Alabama 40Es Template

Understanding the Alabama Form 40ES is crucial for anyone expecting to pay estimated taxes, whether as an individual or a corporate entity. This form, provided by the Alabama Department of Revenue, serves as a worksheet to assist in calculating and recording estimated tax payments for the tax year, ensuring taxpayers do not fall behind. It's designed for both calendar year taxpayers and those who operate on a fiscal year basis. Taxpayers can detail their adjusted gross income, deductions, exemptions, and calculate their estimated tax liability based on provided tax rates for different filing statuses. Importantly, this form also includes a section for recording the dates and amounts of estimated tax payments made throughout the year, offering a straightforward way to keep track of payments without the need for formal notices from the state. The form is clear on who needs to pay estimated taxes, applying mainly to those who anticipate owing at least $500 in taxes for the year after accounting for withholdings and credits, with special considerations for higher-income taxpayers. Instructions on the form guide taxpayers on when and where to file this estimated tax, including specific dates for payments or amendments to estimates based on changes in income or tax situations. It's a comprehensive guide meant to simplify the process of managing estimated taxes in Alabama.

Alabama 40Es Example

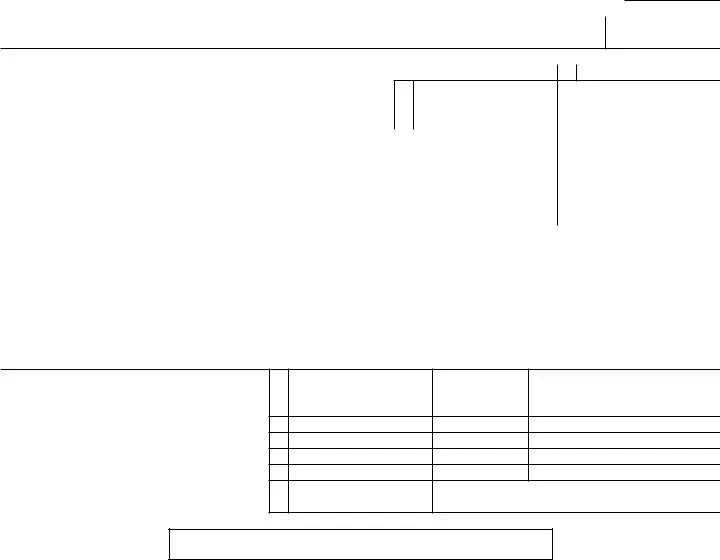

FORM |

ALABAMA DEPARTMENT OF REVENUE |

40ES |

ESTIMATED TAX |

|

INDIVIDUAL & CORPORATE TAX DIVISION |

|

(WORKSHEET – KEEP FOR YOUR RECORDS – DO NOT FILE) |

Name |

|

CALENDAR YEAR

2013

or Fiscal Year Ending

Social Security Number

1 Enter amount of adjusted gross income expected in taxable year |

1 |

2If deductions are itemized, enter total of such deductions expected. If deductions

|

will not be itemized, enter the amount from the standard deduction table |

2 |

|

|

|

3 |

Enter amount of federal income tax liability for taxable year |

3 |

|

|

|

4 |

Total of lines 2 and 3 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

4 |

|

5 |

Subtract line 4 from line 1. Enter balance here |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

5 |

|

6 |

Personal exemption and dependent exemption(s) (see instructions for Forms 40 and 40NR for amounts) |

6 |

|

||

7 |

Subtract line 6 from line 5. This is your estimated taxable income |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

7 |

|

8Compute tax on amount on line 7 at the following rates:

|

Single or Married & Filing Separately |

Married & Filing Jointly |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

a |

1st $500 |

. 2% |

1st $1000 |

2% |

8a |

|

|

|

|

b |

Next $2500 |

. 4% |

Next $5000 |

4% |

8b |

|

|

|

|

c |

Over $3000 |

. 5% |

Over $6000 |

5% |

8c |

|

|

|

|

9 Add lines 8a, 8b, 8c. Enter total here |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

9 |

|

||

|

|

|

|

|

|

||||

10 Amount of Alabama income tax you estimate will be withheld from your wages in taxable year. Enter balance here |

|

10 |

|

||||||

11 Subtract line 10 from line 9. Enter balance here. This is your estimated tax. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

If less than five hundred dollars ($500), no estimated tax is required to be filed (see instructions). |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

11 |

|

||||

|

|

|

|

|

|

|

|||

|

|

RECORD OF STATE OF ALABAMA ESTIMATED TAX PAYMENTS AND CREDIT |

|||||||

|

|

|

|

Amount |

|

Date Paid |

|

Check Number, etc. |

|

1Overpayment credit from last year credited to estimated tax for this year. (Make sure this credit is shown in the proper space on your Alabama income tax return for last year. . . . . . . . . . . . . . .

