Alabama 2320 Template

The intricacies and requirements embedded in the Alabama 2320 form play a pivotal role for businesses operating within the hospitality sector, particularly those providing lodging services. Administered by the Alabama Department of Revenue, this critical documentation serves as a State Lodgings Tax Return, necessitating comprehensive adherence to its stipulations to ensure compliance. The form mandates the disclosure of both 4% and 5% lodgings taxes, reflective of geographically sensitive rates and underscores the state's structured approach to tax collection from accommodations. It emphasizes the versatility in filing options, offering electronic filing through the department's website or telephonic submissions, catering to the diverse preferences of filers. The form is not merely a financial statement but integrates operational changes within businesses, such as closures and address amendments, ensuring that the state's records remain current and accurate. A unique aspect of the form is its detailed listing of county codes alongside corresponding names, which simplifies the process of identifying applicable tax rates based on the lodgings' locations. This meticulous enumeration, alongside the provision for deductions, adjustments for prior overpayments, and penalties for late submissions, encapsulates the multifaceted nature of the tax obligations that hospitality providers must navigate. Thus, the form functions as a crucial bridge between these businesses and the regulatory framework of Alabama's tax system, emphasizing accuracy, timeliness, and adaptability in tax reporting practices.

Alabama 2320 Example

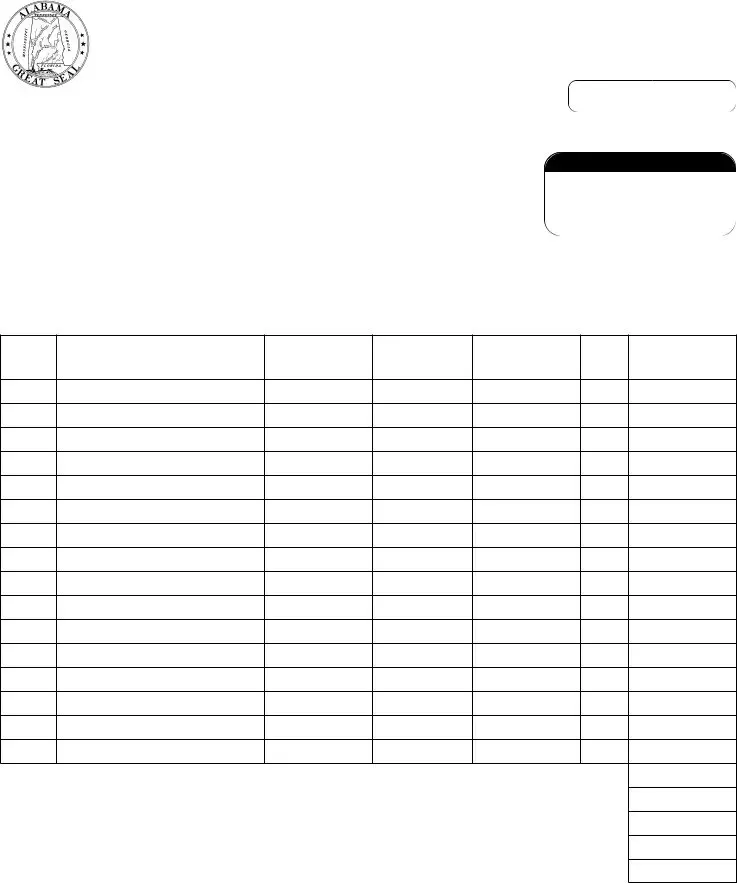

S&U 2320 |

ALABAMA DEPARTMENT OF REVENUE |

4/06 |

P.O. Box 327790 • Montgomery, AL

State Lodgings Tax Return

You may be required to file and pay this return online at:

|

www.revenue.alabama.gov/salestax/efiling.html |

|

This return can also be filed by telephone at: |

CHECK HERE IF BUSINESS HAS CLOSED |

|

Account Number: |

|

Period Covered: |

|

Due Date: |

|

Chain Number:

CHECK HERE FOR ADDRESS CHANGE

TOTAL AMOUNT REMITTED

$

CHECK THIS BOX IF PAYMENT |

|

MADE THROUGH EFT |

IMIMPORTANT!T!

Report the 4% and 5%

Lodgings Taxes on this return.

*See County List on

back of return.

