUND DUE |

Amount Due |

|

|

|

|

6 Secretary of State corporate annual report fee $10 |

6 |

|

7 Less: Annual report fee previously paid for the taxable year |

7 |

|

8 Net annual report fee due (line 6 less line 7) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 |

|

9 |

Privilege tax due (Page 2, Part B, line 20) |

9 |

10 |

Less: Privilege tax previously paid for the taxable year |

10 |

11 |

Net privilege tax due (line 9 less line 10) |

11 |

12 |

Penalty due (see instructions) |

12 |

13 |

Interest due (see instructions) |

13 |

14 |

Total privilege tax due (add lines 11, 12 and 13) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 |

15 |

Net tax due (add lines 8 and 14) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 |

16Payment due with return if line 15 is positive. (Form

Full payment of any amount due for a taxable year is due by the original due date of the return (without

|

consideration of any filing extensions in place) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 |

17 |

Amount to be refunded if line 15 is negative |

17 |

18 |

Check here if paid electronically 6 |

|

Please

Sign

Here

6I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Title |

Date |

Officerʼs |

|

Signature |

|

Paid

Preparer’s

Use Only

Preparerʼs signature

Firmʼs name (or yours, if

Phone No. |

Preparerʼs SSN/PTIN |

Date

E.I. No.

ZIP Code

If you are not making a payment, mail your return to: |

If you are making a payment, mail your return, Form |

Alabama Department of Revenue |

Alabama Department of Revenue |

Business Privilege Tax Section |

Business Privilege Tax Section |

P.O. Box 327431 |

P.O. Box 327320 |

Montgomery, AL |

Montgomery, AL |

Telephone Number: (334) |

Web site: www.revenue.alabama.gov |

ADOR

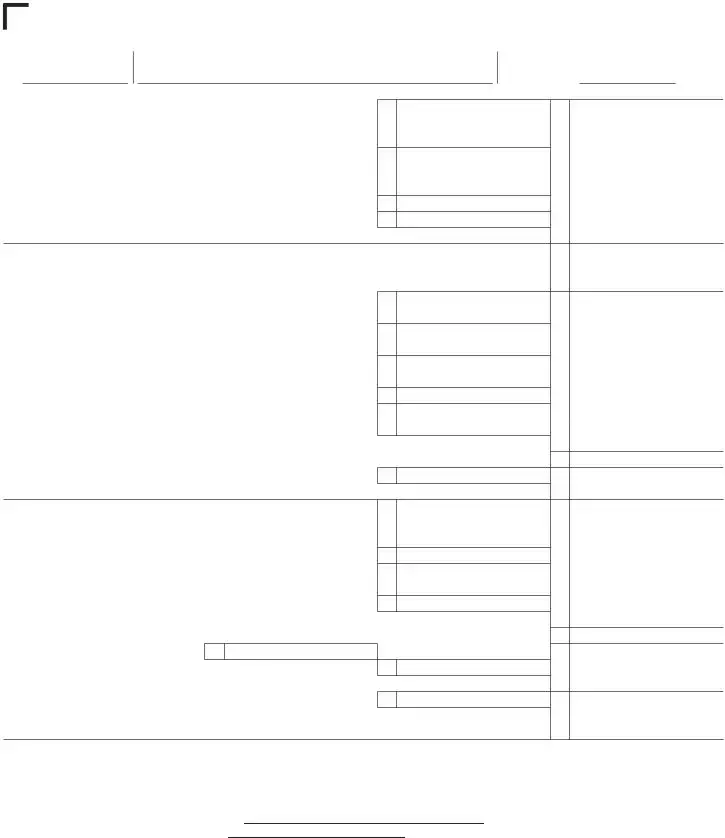

FORM |

BUSINESS PRIVILEGE |

*220002CP* |

Alabama Department of Revenue |

CPT |

TAXABLE/FORM YEAR |

Alabama Business Privilege Tax |

|

PAGE 2 |

2022 |

|

Privilege Tax Computation Schedule |

1a. FEIN |

1b. LEGAL NAME OF BUSINESS ENTITY |

1c. DETERMINATION PERIOD END DATE (BALANCE SHEET DATE) |

|

V |

|

|

(MM/DD/YYYY) |

PART A – NET WORTH COMPUTATION

Corporations & Entities Taxed as Corporations

1Issued capital stock and additional paid in capital (without reduction for treasury stock)

