Alabama 65 Template

The Alabama 65 form is a crucial document for partnerships, limited liability companies (LLCs), syndicates, pools, joint ventures, and similar entities operating within the state. Filing this form accurately and on time for either the calendar year 2010 or a fiscal year starting in 2010 is imperative to comply with the Alabama Department of Revenue requirements. It encompasses a comprehensive declaration of income, deductions, assets, and member details, alongside specific state adjustments and apportionment calculations necessary for accurate tax obligations determination. The form also demands detailed schedules regarding separately and nonseparately stated income, allocation and apportionment of income to Alabama, and additional information that can effect tax computations such as business operations in other states or countries, investments in pass-through entities, and transactions with owners. Additionally, it serves as a medium to apply for Alabama-specific credits like the Alabama Partnership Enterprise Zone Credit or the Capital Credit, further underlining its importance in the state’s tax filing process for eligible entities. The due diligence in completing and attaching requisite schedules, including the federal Form 1065 and Alabama Schedule K-1s for each owner, cannot be overstated, as these elements are integral to a comprehensive and compliant tax return.

Alabama 65 Example

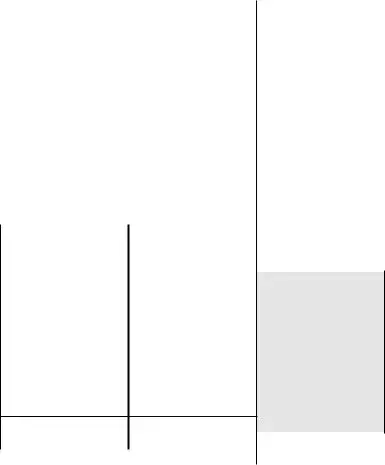

FORM |

*10000165* |

ALABAMA |

|

65 |

|||

|

DEPARTMENT OF REVENUE |

• CY

• FY 2010

•SY

|

|

|

|

|

Partnership/Limited Liability Company Return of Income |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

ALSO TO BE FILED BY SYNDICATES, POOLS, JOINT VENTURES, ETC. |

|

|

|

|

|

|

|||||||||||||||

Important! |

|

|

For Calendar Year 2010 or Fiscal Year |

|

|

|

|

|

|

|

|

|

DEPARTMENT USE ONLY |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

beginning • _________________________________, 2010, and ending • ____________________________, _________ |

FN |

|||||||||||||||||||||

|

You Must Check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Applicable Box: |

|

|

FEDERAL BUSINESS CODE NUMBER |

|

|

|

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|

|

|

|

|

|

||||||||||||

|

|

|

• |

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Amended Return |

|

|

Name of Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Federal income as shown on |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

• |

Initial Return |

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1065, line 8. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

• |

Final Return |

|

|

|

Number and Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Federal deductions as shown on |

|||

• |

General Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 1065, line 21. |

|||||

City or Town |

|

|

|

|

|

|

State |

|

9 Digit ZIP Code |

|

|

|

|

|

|

|

• |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

• |

Limited Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets as shown on Form 1065. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

• |

LLC/LLP |

|

|

|

Check if the company operates |

|

|

If above name or address is different from the one |

|

|

|

|

|

|

|||||||||||||

|

|

|

in more than one state |

• |

|

shown on your 2009 return, check here |

|

|

. |

. . • |

|

|

|

|

|

|

|||||||||||

• |

|

|

|

|

|

. . |

. |

. . . . |

|

|

|

• |

|||||||||||||||

Qualified Investment |

Check if the company qualifies for the Alabama |

Number of Members |

|

|

|

|

|

|

|

CN |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Partnership |

|

|

|

Enterprise Zone Credit or the Capital Credit . |

. . . . . |

. . . . • |

During The Tax Year |

• |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State in Which Company Was Formed |

Nature of Business |

|

Date Qualified in Alabama |

Number of Nonresident Members |

|

|

|

|

|

|

|

||||||||||||||||

• |

|

|

|

|

|

• |

|

• |

|

|

|

Included in Composite Filing . . . |

• |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNLESS A COPY OF FEDERAL FORM 1065 IS ATTACHED THIS RETURN IS INCOMPLETE |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

