Alabama 96 Template

Navigating the complexities of tax documentation and compliance is crucial for individuals and entities engaged in monetarily compensating others within Alabama. Among the plethora of forms required by the Alabama Department of Revenue, the Alabama 96 form stands out for its pivotal role in summarizing annual information returns. Introduced to streamline the reporting of payments excluding interest coupons payable to bearer that amount to $1,500 or more in any calendar year, this form mandates meticulous documentation from resident individuals, corporations, associations, or agents. It's noteworthy that this form becomes necessary only when such payments are made to individuals who are subject to the Alabama income tax, highlighting the state's method of ensuring proper tax collection. Furthermore, the exception for employers who have already filed Form A-2 emphasizes the importance of avoiding redundancy in reporting salary and wage payments. Additionally, the option to file copies of the federal Form 1099 instead of Form 99 introduces a layer of convenience, yet underscores the necessity of adhering to the March 15 filing deadline post the calendar year of the payments. This detailed framework not only aids in the efficient processing of payments and taxes but also delineates clear pathways for compliance, thereby facilitating a smoother interaction with the state's tax system.

Alabama 96 Example

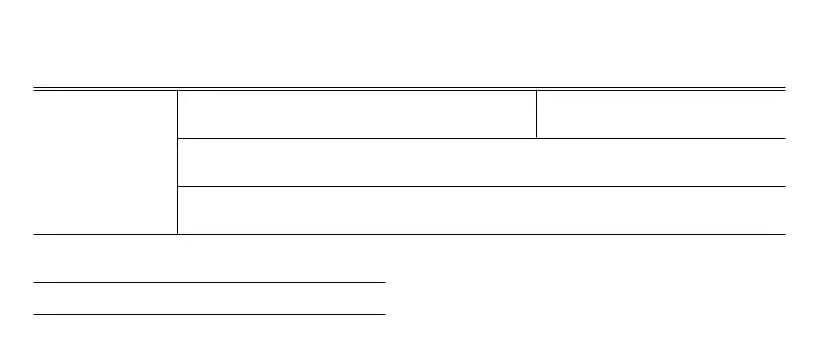

FORM 96 |

ALABAMA DEPARTMENT OF REVENUE |

CALENDAR YEAR |

|

|

|

1/00 |

Summary of Annual Information Returns |

_______________ |

(DATE RECEIVED)

PAYER

SOCIAL SECURITY NO. OR FEIN

STREET ADDRESS OR P.O. BOX

CITY |

STATE |

ZIP CODE |

SIGNATURE

NUMBER OF FORM 99S ATTACHED _________

TITLE

Instructions

Information returns on Form 99 must be filed by every resident individual, corporation, association or agent making payment of gains, profits or income (other than interest coupons payable to bearer) of $1,500.00 or more in any calendar year to any taxpayer subject to Alabama income tax. If you have voluntarily withheld Alabama income tax from such payments, you must file Form 99 or approved substitute regardless of the amount of the payment. Employers filing Form

Returns must be filed with the Alabama Department of Revenue for each calendar year on or before March 15 of the following year.

Mail to: Alabama Department of Revenue |

NOTE: IF ALABAMA INCOME TAX HAS BEEN WITHHELD ON FORM 99 |

Individual & Corporate Tax Division |

DO NOT USE THIS FORM; USE FORM |

P.O. Box 327489 |

OF ALABAMA INCOME TAX WITHHELD. |

Montgomery, AL |

|

Form Specs

| Fact Name | Detail |

|---|---|

| Form Purpose | Form 96 is used for the summary of annual information returns. |

| Governing Law | Alabama income tax regulations require the filing of this form. |

| Who Must File | Individuals, corporations, associations, or agents who pay $1,500 or more in gains, profits, or income in a calendar year to a taxpayer subject to Alabama income tax. |

| Filing Deadline | The form must be filed on or before March 15 of the following year for payments made during the calendar year. |

| Alternative Filing | Instead of Form 99, copies of federal Form 1099 may be filed with the Department. |

| Special Note for Withheld Income Tax | If Alabama income tax has been voluntarily withheld, Form A-3, not Form 96, should be used. |

