Alabama Abandoned Vehicle Template

Dealing with an abandoned vehicle in Alabama requires understanding and completing the Abandoned Vehicle Record Request form, a crucial step outlined by the Alabama Department of Revenue. This procedure is indispensable for anyone looking to comply with the notification requirements stipulated under the Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13. The form serves as a request for current owner and lienholder information, ensuring that individuals or entities can proceed with necessary notifications in adherence to the law. It's essential to recognize that any information obtained through this form is protected under the federal Driver’s Privacy Protection Act of 1994 (DPPA) and its amendments, emphasizing confidentiality and the restricted use of personal data. Moreover, the form outlines specific fees based on whether the vehicle falls under Alabama title law, and underscores the importance of accurate, legible vehicle identification numbers to prevent retrieval errors. With certified funds being the only accepted form of payment, and detailed instructions regarding payment and submission processes, the form is designed to streamline the process of dealing with abandoned vehicles systematically and legally. It is a critical document that bridges the gap between legal obligations and the rightful handling of abandoned vehicles, ensuring that all parties involved adhere to established privacy standards and regulatory requirements.

Alabama Abandoned Vehicle Example

ALABAMA DEPARTMENT OF REVENUE

MVT

MOTOR VEHICLE DIVISION

P.O. Box 327680 • Montgomery, AL

Abandoned Motor Vehicle Record Request

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/forms.html

The undersigned hereby requests the current owner and lienholder information maintained by the Alabama Department of Revenue for the vehicle(s) listed below in order to comply with the noti- fication requirements of the Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13. The undersigned certifies that information received as a result of this request shall only be used to comply with the notification requirements of the Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13, and that the information received shall be considered confidential under the federal Driver’s Privacy Protection Act of 1994 (DPPA) (Title XXX of Public Law

The fee for the title and registration records including owner and lienholder information is $10.00 for each vehicle subject to the Alabama title law or $5.00 for each vehicle not subject to the Alabama title law*. The required fees are collected in accordance with Code of Alabama 1975, Section

MAILED MUST BE IN CERTIFIED FUNDS PAYABLE TO THE ALABAMA DEPARTMENT OF REVENUE. PERSONAL CHECKS WILL NOT BE ACCEPTED. DO NOT MAIL CASH. Cash may be received at the cashier’s counter located adjacent to Room 1202 in the Gordon Persons Building.

Please verify the vehicle identification number(s) and all other information prior to submitting the record request. An incorrect or illegible vehicle identification number will cause an incorrect record to be retrieved and will require that a new request form be executed and submitted with the fee for the correct vehicle search.