|

but not less than zero |

1 |

2 |

Retained earnings, but not less than zero, including dividends payable. For LLC’s taxed |

|

|

as corporations and |

|

|

minus liabilities |

2 |

3 |

Gross amount of related party debt exceeding the sums of line 1 and 2 |

3 |

4 |

All payments for compensation or similar amounts in excess of $500,000 |

4 |

5 |

Total net worth (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 |

PART B – PRIVILEGE TAX EXCLUSIONS AND DEDUCTIONS |

|

|

Exclusions (Attach supporting documentation) (SEE INSTRUCTIONS) |

|

|

1 |

Total net worth from line 5 above |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 |

2 |

Book value of the investments by the taxpayer in the equity of other taxpayers |

2 |

3Financial institutions, only – Book value of the investments in other corporations or LLE’s

|

if the taxpayer owns more than 50 percent of the corporation or LLE |

3 |

4 |

Unamortized portion of goodwill and core deposit intangibles resulting from a direct |

|

|

purchase |

4 |

5 |

Unamortized balance of properly elected |

5 |

6Financial institutions, only – The amount adjusted net worth

|

exceeds six percent of total assets (see instructions) |

6 |

|

|

7 |

Total exclusions (sum of lines |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 7 |

8 |

Net worth subject to apportionment (line 1 less line 7) |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 8 |

9 |

Apportionment factor (see instructions) |

9 |

. |

% |

10 |

Total Alabama net worth (multiply line 8 by line 9) |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 10 |

Deductions (Attach supporting documentation) (SEE INSTRUCTIONS)

11Net investment in bonds and securities issued by the State of Alabama or

political subdivision thereof, when issued prior to January 1, 2000. . . . . . . . . . . . . . . . . . . 11

12 Net investment in all air, ground, or water pollution control devices in Alabama. . . . . . . . . . 12

13Reserves for reclamation, storage, disposal, decontamination, or retirement associated

|

with a plant, facility, mine or site in Alabama . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

13 |

|

14 |

Book value of amount invested in qualifying low income housing projects (see instructions) |

14 |

|

|

15 |

Total deductions (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 15 |

16 |

Taxable Alabama net worth (line 10 less line 15) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 16 |

|

17a |

Federal Taxable Income Apportioned to AL . . |

17a |

|

|

17b |

Tax rate (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

17b |

. |

18 |

Gross privilege tax calculated (multiply line 16 by line 17b) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 18 |

|

19 |

Alabama enterprise zone credit (see instructions) |

19 |

|

|

20Privilege Tax Due (line 18 less line 19) (minimum $100, for maximum see instructions)

Enter also on Form CPT, page 1, line 9, Privilege Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Full payment of any amount due for a taxable year is due by the original

due date of the return (without consideration of any filing extensions in place).

an Alabama Schedule

ADOR

Form Specs

| Fact Name | Fact Detail |

|---|---|

| Form Type | Alabama Business Privilege Tax Return and Annual Report |

| Year | 2005 |

| Applicable Entities | For C-Corporations Only |

| Determination Period | Includes options for Beginning and Ending dates |

| Taxpayer Information | Requires Legal Name, FEIN, Mailing Address, City, State, Zip Code, and Federal Business Code Number (NAICS) |

| Amendment and Initial Return Indicators | Options to indicate if it is an Amended or Initial Return |

| Computation of Tax | Includes sections for computation of amount due or refund due |

| Secretary of State Fee | $10 Corporate Annual Report fee mentioned |

| Electronic Funds Transfer | Option to indicate if payment is made through EFT |

| Signing Requirement | Needs signature of an officer or paid preparer with authorization |

| Governing Laws | Alabama Department of Revenue regulations and Alabama state tax law |