Detailed Guide for Writing Alabama 96

Following the correct procedures to submit an important document like the Form 96 to the Alabama Department of Revenue is crucial for ensuring that all information returns are accurately reported. The process, while straightforward, requires attention to detail to ensure that the information about payments made in the calendar year is complete and correct. By following these instructions carefully, you're taking a significant step toward compliance with Alabama's tax requirements. Once the form is completed and submitted by the due date, the Alabama Department of Revenue will process the information and may get in touch if further information or clarification is needed.

- Begin by obtaining a blank Form 96 from the Alabama Department of Revenue's website or your nearest office. Ensure you have the latest version for the calendar year you are reporting.

- Enter the calendar year for which you are filing the report in the space provided at the top of the form, marked "CALENDAR YEAR."

- Write the date received if known, in the space provided next to “___________ (DATE RECEIVED).”

- In the section marked "PAYER SOCIAL SECURITY NO. OR FEIN," input the Social Security Number or Federal Employer Identification Number relevant to the entity making the payments.

- Next, enter your Street Address or P.O. Box in the space provided.

- Continue by filling in your City, State, and Zip Code in their respective fields.

- In the box labeled "NUMBER OF FORM 99S ATTACHED," indicate the total number of Form 99s you are including with Form 96.

- Sign your name in the “SIGNATURE” line to certify the information provided.

- Indicate your title (e.g., Owner, Accountant, etc.) in the “TITLE” line.

- Before sending, double-check all the information for accuracy and completeness. Ensure that all necessary Form 99s are attached as mentioned in your summary.

- Mail the completed Form 96, along with any Form 99s, to the following address before March 15 of the year following the calendar year you are reporting:

Alabama Department of Revenue

Individual & Corporate Tax Division

P.O. Box 327489

Montgomery, AL 36132-7489.

After the form has been mailed, it's recommended to keep a copy of the form and any attachments for your records. The Alabama Department of Revenue will process your information and will reach out if they require any additional documentation or clarification.

Common Questions

What is Form 96 and who needs to file it in Alabama?

Form 96 is a summary document used by the Alabama Department of Revenue for the reporting of annual information returns. It is required to be filed by every resident individual, corporation, association, or agent in Alabama who makes payments of gains, profits, or income of $1,500 or more in any calendar year to any taxpayer subject to Alabama income tax. This includes payments other than interest coupons payable to bearer. If Alabama income tax has been voluntarily withheld from such payments, Form 96 must be filed (or an approved substitute) regardless of the amount.

Can I file federal Form 1099 instead of Form 96 with the Alabama Department of Revenue?

Yes, you may file copies of federal Form 1099 with the Alabama Department of Revenue in lieu of filing Form 99 and subsequently Form 96. However, it's important to ensure that all the payments made during the calendar year are properly reported, as required by the Alabama Department of Revenue.

What is the deadline for filing Form 96?

The deadline for filing Form 96 with the Alabama Department of Revenue is March 15th of the year following the calendar year in which the payments were made. This means if you're reporting for the year 2020, you must file Form 96 by March 15th, 2021.

Do employers need to file Form 96 for salaries and wages paid to employees?

No, employers who file Form A-2 with the Alabama Department of Revenue for salaries and wages paid to employees do not need to report the same payments on Form 96. Form A-2 serves a similar purpose for reporting wages and salaries and thus, duplicates the need for Form 96 in this specific context.

What should I do if Alabama income tax was withheld on Form 99 payments?

If Alabama income tax has been withheld on payments reported on Form 99, you should not use Form 96. Instead, you are required to use Form A-3, the Annual Reconciliation of Alabama Income Tax Withheld. Form A-3 is specifically designed for reconciling income tax that has been withheld throughout the taxable year.

Common mistakes

Filling out the Alabama 96 form accurately is vital for ensuring compliance with the state's tax requirements. However, several common mistakes can lead to errors, causing delays or even penalties. By understanding these pitfalls, filers can ensure their submissions are correct and timely.

