Alabama Business License Application Template

Starting a business in Irondale, Alabama, requires navigating through some paperwork, the cornerstone of which is the Alabama Business License Application form — a critical first step for entrepreneurs venturing into the city's business landscape. This form, a comprehensive document, captures essential information about the new enterprise, demanding details such as the legal and trade name, the nature of the business activities, and the physical and mailing addresses. It differentiates among various forms of organization like sole proprietorships, partnerships, corporations, and more, ensuring that the city's Revenue Department has a clear understanding of the business structure. Additionally, it seeks information about the owners, partners, or officers, the state and federal tax numbers, and the completion date for when the company plans to commence its operations. By capturing the intended business and tax types, it lays the groundwork for identifying the specific licenses and permits the business will need. Moreover, it includes a section for businesses to indicate if their operations will have a physical presence in Irondale, which is a determining factor for certain zoning and city planning approvals. The application's thoroughness underscores Irondale's regulatory environment, ensuring that every business kicking off within the city is well-accounted for, from retail stores to service providers, and from manufacturing operations to rental agencies. It forms a pivotal part of the city's efforts to manage its commercial activities, providing a structured pathway for businesses to register and comply with local norms.

Alabama Business License Application Example

CITY OF IRONDALE, ALABAMA BUSINESS LICENSE APPLICATION

Complete and Mail/Fax/Email To:

CITY OF IRONDALE

PO BOX 100188,

101 SOUTH 20TH ST. IRONDALE, AL 35210 www.cityofirondale.org

(205) |

Fax (205) |

|

|

|

|

Application Type: |

New |

|

(CONFIDENTIAL) |

|

|

|

|

Applicant Complete This Box |

||

|

|

||

|

FORM OF ORGANZATION (Check One) |

||

|

Sole Prop. _____ |

Partnership _________ |

|

|

Corp. _____ Professional Assoc ______ |

||

|

LLC ______ |

Other_______________ |

|

|

|

|

|

Owner Change Name Change |

Location Change |

||

Legal Business Name: ___________________________________________________________________________________________

Trade Name: (If different from above) _________________________________________________________________________________

Business Activities: (Brief description- Retail clothing sales, wholesale food sales, rental of industrial equip., computer consulting, etc)

________________________________________________________________________________________________________________

Physical Address: |

___________________________________________________________________________________________ |

|||

|

(Street) |

(City) |

(State) |

(Zip) |

Mailing Address:

________________________________________________________________________________________________________________

(Street)(City)(State)(Zip)

Telephone: |

___________________________________________________________________________________________ |

||

|

(Business) |

(Fax) |

(Home Phone) |

List the Owner(s), Partners or Officers (Attach separate sheet if necessary)

Name |

Residence Address |

SSN |

Title |

Contact # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manager or contact person________________________________________________ Phone__________________________________________________

Date Business Activity Initiated or Proposed in Irondale: _____________Business located in___________ or out ____________of City of Irondale limits

If business is physically located in Irondale, list the owner of the building (or leasing agent) and phone number:

State of Alabama Sales Tax #____________________ State of Alabama Use Tax #________________ |

|

_ Federal ID #__________________________ |

||||||

Business Types: |

Retail |

Wholesale |

Contractor Service Professional Manufacturer |

Rental Other |

||||

Tax Types: |

Sales |

Use |

Consumer Use |

Rental |

Lodging |

|

Liquor |

None |

Business License

Comments: _________________________________________________________________________________________________

This application has been examined by me and is, to the best of my knowledge, a true and complete representation of the above named entity, and person(s) listed.