Detailed Guide for Writing Alabama Cpt

Once a year, C-Corporations in Alabama are required to navigate the intricate process of filing their Alabama Business Privilege Tax Return and Annual Report, a vital compliance duty which ensures that these entities contribute their fair share towards the state's fiscal health. This form, known only to affect C-Corporations, details the specifics regarding tax obligations and allows companies to report any significant changes that may have occurred during the tax year, such as alterations in corporate structure or leadership. To complete this task effectively, a clear, step-by-step guide is essential for ensuring that all necessary information is accurately captured and submitted in a timely manner. The following steps are designed to facilitate a smooth, error-free filing process.

- Identify the type of taxpayer by checking the appropriate box under "Type of taxpayer" at the top of the form. Options include C Corporation, Insurance Company, LLE Taxed as Corporation, among others. Only one box should be selected.

- Determine the applicable tax period by providing the starting and ending dates in the section labeled "Determination Period."

- Mark the appropriate box to signify the tax year basis — CY (Calendar Year), FY (Fiscal Year), or SY (Short Year) as it applies to the taxed entity.

- Fill in the "TAXPAYER INFORMATION" section with the legal name of the taxpayer, Federal Employer Identification Number (FEIN), mailing address, city, state, ZIP code, and the Federal Business Code Number (NAICS).

- If any changes to the corporation's address or officer information have occurred, indicate these changes by checking the applicable boxes in the "RETURN INFORMATION" section.

- Check the box if filing an amended return or an initial return. Note, if this is an initial return, Schedule BPT-IN must be attached.

- Calculate the net annual report fee and the privilege tax due, accounting for any previous payments or refunds in their respective sections.

- Compute any applicable penalties and interest, and add these amounts to the total privilege tax due to determine the "Net tax due" on line 16.

- Indicate if payment is made through Electronic Funds Transfer (EFT) by checking the appropriate box and enter the payment information as required.

- Complete the signatory section at the bottom of the form, including the signature, title, and date, alongside the preparer's details if prepared by a third party.

- Attach the Alabama Schedule AL-CAR, Corporation Annual Report, and include the $10 Secretary of State Corporate Annual Report fee on page 1, line 7, unless filing an initial return.

With these steps thoroughly addressed, the Alabama CPT form should be filled out entirely and ready for submission. Taking care to provide accurate and complete data will streamline the review process and foster compliance with state tax obligations. Do remember, timely filing not only helps avoid penalties but also reinforces a corporation's standing in the business community.

Common Questions

What is the Alabama CPT form used for?

The Alabama CPT form is used by C-Corporations to file their Business Privilege Tax Return and Annual Report with the Alabama Department of Revenue. This form applies exclusively to C-Corporations, documenting the privilege tax they are required to pay based on their net worth and Alabama taxable income, as well as including the necessary information for their annual report.

Who needs to file the Alabama CPT form?

Only C-Corporations, including those that have elected to be taxed as a C-Corporation, such as LLEs (Limited Liability Entities) that are treated as C-Corporations for tax purposes, need to file the Alabama CPT form. It's not intended for use by S-Corporations, partnerships, sole proprietorships, or other non-C-Corporation business entities.

What is the deadline for filing the Alabama CPT form?

The filing deadline for the Alabama CPT form is typically within 2 and a half months following the end of the corporation’s fiscal year. For corporations operating on a calendar year basis, this would usually be by March 15th of the following year. It’s important to check for any changes or specific filing deadlines each tax year to avoid penalties.

Can I amend a previously filed Alabama CPT form?

Yes, an Alabama CPT form can be amended if there are changes to be made after the original filing. To do this, you must check the box indicating that the form is an amended return. Accurately complete the form with the amended information and submit it according to the original submission guidelines.

What are the penalties for late filing or non-payment of the Business Privilege Tax?

