Alabama 41 Template

Understanding the intricacies of the Alabama 41 form, officially known as the Alabama Fidiciary Income Tax Return, is essential for fiduciaries managing estates or trusts within the state. Designed for use for the 2006 calendar year or fiscal years beginning in 2006, it applies to a wide array of entities including decedent’s estates, various types of trusts, and bankruptcy estates under chapters 7 and 11. The form requires detailed information about the entity, such as the Employer Identification Number, the fiduciary's name and address, and specifics about the income and deductions that affect Alabama taxable income. Key components of the form include computations of Alabama adjusted total income, special deductions available to trusts, and details about any credits for income tax paid to other states, among others. Additionally, it facilitates the filing of amended returns and provides space for reporting changes in the fiduciary or entity's information. With attached schedules offering a deeper dive into allowable deductions and distributions, the form plays a pivotal role in ensuring fiduciaries accurately report and pay taxes due or request any refunds owed. Moreover, it highlights the need to attach a complete copy of the Federal Form 1041, underscoring the interconnectedness of federal and state tax obligations. Changes in tax law, such as those introduced by Alabama’s Subchapter J and Business Trust Conformity Act of 2006, are also addressed, pointing to the dynamic nature of tax requirements and the necessity for fiduciaries to stay informed about current laws and regulations.

Alabama 41 Example

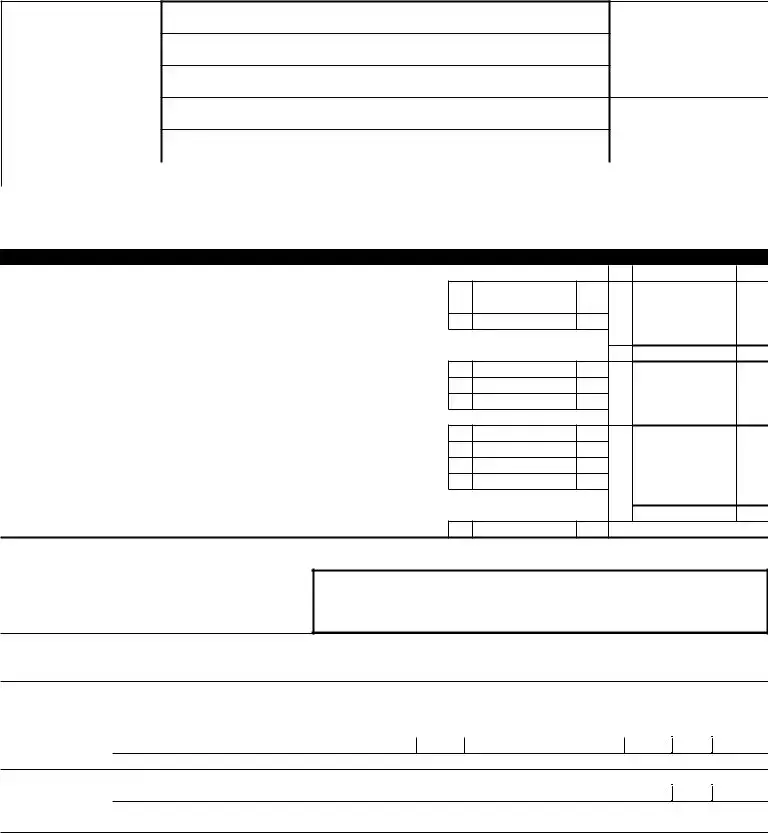

FORM |

|

*0612830141* |

41 |

2006 |

(Rev. 11/06)

ALABAMA DEPARTMENT OF REVENUE

Fiduciary Income Tax Return

For the calendar year 2006 or fiscal year beginning

__________________________, 2006, and ending ____________________________, ___________

Type of entity (see instructions): Decedent’s estate

Simple trust

Complex trust

Qualified disability trust

ESBT (S portion only)

Grantor type trust

Bankruptcy estate – Ch. 7

Bankruptcy estate – Ch. 11

Pooled income fund

Employer Identification Number

Name of Estate or Trust

Name and Title of Fiduciary

Address of Fiduciary (number and street)

City, State, and Zip Code

FN

Initial Return

Amended Return

Final Return

|

|

Address change |

Entity has income from more than one state |

Fiduciary or name change |

||||

|

|

|

|

|

|

|

|

|

Date entity created |

|

|

|

Number of |

|

|

|

|

Return is Filed on Cash Basis |

|

Nonresident estate or trust |

Trust has a nonresident beneficiary |

|

|

|||

A complete copy of the Federal Form 1041 must be attached for this return to be considered complete.