Date ____________________ Signature ___________________________________________________Title _________________________________

THIS AREA FOR MUNICIPAL USE ONLY

ACCOUNT ID # _________________ |

NAICS CODE # __________________ |

REVIEWED BY: ___________________ |

|

Tax Filing Frequency: Monthly |

Quarterly |

Annual |

Other _____________________ |

ZONING CLASSIFICATION: ______________ |

|

|

|

|

|

|

|

City of Irondale

Attention: Revenue Department

101 South 20th Street

Irondale, AL 35210

Name of Business:

Address:

Contact Name: ______________________________ Telephone #: _____________________

NAICS # (North American Industry Classification System) ____________________

ALL SALES ARE SHIPPED BY COMMON CARRIER AND NO PHYSICAL PRESENCE IN THE CITY OF IRONDALE. ___________YES

Date__________Signature______________________________Title______________

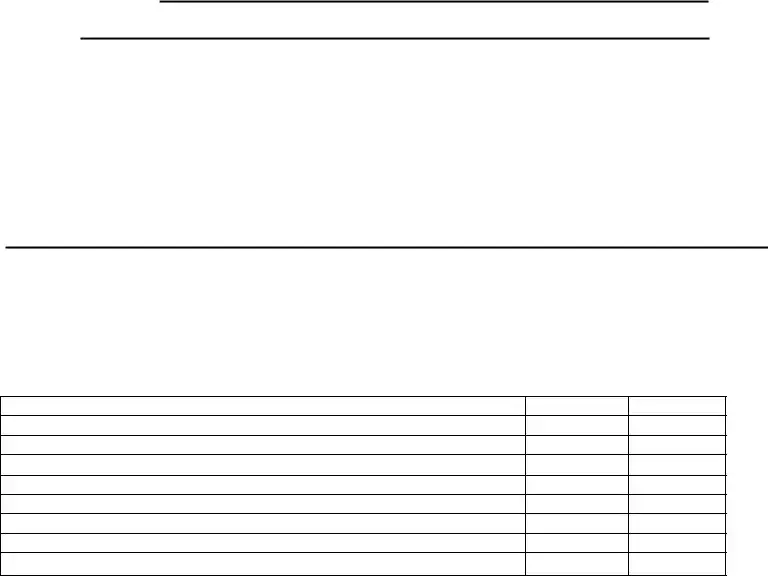

If any of the below question are answered “YES” a Business License is required (in order to process your application, your payment must be included).

1.If all questions are answered “NO” and all merchandise sold at retail was shipped by common carrier you must complete the business license application and report taxes only.

YES NO

Physical Presence (business location) or any of the below:

Representative(s) who visit or deliver to business

Contractor performed a job (in the City of Irondale)

Salesperson came (into the City of Irondale)

Delivery in own truck (in the City of Irondale)

Maintains Equipment (in the City of Irondale)

Leasing Equipment (in the City of Irondale)

Leasing (in the City of Irondale)

Sales are not shipped by common carrier

License fees are determined by the exact nature and type of your business. You should contact the Irondale Revenue Department at (205)

This application has been examined by me and is, to the best of my knowledge, a true and complete representation of the above named entity, and person(s) listed.