2 First payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Second payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Third payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Fourth payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

3

4

5

6

ENTER THIS AMOUNT ON THE PROPER LINE OF YOUR 2013 ALABAMA

INDIVIDUAL INCOME TAX RETURN, FORM 40 OR FORM 40NR.

NOTE: The Alabama Department of Revenue does not send notices of amounts paid on estimated tax. Therefore, it is important that you maintain this record.

Form 40ES Instructions

Who Must Pay Estimated Tax

If you owe additional tax for 2012, you may have to pay esti- mated tax for 2013.

You can use the following general rule as a guide during the year to see if you will have enough withholding, or if you should in- crease your withholding or make estimated tax payments.

General Rule. In most cases, you must pay estimated tax for 2013 if both of the following apply.

1.You expect to owe at least $500 in tax for 2013, after sub- tracting your withholding and credits.

2.You expect your withholding plus your credits to be less than the smaller of:

a.90% of the tax to be shown on your 2013 tax return, or

b.100% of the tax shown on the your 2012 tax return. Your 2012 tax return must cover all 12 months.

Special Rule for Higher Income Taxpayers

If your Alabama AGI for 2012 was more than $150,000 ($75,000 if your filing status for 2013 is Married Filing a Separate Return) substitute 110% for 100% in (2b) under General Rule, above.

When and Where to File Estimated Tax

Your estimated tax must be filed on or before April 15, 2013, or on such later dates as specified under “Farmers.” It should be mailed to the Alabama Department of Revenue, Individual Esti- mates, P.O. Box 327485, Montgomery, AL

Payment of Estimated Tax

Your estimated tax may be paid in full or in equal installments on or before April 15, 2013, June 15, 2013, September 15, 2013 and January 15, 2014. If the 15th falls on a Saturday, Sunday, or State holiday, the due date will then be considered the following

business day. Checks or money orders should be made payable to the Alabama Department of Revenue.

Changes In Tax

Even though your situation on April 15 is such that you are not required to file estimated tax at that time, your expected tax may change so that you will be required to file estimated tax later. In such case, the time for filing is as follows: June 15, if the change occurs after April 1 and before June 2; September 15, if the change occurs after June 1 and before September 2; January 15, if the change occurs after September 1. If, after you have filed a voucher, you find that your estimated tax is substantially increased or de- creased as the result of a change in your tax, you should file an amended voucher on or before the next filing date – June 15, 2013, September 15, 2013, January 15, 2014.

Farmers

If at least 2/3 of your estimated gross income for the taxable year is derived from farming, you may pay estimated tax at any time on or before January 15, 2014 instead of April 15, 2013. If you wait until January 15, 2014, you must pay the entire balance of the estimated tax. However, if farmers file their final tax return on or before March 2, 2013, and pay the total tax at that time, they need not file estimated tax.

Fiscal Year

If you file your income tax return on a fiscal year basis, you will substitute for the dates specified in the above instructions the months corresponding thereto.

Penalties for Underpayment

Penalties are provided for underpaying the Alabama income tax by at least $500.00.