TYPE OR PRINT INFORMATION

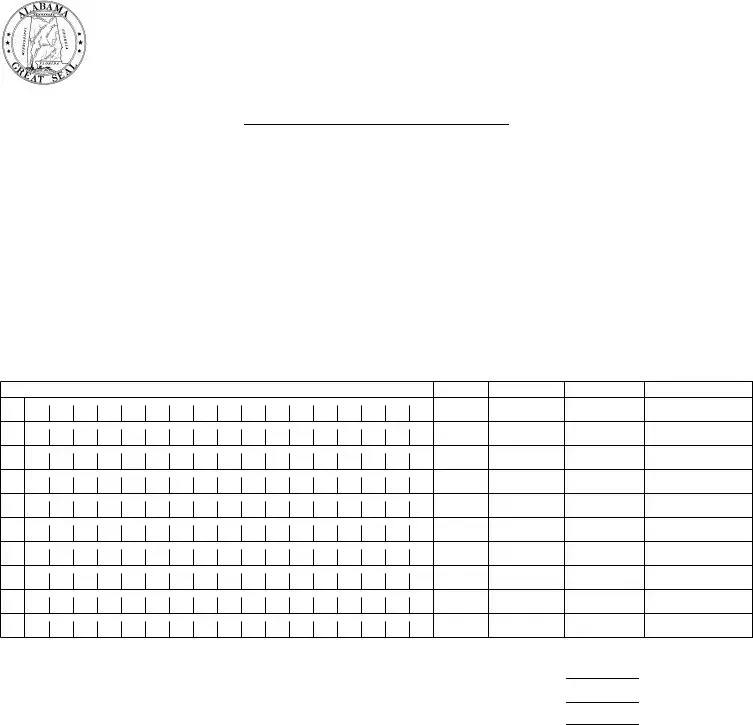

VEHICLE IDENTIFICATION NUMBER* |

YEAR |

MAKE |

MODEL |

AL LICENSE PLATE NO. |

1

2

3

4

5

6

7

8

9

10

**A. |

Total Number of Title/Registration Records |

___________ |

X |

$10.00 |

= |

$ |

0 |

Total Record Fees Due. |

B. |

Total Number of Registration Records |

___________ |

X |

$ 5.00 |

= |

$ |

0 |

Total Record Fees Due. |

C. |

Grand Total Record Fees (Payable to the Alabama Department of Revenue) |

. . . . . . . . . . . . |

. . |

. A + B = $ |

0 |

|

||

|

|

|

( |

) |

||

|

|

|

|

|

||

***REQUESTING INDIVIDUAL, COMPANY, ASSOCIATION OR FIRM (TYPE OR PRINT) |

|

|

|

TELEPHONE NUMBER |

||

|

|

|

|

|

|

|

ORIGINAL SIGNATURE OF REQUESTOR |

DATE |

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

CITY |

STATE |

ZIP CODE |

||

*All VINs for 1981 and subsequent year model vehicles that conform to federal

**NOTE: Title records are not available for trailers and manufactured homes more than 20 model years old or motor vehicles more than 35 model years old. Also, manufactured homes cannot be transferred under the Abandoned Motor Vehicle Act. Do not submit this request form for manufac- tured homes.

***The requesting party listed on the Abandoned Motor Vehicle Record Request response form must be listed as the Seller on the corresponding title application whenever the vehicle is sold under the Alabama Abandoned Motor Vehicle Act.

— FEES ARE NOT REFUNDABLE OR TRANSFERABLE TO ANOTHER RECORD REQUEST —

Form Specs

| Fact | Detail |

|---|---|

| Form Name | Abandoned Motor Vehicle Record Request |

| Form Code | MVT 32-13 |

| Relevant Law | Abandoned Motor Vehicle Act, Code of Alabama 1975, Title 32, Chapter 13 |

| Issuing Authority | Alabama Department of Revenue, Motor Vehicle Division |

| Contact Information | P.O. Box 327680, Montgomery, AL 36132-7680 - mvrecords@revenue.alabama.gov |

| Privacy Protection | Subject to Driver’s Privacy Protection Act of 1994 (DPPA) as amended |

| Fee for Titled Vehicles | $10.00 per vehicle |

| Fee for Non-Titled Vehicles | $5.00 per vehicle |

| Payment Methods | Only certified funds payable to the Alabama Department of Revenue; personal checks and cash mailed are not accepted |

| Important Note | Title records are not available for certain aged trailers, manufactured homes, and motor vehicles |

Detailed Guide for Writing Alabama Abandoned Vehicle

When an individual or an entity wishes to comply with the notification requirements of the Abandoned Motor Vehicle Act in Alabama, filling out the Abandoned Vehicle Record Request (Form MVT 32-13) becomes a necessary step. This procedure allows for the acquisition of essential information pertaining to the current owner and any lienholder of the vehicle. It’s crucial to recognize that the information retrieved through this request is protected under the federal Driver’s Privacy Protection Act of 1994, ensuring the confidentiality and restricted use of the data obtained. This form facilitates a legal pathway to identify and notify relevant parties about an abandoned vehicle, aligning with Alabama state laws. Below, steps to correctly complete the form have been outlined to streamline the process and ensure compliance with all regulatory obligations.