COMPUTATION OF ALABAMA TAXABLE INCOME AND NET TAX DUE |

|

|

1 |

Alabama Adjusted Total Income or (Loss) (Schedule C, Line 18c) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 |

|

Special Deductions Available to Trusts: |

|

2 |

Alabama Income Distribution Deduction (Schedule B, Line 16) |

2 |

3 |

Exemption (Allowed the Estate or Trust by |

3 |

4 |

Total of Special Trust Deductions (Total of Lines 2 and 3) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 |

5 |

Alabama Taxable Income (Line 1 less Line 4) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 |

6a |

$__________________ at 2 percent (On first $500, or fraction thereof, of AL Taxable Income) . . . |

6A |

b$__________________ at 4 percent (On next $2,500, or fraction thereof, of AL Taxable Income) . 6B |

||

c $__________________ at 5 percent (On all over $3,000 of AL Taxable Income) |

6C |

|

7 |

TOTAL INCOME TAX DUE (See instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 |

8 |

Credits: a Income tax paid to other states (See instructions for limitations) |

8A |

|

b Capital Credit (See instructions for limitations) |

8B |

|

c Amount paid with Form 4868A |

8C |

|

d Composite payments. Paid by __________________ TIN _____________________ |

8D |

9 |

Total Credits (Total of Lines 8a through 8d) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 |

10 |

NET TAX DUE (Subtract Line 9 from Line 7) PAY THIS AMOUNT IN FULL WITH RETURN |

. . . . . . . . . . . . . . . . . . . . . . . . . . . 10 |

11 |

NET REFUND (If Line 9 is larger than Line 7, enter overpayment here) |

11 |

(For official use only) |

|

|

|

CN |

|

(For official use only)

Returns with payments must be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327444, Montgomery, AL

Please

Sign

Here

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

( )

Signature of fiduciary or officer representing fiduciary |

Date |

Daytime Telephone No. |

Social Security Number |

Paid

Preparer’s

Use Only

Preparer’s signature

Firm’s name (or yours, if

|

|

Date |

|

Preparer’s Social Security Number |

|

|

|

Check if |

|

|

|

|

|

|

|

Tel. ( |

) |

E.I. No. |

|

|

|

|

|

|

|

|

|

ZIP Code |

|

|

|

|

|

|

FORM |

*0612830241* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 2

Name of estate or trust

Employer identification number

Name and title of fiduciary

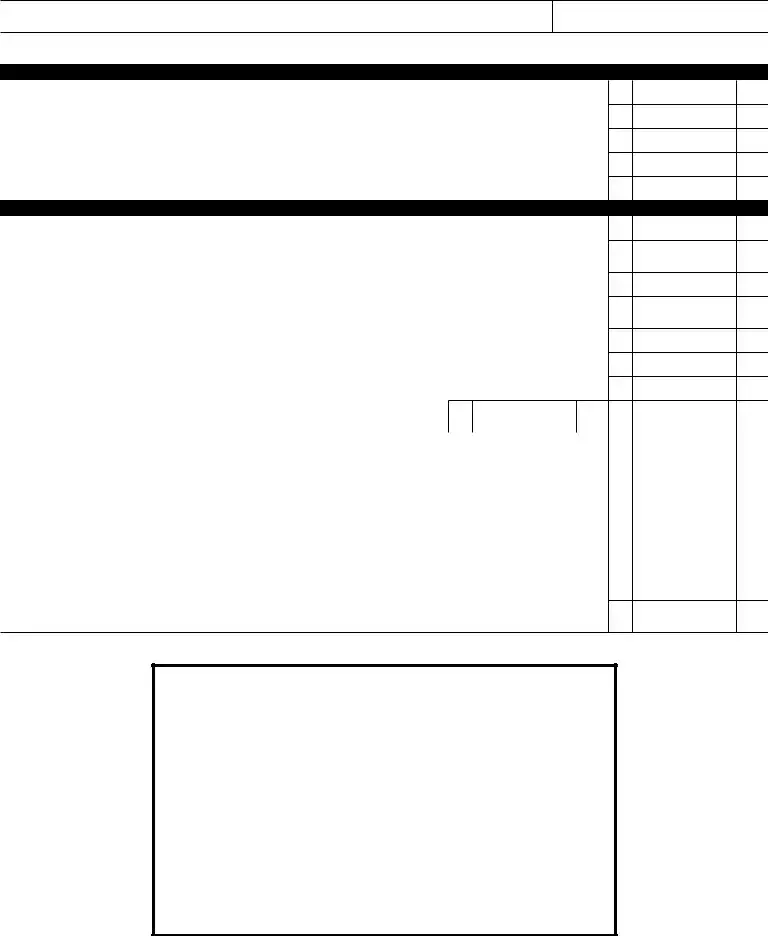

SCHEDULE A – ALABAMA CHARITABLE DEDUCTION. Do not complete for a simple trust or a pooled income fund. |