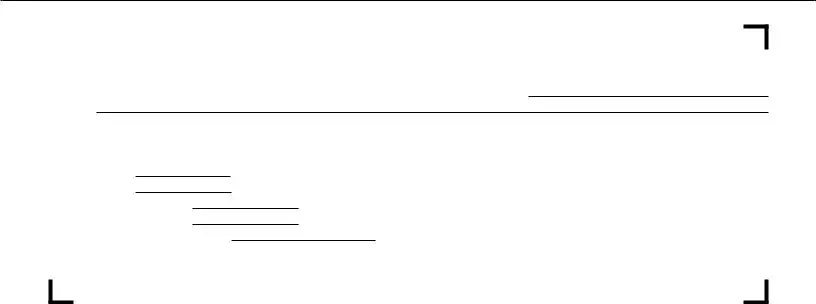

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|||||||||

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➀ |

|||||

|

|

|

|

|

|

||||||||

|

|

|

Estimated Income Tax Payment Voucher |

||||||||||

|

|

|

|||||||||||

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

||||||

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

||||

MAILING |

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

|

✁

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Spouse SSN: |

• |

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL

ADOR |

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

|

After |

& Before |

Filing Date |

Voucher |

1/4 of line 1 |

|||

|

|

|

|

1/3 of line 1 |

|||

|

|

|

|

1/2 of line 1 |

|||

|

|

|

|

All of line 1 |

|||

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL

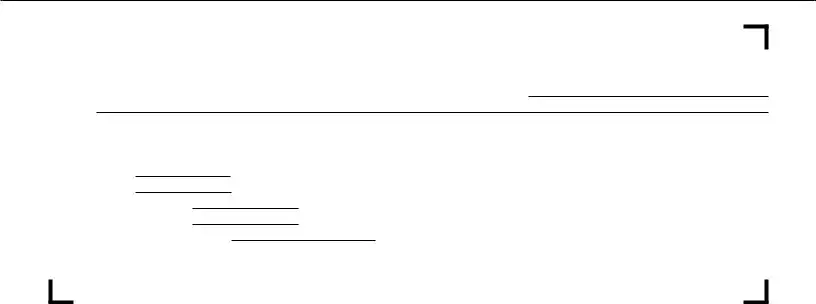

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|||||||||

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➁ |

|||||

|

|

|

|

|

|

||||||||

|

|

|

Estimated Income Tax Payment Voucher |

||||||||||

|

|

|

|||||||||||

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

||||||

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

||||

MAILING |

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

|

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Spouse SSN: |

• |

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL

✁

ADOR

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

|

After |

& Before |

Filing Date |

Voucher |

1/4 of line 1 |

|||

|

|

|

|

1/3 of line 1 |

|||

|

|

|

|

1/2 of line 1 |

|||

|

|

|

|

All of line 1 |

|||

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL

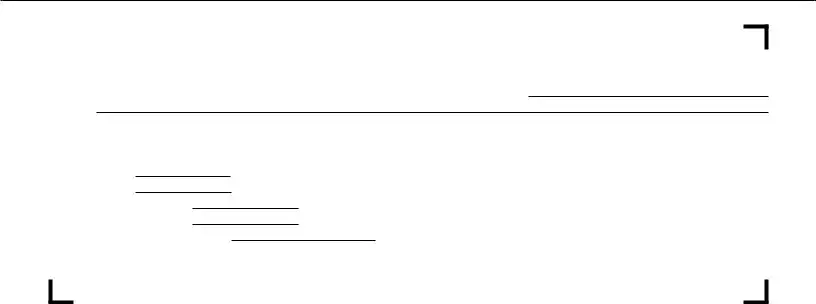

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|||||||||

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➂ |

|||||

|

|

|

|

|

|

||||||||

|

|

|

Estimated Income Tax Payment Voucher |

||||||||||

|

|

|

|||||||||||

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

||||||

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

||||

MAILING |

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

|

✁

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Spouse SSN: |

• |

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL

ADOR |

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

|

After |

& Before |

Filing Date |

Voucher |

1/4 of line 1 |

|||

|

|

|

|

1/3 of line 1 |

|||

|

|

|

|

1/2 of line 1 |

|||

|

|

|

|

All of line 1 |

|||

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL

✁ |

|

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT |

|

|

|||||||||

|

|

|

40ES 2013 |

|

|

|

Alabama Department of Revenue |

➃ |

|||||

|

|

|

|

|

|

||||||||

|

|

|

Estimated Income Tax Payment Voucher |

||||||||||

|

|

|

|||||||||||

PRIMARY TAXPAYER’S |

SPOUSE’S |

|

|

|

LAST |

|

|

||||||

FIRST NAME |

|

|

FIRST NAME |

|

|

|

NAME • |

|

|

||||

MAILING |

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

DAYTIME |

|

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

TELEPHONE NUMBER |

|

|

|

|

✁

CHECK IF FISCAL YEAR

Beginning Date:

Ending Date: •

Primary Taxpayer SSN: •

Spouse SSN: |

• |

Amount Paid With Voucher: $ •

MAIL TO: Alabama Department of Revenue, Individual Estimates,

P.O. Box 327485, Montgomery, AL

ADOR |

Instructions

1.Be sure you are using a form for the proper year. Do not use this form to file for any calendar year other than the year printed in bold type on the face of the form. Individuals who file on fiscal year basis (other than calendar year ending Dec. 31) should show beginning and ending dates of fiscal year in spaces provided on Form 40ES and each payment voucher.