- Type or print clearly to avoid any misunderstandings or the need for resubmission due to illegible handwriting.

- Enter the Vehicle Identification Number (VIN) in the designated space. Ensure the VIN is accurate; this is crucial for vehicles from 1981 and onwards, which should have 17 characters in compliance with federal anti-theft standards.

- Fill in the year, make, and model of the vehicle, as well as the Alabama license plate number if available. This information helps in accurately identifying the vehicle in question.

- In sections A and B, indicate the total number of Title/Registration Records required. The fee is $10.00 for each vehicle subject to the Alabama title law and $5.00 for vehicles not subject to this law. Calculate the total record fees due accordingly.

- Add the calculated fees from sections A and B to determine the Grand Total Record Fees. Ensure the amount is correct as fees are non-refundable and not transferable to another record request.

- Provide the name of the requesting individual, company, association, or firm in the space provided. Also, include a contact telephone number for potential follow-up or queries.

- Sign the form to certify that the information provided is accurate and that the intended use of the information is in compliance with the Abandoned Motor Vehicle Act and the Driver’s Privacy Protection Act. Include the date next to the signature.

- Enter the complete address, city, state, and zip code of the requester to ensure any communication or response from the Alabama Department of Revenue can be directed correctly.

- Review all the information entered for accuracy and completeness. Any errors or omissions may delay the process or require resubmission.

- Remember, the payment for the search must be in certified funds payable to the Alabama Department of Revenue, as personal checks are not accepted. Include the correct payment amount calculated in the Grand Total Record Fees section.

Once the form is completely filled out and the payment is prepared, submit the package to the specified address of the Motor Vehicle Division in Montgomery, AL. It's important to verify all details before submission to minimize the risk of errors or delays. Ensuring the form is filled out comprehensively will smoothen the process of obtaining the necessary records for the abandoned vehicle, facilitating compliance with legal requirements in a timely and efficient manner.

Common Questions

What is the purpose of the Alabama Abandoned Vehicle form (MVT 32-13)?

The Alabama Abandoned Vehicle form, also known as MVT 32-13, is used to request current owner and lienholder information from the Alabama Department of Revenue. This information is necessary to comply with the notification requirements of the Abandoned Motor Vehicle Act, as stipulated in the Code of Alabama 1975, Title 32, Chapter 13. The form facilitates the process of identifying and contacting the rightful owners and lienholders of the vehicle to resolve the abandonment issue.

Who can request an Abandoned Vehicle Record in Alabama?

Individuals, companies, associations, or firms seeking to comply with the notification requirements of the Abandoned Motor Vehicle Act may request an Abandoned Vehicle Record. The requester must certify that the information will only be used as required by the Act and that the data received will be kept confidential in accordance with the federal Driver’s Privacy Protection Act of 1994.

How much does it cost to request vehicle records?

The fee for title and registration records, including owner and lienholder information, is $10.00 for each vehicle subject to the Alabama title law. For vehicles not subject to the Alabama title law, the cost is $5.00 per vehicle. These fees are collected as per the Code of Alabama 1975, Section 32-8-6(a)(7).

Are personal checks accepted for payment of the record request fees?

No, personal checks are not accepted for payment of the record request fees. Payment must be made in certified funds payable to the Alabama Department of Revenue. Cash payments are not recommended to be mailed but can be received at the cashier’s counter in the Gordon Persons Building.

What information is required to submit a request?

To submit a request for an abandoned vehicle record, the requester must provide the vehicle identification number (VIN), year, make, model, and Alabama license plate number, if available. It is crucial that all information, especially the VIN, is accurate to ensure the correct record is retrieved.

Are there any vehicles that cannot be included in this request?

Yes, title records are not available for trailers and manufactured homes more than 20 model years old or motor vehicles more than 35 model years old. Additionally, manufactured homes cannot be transferred under the Abandoned Motor Vehicle Act. Requesters should not submit this form for such vehicles.