- Not verifying the taxpayer's identification number: A crucial step often overlooked is verifying the accuracy of the Social Security Number (SSN) or the Federal Employer Identification Number (FEIN) listed. This oversight can lead to the misallocation of payments or penalties for providing incorrect information.

- Incorrect or incomplete address information: Since the form requires the payer's street address or P.O. Box, city, state, and ZIP code, failing to provide complete or accurate address details can result in the form not being processed correctly.

- Failure to sign the form: The signature line at the bottom serves as a certification of the information provided. Neglecting to sign the form renders it invalid and can lead to processing delays.

- Incorrect number of Form 99s attached: Each payment of $1,500 or more to a taxpayer requires accurate reporting. Overlooking or miscounting the number of Form 99s attached can result in incomplete reporting of taxable income.

- Using the form when Alabama income tax has been withheld: If Alabama income tax was voluntarily withheld from any payments, filers must use Form A-3 instead. Utilizing Form 96 in such instances is a common error.

- Misunderstanding the type of payments that need to be reported: The requirement is to report payments of gains, profits, or income other than interest coupons payable to bearers. Misinterpreting the types of payments that qualify can lead to either underreporting or overreporting.

- Not including payments made to non-residents subject to Alabama income tax: The mandate to file applies to payments to both residents and non-residents subject to Alabama income tax. Overlooking payments made to non-residents is a frequent mistake.

- Sending the form to an incorrect address: The form must be mailed to a specific address provided by the Alabama Department of Revenue. Sending the form to any other address can significantly delay processing.

- Filing after the deadline: Returns must be filed on or before March 15 of the year following the payment year. Filing after this date can incur penalties and interest on any underreported amounts.

To minimize errors, filers should diligently check the accuracy of all information entered on the form, adhere to the filing deadline, and ensure that all requirements specific to the type of payments and taxpayer status are met. Familiarizing oneself with the instructions and seeking clarification when needed can greatly reduce the likelihood of mistakes.

By avoiding these common errors, taxpayers can ensure their Form 97 submissions are both compliant and processed in a timely manner, thus avoiding unnecessary delays or financial penalties. Paying close attention to detail and double-checking all entries can significantly streamline the reporting process.

Documents used along the form

When engaging with the Alabama 96 form, it's imperative for organizations and individuals to ensure full compliance with the state's filing requirements. This often involves preparing and submitting additional documents that support or directly relate to the information outlined in the Alabama 96 form. The documents listed below are typically used alongside the Alabama 96 form to provide a comprehensive overview of annual information returns, ensuring that all necessary details are accurately and thoroughly reported to the Alabama Department of Revenue.

- Form 99 – This is described in the Alabama 96 form instructions and is required for reporting gains, profits, or income payments of $1,500 or more in any calendar year to any taxpayer subject to Alabama income tax. It's essential for resident individuals, corporations, associations, or agents making such payments.

- Form A-2 – Employers use this form for reporting salaries and wages paid to employees. It's crucial for those who have made payments subject to Alabama income tax but are exempt from reporting the same payments on Form 99, as mentioned in the Form 96 instructions.

- Form A-3 – An Annual Reconciliation of Alabama income tax withheld, which must be used if Alabama income tax has already been withheld from the payments, as indicated in the instructions for Form 96. This form summarizes the amount of state income tax withheld from employees' wages throughout the year.

- Federal Form 1099 – Copies of this form may be filed with the Department in lieu of Form 99 for reporting various types of income, healthcare payments, and other miscellaneous payments made during the calendar year.

- Form W-2 – This wage and tax statement is often filed together with the Alabama 96 form for employees, indicating the salary or wages paid and the taxes withheld from them throughout the calendar year.

- Form W-3 – The Transmittal of Wage and Tax Statements accompanies Form W-2 submissions and summarizes the employees' W-2 information for state tax purposes.