SCHEDULE A |

|

|

|

COMPUTATION OF SEPARATELY STATED AND NONSEPARATELY STATED INCOME |

|

|

|

|

|

|

||||||||||||||||

|

|

1 |

Federal Ordinary Income or (Loss) from trade or business activities |

. . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . |

. |

1 |

|

• |

|

|||||||||||||||

|

|

2 |

Net |

. . |

. . |

. |

. . . . |

|

2 |

• |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

3 |

.Salaries and wages reduced for federal employment credits |

. . |

. . |

. |

. . . . |

|

3 |

•( |

|

|

|

|

) |

|

|

|

|

|

|||||||

|

|

4 |

. . . . . . . .Net income or (loss) from rental real estate activities |

. . |

. . |

. |

. . . . |

|

4 |

• |

|

|

|

|

|

|

|

|

|

|

|||||||

Reconciliation |

5 |

. . . . . . . . . . . .Net income or (loss) from other rental activities |

. . |

. . |

. |

. . . . |

|

5 |

• |

|

|

|

|

|

|

|

|

|

|

||||||||

6 |

Net gain or (loss) under I.R.C. §1231 (other than casualty losses) |

|

|

6 |

• |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

to Alabama |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

7 |

Adjustments due to the Federal Economic Stimulus Act of 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basis (see |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

(attach schedule) |

|

|

|

|

|

|

|

|

7 |

• |

|

|

|

|

|

|

|

|

|

|

|||||

|

instructions) |

|

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

8 |

Other reconciliation items (attach schedule) |

|

|

|

|

|

|

|

8 |

• |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

9 |

.Net reconciling items (add lines 2 through 8) |

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . . |

. |

. . |

. . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . |

. |

9 |

|

• |

|

|||||||

|

|

10 |

Net Alabama nonseparately stated income or (loss) (add line 1 and line 9) |

. . |

. . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . |

. |

10 |

|

• |

|

||||||||||||||

|

|

11 |

Contributions |

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . |

|

11 |

•( |

|

|

|

|

) |

|

|

|

|

|

|||||

|

|

12 |

. . . . . . . . . . . . . . . . . . . . .Oil and gas depletion |

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . |

|

12 |

•( |

|

|

|

|

) |

|

|

|

|

|

|||||

|

|

13 |

. . . . . .I.R.C. §179 expense deduction (complete Schedule K) |

. . |

. . |

. |

. . . . |

|

13 |

•( |

|

|

|

|

) |

|

|

|

|

|

|||||||

|

Separately |

14 |

. . . . . . . . . . . . . . . . . . . . . . . . . .Casualty losses |

. . . . |

. . . . . . . . . . |

. . |

. . |

. |

. . . . |

|

14 |

•( |

|

|

|

|

) |

|

|

|

|

|

|||||

|

15 |

Portfolio income or (loss) less expenses (complete Schedule K) |

|

|

15 |

• |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Stated Items |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

16 |

Other separately stated items (attach schedule) |

|

|

|

|

|

16 |

• |

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Related to |

. . |

. . |

. |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Business |

17 |

. . . . . . . .Net separately stated items (add line 11 through 16) |

. . |

. . |

. |

. . . . . |

. |

. . |

. . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . |

. |

17 |

|

• |

|

|||||||||

|

18 |

Total separately stated and nonseparately stated items (add line 10 and line 17) |

|

|

|

|

|

18 |

|

• |

|

||||||||||||||||

|

Income) |

. . . . . |

. . . . . |

. |

|

|

|||||||||||||||||||||

|

19 |

Alabama apportionment factor from Schedule D, line 4 |

|

|

|

|

|

19 |

• |

% |

|

|

Do not multiply line 18 by line 19 |

||||||||||||||

|

|

. . |

. . |

. |

. . . . |

|

|

|

|||||||||||||||||||

|

|

20 |

Nonseparately Stated Income Allocated and Apportioned to Alabama from Schedule D, line 7 |