||

|

|

1 |

1 |

Amounts paid or permanently set aside for charitable purposes from gross income |

|

|

|

2 |

2 |

Alabama |

|

|

|

3 |

3 |

Subtract line 2 from line1 |

|

|

|

4 |

4 |

Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes |

|

|

|

5 |

5 |

Alabama Charitable Deduction.Add Line 3 and Line 4. Enter total here and on Page 3, Schedule C, Line 13, Column C |

|

SCHEDULE B – COMPUTATION OF ALABAMA INCOME DISTRIBUTION DEDUCTION |

|

|

|

|

1 |

1 |

Alabama Adjusted Total Income (Page 1, Lne 1) |

|

2The amount of gain from the sale of capital assets, but only if the gain was allocated to corpus and not paid, credited,

|

2 |

or required to be distributed to any beneficiary during the taxable year or not included in Line 4, Schedule A (see instructions) |

|

|

3 |

3 Subtract the amount entered on Line 2 from the amount entered on Line 1, and enter in Line 3 |

|

4The amount of loss from the sale of capital assets – entered as a positive number, only if the loss was not considered

|

in the determination of the amount to be paid, credited, or required to be distributed to any beneficiary during taxable year |

4 |

5 |

Amount of tax exempt interest income excluded in computing Alabama taxable income |

5 |

6 |

Other adjustments – see instructions |

6 |

7 |

Alabama Distributable Net Income (Sum of Lines 3 through 6) |

7 |

8If a complex trust, enter accounting income for the tax year as determined under the

|

governing instrument and applicable local law |

8 |

|

|

|

|

|

|

|

|

|

9 Income required to be distributed currently |

9 |

||

|

|

|

|

10 |

Other amounts paid, credited, or otherwise required to be distributed |

10 |

|

|

|

|

|

11 |

Total distributions. add Lines 9 and 10 |

11 |

|

|

|

|

|

12 |

Enter the amount of |

12 |

|

|

|

|

|

13 |

Tentative income distribution deduction. Subtract Line 12 from Line 11 |

13 |

|

|

|

|

|

14 |

Tentative income distribution deduction. Subtract Line 5 from Line 7. If zero or less, enter |

14 |

|

|

|

|

|

15 |

Special Alabama Income Distribution Deduction (see instructions for applicability of the special limitation) |

15 |

|

16Alabama Income Distribution Deduction. Enter the smallest of Line 13, Line 14, or, if applicable, Line 15,

on this line and on Page 1, Line 2. (Do not enter less than zero.) |

16 |

CHANGE IN ALABAMA TAX LAW

CONCERNING ESTATES AND TRUSTS

The Alabama Legislature passed the Subchapter J and Business Trust Conformity Act (Act Number

At the time the 2006 Form 41 was being developed, the promulgation process had begun for the regulations to implement the Act.