The Alabama Department of Revenue imposes penalties for both late filing of the Alabama CPT form and for the late payment or non-payment of the Business Privilege Tax. These penalties are assessed as a percentage of the tax due and can accrue interest over time. Specific penalty amounts and interest rates may vary, so it’s advisable to file and pay on time or consult the Department’s guidelines if you anticipate a delay.

How is the Business Privilege Tax calculated on the Alabama CPT form?

The Business Privilege Tax on the Alabama CPT form is calculated based on the corporation’s federal taxable income and its Alabama net worth. The computation involves several steps, beginning with determining the corporation's net worth, then applying exemptions and deductions, finally applying the appropriate tax rate to the adjusted net worth. A minimum tax amount applies, and entities may be subjected to different rates or provisions depending on their specific circumstances, such as their business activities or the elections they have made for federal tax purposes.

Common mistakes

Filling out the Alabama CPT form, specifically designed for C-Corporations, involves several common mistakes that can lead to incorrect submissions or processing delays. Recognizing and avoiding these errors can streamline tax reporting and compliance processes for businesses. Below are key errors often encountered on this form:

- Incorrect Type of Taxpayer Identification: The form clearly states it is for C-Corporations only. A frequent mistake is when entities other than C-Corporations attempt to file using this form, such as LLCs not taxed as corporations or S-Corporations.

- Selection of Incorrect Tax Period: The determination period for the tax year must be accurately entered. Confusion often arises between calendar year (CY), fiscal year (FY), and short year (SY) designations, leading to incorrect reporting periods on the form.

- Failure to Indicate Amended or Initial Returns: Boxes for amended or initial returns are frequently overlooked. Initial returns must be filed within 2.5 months of incorporation or qualification, and failing to check these boxes can cause processing delays or errors in record keeping.

- Errors in Taxpayer Information: Simple errors in the legal name of the taxpayer, FEIN, or mailing address can significantly impact the processing of the return. Accuracy in these sections is paramount to ensure proper tax recording and correspondence.

- Incorrect Calculation of Net Worth and Privilege Tax: Calculations relating to the corporation's net worth and the subsequent privilege tax calculations require careful attention to ensure that all applicable deductions and exclusions are accurately applied. Mistakes in this area can lead to either underpayment or overpayment of taxes.

- Omission of Supporting Documentation: For certain exclusions and deductions, supporting documentation is required. Failing to attach the necessary documents can result in disallowed deductions, leading to higher tax liabilities.

- Signature and Authorization Issues: The form requires a signature under penalties of perjury, and in cases where a paid preparer is utilized, proper authorization must be granted. Overlooking these requirements can lead to an invalid return submission.

- Payment Details Errors: Incorrect payment amounts or failure to indicate EFT payment when applicable can cause discrepancies in tax accounts. Ensuring the correct amount is paid and properly indicated is crucial for full compliance.

Each of these mistakes can be avoided by carefully reviewing the instructions provided with the form, ensuring all relevant sections are completed accurately, and double-checking calculations and supporting documents before submission. Additionally, consulting with a tax professional can provide further clarity and assistance in navigating the complexities of state tax compliance.

Documents used along the form

Filing the Alabama Business Privilege Tax Return and Annual Report requires careful attention and the inclusion of several other important documents and forms to ensure compliance and accuracy. Below is a description of additional forms and documents often used in conjunction with the Alabama CPT form to provide a comprehensive overview of a corporation’s financial and tax responsibilities.

- Schedule AL-CAR (Corporation Annual Report): This form complements the CPT by providing detailed information about the corporation’s structure, activities, and changes in corporate information over the fiscal year. It is mandatory for annual filings, excluding initial returns.

- Schedule BPT-IN: Required for initial returns, this form captures the initial details about the corporation’s formation or qualification within the state. It must be filed within 2-1/2 months of incorporation or qualification.

- Form BPT-V (Business Privilege Tax Voucher): Used for making payments if the corporation owes taxes with the return. Ensures that payments are correctly applied to the corporation’s account.

- Power of Attorney and Declaration of Representative (Form 2848A): Allows a representative to discuss and handle tax matters with the Department of Revenue on behalf of the corporation.