Date________Signature__________________________________Title_____________

THIS FORM MUST BE SIGNED AND RETURNED WITH APPLICATION

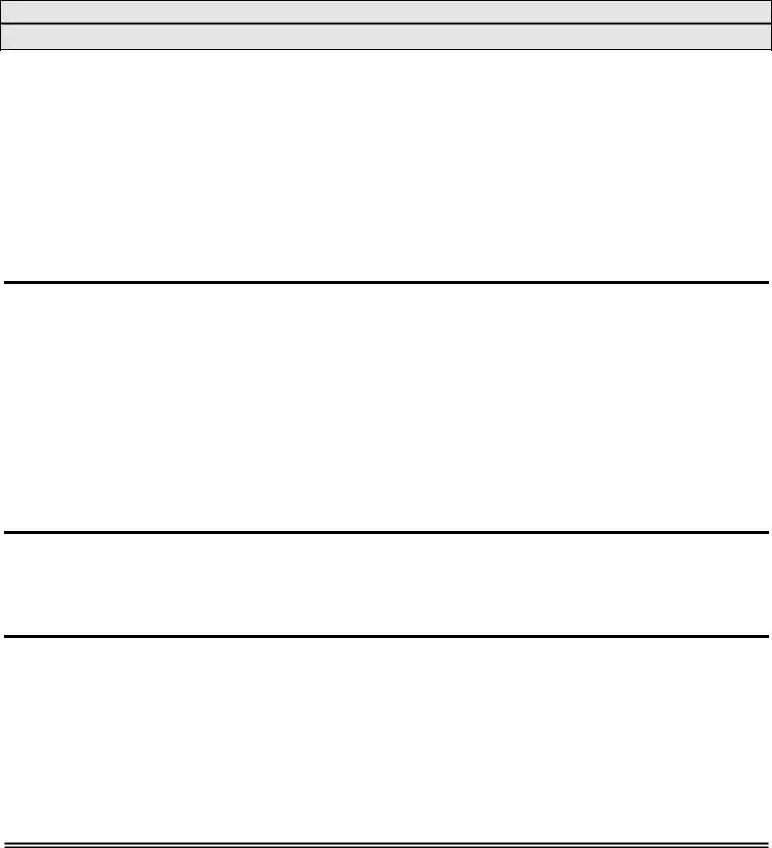

PLEASE READ THE FOLLOWING INFORMATION CONCERNING THE COMPLETION OF THIS FORM

•PLEASE COMPLETE ALL AREAS OF THE FORM EXCEPT FOR THE MUNICIPAL USE ONLY AREA AT THE BOTTOM.

•FORM SHOULD BE TYPED OR PRINTED LEGIBLY

•FORM SHOULD BE DATED AND SIGNED BY AN OWNER, PARTNER, OR OFFICER OF THE BUSINESS

•FORM WILL INITIATE THE PROCESS FOR REGISTERING YOUR BUSINESS WITH THE MUNICIPALITY

⇒IF YOUR BUSINESS WILL HAVE A PHYSICAL LOCATION WITHIN THE MUNICIPALITY PLEASE USE THAT ADDRESS ON THE FRONT OF THIS FORM. (Complete separate forms for each physical location in the city)

⇒AFTER COMPLETING THIS FORM IT CAN BE MAILED, SENT BY FAX, OR WHERE POSSIBLE, SENT BY ELECTRONIC MAIL TO THE MUNICIPALITY.

⇒UPON RECEIPT OF THE COMPLETED FORM, THE MUNICIPALITY WILL PROVIDE ANY ADDITIONAL FORMS AND INFORMATION REGARDING OTHER SPECIFIC REQUIREMENTS TO YOU IN ORDER TO COMPLETE THE LICENSING PROCESS.

ALL LICENSE RENEWALS ARE DUE JANUARY 1 AND DELINQUENT AFTER JANUARY 31, WITH THE FOLLOWING EXCEPTIONS:

INSURANCE COMPANY LICENSE: DUE JANUARY 1, DELINQUENT AFTER MARCH 1

This form is intended as a simplified, standard mechanism for businesses to initiate contact with a municipality concerning their activities within that city. A business license will be required prior to engaging in business. If a business intends to maintain a physical location within the city, there are normally zoning and building code approvals required prior to the issuance of a license.

In certain instances, a business may simply be required to register with the city to create a mechanism for the reporting and payment of any tax liabilities. If that is the case, you will be provided the materials for that registration process.

The completion and submission of this form does not guarantee the approval or subsequent issuance of a license to do business. Any prerequisites for a particular type and location of the business must be satisfied prior to licensing.

SHOULD THERE BE ANY QUESTI ONS CONCERNI NG THE COMPLETI ON OF THI S FORM REGI STRATI ON PROCESS, PLEASE CALL ( 205) 956 - 9200 OR FAX ( 205) 956 - 0950

EXPLANATI ON.

OR THE LI CENSI NG FEE AND/ OR TO OBTAI N A MORE DETAI LED

Each per son, fir m , cor por at ion or ot her business ent it y m ust obt ain a Cit y of I r ondale business license pr ior t o conduct ing business act iv it y in t he Cit y of I r ondale. The license y ear is Januar y 1 t hr ough Decem ber 31 . Business license r enew als ar e due Januar y 1 and delinquent aft er Januar y 31 each y ear . Pr oof of St at e cer t ificat ion is r equir ed for cer t ain classificat ions.