FORM |

*0612830341* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 3

Name of estate or trust

Employer identification number

Name and title of fiduciary

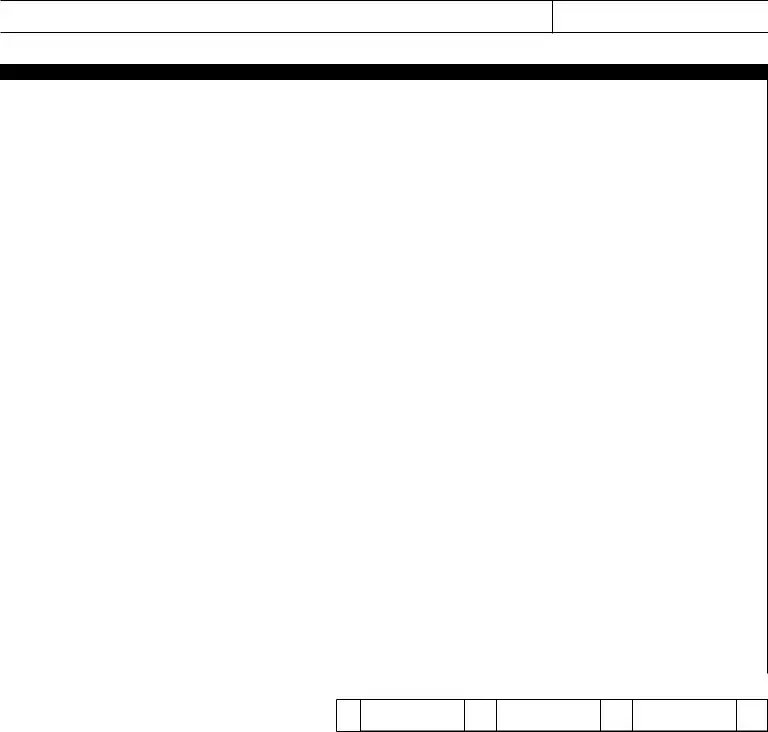

SCHEDULE C – COMPUTATION OF ALABAMA ADJUSTED TOTAL INCOME

|

|

|

Column A |

|

|

Column B |

|

Column C |

|||

|

|

|

AS REPORTED ON |

|

|

ALABAMA |

|

ALABAMA AMOUNT |

|||

|

|

|

FEDERAL FORM 1041 |

|

|

ADJUSTMENTS |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Interest income |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Ordinary dividends |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Business income or (loss) |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Capital gain or loss (see instructions) |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Rents, royalties, partnerships, and other estates and trusts |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Farm income or (loss) |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Ordinary gain or (loss) from Form 4797 |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Other income |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9 |

Total Income (Sum of Lines 1 through 8) |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Deductions: |

|

|

|

|

|

|

|

|

|

|

10 |

Interest |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Taxes (include federal estate and income taxes) |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Fiduciary fees |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Charitable deduction |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Attorney, accountant, and return preparer fees |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Other deductions not subject to the 2% floor |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Allowable miscellaneous itemized deductions subject to the 2% floor . . |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Total Ordinary Deductions (Sum of Lines 10 through 16) |

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18a |

Federal Adjusted Total Income (Line 9 less Line 17 – the amount |

|

|

|

|

|

|

|

|

|

|

|

entered on this line in Column A must equal the amount entered on |

|

|

|

|

|

|

|

|

|

|

|

Page 1, Line 17, Form 1041) |

18A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

Net Alabama Adjustments (Column B, Line 9 less Line 17) |

|

|

|

18B |

|

|

|

|

|

|

. . . . . |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

||

18c |

Alabama Adjusted Total Income (Column C, Line 9 less Line 17). Enter here and on Page 1, Line 1 |

|

|

|

|

18C |

|

|

|||

. . . . |

. |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|||||

19 Alabama Tax Exempt Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

Attach a complete explanation, showing all computations, for each item of income or deduction included in Column B (Alabama Adjustments), include also a complete explanation and computation for the items of exempt income. See instructions.

FORM |

*0612830441* |

|

41 2006 |

Alabama Fiduciary Income Tax Return |

PAGE 4

Name of estate or trust

Employer identification number

Name and title of fiduciary

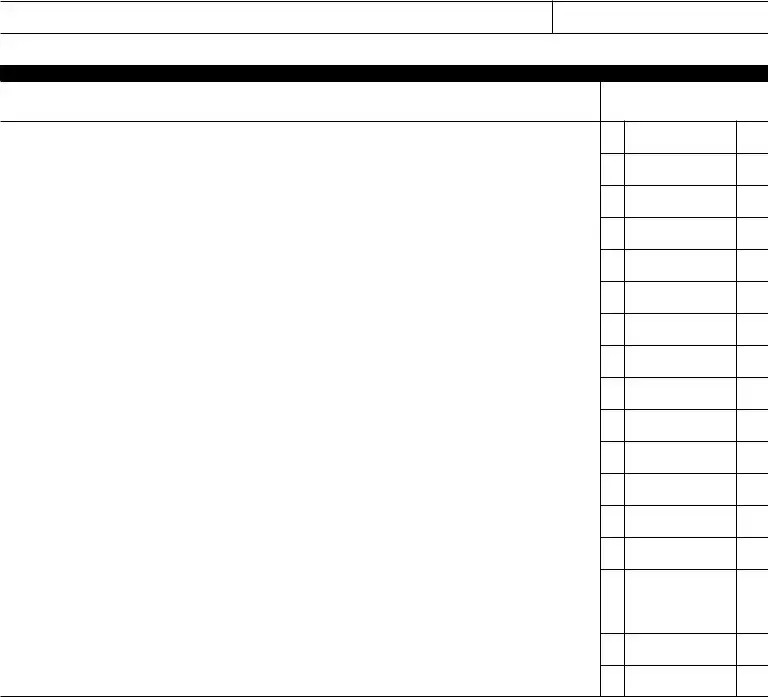

SCHEDULE K – SUMMARY OF

TOTAL ALABAMA AMOUNT

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Net Alabama capital gain or loss (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Rents, royalties, partnerships, and other estates and trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Ordinary gain or (loss) from Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Alabama Tax Exempt Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10a Grantor Trust Income (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10A