- Annual Report Fee Payment Proof: A copy of the payment receipt for the Secretary of State Corporate Annual Report fee, which is recorded on the first page of the CPT form.

- Documentation for Deductions and Exclusions: Supporting documentation for any exclusions or deductions claimed on the return, such as investments in Alabama bonds, pollution control devices, and qualifying low-income housing projects.

- Form PPT: The pass-through entity version of the business privilege tax return for entities taxed as partnerships or S-corporations, which may be relevant for corporations with interests in such entities.

- Electronic Funds Transfer (EFT) Authorization: For corporations choosing to make payments via EFT, an authorization form or registration may be necessary to set up this payment method with the Department of Revenue.

Collectively, these documents ensure that corporations provide a full picture of their operations, financial status, and tax liabilities. It is important for corporations to maintain accurate and complete records, not only to comply with state tax regulations but also to facilitate potential audits and financial planning.

Similar forms

- The Alabama CPT form bears similarities to the Federal Form 1120, the U.S. Corporation Income Tax Return. Like the Federal 1120, the Alabama CPT mandates detailed financial disclosures, including net worth computation, income, deductions, and tax calculations specific to the reporting period. Both forms serve the purpose of calculating tax liability but for different tax authorities: the Alabama CPT for the state and the 1120 for the federal government. They require a declaration of the legal name, taxpayer identification numbers (FEIN for corporations), and the respective periods covered by the fiscal year or calendar year. The key similarity lies in their function to assess the tax based on the corporations' ability to pay, as indicated by their financial standings and operations within the specified tax period.

- Another comparable document is the State of Alabama Department of Revenue Annual Report Form, which, much like the CPT form, is geared towards gathering annual operational specifics from corporations. This form, while focusing less on the precise tax calculations, also collects essential data on corporate structure, amendments to corporate information, and operational updates that could affect tax liability and status within the state. Both are integral in ensuring corporations are in compliance with Alabama’s regulatory and tax obligations. They complement each other in providing a comprehensive view of a corporation’s annual activities and financial health to state tax authorities.

- Moreover, the Alabama CPT form is akin to the Business Privilege Tax Return forms used by other states, such as the Texas Franchise Tax Report. Although each state has its own tax implications and rate structures, the foundational requirement of reporting the financial metrics that determine the business privilege tax liability is consistent. Entities are required to disclose information about their net worth, earned income, and other financial and operational information crucial for calculating the tax owed under the specific statutes of each state’s law governing businesses. These forms serve as a means for states to levy taxes on businesses for the privilege of operating within their jurisdiction, emphasizing the importance of compliance with state tax laws.

Dos and Don'ts

When it comes to filling out the Alabama CPT form, accurate reporting and attention to detail are crucial. Here's a list of dos and don'ts that can help ensure the process is smooth and error-free.

Things You Should Do

- Verify your corporation type before you begin. The Alabama CPT form is specifically for C-Corporations, so confirm that this applies to your business.

- Double-check the determination period dates for accuracy. Ensure that the beginning and ending dates are correctly entered in the format mm/dd/yyyy.

- Review the taxpayer information section thoroughly. Make sure the legal name, FEIN, mailing address, and other details are current and correctly entered.

- Accurately calculate your net worth and privilege tax dues. Utilize the computation section on page 2 and attach any required documentation for exclusions or deductions.

- Sign and date the form. A signature is necessary to validate the form, and if a paid preparer completed the form, their information should be included as well.

Things You Shouldn't Do

- Don’t overlook the checkbox options for address change, initial return, or amended return. These are important for the Department of Revenue's records.

- Do not underestimate the importance of checking the appropriate tax year and ensuring all schedules and fees align with that year.

- Avoid skipping the computation of the amount due or refund due. This section is critical for understanding what your corporation owes or is owed.

- Don't forget to include the Secretary of State Corporate Annual Report fee if it applies to your submission. This is a common oversight.