- Form W-9 – Request for Taxpayer Identification Number and Certification may be necessary for verifying the taxpayer's identification number before making payments that would be reported on Form 99 or directly on the Alabama 96.

- Form R-1 – Employer's Quarterly Return of Income Tax Withheld, which is used for reporting the amount of Alabama income tax withheld from employees' wages each quarter, supporting the annual totals reported on Form A-3.

Properly compiling and submitting these documents, alongside the Alabama 96 form, ensures that individuals and corporations are compliant with Alabama's reporting requirements for income, gains, and profits. By doing so, it aids in the transparent and efficient processing of tax information, crucial for both the filer and the state tax authority. The cooperation between taxpayers and the Alabama Department of Revenue, facilitated through accurate and complete documentation, is essential for maintaining the integrity of the state's tax system.

Similar forms

The Alabama 96 form is similar to several other documents used for tax reporting purposes. Each of these documents has specific functions but shares the common goal of reporting income or financial transactions to tax authorities. Understanding the similarities and differences among these forms can help in ensuring that all tax-related documentation is accurately completed and submitted.

Federal Form 1099 is one of the documents that closely resembles the Alabama 96 form. This federal form is used to report various types of income outside of wages, salaries, and tips. For instance, both the Alabama 96 form and Form 1099 are utilized to report income such as dividends, interest, and miscellaneous income payments. Like the Alabama 96 form, the requirement to file a Form 1099 is triggered by certain thresholds of payment amounts within a tax year. Moreover, businesses and individuals who make payments subject to reporting on Form 1099 must submit this information to the IRS, akin to the requirement of filing the Alabama 96 form with the Alabama Department of Revenue.

The Form A-3, Annual Reconciliation of Alabama Income Tax Withheld, also holds similarities to the Alabama 96 form, especially in the context of withholding and reporting Alabama income tax. While the Alabama 96 form is designed for reporting certain payments made, the Form A-3 is specifically aimed at reconciling the total amount of Alabama income tax withheld from employees' wages with the total tax deposits made throughout the year. Both forms serve as yearly summaries intended for the Alabama Department of Revenue, ensuring that income payments and tax withholdings are accurately recorded and reported.

Another document related to the Alabama 96 form is the Form A-2, Employer’s Quarterly Return of Income Tax Withheld. This form is used by employers to report wages paid to employees and the income tax withheld on those wages within a quarter. While the Form A-2 deals with quarterly reporting, and the Alabama 96 form focuses on annual summarization of certain types of payments, both forms are vital in reporting income and withholding to the Alabama Department of Revenue. Understanding the specific use of each form helps in ensuring compliance with Alabama's tax reporting requirements.

Dos and Don'ts

When filling out the Alabama 96 form, accurate and thoughtful completion is critical to ensure compliance with the state's taxation laws. Here's a guide to what you should and shouldn't do to fulfill your tax obligations effectively:

Do:Ensure that all the information you provide is accurate, including your social security number or Federal Employer Identification Number (FEIN), address, and the total number of Form 99s attached.

Verify the amount reported is for payments of $1,500 or more in the calendar year to individuals subject to Alabama income tax.

Remember to sign the form. An unsigned form may be considered invalid and could lead to processing delays.

File the form before the deadline, which is March 15th of the year following the calendar year in which the payments were made.

Use Form A-3, instead of the Form 96, if Alabama income tax has already been withheld from the payments you're reporting.

Forget to attach Form 99 or approved substitutes if you're reporting payments made to taxpayers. Failing to attach the necessary documentation could result in your form being returned or processed incorrectly.

Confuse this form with Form A-2, which is used for reporting salaries and wages paid to employees, not for the reporting of gains, profits, or income as Form 96 is used.

Disregard the option to file copies of federal Form 1099 with the Department if that suits your situation better. However, ensure that these forms report payments made during the calendar year accurately.

Assume that electronic filing is an option without checking the latest requirements from the Alabama Department of Revenue, as these can change.

Submit the form without double-checking all the figures and information you've entered. Mistakes can delay processing and may even result in penalties.