10b Grantor trust Deductions (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10B

10c Net Grantor Trust Income (Resident Beneficiaries Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10C

11 Nonresident Beneficiary – Alabama Source Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Nonresident Beneficiary –

12

Directly apportioned deductions:

13a Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13A

13b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13B

13c Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13C

Schedule K is a summary of the information reported on the

CHARACTER OF INCOME – In accordance with

ALLOCATION OF THE ALABAMA INCOME DISTRIBUTION DEDUCTION – The amount entered in Page 1, Line 2 (Alabama Income Distribution Deduction) must be allocated to resident beneficiaries and owners, so that the income reported by the beneficiaries or owners will retain its character . Generally the allocation is completed in accordance with Internal Revenue Code §§652 and 662. No amount may be included in the Alabama Income Distribution Deduction which is not included in the gross income of the estate or trust. See the instructions for more guidance concerning the allocation of income to the beneficiaries and owners.

Form Specs

| Fact Name | Description |

|---|---|

| Form Identification | Alabama Form 41 is the Fiduciary Income Tax Return for the state of Alabama, applicable for the year 2006. |

| Purpose | The form is designed for the reporting of income tax for fiduciary entities such as decedent's estates, various types of trusts, and bankruptcy estates under Chapters 7 and 11. |

| Type of Entities Covered | It covers decedent’s estates, simple trusts, complex trusts, qualified disability trusts, ESBT (S portion only), grantor type trusts, and bankruptcy estates (Ch. 7 & 11), among others. |

| Submission Deadline | For calendar year filings, the due date is April 16, 2007. For fiscal year filings, it is due by the 15th day of the fourth month following the close of the fiscal year. |

| Governing Law | The form is governed by the Code of Alabama 1975 and the Subchapter J and Business Trust Conformity Act (Act Number 2006-114). |

| Attachment Requirements | A complete copy of the Federal Form 1040 must be attached for the return to be considered complete. |

| Special Deductions | It allows for special deductions such as the Alabama Income Distribution Deduction and exemption as allowed by 40-18-19, Code of Alabama 1975. |

| Filing Addresses | Returns with payments should be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, at a specific address, and there's a different address for returns without payments. |

Detailed Guide for Writing Alabama 41

Filling out the Alabama 41 form is a critical step for fiduciaries of estates or trusts to ensure compliance with state tax regulations. The form facilitates the reporting of income, deductions, and the calculation of Alabama taxable income and net tax due for fiduciaries. Following the steps correctly will help avoid potential errors that could lead to delays or queries from the Alabama Department of Revenue. Once the form is completed and submitted along with any applicable attachments, fiduciaries should prepare for any potential correspondence from the tax department and ensure that any taxes due are paid to avoid penalties.

- Identify the Type of entity: Mark the appropriate box to indicate whether the entity is a decedent’s estate, simple trust, complex trust, qualified disability trust, ESBT (S portion only), Grantor type trust, Bankruptcy estate (Chapter 7 or 11), or Pooled income fund.

- Fill in the calendar year or fiscal year that the return covers in the spaces provided at the top of the form.

- Provide the Employer Identification Number of the estate or trust.

- Enter the Name of Estate or Trust and the Name and Title of Fiduciary.

- Complete the Address of Fiduciary, including the number and street, city, state, and zip code.

- Check any applicable boxes: Initial Return, Amended Return, Final Return, Address change, Fiduciary or name change, Entity has income from more than one state, Trust has a non-resident beneficiary, or Return is filed on a cash basis.

- Enter the Date entity created and the Number of K-1s attached.

- Under COMPUTATION OF ALABAMA TAXABLE INCOME AND NET TAX DUE, enter Alabama Adjusted Total Income or (Loss) from Schedule C, Line 18c; and follow through entering details for Special Deductions, Exemption, and calculating Alabama Taxable Income.

- Calculate the tax due, based on the Alabama taxable income from the table provided in Step 6aa, 6b, and 6c. Add these amounts to determine TOTAL INCOME TAX DUE.

- Determine applicable credits including taxes paid to other states and any other credits specified, then calculate the NET TAX DUE or NET REFUND.