- Avoid making your payment without including the EFT Indicator if you're using Electronic Funds Transfer. Properly indicating your payment method helps in processing your return efficiently.

By following these guidelines, you can improve the accuracy of your Alabama CPT form submission and avoid common pitfalls. Always remember to keep a copy of your submitted form and any correspondence from the Alabama Department of Revenue for your records.

Misconceptions

When navigating the complexities of the Alabama CPT Form, misconceptions can easily arise. Clearing up these misunderstandings helps ensure that C-Corporations fulfill their tax obligations accurately and efficiently. Below is a list of seven common misconceptions about the Alabama CPT Form:

- The form is for all types of businesses: This is a significant misconception. The Alabama CPT Form is specifically designed for C-Corporations only. Other business entities, such as sole proprietorships, partnerships, and S-Corporations, must use different forms for their business privilege tax and annual report filings.

- Insurance Companies and Financial Institutions file the same way as any C-Corporation: While it's true that these entities might fall under the broader umbrella of C-Corporations for federal tax purposes, the Alabama CPT Form provides specific checkboxes for Insurance Companies and Financial Institutions due to their unique tax considerations and requirements in the state of Alabama.

- Initial returns have the same filing deadline as regular returns: This assumption could lead to missing the specific filing window for initial returns. In reality, initial returns must be filed within 2-1/2 months of incorporation or qualification in Alabama, which is a stricter timetable than that for regular annual filings.

- Payment methods are limited: Some may believe that payments must be made by check only. However, the form clearly indicates that payments can also be made through Electronic Funds Transfer (EFT), offering greater flexibility for corporations in how they submit their payments.

- All corporations pay the same amount of privilege tax: The calculation of the privilege tax is not one-size-fits-all. It involves a detailed process that includes net worth computation, exclusions, deductions, and an apportionment factor. Therefore, the amount of privilege tax due can significantly vary among different corporations.

- Filing an amended return is unnecessary: If a corporation discovers errors or omissions in their originally filed return, filing an amended return is essential for correcting these mistakes. The Alabama CPT Form includes a specific checkbox to indicate if the filing is an amended return, underscoring the importance of this process.

- Electronic filing is not available or recommended: While the form itself might be completed in a physical format for some, electronic filing is not only available but also encouraged for many taxpayers due to its efficiency and reduced likelihood of errors. This misconception may slow down the filing process for corporations that are unaware of their electronic filing options.

Understanding these key aspects of the Alabama CPT Form ensures that C-Corporations are better equipped to navigate their state tax obligations accurately. This clarity helps in avoiding unnecessary errors and in making the filing process as smooth as possible.

Key takeaways

Filling out the Alabama CPT form is a requirement exclusively for C-Corporations operating within the state, emphasizing the specialized nature of the tax document catered towards a specific type of company.

The determination period for tax purposes, marked by the start and end dates, requires clarity on whether the business operates on a calendar year (CY), fiscal year (FY), or short year (SY) basis. This distinction is crucial for accurate tax reporting and compliance.

Amendments to basic corporate information such as address changes or updates to the corporate president or secretary's details can be reported directly on the form, ensuring that the state's records are current.

The computation of the business privilege tax due includes several steps, such as accounting for the Secretary of State corporate annual report fee, potential deductions or exclusions, and adjustments for previously paid taxes, penalties, and interest, illustrating the comprehensive nature of tax liability assessment.

The form requires various attachments, including documentation for exclusions and deductions, a completed Alabama Schedule AL-CAR for non-initial returns, and payment if due. These requirements underline the importance of thorough preparation and the potential for reducing tax liability through compliant documentation.

Check out Popular PDFs

Selling Real Estate Contract - Questions the necessity of the contract and why these services cannot be fulfilled by existing state employees, ensuring cost-effectiveness.

Medicaid Application Alabama - Demands details on household composition, including children, stepchildren, and any dependants for thorough coverage consideration.

Alabama Affidavit Form - Instructions are included for legally transferring possession of essential items and vehicles to the petitioner, addressing practical needs.