By adhering to these guidelines, you can streamline the process of filing your Alabama 96 form, ensuring that you remain in good standing with state tax laws.

Misconceptions

Understanding the Alabama 96 form and its requirements is essential for individuals and entities making payments that are subject to Alabama income tax. However, there are several misconceptions about the form that can lead to confusion. Here, we aim to clarify these misunderstandings.

Form 96 is the primary document for reporting income payments in Alabama: This is incorrect. Form 96, also known as the Summary of Annual Information Returns, is specifically used for summarizing Form 99s, not for reporting all types of income payments. For direct income reporting, other forms like Form 99 or federal Form 1099 should be used.

Only businesses need to file Form 96: In reality, Form 96 must be filed by any resident individual, corporation, association, or agent that makes payments amounting to $1,500 or more in gains, profits, or income in a calendar year to any taxpayer, indicating that it's not solely for businesses.

Interest payments do not need to be reported on Form 96: The statement is misleading. While Form 96 itself is not used for direct reporting, payments excluding interest coupons payable to bearer must still be reported on Form 99, which is summarized in Form 96.

There is no alternative to filing Form 96: This is not true. In lieu of filing Form 99 directly with the Alabama Department of Revenue, filers can submit copies of the federal Form 1099, thus negating the need to file Form 96 if not required by the specific circumstances.

If Alabama income tax is voluntarily withheld, Form 96 is required: This misconception simplifies the requirement. If Alabama income tax is withheld, one should not use Form 96 but instead file Form A-3 for the reconciliation of Alabama income tax withheld.

Form 96 allows for electronic filing: As of the last update, there is no indication that Form 96 can be filed electronically. Filers need to mail the forms to the Alabama Department of Revenue's provided address.

Employers need to report salaries and wages on Form 96: Actually, employers who file Form A-2 for salaries and wages paid to employees are not required to report those payments again on Form 99 or on Form 96. This helps avoid duplicate reporting and simplifies the process for employers.

Form 96 can be filed at any time during the year: This information is incorrect. The form must be filed with the Alabama Department of Revenue for each calendar year on or before March 15 of the following year, creating a specific filing deadline that must be adhered to in order to avoid penalties.

Correcting these misconceptions ensures compliant and accurate filing of necessary tax documents with the Alabama Department of Revenue, thereby avoiding potential errors and penalties associated with misfiling.

Key takeaways

Filling out and using the Alabama 96 form is crucial for individuals and entities making certain payments within the state. Here are key takeaways to remember:

- Who Needs to File: The form is required for residents, corporations, associations, or agents in Alabama that make payments of $1,500 or more in any calendar year to taxpayers. These payments include gains, profits, or income, excluding interest coupons payable to bearer.

- Voluntary Withholding: If you voluntarily withheld Alabama income tax from payments, filing Form 99 or an approved substitute is mandatory, regardless of the payment amount. This requirement ensures proper tax practices and helps prevent errors in tax withholding reporting.

- Alternative Filing Options: Instead of filing Form 99 directly, filers have the option to submit copies of the federal Form 1099. This flexibility can simplify the process for those who are already familiar with federal tax reporting requirements.

- Deadline and Mailing Information: All returns must be filed by March 15 of the year following the payment year. Ensure documents are mailed to the Alabama Department of Revenue, Individual & Corporate Tax Division, at the provided address, to ensure timely compliance with state regulations.

It's important to stay informed and ensure compliance with these guidelines to avoid potential issues. Understanding these key aspects of the Alabama 96 form will help streamline the reporting process for applicable gains, profits, or income within Alabama.

Check out Popular PDFs

New Hire Alabama - Includes the official seal of approval from the State of Alabama Department of Labor, adding credibility.

Alabama Irp - Maximize your tax accuracy with dedicated spaces for each fuel type, including unique codes and rates.

Alabama Small Claims Court Forms - The form's design focuses on clarity and comprehensiveness, minimizing the risk of incomplete filings that could hinder the progress of small claims actions.