. . . . . |

. . . . . |

. |

20 |

|

• |

|

|||||||||||||||||

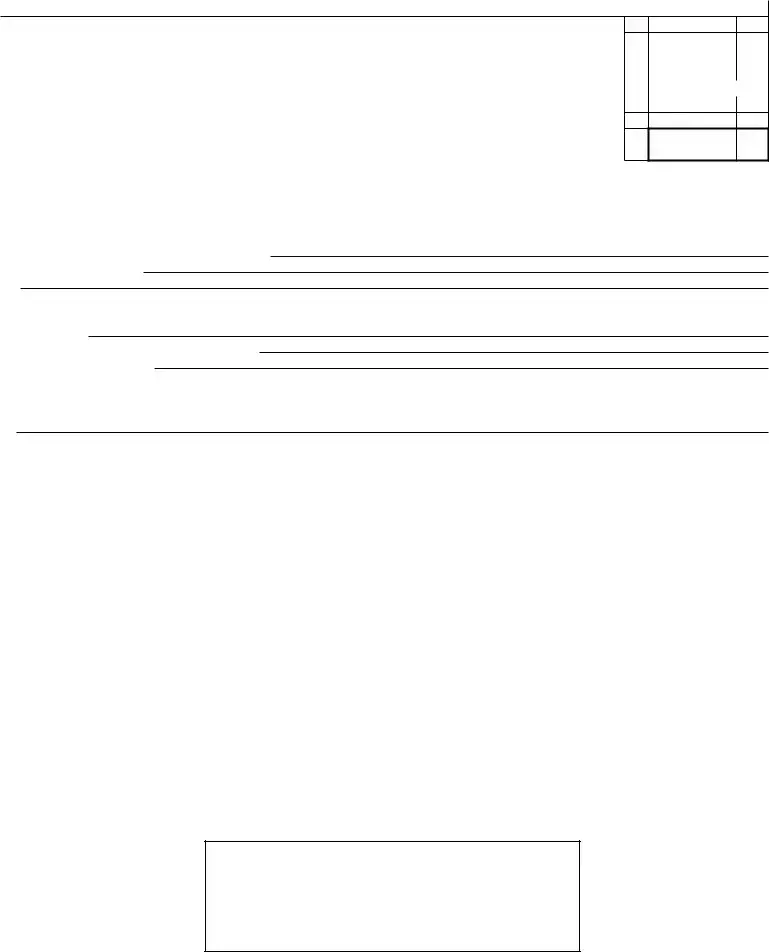

•I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Sign

Here

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

|

( |

) |

|

Signature of general partner |

Date |

Daytime Telephone No. |

Social Security No. |

|

|

Preparer’s |

|

|

Signature |

|

Paid |

Firm’s name (or yours, • |

|

Preparer’s |

||

if |

||

Use Only |

and address |

|

|

||

|

• |

Date |

Check if |

|

Preparer’s Social Security No. |

|

|

|

|

• |

|

• |

|

Telephone No. |

|

E.I. No. |

|

()

ZIP Code

Email Address

Mail to: Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327441, Montgomery, AL |

ADOR |

on or before April 15, 2011. (Fiscal Year Returns must be filed on or before the 15th day of the fourth month following the close of the fiscal year.) |

|

|

|

|

*10000265* |

|

Form 65 — 2010 |

Page 2 |

|

|

|

|

|

SCHEDULE B |

|

ALLOCATION OF NONBUSINESS INCOME, LOSS, AND EXPENSE |

|

Identify by account name and amount all items of nonbusiness income, loss, and expense removed from apportionable income and those items which are directly allocable to Alabama. Adjustment(s) must also be made for any proration of expens- es under Alabama Income Tax Rule

deduction that is applicable to both business and nonbusiness income of the tax- payer shall be prorated to each class of income in determining income subject to tax as provided…” (See instructions).

|

DIRECTLY ALLOCABLE ITEMS |

|

ALLOCABLE GROSS INCOME / LOSS |

|

|

|

RELATED EXPENSE |

|

NET OF RELATED EXPENSE |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Column A |

|

Column B |

|

|

Column C |

|

Column D |

|

Column E |

|

Column F |

|||

|

|

|

|

Everywhere |

|

Alabama |

|

|

Everywhere |

|

Alabama |

|

Everywhere |

|

Alabama |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Col. A less Col. C) |

(Col. B less Col. D) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Nonseparately stated items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1b |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1d Total (add lines 1a, 1b, and 1c) |

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|||

Separately stated items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1e |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1f |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1g |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1h Total (add lines 1e, 1f, and 1g) |