What happens if the VIN provided is incorrect or illegible?

If the VIN provided is incorrect or illegible, it will result in an incorrect record being retrieved. In such a case, a new request form must be completed and submitted with the correct vehicle information, accompanied by the required fee for a new vehicle search.

Is the fee refundable or transferable if a mistake is made?

No, the fees for an abandoned vehicle record request are not refundable or transferable. If a mistake is made, it is the requester’s responsibility to submit a new form with the correct information and an additional payment.

Common mistakes

Filling out the Alabama Abandoned Vehicle form requires attention to detail and an understanding of the process. It is easy to make mistakes that can complicate or delay the process of claiming an abandoned vehicle. Here are eight common errors to avoid:

Incorrectly entering the Vehicle Identification Number (VIN): It is crucial to verify the VIN carefully before submitting the form. An incorrect or illegible VIN can lead to retrieving the wrong record, necessitating a redo of the request with additional fees for the correct vehicle search.

Not using certified funds for payment: The form specifies that payment must be in certified funds payable to the Alabama Department of Revenue. Personal checks are not accepted, and cash should not be mailed. Ignoring these instructions can result in payment issues.

Omitting fees for non-titled vehicles: There is a $5.00 fee for each vehicle not subject to the Alabama title law. Failure to include this fee for applicable vehicles can delay the processing of the request.

Providing incomplete or inaccurate requestor information: The requesting individual, company, association, or firm's information must be filled out completely and accurately. Any errors in this section can cause delays in processing.

Forgetting to calculate and include the total record fees due: Applicants must calculate the total fees based on the number of title/registration records requested and ensure the correct amount is included. Incorrect calculations can lead to processing delays.

Failure to sign the form: The original signature of the requester is mandatory. An unsigned form will not be processed, as the signature certifies the information's intended use and acknowledges the confidentiality agreement.

Not checking the vehicle's eligibility: Title records are not available for certain older vehicles, including trailers and manufactured homes older than specified model years. Submitting a request for such vehicles is a wasted effort since they cannot be transferred under the Abandoned Motor Vehicle Act.

Ignoring the confidentiality agreement: By signing the form, the requester agrees to use the information received only for complying with the notification requirements of the Abandoned Motor Vehicle Act and to consider the information confidential under the Driver’s Privacy Protection Act. Misusing this information can have legal consequences.

Avoiding these mistakes can help ensure the abandoned vehicle claim process is completed smoothly and efficiently. Remember, the details matter from accurately entering the VIN to respecting the confidentiality agreement. Careful attention to each step and requirement will assist in navigating the process successfully.

In summary, taking the time to review and accurately complete the Alabama Abandoned Vehicle form is crucial. Each step, from ensuring payment is in the correct form to correctly identifying the vehicle and adhering to legal agreements, plays a significant role in the successful processing of your request. Avoid common pitfalls and ensure your request is handled promptly and without unnecessary complications.

Documents used along the form

When dealing with the intricacies of handling an abandoned vehicle in Alabama, the ALABAMA DEPARTMENT OF REVENUE MVT 32-13 form is just the starting point. Frequently, other documents and forms become necessary to navigate the process completely and legally. These documents help in establishing ownership, ensuring compliance with local laws, and facilitating the proper transfer or disposal of the vehicle.

- Vehicle Title Application – This is required for establishing new ownership of the vehicle. It outlines the vehicle's details and the new owner's information, necessary for the Alabama Department of Revenue.

- Bill of Sale – Often used alongside the Vehicle Title Application, it serves as a record of the transaction between the seller and the buyer, detailing the vehicle's purchase price and date of sale.

- Notice of Public Auction – When an abandoned vehicle is to be sold at public auction, this document announces the event, including the date, time, and location of the auction, and details about the vehicle being sold.

