Alabama 9501 Template

In Alabama, navigating the intricacies of taxation and business infrastructure is made simpler with the introduction of specific instruments, among which the Alabama 9501 form is a vital component. Serving as a critical document, this form is employed primarily for the purpose of tax clearance when engaging in business transactions, particularly in the realms of licensing and permits. It operates as a testament to a business's compliance with state tax obligations, ensuring that all dues are settled before undertaking new ventures or renewing existing licenses. The utility of the form spans across various sectors, making it an indispensable tool for businesses striving to maintain their credibility and operational legality within the state. Its significance is further magnified by its role in fostering a transparent and compliant business environment, echoing the state's commitment to fair and regulated commerce. The Alabama 9501 form effectively bridges the gap between businesses and regulatory compliance, embodying a proactive approach towards fostering economic stability and integrity through adherence to tax regulations.

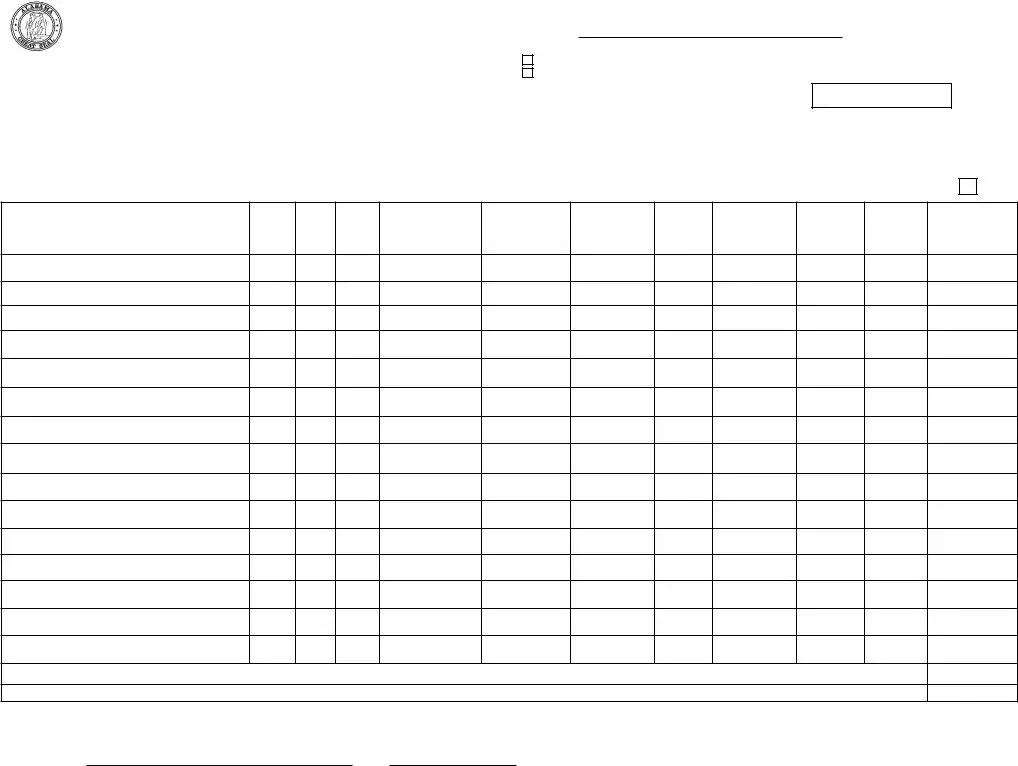

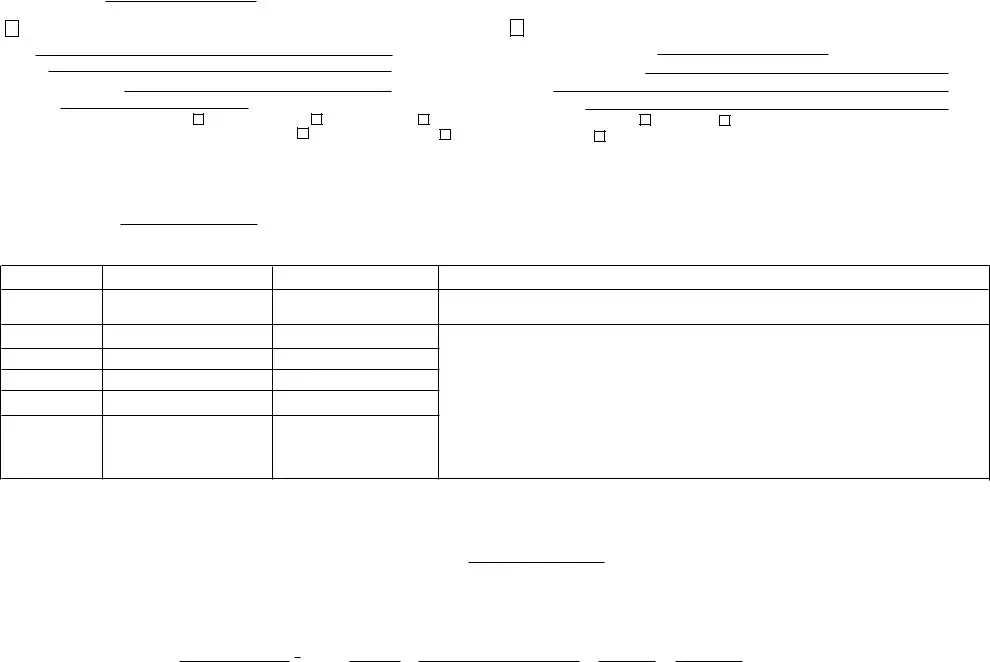

Alabama 9501 Example

Form Specs

| Name of Fact | Description |

|---|---|

| Form Designation | Alabama 9501 Form |

| Purpose | Used for business tax registration within the state of Alabama |

| Governing Law | Administered by Alabama Department of Revenue under Alabama state tax laws |

| Who Must File | Any entity conducting business in Alabama requiring a state tax account |

| Accessibility | Available for download from the Alabama Department of Revenue website |

| Filing Frequency | Filed once upon commencement of business activities in Alabama, unless a change requires an update |