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

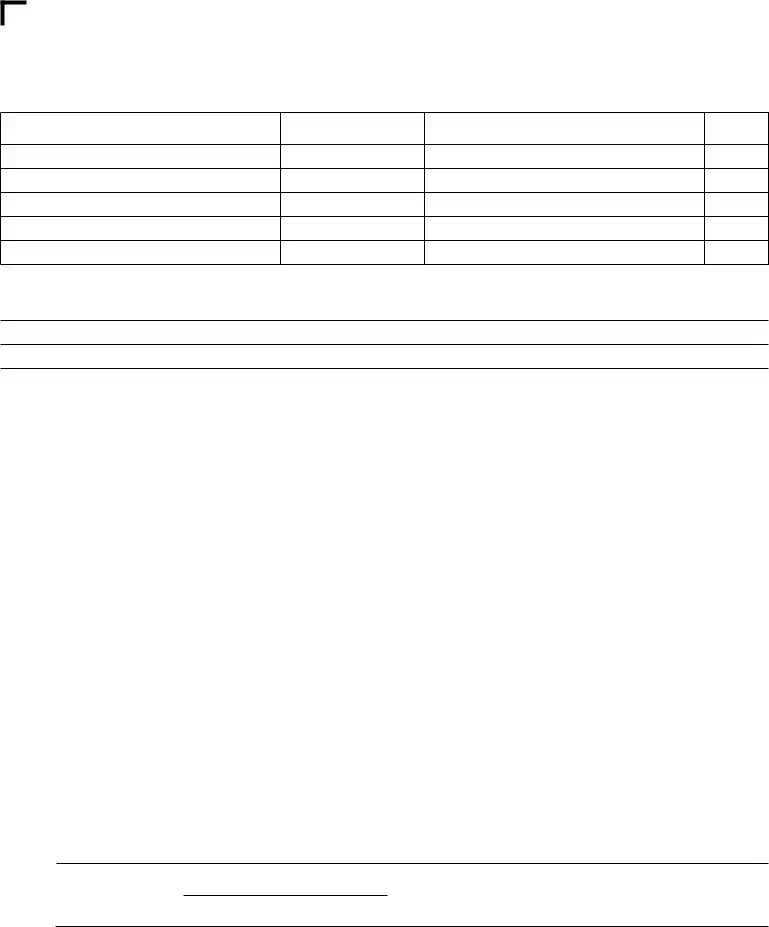

SCHEDULE C |

|

|

APPORTIONMENT FACTOR SCHEDULE – Do not complete if the entity operates exclusively in Alabama. |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

TANGIBLE PROPERTY AT COST FOR |

|

|

ALABAMA |

|

|

|

|

|

EVERYWHERE |

||||||||

|

PRODUCTION OF BUSINESS INCOME |

BEGINNING OF YEAR |

|

END OF YEAR |

|

BEGINNING OF YEAR |

|

END OF YEAR |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Inventories |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

2 |

Land |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

Furniture and fixtures |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

Machinery and equipment |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

5 |

Buildings and leasehold improvements |

• |

|

|

|

|

|

|

|

|

|

|

|

|

||||

6 |

IDB/IRB property (at cost) |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

7 |

Government property (at FMV) |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

8 |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

9 |

Less Construction in progress (if included) |

• |

|

|

|

|

|

|

|

|

|

|

|

|

||||

10 |

Totals |

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

||

11 |

Average owned property (BOY + EOY ÷ 2) |

|

|

|

• |

|

|

|

|

|

|

|

• |

|

||||

12 |

Annual rental expense |

|

|

• |

x8 = |

|

|

|

|

|

|

x8 = |

|

|

||||

13 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total average property (add line 11 and line 12) |

|

13a |

• |

|

|

|

. . . . . . |

. . . . |

. . . . . . . . . . . . |

13b |

• |

|

|||||

14 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Alabama property factor — 13a ÷ 13b = line 14 |

. |

. . . . . . |

. . . . . . |

. . . . . . . . . . . |

. . . . . . . |

. . . . . |

. . . . . . . |

. . . . |

. . . . . . . . . . . . |

14 |

• |

% |

|||||

|

SALARIES, WAGES, COMMISSIONS AND OTHER COMPENSATION |

|

|

15a |

ALABAMA |

|

15b |

EVERYWHERE |

15c |

|

||||||||

|

RELATED TO THE PRODUCTION OF BUSINESS INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15 |

Alabama payroll factor — 15a ÷ 15b = 15c |

. |

. . . . . |

• |

|

|

|

|

|

|

|

|

% |

|||||

|

|

|

|

SALES |

|

|

|

|

ALABAMA |

|

|

EVERYWHERE |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Destination sales |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