2.Enter your social security number in space pro- vided. If joint voucher, enter spouse’s number on the line after yours.

3.Enter your first name, middle initial, and last name. If joint estimated tax, show first name and middle initial of both spouses. (Example: John T. and Mary A. Doe).

4.The amount to be shown on Amount Paid With Voucher line is determined by (a) the date you meet the requirements for filing a estimated tax,

(b) the amount of credit, if any, for overpayment from last year or income taxes withheld. Any overpayment credit may be applied to your earli- est installment or divided equally among all the installments for the year. See the following schedule:

Requirements Met |

Required |

Amt. Due With |

|

After |

& Before |

Filing Date |

Voucher |

1/4 of line 1 |

|||

|

|

|

|

1/3 of line 1 |

|||

|

|

|

|

1/2 of line 1 |

|||

|

|

|

|

All of line 1 |

|||

|

|

|

|

MAIL TO: Alabama Department of Revenue

Individual Estimates

P.O. Box 327485

Montgomery, AL

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Form 40ES is intended for the calculation and payment of estimated individual and corporate state taxes in Alabama. |

| Governing Law | The form is governed by the Alabama Department of Revenue’s regulations and the state's tax law. |

| Filing Requirements | Individuals are required to file if they expect to owe at least $500 in taxes for 2013 after accounting for withholdings and credits, and their withholdings plus credits are less than 90% of the tax to be shown on their 2013 tax return, or 100% of the tax shown on their 2012 tax return, with adjustments for higher income taxpayers. |

| Payment Schedule | Estimated tax payments are due in four equal installments on or before April 15, 2013, June 15, 2013, September 15, 2013, and January 15, 2014. If the due date falls on a weekend or state holiday, the deadline is the next business day. |

Detailed Guide for Writing Alabama 40Es

Filling out the Alabama 40ES form is a critical step for those who need to pay estimated taxes. This structured process ensures that individuals can accurately calculate and make their estimated tax payments to the Alabama Department of Revenue. It's designed for both individual and corporate taxpayers to keep accurate records of their estimated tax liabilities and payments throughout the fiscal year. Understanding and accurately completing this form is essential for compliance with state tax regulations and to avoid potential penalties for underpayment of estimated taxes.

- Identify whether you are completing the form for a calendar year or a fiscal year. If it's for a fiscal year, specify the beginning and ending dates.

- Write your full name (and spouse's if filing jointly) along with your Social Security Number(s).

- Enter the expected amount of adjusted gross income for the taxable year in the space provided.

- If you itemize deductions, total these amounts and enter the total. If not, refer to the standard deduction table and enter the applicable amount.

- Calculate and enter your federal income tax liability for the taxable year.

- Add the total of the itemized or standard deductions (from step 4) and federal income tax liability (from step 5) and enter this total.

- Subtract this total from your adjusted gross income (from step 3) to find the balance and enter this amount.

- Refer to the specific instructions for calculating your personal and dependent exemptions, then subtract this amount from the balance calculated in step 7 to determine your estimated taxable income.

- Compute the tax on your estimated taxable income using the rates provided for either Single, Married & Filing Separately, or Married & Filing Jointly. Sum these amounts for the total tax.

- Estimate the total amount of Alabama income tax that you expect to be withheld from your wages during the taxable year and enter this amount.

- Subtract the tax withheld (from step 10) from the total tax (from step 9) to find your estimated tax liability. If this amount is less than $500, no estimated tax is required to be filed.

- For record-keeping, fill in the dates and amounts of your estimated tax payments, check numbers, and overpayment credits from the previous year (if applicable). Ensure these records are accurate for future reference and include them in your Alabama income tax return.

- Check the box if you're filing on a fiscal year basis and provide the dates.

- On the voucher, fill in your and your spouse's name, mailing address, daytime phone number, and social security numbers.

- Enter the amount paid with the voucher, adhering to the schedule and requirements for filing and payment deadlines as outlined in Form 40ES instructions.

- Send your completed 40ES form and payment to the Alabama Department of Revenue at the specified address before the due date to avoid penalties.

Remember, maintaining accurate and up-to-date records of all estimated tax payments is crucial. The Alabama Department of Revenue does not notify taxpayers of their payments, so this responsibility falls on the taxpayer. Carefully tracking these payments will facilitate a smooth filing process for your annual state income tax return.