- Odometer Disclosure Statement – This form is required for vehicles less than ten years old to document the mileage at the time of sale or transfer of ownership, ensuring buyer awareness of the vehicle’s condition.

- Lien Release – If there was a lien on the vehicle, this document from the lienholder states that the lien has been satisfied and can be removed from the title.

- Request for Motor Vehicle Record – This is a request to the Alabama Department of Public Safety for a detailed report of the vehicle's history, including previous owners and, potentially, a history of accidents or liens.

Together, these documents form a comprehensive toolkit for correctly addressing the issue of abandoned vehicles. Each plays a specific role in ensuring that all legal requirements are met, that all parties are adequately informed, and that the new ownership is established without future disputes. It's crucial for those involved in this process to be aware of and understand how these forms contribute to the smooth transfer or disposal of abandoned vehicles.

Similar forms

The Alabama Abandoned Vehicle form is similar to various other documents used across the United States for handling matters related to vehicles. Its purpose, structure, and requirements echo those found in these comparable documents, highlighting the consistent approach taken nationwide to address vehicle administration and legal compliance. Each of these documents, while serving a similar function, is tailored to meet the specific legal and procedural frameworks of their respective states or purposes.

Notice of Lien Sale for Abandoned Vehicle is one document similar to the Alabama Abandoned Vehicle form. This document, used by many states, notifies interested parties that a vehicle, which has been deemed abandoned, is scheduled to be sold to satisfy a lien. Like the Alabama form, it includes information about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN), and details about the owner and lienholder. The purpose of both documents is to ensure that all parties with a legal interest in the vehicle are adequately notified about the actions being taken regarding the abandoned vehicle. The key similarity lies in their preventative approach towards ensuring due process is followed before a vehicle is sold or disposed of, protecting the rights of owners, lienholders, and interested parties.

VIN Inspection Form shares some functional similarities with the Alabama Abandoned Vehicle form, particularly in the requirement for accurate vehicle identification. Both forms require the VIN to confirm the identity of the vehicle in question. The VIN Inspection Form, often a prerequisite for registration in many states, is used to verify that the vehicle's identification number matches the one on record, preventing fraud and ensuring the vehicle is not stolen. Although serving different primary purposes, both documents emphasize the importance of accurate vehicle identification in maintaining the integrity of motor vehicle records and compliance with legal standards.

Title Application Forms across various states also resemble the Alabama Abandoned Vehicle form in their utilization for legal documentation and transfer of ownership. Title applications are necessary when ownership of a vehicle is being transferred under normal circumstances, including sale, gift, or inheritance. Similar to the abandoned vehicle form, title applications require detailed information about the vehicle and its current legal owner. Both sets of documents are crucial in the legal process of transferring ownership, ensuring that all necessary information is recorded accurately and that any liens or encumbrances against the vehicle are acknowledged and addressed.

Dos and Don'ts

When filling out the Alabama Abandoned Vehicle form, it’s crucial to ensure accuracy and compliance with state laws. The actions you take can significantly impact the process. Here are five things you should do and five things you should avoid to help streamline your experience.

What you should do:

- Verify the vehicle identification number (VIN) carefully to ensure it matches the vehicle you are inquiring about. An error here can lead to incorrect information retrieval and additional fees.

- Use certified funds for the payment, as personal checks are not accepted. This helps avoid delays in processing your request.

- Ensure that you have the correct fee amount based on whether the vehicle is subject to the Alabama title law. Misunderstanding the fee requirement can delay your application.

- Print or type the information clearly on the form to prevent any misunderstanding or processing errors.

- Sign the request form as the original signature of the requester is required for the form to be processed.

What you shouldn’t do:

- Do not mail cash with your form, as it is not a secure method of payment and the Department explicitly advises against it.

- Do not leave the VIN, year, make, model, or license plate number fields blank or incomplete. These details are crucial for identifying the correct vehicle.