Form Specs

| Fact Name | Details |

|---|---|

| Governing Law | City of Irondale ordinances and the State of Alabama regulations govern the requirement for obtaining a business license. |

| Application Submission Methods | Applications can be completed and submitted via mail, fax, or email to the City of Irondale Revenue Department. |

| Business Types and Activities | The form accommodates various business structures and activities, including retail, wholesale, contractor, service, professional, manufacturer, rental, and others. |

| License Renewal Period | Business licenses must be renewed annually by January 1 and become delinquent after January 31, with exceptions for specific types like insurance companies. |

Detailed Guide for Writing Alabama Business License Application

Embarking on the path to establishing a business in the vibrant community of Irondale, Alabama, turns an entrepreneurial dream into reality. This journey begins with a critical step: completing the Alabama Business License Application form. This document not only registers your venture with the city but also lays the groundwork for compliance with local regulations. It's a straightforward process that requires attention to detail. Here's how to fill out the form, ensuring your entry into the Irondale business community is smooth and successful.

- First, determine the Application Type relevant to your situation by checking the appropriate box: New, Owner Change, Name Change, or Location Change.

- Select your Form of Organization by ticking the correct option that describes your business structure (Sole Proprietorship, Partnership, Corporation, LLC, etc.).

- Fill in your Legal Business Name and, if applicable, the Trade Name under which your business will operate.

- Briefly describe your Business Activities, providing a concise overview of what your business will do (e.g., retail, consulting).

- Enter the Physical Address of your business, including street, city, state, and zip code. If your mailing address is different, provide that as well.

- Provide your Telephone number(s), including business, fax, and home phone numbers.

- For the section about Owner(s), Partners, or Officers, list their names, residence addresses, SSNs, titles, and contact numbers. Attach an additional sheet if necessary.li>

- Identify your Manager or contact person and their phone number for easy communication.

- Indicate the Date Business Activity Initiated or is proposed to start in Irondale and whether your business is located in or out of the City limits.

- If your business is physically located in Irondale, list the building owner or leasing agent's name and phone number.

- Fill in your State of Alabama Sales Tax #, Use Tax #, and Federal ID #.

- Check the box(es) that best describe your Business Types and Tax Types.

- In the Business License Comments section, add any additional information or comments relevant to your application.

- The application must be examined, dated, and signed by you, including your title, to certify that the information provided is accurate and complete.

- Finally, review the section marked "THIS AREA FOR MUNICIPAL USE ONLY" and ensure it's left blank for city officials to complete.

Once your application is filled out, you have several options for submitting it: mail, fax, or email, as provided in the form's instructions. The City of Irondale will then provide any additional forms and details needed to finalize your business's license process. Remember, a comprehensive and accurately filled-out application facilitates a smoother passage through the necessary bureaucratic procedures, bringing you one step closer to operating your business in Irondale. Best of luck on your business venture!

Common Questions

1. How do I apply for a business license in the City of Irondale, Alabama?

To apply for a business license in Irondale, Alabama, you need to complete the Business License Application form. This form can be submitted by mail, fax, or email to the City of Irondale's Revenue Department. Ensure that all sections of the application are filled out, except for the area marked for municipal use only. The form should be typed or printed legibly, dated, and signed by an owner, partner, or officer of the business. Upon submission, the municipality will reach out with any additional forms or specific requirements needed to complete your licensing process.

2. What information do I need to provide on the Business License Application form?

You are required to provide a range of information on the application form, including the legal business name, trade name (if applicable), a brief description of business activities, physical and mailing addresses, telephone numbers, and details about the owners, partners, or officers. Additionally, you must indicate the type of organization (e.g., Sole Proprietorship, LLC, Corporation), the date business activity began or is proposed to begin in Irondale, and various tax identification numbers (State of Alabama Sales Tax, Use Tax, and Federal ID numbers). It’s important to specify your business and tax types as well.

3. How does the City of Irondale determine the license fees?

License fees in the City of Irondale are determined based on the nature and type of your business. To find out the specific license fees applicable to your business, you should contact the Irondale Revenue Department directly. This step is crucial as it helps in understanding the cost involved and any state regulatory permits needed before your business license can be issued. Certain types of businesses, like auto dealers, food establishments, and contractors, may require specific state regulatory permits.

4. Is a business license necessary if I don’t have a physical location within the city limits but conduct business in Irondale?