- Fill in the preparer's information at the end of the form if prepared by someone other than the fiduciary and ensure the fiduciary’s signature, date, and contact information are included.

- Review the completed form and schedules for accuracy. Attach a complete copy of the Federal Form 1041 as required.

- Send the completed form, along with any payment due, by the deadline to the appropriate address provided for returns with payments or returns without payments.

Meticulous attention to detail during the completion of the Alabama 41 form is crucial for a proper submission. Accurate reporting and timely submission will fulfill the fiduciary’s obligations and contribute toward the efficient administration of the estate or trust.

Common Questions

What is the Alabama Form 41?

Alabama Form 41 is a Fiduciary Income Tax Return utilized by estates and trusts to report income, deductions, and taxes due to the state of Alabama. It is required for various types of entities, including decedent's estates, simple trusts, complex trusts, and bankruptcy estates, among others.

Who needs to file the Alabama 41 Form?

This form must be filed by fiduciaries of estates and trusts that have earned income within the tax year. The requirement applies whether the trust or estate is resident or nonresident, as long as it generates income that is taxable by the state of Alabama.

What should be attached to the Alabama 41 Form before submission?

A complete copy of the Federal Form 1041 must be attached to the Alabama 41 Form for the return to be considered complete. This ensures proper reporting and consistency between federal and state tax obligations.

How is the income tax calculated on this form?

Income tax on the Alabama 41 Form is calculated by first determining the Alabama Adjusted Total Income. Special deductions available to trusts are then subtracted to arrive at the Alabama Taxable Income. Taxes are calculated progressively, with rates starting at 2% for the first $500 of taxable income and increasing to 5% for amounts over $3,000.

Can a fiduciary claim credits for income tax paid to other states?

Yes, a fiduciary can claim a credit for income tax paid to other states on income also taxed by Alabama. The form provides a section for these credits, but limitations apply, and instructions provided with the form should be reviewed to ensure proper calculation.

What are the types of deductions available on the Alabama 41 Form?

The form allows for several deductions, including the Alabama Income Distribution Deduction and a general exemption as allowed by the Code of Alabama 1975. Other deductions relate to amounts set aside for charitable purposes and depreciation, depletion, and amortization directly apportioned to the income reported.

When is the Alabama 41 Form due?

For calendar year returns, the due date is April 16 of the following year. For fiscal year returns, it is due on the 15th day of the fourth month following the close of the fiscal year.

Where should the Alabama 41 Form be filed?

Forms with payments must be submitted to the Alabama Department of Revenue, Individual and Corporate Tax Division, at the designated P.O. Box in Montgomery, AL. Forms without payment are submitted to a different address, also specified in the form instructions.

How does one authorize a representative to discuss the return with the Department of Revenue?

To authorize a representative, the fiduciary must sign the designated section on the form, thereby granting the Department of Revenue permission to discuss the return and its attachments with the preparer or another nominated representative.

Common mistakes

Completing the Alabama 41 form, also known as the Fiduciary Income Tax Return, can be challenging. Individuals often make mistakes that can be easily avoided. Understanding and addressing these common errors can improve the accuracy of the tax returns filed.

Not attaching a complete copy of the Federal Form 1041: The Alabama 41 form requires that a complete copy of the Federal Form 1041 is attached for the return to be considered complete. A common mistake is either forgetting to attach this form or not providing all the necessary pages and schedules. This omission can lead to processing delays or requests for additional information, complicating the filing process.

Incorrectly calculating Alabama Taxable Income: Alabama taxable income is calculated by adjusting the total income with specific deductions and exemptions available to trusts or estates. Filers sometimes miscalculate these figures by overlooking allowable deductions or not applying them correctly. It's crucial to carefully review the computation of Alabama taxable income and verify all deductions and exemptions have been accurately applied.

Failing to indicate the type of entity: At the beginning of the form, filers must select the type of entity for which they are filing. This includes options such as a Decedent’s estate, simple trust, complex trust, among others. Failure to designate the correct entity type can result in the incorrect processing of the return, as different rules and tax rates may apply depending on the entity type.

Omitting details about income from more than one state: If the entity has income from sources outside Alabama, this should be explicitly stated on the form. Filers often overlook or forget to check the box indicating income from more than one state. This information is essential for accurately calculating the tax due and determining any credits for taxes paid to other states.

Inaccurate beneficiary information: For trusts with beneficiaries, especially nonresident beneficiaries, providing accurate and complete information is paramount. The schedule related to beneficiaries must detail the allocation of income among them. Mistakes in this section, such as incorrect amounts, failing to report all beneficiaries, or misreporting resident vs. nonresident status, can affect the rightful reporting of income and allocation of deductions.

