Alabama 3 Template

Delving into the intricacies of state-specific documentation can often appear daunting, yet understanding these forms serves as a cornerstone for ensuring legal compliance and smooth operations. The Alabama 3 form is no exception, encapsulating critical aspects that cater to various stakeholders within the state's jurisdiction. Designed with the intention to streamline procedures and uphold standards, this document touches upon numerous significant elements ranging from personal identification to transactional details, contingent upon its application. Its versatility makes it an indispensable tool across multiple sectors, demonstrating the state's commitment to both clarity and efficiency in its bureaucratic processes. With its comprehensive approach, the Alabama 3 form not only facilitates smooth administrative workflows but also fortifies legal adherence, thereby upholding individual rights and fostering a sense of trust and reliability among the public and the authorities alike.

Alabama 3 Example

Form Specs

| Fact | Detail |

|---|---|

| Definition | The Alabama 3 Form, commonly known as the Alabama Sales and Use Tax Certificate of Exemption, is a document that allows a purchaser to make tax-exempt purchases for resale, lease, or rental in the state of Alabama. |

| Utilization | This form is primarily used by businesses to avoid the payment of sales tax on items that will be resold or rented. It ensures that sales tax is only collected from the end consumer. |

| Governing Laws | The form is governed under the Alabama Code Title 40, Revenue and Taxation, which outlines the conditions under which sales and use taxes can be exempted for certain transactions. |

| Validity | To remain valid, the purchaser must fill out the form completely and provide it to the seller at the time of purchase. It is the seller's responsibility to verify the accuracy of the form and keep it on file for audit purposes. |