Common Questions

Who needs to file the Alabama 40ES form?

The Alabama 40ES form must be filed by individuals who expect to owe at least $500 in Alabama income tax for the year, after subtracting withholdings and credits. This includes individuals whose withholding and credits will be less than either 90% of the tax to be shown on their current year's tax return, or 100% of the tax shown on the previous year's return, with a special rule for higher income taxpayers.

When are the deadlines to file the 40ES payments?

Estimated tax payments for the Alabama 40ES form are due in four installments throughout the tax year: April 15, June 15, September 15, and January 15 of the following year. If any of these dates fall on a weekend or a state holiday, the deadline moves to the next business day. It's crucial to meet these deadlines to avoid any penalties for late payments.

How can I pay my estimated taxes using the 40ES form?

You can pay your estimated taxes either in full by the first deadline or through equal installments by each of the specified due dates. Payments can be made via check or money order, payable to the Alabama Department of Revenue. Ensure to send your payment to the correct address provided by the Alabama Department of Revenue to avoid any processing delays.

What if my estimated tax changes after I've filed the 40ES form?

If your estimated tax obligation increases or decreases significantly after you've already filed a voucher, you should file an amended 40ES form on or before the next due date. This will help you adjust your remaining payments to reflect the change in your estimated tax liability, thereby avoiding underpayment or overpayment when you file your annual return.

Common mistakes

Filling out the Alabama Department of Revenue 40ES form, also known as the Estimated Tax for Individuals form, can be a challenging task. Several common mistakes can lead to errors in the calculation and payment of your estimated taxes. Avoiding these mistakes is crucial for staying compliant with Alabama state tax laws.

Firstly, one of the most notable errors people make is not using the form for the correct year. Tax laws and standard deductions often change from year to year; using an outdated form can result in incorrect calculations. Secondly, misunderstanding the purpose of the 40ES form can also lead to mistakes. This form is specifically designed for those who need to pay estimated taxes either because their withholding is not sufficient or because they have income that is not subject to withholding.

Another frequent error is incorrectly calculating adjusted gross income (AGR). This figure is essential for accurately determining your estimated tax, and getting it wrong can significantly affect the outcome. Similarly, failing to properly calculate deductions, whether itemized or standard, can throw off the entire calculation. It’s equally important to accurately estimate the amount of Alabama income tax that will be withheld from your earnings throughout the year. Overestimating or underestimating can lead to underpayment or overpayment of taxes.

- Using the wrong year's form: Tax laws change, and it’s vital to use the most current form.

- Misinterpreting the form’s purpose: Understanding who is required to file the 40ES form can prevent unnecessary filings.

- Incorrectly calculating adjusted gross income: Accurate calculation is key to determining your tax responsibility.

- Inaccurate deduction calculations: Whether itemizing or using the standard deduction, accuracy is paramount.

- Miscalculating the amount of tax withheld: Accurately predict your withholdings to avoid tax liabilities or overpayment.

Additionally, not keeping good records of estimated tax payments can cause confusion and potential issues with the Alabama Department of Revenue. The form itself states that the department does not send notices of amounts paid for estimated tax, making it the taxpayer's responsibility to track these payments.

Moreover, many people fail to adjust their estimated taxes after a change in income, whether an increase or decrease. This adjustment is crucial to avoid underpaying or overpaying taxes. Lastly, a common oversight includes missing the deadlines for quarterly payments. These payments are due on specific dates throughout the year, and failure to meet these deadlines can result in penalties and interest charges.

- Not keeping records of the payments made can lead to discrepancies during filing.

- Failing to adjust estimated taxes after a significant change in income can result in incorrect payment amounts.

- Overlooking the quarterly payment deadlines can incur unnecessary penalties.

By steering clear of these common mistakes when completing the 40ES form, filers can ensure they accurately calculate and remit the right amount of taxes, avoiding both penalties for underpayment and the frustration of overpayment. Always double-check your work and consult the instructions provided by the Alabama Department of Revenue or a tax professional if you're unsure about any part of the process.

Documents used along the form

When preparing your taxes, especially if you're working with estimated taxes such as the Alabama Form 40ES, there are a range of other documents and forms you might need to gather or complete to ensure a smooth and accurate process. Below is a brief overview of some of these essential documents and forms.