Address __________________________________________

City, County, State, Zip ______________________________

Phone Number ____________________________________

Location Change ____ or Mailing Address Change ____

Effective Date of Change ____________________________

A

*COUNTY

CODE

B

COUNTY NAME

C

GROSS LODGING

RECEIPTS

D

DEDUCTIONS

E

MEASURE OF TAX

F

TAX

RATE

G

AMOUNT DUE

TOTAL AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . LESS DISCOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PLUS PENALTY AND INTEREST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LESS CREDIT FOR PREVIOUS OVERPAYMENT. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NET AMOUNT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Signature _____________________________________________________________________ Date _________________________________________

4% Counties

COUNTY |

|

COUNTY |

|

CODE |

COUNTY |

CODE |

COUNTY |

0100 |

Autauga |

3400 |

Henry |

0200 |

Baldwin |

3500 |

Houston |

0300 |

Barbour |

3700 |

Jefferson |

0400 |

Bibb |

3800 |

Lamar |

0600 |

Bullock |

4100 |

Lee |

0700 |

Butler |

4300 |

Lowndes |

0800 |

Calhoun |

4400 |

Macon |

0900 |

Chambers |

4600 |

Marengo |

1100 |

Chilton |

4900 |

Mobile |

1200 |

Choctaw |

5000 |

Monroe |

1300 |

Clarke |

5100 |

Montgomery |

1400 |

Clay |

5300 |

Perry |

1500 |

Cleburne |

5400 |

Pickens |

1600 |

Coffee |

5500 |

Pike |

1800 |

Conecuh |

5600 |

Randolph |

1900 |

Coosa |

5700 |

Russell |

2000 |

Covington |

5800 |

Shelby |

2100 |

Crenshaw |

5900 |

St. Clair |

2300 |

Dale |

6000 |

Sumter |

2400 |

Dallas |

6100 |

Talladega |

2600 |

Elmore |

6200 |

Tallapoosa |

2700 |

Escambia |

6300 |

Tuscaloosa |

2900 |

Fayette |

6400 |

Walker |

3100 |

Geneva |

6500 |

Washington |

3200 |

Greene |

6600 |

Wilcox |

3300 |

Hale |

|

|

5% Counties

COUNTY |

|

CODE |

COUNTY |

0500 |

Blount |

1000 |

Cherokee |

1700 |

Colbert |

2200 |

Cullman |

2500 |

DeKalb |

2800 |

Etowah |

3000 |

Franklin |

3600 |

Jackson |

3900 |

Lauderdale |

4000 |

Lawrence |

4200 |

Limestone |

4500 |

Madison |

4700 |

Marion |

4800 |

Marshall |

5200 |

Morgan |

6700 |

Winston |

Form Specs

| Fact | Detail |

|---|---|

| Form Title | State Lodgings Tax Return |

| Form Number | S&U 2320 |

| Issuing Department | Alabama Department of Revenue |

| Revision Date | April 2006 |

| Contact Information | P.O. Box 327790, Montgomery, AL 36132-7790, Phone: (334) 242-1490 |

| Online Filing Option | Available at www.revenue.alabama.gov/salestax/efiling.html |

| Telephone Filing Option | Option to file by telephone at 1-800-828-1727 |

| Governing Law(s) | Alabama State Lodgings Tax regulations |

Detailed Guide for Writing Alabama 2320

Filling out the Alabama 2320 form is a critical process for reporting and paying State Lodgings Tax. This form allows businesses to report their lodgings tax due to the Alabama Department of Revenue. It spells out the necessary details regarding gross lodging receipts, applicable deductions, and calculates the correct amount of tax owed. Below is a step-by-step guide to help you accurately complete the form.

- Start by checking if it's mandatory for your business to file and pay this return online by visiting www.revenue.alabama.gov/salestax/efiling.html. If applicable, the same process can often be completed by phone at 1-800-828-1727.

- If your business has closed or if there's been an address change, check the appropriate box at the top of the form.

- Enter your Account Number, Period Covered, and the Due Date for this tax return.

- For chain businesses, provide your specific Chain Number.

- Fill in the Address, including city, county, state, and zip code. Also, provide the best contact Phone Number.

- Indicate whether you have a Location Change or a Mailing Address Change, including the effective date of this change.