Detailed Guide for Writing Alabama 3

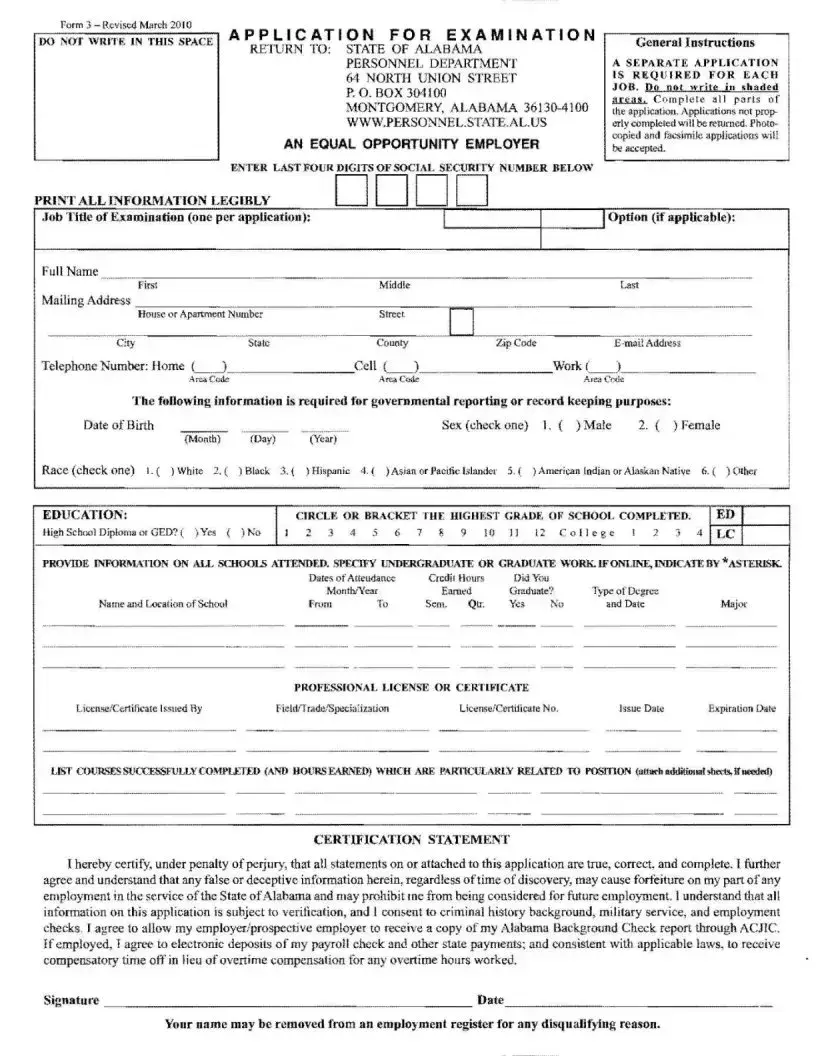

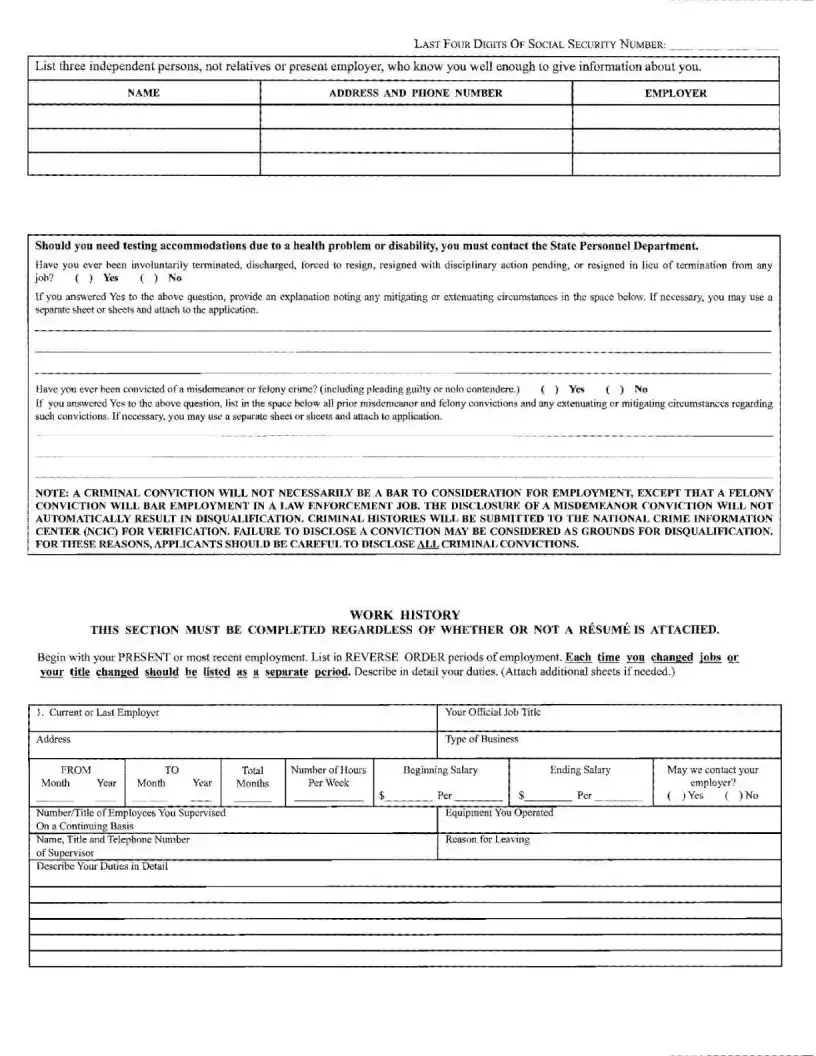

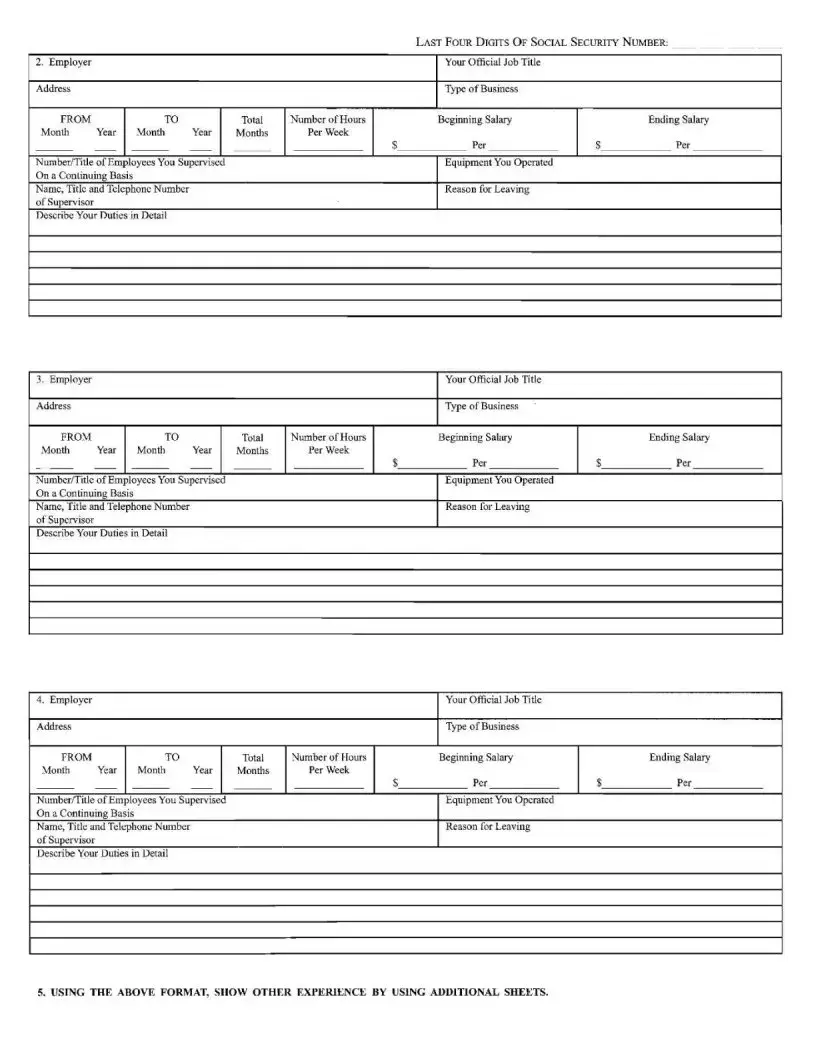

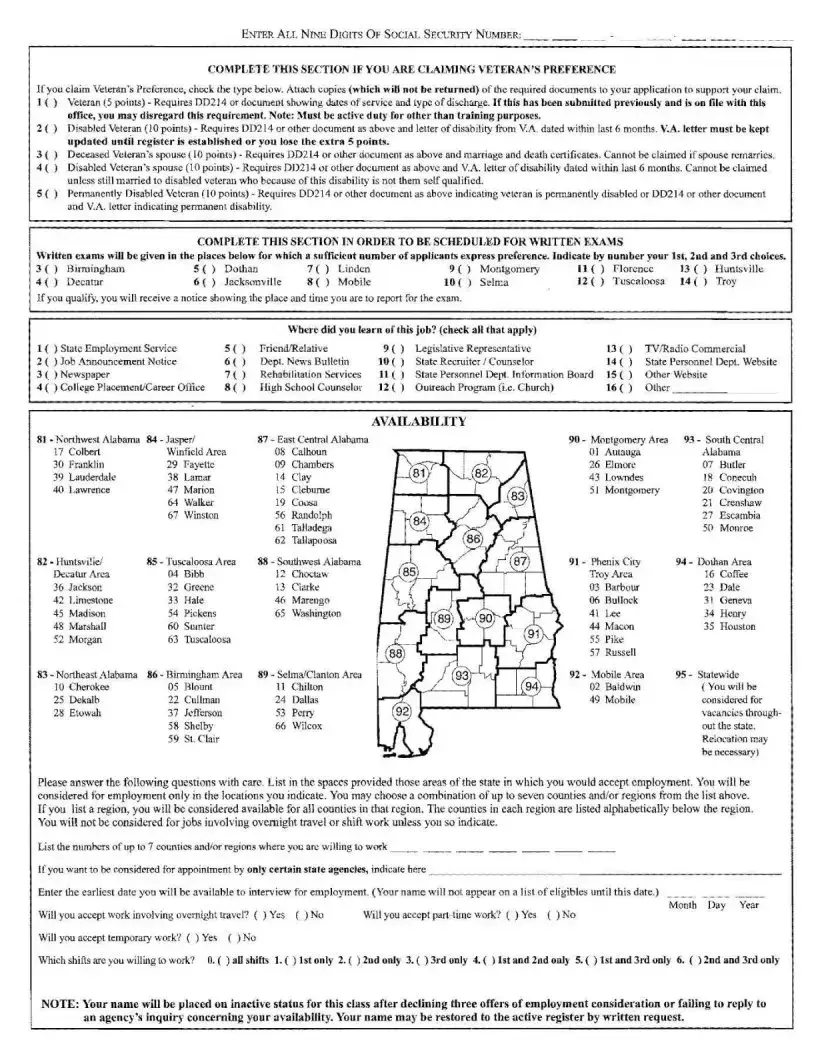

After acquiring the Alabama 3 form, individuals step into a procedure designed to ensure all the necessary information is captured accurately and completely. This precise documentation process is critical for the next stages, which rely heavily on the details provided in this form. The steps outlined below guide users through a straightforward, though detailed, process of completion. Adherence to these instructions is crucial to avoid errors that could potentially delay or disrupt the subsequent procedures.

- Start by entering the date at the top right corner of the form, using the month/day/year format.

- Provide the full legal name of the person or entity the form is about in the designated space.

- Fill in the current address, including street name and number, city, state, and ZIP code, in the appropriate field.

- Indicate the phone number where you can be easily reached. Include the area code.

- Enter the social security number or employer identification number in the specified section, ensuring accuracy to avoid issues with identity verification.

- List the type of activities or transactions this form pertains to in the designated area, providing as much detail as possible to facilitate clear understanding.

- Specify the period or date range these activities or transactions cover, using the month/day/year format for both start and end dates.

- Detail the exact locations involved, including any additional sites if the activities or transactions occurred in multiple places.