17 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Origin sales |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

18 |

. .Total gross receipts from sales |

. . . . . . . . . . . . . . . . . . . |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

||

19 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Dividends |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

20 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Interest |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

21 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Rents |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

22 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Royalties |

. . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

|||

23 |

. . . . . . .Gross proceeds from capital and ordinary gains |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

• |

|

|

|

|

|

|

|

|

|

||||

24Other •____________________________________ (Federal 1065, line •_____ ) •

25 |

Alabama sales factor — 25a ÷ 25b = line 25c |

25a • |

25b |

|

25c |

% |

26 |

Sum of lines 14, 15c, and 25c ÷ 3 = ALABAMA APPORTIONMENT FACTOR (Enter here and on line 4, Schedule D, page 3) |

26 |

• |

% |

||

ADOR

|

|

|

*10000365* |

|

Form 65 — 2010 |

Page 3 |

|

|

|

|

|

SCHEDULE D |

|

APPORTIONMENT AND ALLOCATION OF INCOME TO ALABAMA |

|

1 Net Alabama nonseparately stated income or (loss) from line 10, Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Nonseparately stated (income) or loss treated as nonbusiness income (line 1d, Column E, Schedule B)

– please enter income as a negative amount and losses as a positive amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Apportionable income or (loss) – add line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Apportionment factor from line 26, Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Income or (loss) apportioned to Alabama (multiply amount on line 3 by the percentage on line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Nonseparately stated income or (loss) allocated to Alabama as nonbusiness income (Column F, line 1d, Schedule B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Nonseparately Stated Income Allocated and Apportioned to Alabama (add lines 5 and 6). Enter this amount on line 20,

Schedule A and line 1, Schedule K – Alabama Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1•

2 |

• |

|

3 |

• |

|

4 |

• |

% |

5 |

• |

|

6•

7•

|

SCHEDULE E |

|

|

|

OTHER INFORMATION |

|

|

|

1 |

Indicate method of accounting |

(a) • |

cash |

(b) • |

accrual |

(c) • |

other |

|

2 |

Check if the company is currently being audited by the IRS |

• |

What years are involved? __________________________________ |

|||||

3 |

Check if the IRS has completed any audits |

• |

|

|

|

|

|

|

4Enter this company’s Alabama Withholding Tax Account Number •

5 Briefly describe your operations •

•

6 Indicate if company has been(a) • dissolved(b) • sold(c) • incorporated If company has been dissolved, sold, or incorporated, complete the following:

Nature of change •

Name and address of new company, corporation, or owner(s) •

7Location of the partnership records •

8 Check if an Alabama business privilege tax return was filed for this entity •

If the privilege tax return was filed using a different FEIN, please provide the name and FEIN used to file the return.

FEIN: • |

NAME: • |

|

|

|

|

9Taxpayer’s email address:

|

SCHEDULE K |

|

DISTRIBUTIVE SHARE ITEMS |

|

|

|

|

|

|

|

|

Federal Amount |

|

Apportionment |

|

Alabama Amount |

Enter on Alabama |

|

|

|

|

Factor |

|

Schedule |

||

|

|

|

|

|

|

|

||

1 |

Alabama Nonseparately Stated Income (Schedule D, line 7) |

|

|

|

|

|

|

|

|

|

|

• |

|

Part III, Line M |

|||

|

Separately Stated Items: |

|

|

|

|

|

|

|

2 |

. . . . . .Contributions |

• |

|

|

|

|

Part III, Line S |

|

3 |

Oil and gas depletion |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line Z |

|||

4 |

I.R.C. §179 expense deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a. Amount allowed on 1065 |

• |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . .b. Adjustments required (see instructions) |

• |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .c. Amount to be apportioned |

• |

|

|

|

|

Part III, Line O |

|

5 |

. . .Casualty losses |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line W |

|||

6 |

. . .Portfolio income |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line Q |

|||

7 |

Interest expense related to portfolio income |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line P |

|||

8 |

Other expenses related to portfolio income (attach schedule) |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line R |

|||

9 |

Other separately stated business items (attach explanation) |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line T |

|||

10 |

Small business health insurance premiums (attach explanation) |

|

|

|

|

|

|

|

|

|

|

• |

|

Part III, Line Y |

|||

11 |

. . . . . . . . . . .Separately stated nonbusiness items (attach schedule) |

• |

|

|

• |

|

Part III, Line AA |

|

12 |

. . . . . . . .Composite payment made on behalf of owner/shareholder |

|

|

|

• |

|

Part III, Line U |

|

13 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .U.S. taxes paid (attach explanation) |