- Form 40: The Alabama Individual Income Tax Return form is the primary document filed by residents to report their annual income. It’s used to compute the state income tax owed.

- Form 40NR: This form is the Non-Resident Alabama Individual Income Tax Return. It's used by individuals who earned income in Alabama but are not residents of the state.

- Form W-2: This wage and tax statement is issued by employers to report an employee's annual earnings and taxes withheld. It's crucial for accurately filling out the income sections on Alabama tax forms.

- Schedule A: Itemized Deductions Form, which is used for taxpayers who choose to itemize deductions instead of taking the standard deduction.

- Schedule B: This is used for reporting income from interest and dividends on your tax return. Including this with your forms may be necessary if you have significant income from these sources.

- Schedule D: Used for reporting capital gains or losses from the sale or exchange of assets. It's important for individuals who have investments.

- Schedule E: Supplemental Income and Loss, often used by those who receive rental income, income from partnerships, S corporations, estates, or trusts.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. If you need more time to file your Alabama tax return, you’ll likely need to file this federal extension form as well.

- Form W-4: Employee's Witholding Certificate is used to inform employers how much tax to withhold from an employee's paycheck. Correct withholding can prevent the need for estimated tax payments.

Collecting and organizing these forms can streamline your tax preparation process. It’s always a good idea to check for the most current versions of these forms and any specific instructions that may apply to your tax situation. Accurate and complete documentation is key to ensuring that your estimated taxes are calculated correctly and that you comply with all federal and state tax obligations.

Similar forms

The Alabama 40ES form is similar to the federal 1040-ES form used for estimating taxes on a federal level.

Both documents are used for the same fundamental purpose: to calculate and make payments for estimated taxes due throughout the year. They cater to individuals and businesses that expect to owe tax amounts that won't be covered by withheld taxes or other credits. The structure of the forms mirrors each other, guiding the taxpayer through a series of calculations to determine their estimated tax liability. This includes accounting for expected gross income, allowable deductions, and applicable tax rates to find the total estimated tax. The forms also break down how to pay this tax in equal installments throughout the year. While the Alabama 40ES is specific to Alabama state income tax, the 1040-ES tackles the federal income tax, underscoring the main similarity in their roles across different tax jurisdictions.

Another document that shares similarities with the Alabama 40ES form is the estimated tax forms of other states, such as the California Form 540-ES.

Like the Alabama 40ES, state-specific estimated tax forms such as California's 540-ES are designed to help taxpayers calculate their state tax obligations in advance, on an income that is not subject to withholding. Key elements such as expected income, deductions, and personal exemptions feature prominently, allowing taxpayers to determine their estimated tax due. While each state has its own tax rates and rules, the basic premise of the forms remains consistent: estimating taxes based on projected financial figures for the year. Both the 40ES and forms like the 540-ES underline the importance of accurately planning for tax liabilities to avoid underpayment penalties, making them vital tools for financial planning throughout the year.

Dos and Don'ts

Filling out the Alabama 40ES form, which is the Estimated Tax for Individuals, requires careful attention to detail and an understanding of one’s financial situation. Below are essential do’s and don’ts to assist taxpayers in accurately completing their forms.

- Do ensure that you are using the correct form for the current tax year. Utilizing an outdated form can lead to incorrect submissions.

- Do accurately enter your Social Security Number and, if applicable, that of your spouse. Accuracy in these details is paramount for your tax records.

- Do itemize deductions if this benefits your financial situation. Review and enter the total of such deductions as expected for the year, or opt for the standard deduction if it's more beneficial.

- Do accurately calculate your federal income tax liability and enter this amount where required. It is an essential part of determining your estimated tax.

- Do maintain a record of all estimated tax payments, including the amount, date paid, and check number. This information is critical for your records as the Alabama Department of Revenue does not send notices of amounts paid.

- Don't neglect the special rule for higher income taxpayers. If your adjusted gross income exceeds the specified threshold, you must adjust your calculations accordingly.

- Don't forget to adjust your payments if your financial situation changes throughout the year. If you anticipate a significant alteration in income or deductions, amend your estimated tax accordingly.

- Don't disregard the due dates for filing and paying your estimated tax. Missing these deadlines can result in penalties. Take special note of the provisions for farmers and those filing on a fiscal year basis. Adhering to these recommendations can assist in avoiding common mistakes and ensure compliance with Alabama state tax laws. A careful approach to estimating and paying taxes can help in managing one’s financial obligations effectively.