Yes, a business license is required even if you do not have a physical location within Irondale but engage in business activities such as having representatives visiting or delivering to businesses, performing contracts, sales visits, delivering in your own trucks, maintaining or leasing equipment, or leasing premises within the city. If your sales involve shipping by a common carrier without a physical presence, you still need to complete the business license application and report taxes accordingly.

5. What is the duration of a business license and its renewal process?

The business license year in the City of Irondale runs from January 1 through December 31. All business licenses are due for renewal by January 1 each year and become delinquent after January 31, with the exception of insurance company licenses, which become delinquent after March 1. To renew your license, ensure that you meet all the specified requirements and submit your renewal application before the deadline to avoid any penalties.

6. Who should I contact if I have questions about completing the Business License Application or the licensing process?

If you have any questions or require clarification about the Business License Application form or the licensing process, you should contact the City of Irondale's Revenue Department directly. You can call at (205) 956-9200 or fax your inquiries to (205) 956-0950. The Revenue Department can provide you with detailed explanations, assist with any challenges you might encounter during the application process, and offer guidance on fulfilling any additional requirements for obtaining your business license.

Common mistakes

Filling out the Alabama Business License Application form requires careful attention to detail. Many business owners, eager to get their operations up and running, often rush through the process without fully understanding the consequences of inaccuracies. Here are ten common mistakes people make when completing this form:

- Not specifying the correct form of organization. Checking the right box is crucial as it impacts tax obligations and legal liabilities.

- Failing to provide a complete and accurate description of business activities. This brief description helps determine the specific licenses and permits needed.

- Entering incorrect or incomplete physical and mailing addresses. Accuracy in this section is key for receiving important documentation and correspondence.

- Overlooking the need to list all owners, partners, or officers. Detailed information, including contact details, is essential for proper registration and potential future contact.

- Not accurately stating the date business activity initiated or is proposed to initiate. This information can affect licensing requirements and deadlines.

- Omitting or incorrectly providing the required tax identification numbers, including the State of Alabama Sales Tax Number and Federal ID Number, which are critical for tax purposes.

- Checking the wrong business and tax types. The selected categories should reflect the actual operations of the business to ensure compliance with all pertinent regulations.

- Misunderstanding the questions regarding a physical presence in the City of Irondale. These responses significantly affect whether a business license is required.

- Failing to include the necessary payment with the application. Without the appropriate fees, the application process cannot move forward.

- Skipping the signature and date fields at the bottom of the form. An unsigned form is considered incomplete and will not be processed.

Submitting a fully completed and accurate Alabama Business License Application is critical for legal and operational reasons. Errors and omissions can lead to unnecessary delays, legal issues, and possible fines. Ensuring that the form is filled out completely, with attention to each detail, can significantly smoothen the process of obtaining the necessary business license.

In summary, when business owners take the time to accurately complete their Alabama Business License Application, they pave the way for a smoother registration process. Diligence in filling out the form not only demonstrates compliance but also helps avoid the pitfalls that can hinder a business's ability to operate effectively in Alabama.

Documents used along the form

When applying for an Alabama Business License, especially within the City of Irondale, it's essential to consider that you may need to accompany your application with various other forms and documents. These materials are crucial for providing a comprehensive overview of your business operations, compliance with state and local laws, and verification of your qualifications to undertake certain types of work. Below is a list of forms and documents often used alongside the Alabama Business License Application form.

- Articles of Incorporation/Organization: This document officially establishes your business's existence under state law and is necessary for corporations and Limited Liability Companies (LLCs).

- Federal Employer Identification Number (FEIN): Issued by the IRS, this number serves as a tax identification for your business and is required for the hiring of employees, opening a bank account, and for tax filing purposes.

- State Tax Identification Number: Similar to the FEIN but for state tax obligations. It's essential for reporting state taxes and, for businesses selling a product or service, necessary for sales tax collection.

- Professional Licenses: Certain business activities require professional licensing (e.g., contractors, cosmetologists, attorneys). These documents verify the business and its employees are qualified for specific professional services.

- Zoning Permit: This document confirms that your business location is zoned for the type of business you intend to conduct and is typically issued by the city or county zoning office.