- Avoid using the information obtained for purposes other than complying with the notification requirements of the Abandoned Motor Vehicle Act. Misuse of the information is prohibited by law.

- Do not request title records for vehicles not eligible under the law, such as trailers and manufactured homes more than the specified model years old.

- Do not forget to include your telephone number and the correct address details. This information is essential for any follow-up required.

Misconceptions

When dealing with the Alabama Abandoned Vehicle form, there are several misconceptions that can cause confusion. Understanding the facts can simplify the process for individuals looking to handle abandoned vehicles legally. Here are six common misconceptions and the truths behind them:

- Personal checks are accepted for payment: The form explicitly states that payment must be made in certified funds payable to the Alabama Department of Revenue. Personal checks are not accepted, and attempting to use one will delay the process.

- Information obtained can be used for any purpose: The information received from the Alabama Department of Revenue must only be used to comply with the notification requirements of the Abandoned Motor Vehicle Act. It is protected under the federal Driver’s Privacy Protection Act of 1994 (DPPA) and cannot be used for unrelated purposes.

- Any vehicle can be searched, regardless of its age: Title records are not available for trailers and manufactured homes more than 20 model years old or motor vehicles more than 35 model years old. Requests for such vehicles will not produce results, emphasizing the importance of verifying the vehicle's age before submitting a request.

- The fee is the same for all vehicles: The fee structure is based on whether the vehicle is subject to the Alabama title law, with a $10.00 fee per vehicle subject to the title law and a $5.00 fee for vehicles that are not. Understanding this distinction ensures the correct fee is paid.

- Cash payments can be mailed with the request form: The form clearly states that cash should not be mailed. If one opts to pay in cash, it must be done in person at the designated cashier's counter, ensuring payments are processed safely and correctly.

- You can use the information for transferring manufactured homes under the Abandoned Motor Vehicle Act: The form prohibits submitting requests for manufactured homes to be processed or transferred under the Abandoned Motor Vehicle Act. This specific detail highlights the limitations of what the form can be used for.

Clarifying these misconceptions ensures that the process of handling an abandoned vehicle in Alabama is smooth and compliant with state laws and regulations. It is crucial to read the form carefully and understand the requirements and limitations before proceeding.

Key takeaways

Understanding the Alabama Abandoned Vehicle form is crucial for properly processing vehicles deemed abandoned. Here are key takeaways to ensure compliance and accuracy:

- Utilize the form to request current owner and lienholder information as necessary for compliance with the Abandoned Motor Vehicle Act, reflecting the commitment to adhere to legal notification requirements.

- Information obtained through the form is to be used strictly for compliance with the notification requirements of the Abandoned Motor Vehicle Act, safeguarding personal privacy under the federal Driver’s Privacy Protection Act of 1994.

- The request form emphasizes the need for accuracy, particularly regarding the vehicle identification number (VIN), to prevent retrieval of incorrect records, which could complicate the process.

- The fee structure is set forth clearly, differentiating between vehicles subject to Alabama title law and those that are not, underscoring the importance of understanding the applicable fees to avoid processing delays.

- Payment must be made in certified funds payable to the Alabama Department of Revenue, highlighting the necessity of following specific payment guidelines.

- The form contains a notation that fees are non-refundable and non-transferable, signaling the importance of accuracy and decisiveness when submitting a request.

By meticulously following these guidelines, individuals and entities can navigate the process of claiming abandoned vehicles with an understanding of the legal and procedural requirements involved. This not only facilitates the proper transfer of ownership but also ensures protection of personal information in accordance with federal law.

Check out Popular PDFs

Alabama Business Privilege Tax Return - Alabama Form 65 underscores the importance of entities accurately reporting federal ordinary income or losses from trade or business activities.

Alabama Department of Revenue Forms - Includes provisions for residents with varied sources of income, ensuring all Alabama taxpayers can accurately estimate their tax dues.