- For each county where you operate, enter the necessary information in the table provided. This includes the County Code, County Name, Gross Lodging Receiptcs, Deductions, Measure of Tax, Tax Rate, and Amount Due.

- Compute the Total Amount Due at the bottom of the table.

- If applicable, deduct any discount, and add penalties and interest to calculate the Net Amount Due.

- If there was a previous overpayment, enter the value in the designated field to adjust the Net Amount Due.

- Sign and date the form at the bottom to certify the accuracy of the information provided.

- Before submission, double-check all entries for accuracy to ensure compliance and correct tax calculation.

After completing and signing the form, follow the submission instructions provided by the Alabama Department of Revenue. This may include mailing the physical form to the address provided or submitting it electronically, depending on your business requirements or preferences. Pay close attention to the due date to avoid any potential penalties or interest for late filing. Proper submission of the Alabama 2320 form helps ensure your business meets its tax obligations efficiently and accurately.

Common Questions

What is the Alabama 2320 form used for?

The Alabama 2320 form is utilized by businesses to file their State Lodgings Tax Return. It details the reporting and payment of both the 4% and 5% lodgings taxes due to the Alabama Department of Revenue to ensure compliance with state tax obligations for rented accommodations.

Who is required to file the Alabama 2320 form?

Any business that provides lodging services in the state of Alabama is required to file the Alabama 2320 form. This includes hotels, motels, and other types of accommodations that charge for overnight stays.

Can the Alabama 2320 form be filed online?

Yes, the Alabama 2320 form can be filed online. Businesses can submit their State Lodgings Tax Return electronically through the Alabama Department of Revenue's official website at www.revenue.alabama.gov/salestax/efiling.html, which is recommended for faster processing and confirmation of submission.

Is telephone filing available for the Alabama 2320 form?

Yes, in addition to online filing, the Alabama 2320 form can also be filed by telephone. This service is available by calling 1-800-828-1727, providing a convenient option for those who may not have access to online filing services.

What information is needed to complete the Alabama 2320 form?

When filling out the Alabama 2320 form, businesses need to provide various pieces of information, including their Account Number, the Period Covered, Due Date, and Chain Number if applicable. Additionally, they must report Gross Lodging Receipts, Deductions, Measure of Tax, Tax Rate, and the Amount Due for each county in which they operate. Any address changes must also be noted on the form.

What happens if there is a change in business address or closure?

If a business changes its address or closes, it must indicate these changes on the Alabama 2320 form. There are specific boxes to check for an address change or business closure, and the effective date of the change must be provided to ensure accurate records and communication.

How is the tax rate determined for the Alabama 2320 form?

The tax rate for the Alabama 2320 form is determined based on the county codes listed on the back of the return. Counties are categorized under 4% and 5% lodgings taxes. The appropriate tax rate applies based on the location of the lodging service provided, which must be accurately reported to calculate the total amount due correctly.

Common mistakes

Filling out the Alabama 2320 form for State Lodgings Tax Returns requires attention to detail. However, some common mistakes can lead to errors in the submission process. Recognizing and avoiding these pitfalls can help ensure that your lodgings tax return is filed accurately and on time.

- One common mistake is not checking the appropriate boxes at the top of the form for business closure or change of address. This information is crucial for maintaining accurate records.

- Failure to enter the correct account number can also lead to processing delays. This number identifies your business to the Department of Revenue and is essential for your return to be filed correctly.

- Incorrectly reporting the period covered and the due date is another frequent error. These dates help the Department of Revenue track your filing and ensure timely processing.

- Not listing the correct county code and name where the lodging services were provided can lead to inaccuracies in your return. Each county may have different tax rates, which are crucial for calculating the correct amount of tax owed.

- Overlooking to report gross lodging receipts accurately can result in underpaying or overpaying taxes. It's critical to diligently calculate this figure to reflect your actual earnings from lodging services.

- Mistakes in calculating deductions are also common. Properly understanding which deductions are allowed and accurately calculating them can prevent discrepancies in the tax amount owed.

- Failing to apply the correct tax rate for the 4% and 5% lodgings taxes can significantly affect the amount due. It's imperative to consult the county list provided on the back of the return to determine the correct tax rate for each location.

- Omitting to subtract any discounts or to add penalties and interest for late payments can alter the net amount due. Remembering to account for these adjustments ensures your payment is processed correctly.