By paying close attention to these common pitfalls, filers can enhance the accuracy of their Alabama 41 form submissions. Diligently reviewing each section, ensuring all necessary attachments are included, and double-checking calculations can significantly reduce the likelihood of errors and the potential for additional correspondence with the Alabama Department of Revenue.

Documents used along the form

When filing the Alabama Form 41, Fiduciary Income Tax Return, it's essential to gather and prepare additional documents to ensure accurate and comprehensive tax reporting. Curating the necessary forms will facilitate a smoother filing process and ensure compliance with state tax laws. Here is a look at several documents commonly used along with Alabama Form 41:

- Form 1041, U.S. Income Tax Return for Estates and Trusts: This form is the federal counterpart to the Alabama Form 41 and is required to calculate and report income, deductions, and gains of estates and trusts. A complete copy of Form 1041 must be attached to the Alabama Form 41 for it to be considered complete.

- Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc.: This schedule outlines the distribution of estate or trust income, deductions, and credits to beneficiaries. Information from Schedule K-1 is crucial for beneficiaries to accurately report income on their personal tax returns and for the estate or trust to complete Alabama Form 41.

- Alabama Schedule A, Charitable Deduction: This document provides detailed information about amounts paid or permanently set aside for charitable purposes from the estate or trust's gross income. It's necessary for estates and trusts that contribute to charitable organizations.

- Alabama Schedule B, Computation of Alabama Income Distribution Deduction: This schedule helps calculate the distributable net income for Alabama purposes, providing insights into the income distribution deduction for the state tax return.

- Alabama Schedule C, Computation of Alabama Adjusted Total Income: Essential for determining the adjusted total income for Alabama, this schedule requires adjustments and recalculations from the federal income reported on Form 1041 to meet state-specific tax laws and requirements.

Together, these documents form a comprehensive suite of forms necessary for accurate fiduciary income tax reporting in Alabama. They ensure estates and trusts meet their tax obligations comprehensively, both at the federal and state levels. Knowing the purpose and requirement of each document will make the tax filing process more efficient and timely for fiduciaries.

Similar forms

The Alabama 41 form, a Fidiciary Income Tax Return, shares similarities with several other essential tax documents in terms of purpose, structure, and required information. These documents play a crucial role in tax planning and compliance for various entities.

Similar to the Federal Form 1041, U.S. Income Tax Return for Estates and Trusts, the Alabama 41 form requires detailed information about the income, deductions, and tax liabilities of estates and trusts. Both forms cater to the same types of entities, including decedent’s estates, simple trusts, complex trusts, and bankruptcy estates, among others. They require a calculation of taxable income after deducting allowed expenses and distributions to beneficiaries. The necessity of attaching a complete copy of the Federal Form 1041 to the Alabama 41 form underscores the close connection between federal and state tax reporting for fiduciary entities.

Comparable to the Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc., the Alabama 41 form includes a section for summarizing K-1 information, specifically on Schedule K. The Schedule K-1 is pivotal in notifying beneficiaries about their share of an estate's or trust's income, deductions, and credits that they need to report on their individual tax returns. Similarly, the Alabama 41 form’s Schedule K allows for a summarization of this information, ensuring that the income reported retains its character from when it was originally received by the estate or trust. This parallel structure facilitates the accurate and transparent reporting of distributable net income to beneficiaries, highlighting the interdependence of these documents in managing fiduciary tax obligations.

Analogous to the State Income Tax Return forms of other states, such as the California Form 541, Fiduciary Income Tax Return, the Alabama 41 form serves a similar foundational role for estates and trusts within its jurisdiction. While each state has its specific requirements and tax codes, the overarching goal is to report the income, deductions, and taxes due for fiduciary entities operating within the state. These forms share common sections for reporting income distributions, deductions specific to trusts and estates, and calculating the tax liability based on state-specific tax rates. This similarity underlines the universal need for fiduciary entities across the U.S. to comply with state tax regulations while accounting for the unique attributes of each jurisdiction.

Dos and Don'ts

When filling out the Alabama 41 Form, which is the Fidiciary Income Tax Return, there are several important practices you should follow, as well as some pitfalls you'll want to avoid. Below are the key dos and don'ts to consider:

- Do make sure to review the type of entity and check the appropriate box at the beginning of the form, such as Decedent’s estate, Simple trust, Complex trust, etc.

- Do include the Employer Identification Number (EIN) of the estate or trust at the top of the form.

- Do provide complete contact information for the fiduciary, including name, title, address, city, state, and zip code.