- Building Permit: If your business operation requires construction, modification, or renovation of a building, a building permit ensures that all changes comply with local building codes and regulations.

- Health Department Permit: Required for businesses involved in food preparation, sales, or services to ensure compliance with health and safety standards.

- Sales Tax License: Essential for businesses that intend to sell goods or taxable services, enabling them to collect sales tax on transactions.

- Fire Department Permit: Certain businesses, especially those open to the public or handling flammable materials, must have this permit to ensure compliance with fire safety regulations.

- Signage Permit: If your business plans to use signage, local regulations may require a permit to ensure that signs meet specific size, location, and safety standards.

Gathering and completing these additional forms and documents is an integral step in the process of legitimizing your business operations within Alabama. Each document serves a unique purpose, from ensuring public safety and welfare to facilitating tax collection and regulatory compliance. Prospective business owners should carefully review each requirement to ensure a smooth application process and to avoid potential delays in obtaining a business license. It's also advisable to consult with legal or professional advisors to ensure all documentation is correctly filed and compliant with local, state, and federal regulations.

Similar forms

The Alabama Business License Application form is similar to several other documents used in the business registration process, each serving its own unique function for business entities. The documents it closely resembles include the Employer Identification Number (EIN) application and local zoning permits, among others. Understanding these similarities can streamline the process for businesses as they navigate through various regulatory requirements.

One notable similarity is with the Employer Identification Number (EIN) application (Form SS-4) that businesses file with the IRS. Like the Alabama Business License Application, the EIN application requests detailed information about the business, including the legal name, trade name, and the type of business entity (e.g., sole proprietorship, partnership, corporation). Both forms are crucial for legally establishing a business and ensuring proper tax identification and compliance. However, the EIN application is specifically tailored towards tax administration at the federal level, enabling businesses to open bank accounts, hire employees, and fulfill their federal tax obligations.

Another document that parallels the Alabama Business License Application is the application for local zoning permits. These permits are necessary for businesses to ensure their operations comply with local zoning laws regarding land and building use. While the business license application seeks to register the business with the city and assess the appropriate business license taxes and fees, the zoning permit focuses on the physical location's compliance with city planning and zoning ordinances. Despite these different focuses, both processes are intertwined; obtaining a zoning permit is often a prerequisite for finalizing a business license, as it verifies the business location is suitable for the intended use.

Dos and Don'ts

When filling out the Alabama Business License Application form, attention to detail and accuracy are key. Here is a guide to help you navigate the process smoothly.

Do:

- Read through the entire application before starting to ensure you understand all requirements.

- Use black ink or type your responses to enhance readability.

- Provide accurate and complete information for all fields to avoid delays.

- Check the appropriate box for the form of organization that accurately represents your business structure.

- Include a detailed description of your business activities to prevent misunderstandings.

- Ensure that the physical and mailing addresses are correctly listed, including zip codes.

- List all owners, partners, or officers as required, attaching a separate sheet if necessary.

- Sign and date the application since an unsigned form is invalid.

- Contact the Irondale Revenue Department if you have questions or need clarification on license fees or other matters.

- Review your completed application for any errors or omissions before submission.

Don't:

- Leave any sections blank. If a section does not apply, mark it as "N/A" (Not Applicable).

- Assume the information is only for municipal use; some data might be required for state or federal purposes.

- Rush through the application without double-checking your business activity codes or descriptions for accuracy.

- Forget to include the application fee, as this will delay processing.

- Use pencil or any ink color other than black, as this can cause issues with photocopies or scanning.

- Overlook the importance of attaching additional required documentation, such as proof of state certification for certain business types.

- Ignore the zoning and building code approvals section if your business will have a physical location within the municipality.

- Submit the form without the required owner, partner, or officer signature.

- Misplace the contact information for the Irondale Revenue Department, as you may need to reach out with questions.

- Forget to follow up if you do not receive a response within a reasonable time frame.

Completing the Alabama Business License Application form accurately and thoroughly is the first step in ensuring your business complies with local regulations and can operate without legal impediments. Taking the time to review and double-check your application can save time and effort in the long run.