- Sign the form in the allocated space at the bottom. If representing an entity, include your title or position next to your signature.

- Date your signature, again using the month/day/year format, to confirm when the form was completed and submitted.

Upon completion, the form is ready for review and processing. This involves verifying the information provided, ensuring compliance with relevant regulations, and determining the appropriate next steps. Prompt and accurate filling out of the Alabama 3 form is essential in facilitating a smooth progression to these subsequent phases, ultimately enabling individuals and entities to efficiently achieve their intended outcomes.

Common Questions

What is the Alabama 3 form used for?

The Alabama 3 form is primarily utilized for the registration and titling of various types of vehicles within the state of Alabama. This includes, but is not limited to, cars, trucks, motorcycles, and trailers. It ensures that the vehicle is legally recognized by the state, providing a legal framework for ownership, taxation, and identification purposes.

Who needs to file an Alabama 3 form?

Individuals or businesses possessing vehicles that are to be operated on Alabama roads must file the Alabama 3 form. This requirement is applicable immediately upon purchasing a vehicle or when bringing a vehicle into Alabama from another state with the intention of establishing residency or conducting business.

Where can one obtain an Alabama 3 form?

The form can be sourced directly from the Alabama Department of Revenue's website. Additionally, it is available at local county tag and title offices throughout Alabama. Individuals seeking person-to-person assistance in completing the form may find these offices particularly helpful.

Is there a deadline for submitting the Alabama 3 form?

Yes, there is a specific timeframe within which the Alabama 3 form must be submitted. Typically, this is within 20 days following the acquisition of a vehicle, or upon establishing residency in Alabama. Failing to adhere to this deadline may result in late fees or penalties.

What documents are required to accompany the Alabama 3 form?

Submitting the Alabama 3 form requires several accompanying documents. This includes proof of vehicle ownership, such as a title or manufacturer's certificate of origin, proof of Alabama residency, a valid Alabama driver's license, and proof of insurance. The specific requirements may vary depending on the vehicle type and transaction details.

Can the Alabama 3 form be submitted electronically?

As of the latest update, the Alabama Department of Revenue permits the electronic submission of the Alabama 3 form for certain transactions. However, this service is not universally available for all vehicle-related transactions. It is advisable to check the Department's official website or consult directly with local county offices for more details regarding electronic submission options.

What are the consequences of not filing the Alabama 3 form?

Failing to file the Alabama 3 form can result in a variety of legal and financial consequences. This includes the impossibility to legally operate the vehicle on Alabama roads, potential fines, and penalties. Additionally, it may complicate legal proceedings involving the vehicle, such as ownership disputes or claims. It is crucial to comply with the Alabama 3 form requirements to ensure seamless vehicle use and ownership within the state.

Common mistakes

When filling out the Alabama 3 form, it's crucial to approach the process with attention and care. This document, often utilized for a variety of state-specific legal matters, can easily become a source of errors if not handled properly. Understanding the common mistakes can guide individuals through a smoother completion process.

Not double-checking personal information stands out as a frequent error. This encompasses misspelling names, incorrect dates, or inaccurate Social Security numbers. Such mistakes might seem minor, but they can lead to significant delays or even the rejection of the application.

Another common issue is neglecting to provide required signatures. The Alabama 3 form mandates signatures in specific sections to validate the information provided. Skipping these signatures might render the form incomplete, leading to administrative complications or the need for resubmission.

Frequently, individuals omit crucial details that are essential for the form's purpose. Leaving out information regarding dependents, financial data, or relevant legal information can obstruct the intended legal or administrative process. This oversight often results from rushing or not understanding the importance of every section on the form.

In addition, there's a tendency to use incorrect forms or outdated versions. The state of Alabama periodically updates its forms to reflect changes in law or procedure. Using an outdated version can result in processing delays or outright refusal of the application.

Many also fail to ensure consistency across all documents. When multiple forms are required, the information provided must match across all submissions. Discrepancies in details like addresses, names, or dates can raise questions about the veracity of the information presented.

Lastly, overlooking the necessity to keep copies of the completed form leaves individuals without proof of their submission. In the administrative journey, having a copy of what was submitted can help in resolving any disputes or errors that might arise later.

Common mistakes include:

- Not double-checking personal information for errors.

- Neglecting to provide required signatures.

- Omitting crucial details necessary for the form's purpose.

- Using incorrect forms or outdated versions.

- Failing to ensure consistency across all documents.

- Overlooking the necessity to keep copies of the completed form.

To avoid these pitfalls, individuals should take their time, review each section carefully, and consult guidelines or seek professional assistance if uncertainties arise. Ensuring accuracy and completeness in the Alabama 3 form submission sets the foundation for a smoother process, whether for legal, financial, or administrative purposes.