- Do attach a complete copy of the Federal Form 1041 as indicated. This is necessary for the return to be considered complete.

- Do correctly calculate the Alabama Adjusted Total Income and Net Tax Due, ensuring that all applicable deductions and credits are applied accurately.

- Do sign the form in the designated area at the bottom, providing the date and, if applicable, the contact information of the fiduciary or officer representing the fiduciary.

- Don't leave any required fields blank. If a particular section does not apply, indicate with a “N/A” or “0” as appropriate.

- Don't forget to indicate if the return is an initial return, amended return, final return, if there’s been an address change, or if the entity has income from more than one state.

- Don't disregard the importance of accurate computation on Schedule A for charitable deductions, Schedule B for Alabama Income Distribution Deduction, and Schedule C for Adjusted Total Income. Errors in these areas can significantly impact the accuracy of the return.

Following these guidelines will help ensure that the Alabama 41 Form is filled out correctly and completely, facilitating a smoother tax return process for estates and trusts.

Misconceptions

There are several misconceptions about the Alabama 41 form, a Fidiciary Income Tax Return, that require clarification to ensure that trustees and fiduciaries of estates and trusts comply accurately with tax obligations in Alabama.

Misconception #1: The Alabama 41 form is only for estates, not trusts. This misconception arises because of the term "fiduciary," which is often associated with estates. However, the Alabama 41 form covers a range of entities beyond decedent's estates, including simple trusts, complex trusts, qualified disability trusts, and grantor type trusts, among others. The form is designed to account for fiduciary income tax responsibilities for both estates and various types of trusts.

Misconception #2: All trusts and estates must file the Alabama 41 form. In reality, the requirement to file depends on several factors, including the type of trust or estate, the source of income, and whether the income exceeds certain thresholds. Not all trusts or estates are required to file; for example, some types that solely have non-Alabama-source income and no distribution to nonresident beneficiaries may not need to file.

Misconception #3: Income distribution deductions are simple to calculate. The calculation for Alabama Income Distribution Deduction, as shown on the form, can be complex. It involves understanding the different types of income and deductions that can be allocated to beneficiaries, as well as specific limitations and special rules provided in the instructions. Incorrect assumptions about the simplicity of these calculations can lead to errors in filing.

Misconception #4: The Alabama 41 form does not require detailed income and deduction reports. This misunderstanding might stem from underestimating the form's requirements. In truth, a complete copy of the Federal Form 1041 must be attached, and detailed schedules must be included for income, deductions, and credits. Additionally, the form requires a comprehensive computation of Alabama adjusted total income, special trust deductions, and taxable income, with clear instructions on apportionment and allocation for resident and non-resident beneficiaries.

Understanding these misconceptions about the Alabama 41 form is crucial for trustees and fiduciaries. Accurate compliance with tax obligations requires a detailed and informed approach to each section of this crucial tax document.

Key takeaways

Filling out and using the Alabama Form 41, the Fiduciary Income Tax Return, requires attention to detail and understanding of specific guidelines. Here are key takeaways to assist in the process:

- The Form 41 is designed for various types of entities including decedent’s estates, various trusts, and bankruptcy estates under Chapters 7 and 11, among others. Identifying the correct type of entity at the outset is crucial for proper compliance.

- A complete copy of the Federal Form 1041 must be attached with the return for it to be considered complete. This requirement underscores the need for careful coordination between federal and state tax filings.

- The return allows for special deductions and credits. These include Alabama income distribution deduction, exemptions, and credits for income tax paid to other states, highlighting opportunities to reduce the taxable income of the estate or trust.

- Detailed schedules, such as Schedule A for Alabama Charitable Deduction and Schedule B for the computation of Alabama Income Distribution Deduction, require careful calculation. Each provides specific instructions to calculate deductions that can impact the final tax obligation.

- Finally, understanding the tax rates and the allocation of the Alabama Income Distribution Deduction to resident and nonresident beneficiaries is critical. The form outlines a tiered tax rate structure and specifies how to allocate deductions to maintain the income's character as required by Alabama law.

Properly navigating the intricacies of the Alabama Form 41 can ensure that fiduciaries meet their tax obligations while optimizing the financial position of the estates or trusts they manage.

Check out Popular PDFs

Alabama Certificate Of Compliance - Clarifying that the Certificate of Compliance will be mailed emphasizes the tangible outcome of the application process.

How to Write a Legal Bill of Sale - The MVT 5-13 form simplifies the process of managing vehicle affairs, making it more efficient and less time-consuming.