Misconceptions

When it comes to applying for a business license in the City of Irondale, Alabama, there are several common misconceptions that can cause confusion among applicants. Understanding these can streamline the application process and help ensure compliance with local regulations. Here are five misconceptions explained:

- One Application Fits All Business Types: It's a common belief that a single business license application will suit every business type, be it retail, service, manufacturing, or another classification. However, the form requires applicants to specify their business activity, as licensing requirements may vary dramatically depending on the nature of the business. Certain operations might also necessitate additional permits or state regulatory approvals, such as those for food establishments or auto dealers.

- Physical Presence Is Mandatory for Licensure: While the application queries about physical location within the city limits, some business owners erroneously think a physical presence in Irondale is a prerequisite for obtaining a business license. Yet, as noted in the form, even businesses operating outside City limits but engaging in activities within — such as sales, deliveries, or contracting services — must apply for and secure a business license.

- Once Submitted, Licensing Is Guaranteed: Another misconception is the assumption that submitting an application automatically guarantees the issuance of a business license. The reality is the completion and submission of the application begins the process. Approval and subsequent license issuance depend on fulfilling all requirements for the specific type and location of the business, including zoning and building codes for those within the city.

- Digital Submission Is Universally Accepted: Applicants may believe that electronic submission is available or preferred in all instances because the application mentions the possibility of emailing the completed form. However, it's crucial to confirm the current acceptance and processing policies with the Irondale Revenue Department, as preferences or capabilities may change.

- All Businesses Are Subject to the Same Tax Types and Filing Frequencies: The application outlines various tax types and filing frequencies, which might lead some to suppose these apply uniformly to all businesses. In fact, the specific nature of your business activity will dictate the applicable taxes and how often they must be filed. The city's revenue department can offer guidance on what's required based on the detailed description of business activities provided in the application.

In summary, comprehensively understanding the application process, requirements, and individual responsibilities is crucial for prospective business owners in Irondale. Clarifications or additional information can always be sought from the City's Revenue Department, ensuring that applicants meet all local business licensing requirements.

Key takeaways

When it comes to operating a business in the City of Irondale, Alabama, understanding the requirements for the Business License Application is crucial for compliance and to ensure smooth operations. Here are some key takeaways to help guide you through the process:

- Complete the Application Fully: Every section of the Alabama Business License Application form must be completed except for the area designated for municipal use only. This includes providing comprehensive details about the business such as legal and trade names, business activities description, and contact information. Ensuring that all parts of the form are filled out correctly can prevent delays in processing.

- Understand the License Requirements: The need for a business license and the corresponding fees are determined by the type of business and its activities. It’s advised to contact the Irondale Revenue Department directly for information specific to your business. This proactive step can provide insight into the necessary licenses, any state regulatory permits required, and the relevant fees.

- Required Documentation for Different Business Types: Depending on your business activities, additional permits or state certifications may be required. For instance, auto dealers, food establishments, and contractors often require additional state regulatory permits. Therefore, it’s important to research and understand the specific requirements for your business category to ensure compliance from the start.

- Submission and Renewal: The completed application form can be submitted via mail, fax, or email, offering flexibility for business owners. It’s important to note that all business licenses need to be renewed annually by January 1st to avoid penalties, with the exception of insurance company licenses which have a different timeline. Timely renewal of your business license ensures ongoing compliance with municipal requirements.

By keeping these key points in mind, you can navigate the process of obtaining and maintaining a business license in Irondale more effectively. Remember, the completion and submission of this form initiates the licensing process but does not guarantee the issuance of a license. Each business's prerequisites must be met before a license is granted. For any questions or further clarification, reaching out to the Irondale Revenue Department is encouraged.

Check out Popular PDFs

Alabama Driver's License Replacement - Utilized in the state of Alabama, the SR-58 form helps maintain records for the Department of Public Safety, supporting the administration of vehicle safety laws.

Alabama Child Support Modification Forms - Detailed instructions guide parents through the process of determining monthly child support obligations.

Catastrophe Savings Account Alabama - Makes it possible for individuals in Alabama to continue using paper tax returns in compliance with state regulations.