• |

|

|

|

|

Part III, Line V |

|

14 |

Alabama exempt income (attach explanation) |

|

|

|

|

|

|

|

• |

|

|

|

|

Part III, Line AB |

|||

|

Transactions with Owners: |

|

|

|

|

|

|

|

|

|

|

100% |

|

|

|

||

15 |

Property distributions to owners |

• |

|

• |

|

Part III, Line X |

||

|

|

|

||||||

16 |

Guaranteed payments to partners |

|

|

|

|

|

|

|

• |

|

|

• |

|

Part III, Line N |

|||

CHECK LIST

HAVE THE FOLLOWING FORMS BEEN ATTACHED TO THE FORM 65?

ALABAMA SCHEDULE

ALABAMA SCHEDULE NRA (if applicable)

FEDERAL FORM 1065 (entire form as filed with the IRS)

ADOR

*10000465*

Form 65 — 2010 |

Page 4 |

Required Entity Information For Partnerships and LLCs

1. List general partners.

NAME OF GENERAL PARTNER |

SSN / FEIN |

ADDRESS |

a.•

b.•

c.•

d.•

e.•

PERCENT OF OWNERSHIP

2. List other states in which the Partnership/LLC operates, if applicable.

3. At any time during the tax year, did the Partnership/LLC transact business in a foreign country? |

Yes |

No |

||

If yes, complete the information below: |

|

|

|

|

|

|

|

|

|

NAME OF COUNTRY |

NATURE OF BUSINESS |

|

|

TAXABLE INCOME |

|

|

REPORTED TO COUNTRY |

||

|

|

|

|

|

|

|

|

|

|

a. • |

|

|

|

|

|

|

|

|

|

b. • |

|

|

|

|

|

|

|

|

|

c. • |

|

|

|

|

|

|

|

|

|

d. • |

|

|

|

|

|

|

|

|

|

e. • |

|

|

|

|

|

|

|

|

|

4. At any time during the tax year, did the Partnership/LLC invest in another |

Yes |

|

No |

||

If yes, complete the information below: |

|

|

|

|

|

|

|

|

|

|

|

NAME OF ENTITY |

|

|

FEIN |

|

PERCENT OF |

|

|

|

OWNERSHIP |

||

|

|

|

|

|

|

|

|

|

|

|

|

a. • |

|

|

|

|

|

|

|

|

|

|

|

b. • |

|

|

|

|

|

|

|

|

|

|

|

c. • |

|

|

|

|

|

|

|

|

|

|

|

d. • |

|

|

|

|

|

|

|

|

|

|

|

e. • |

|

|

|

|

|

|

|

|

|

|

|

5.Person to contact for information regarding this return:

Name:

Telephone Number: ( |

|

) |

Email:

ADOR

Form Specs

| Fact | Description |

|---|---|

| Form Designation | Alabama Form 65 |

| Governing Body | Alabama Department of Revenue |

| Year | 2010 |

| Applicable Entities | Parnership/Limited Liability Company, and also includes syndicates, pools, joint ventures, etc. |

| Required Identification Numbers | Federal Business Code Number and Federal Employer Identification Number |

| Type of Returns | Initial, Amended, and Final Returns |

| Important Schedules | Schedule A (Income Computation), Schedule B (Allocation of Nonbusiness Income), Schedule C (Apportionment Factor), Schedule D (Apportionment and Allocation to Alabama), Schedule E (Other Information), and Schedule K (Distributive Share Items) |

| Filing Deadlines | April 15, 2011, for Calendar Year; or 15th day of the 4th month following the close of the fiscal year for Fiscal Year filers |

| Declaration and Signatures | Includes declarations by the preparers, signatures of a general partner, and other relevant authorizations for discussions with Alabama Department of Revenue |

| Governing Laws for Allocation and Apportionment | Alabama Income Tax Rule 810-27-1-4-.01 regarding proration of expenses between business and nonbusiness income |

| Important Features | Mentions specific IRS forms (like 1065) for reference, and indicates the need for allocations for nonbusiness income and deductions as per Alabama laws |