Misconceptions

Understanding the intricacies of tax forms and their instructions is crucial for compliance and financial planning. However, misconceptions about these forms, such as the Alabama 40ES, can lead to confusion and possible errors. Here are five common misconceptions about the Alabama 40ES form and clarifications to help dispel these misunderstandings:

- Misconception 1: The 40ES form is required to be filed by everyone. Not everyone is required to file the 40ES form. It is specifically designed for individuals and corporations that expect to owe at least $500 in tax for the year, after subtracting withholdings and credits. Taxpayers whose withholdings and credits meet or exceed their tax obligations may not need to file this form.

- Misconception 2: Estimated taxes must be filed annually. While the form relates to annual income, estimated taxes must be paid quarterly. The deadlines for these payments are April 15, June 15, September 15, and January 15 of the following year. It's essential to understand these dates to avoid underpayment penalties.

- Misconception 3: Overpayment credit cannot be applied to estimated taxes. If you have an overpayment credit from the previous year, it can indeed be credited towards your estimated taxes for the current year. This credit should be shown in the appropriate space on your Alabama income tax return for the last year, demonstrating its role in reducing your current year's estimated tax obligations.

- Misconception 4: There are no special rules for certain taxpayers. Special rules apply to higher income taxpayers and farmers. For instance, higher income taxpayers with an Alabama Adjusted Gross Income (AGI) over certain thresholds must substitute 110% for 100% of the previous year's tax for their estimated payments. Farmers have the flexibility to pay estimated tax by January 15 of the following year rather than adhering to the quarterly schedule.

- Misconception 5: The 40ES form is the only document necessary for estimating taxes. While the 40ES Voucher is crucial for submitting your estimated tax payments, it is equally important to maintain accurate records of these payments and refer to the accompanying instructions and the Alabama Department of Revenue's guidelines. The worksheet portion of the 40ES form is a vital tool for calculating your estimated taxes but should be kept for your records and not filed.

Addressing these misconceptions is fundamental for taxpayers to navigate their responsibilities accurately. Proper understanding and adherence to the stipulations of the 40ES form ensure compliance and prevent unnecessary penalties, thus contributing to a smoother financial and administrative experience with the Alabama Department of Revenue.

Key takeaways

When it comes to navigating the process of handling the 40ES form for estimated taxes in Alabama, individuals and corporations must pay attention to several crucial components to ensure compliance and avoid potential penalties. Below are key takeaways to guide taxpayers through this process:

- Understanding eligibility for filing: Taxpayers need to assess their situation against the criteria set by the Alabama Department of Revenue. This involves estimating whether they owe at least $500 in tax for the year, after accounting for withholding and credits. Individuals whose withholding and credits are expected to be less than 90% of their tax liability for the current year, or 100% (110% for higher income individuals) of the previous year's tax, must pay estimated tax.

- Filing deadlines and methods: The initial filing for the estimated tax must be completed by April 15 of the tax year. However, taxpayers have the flexibility to pay in full at this time or to make equal installment payments following a set schedule throughout the year. Payments are typically due on April 15, June 15, September 15, and January 15, with adjustments made for weekends and holidays. It's important to note that all payments should be directed to the Alabama Department of Revenue, ensuring the correct mailing address is used.

- Maintaining records: The Alabama Department of Revenue does not send reminders or notices for estimated tax payments. Consequently, it's imperative for taxpayers to keep detailed records of all estimates made, changes in income that might affect tax estimates, and actual payments dispatched. This includes dates, amounts, and the method of payment. Such diligence will aid in future tax preparations and any necessary adjustments.

- Addressing changes in tax situation: If after filing a voucher, taxpayers find that their estimated tax significantly increases or decreases due to changes in their income or tax situation, an amended voucher should be filed before the next due installment. It’s essential for taxpayers to stay vigilant and responsive to their financial fluctuations throughout the year to avoid penalties related to underpayment or overpayment of taxes.

Grasping these key aspects will better equip taxpayers in Alabama to manage their estimated taxes efficiently, ensuring they meet their tax obligations appropriately and avoid unnecessary penalties.

Check out Popular PDFs

Catastrophe Savings Account Alabama - A vital document for Alabama taxpayers inclined towards traditional tax filing methods, ensuring their choice is recognized.

Medicaid Application Alabama - Advises pregnant applicants to provide proof of pregnancy and expected due date as part of the application requirements.