- Lastly, neglect is often found in not double-checking calculations before submitting the form. This simple step can prevent many of the errors mentioned above and help avoid potential penalties or delays in processing.

In summary, accurately completing the Alabama 2320 form requires a careful review of several key areas: correct identification information, precise reporting of financial figures, understanding of applicable tax rates, and diligent calculation of totals. By avoiding the common mistakes outlined above, filers can improve the accuracy of their submissions and ensure compliance with state requirements.

Documents used along the form

When dealing with the Alabama 2320 form, it's crucial to understand that this document is just a component of a wider array of paperwork needed for comprehensive tax reporting and compliance. This form, specifically used for state lodgings tax returns, is often accompanied by several other forms and documents that facilitate thorough record-keeping and adherence to Alabama's tax regulations. Below is an explanation of up to nine other forms and documents commonly used alongside the Alabama 2320 form.

- Form BPT-V: This is a payment voucher for businesses paying their annual income tax to the state of Alabama. It's crucial for businesses to complete this form accurately to ensure that their payment is credited to the correct account.

- Form 40: Alabama Individual Income Tax Return form is used by individuals to report their annual income. This form plays a crucial role in calculating the owed taxes or expected refunds for individuals within Alabama.

- Form A-3: Annual Reconciliation of Alabama Income Tax Withheld is a summary form used by employers to report the total income taxes withheld from their employees' wages throughout the year. This form helps in reconciling the employers' tax withholdings with the individual tax liabilities.

- Form COM:101: Combined Registration Form is used by businesses to register for various taxes, including sales tax, consumers use tax, and lodgings tax in Alabama. This is often one of the initial forms completed by new businesses operating within the state.

- Form 941: Employer’s Quarterly Federal Tax Return is a federal form that complements state-level documentation, especially for businesses with employees, ensuring that they meet their federal tax withholding and reporting responsibilities.

- Form SUI-2: Alabama Department of Labor Unemployment Compensation Contribution Report is used by employers to report wages paid to employees, which is important for determining unemployment insurance liability.

- Form PPT: Business Privilege Tax Return and Annual Report, which is required from most entities doing business in Alabama. It is an essential document for reporting the privilege of doing business in the state.

- Form R-1: Alabama Department of Revenue Employer’s Quarterly Return of Income Tax Withheld is used by employers to report state income tax withheld from their employees' wages during each quarter.

- Form SE:WLF: Statewide Lodging Fee form is specifically used in conjunction with the Alabama 2320 form for businesses that involve lodging facilities, requiring them to report and remit a separate lodging fee mandated by the state.

Understanding and utilizing these forms accurately ensures that businesses and individuals comply with all pertinent state tax laws, ultimately contributing to the economic stability and public service funding within Alabama. While this might seem daunting, each document provides vital information for maintaining tax compliance, making the complexities of tax preparation and filing manageable and straightforward.

Similar forms

The Alabama 2320 form, issued by the Alabama Department of Revenue for logging State Lodgings Tax Returns, bears resemblance to several other tax documents due to its structure and purpose. Among them, the most closely related documents are the Sales and Use Tax Return form that many states utilize and the local Occupation Tax form used in certain municipalities. Each of these forms shares the aim of reporting and remitting taxes, yet they cater to different sectors of economic activities.

The Sales and Use Tax Return form, similar to the Alabama 2320, requires businesses to report their total sales, the amount subject to tax, and the applicable taxes collected. Both forms necessitate detailed calculations to determine the tax owed, including deductions, exemptions, and any applicable discounts for early payments. The main difference lies in the nature of the tax collected; while the 2320 form focuses on lodgings tax, the Sales and Use Tax form encompasses a broader range of goods and services. Nonetheless, the procedural steps for filing, remitting payments, and reporting any changes in business status or information mirror those found in the lodgings tax return.

On the other hand, the Occupation Tax form bears similarity to the Alabama 2320 in that it is also specific to a certain type of business activity. This form is typically filed by professionals and businesses within a municipality that levies a tax on the privilege of conducting business within its jurisdiction. Like the 2320 form, it requires information on business receipts and allows for deductions. However, the Occupation Tax form's focus is distinctly on the gross income from professional services or business transactions, contrasting with the 2320's emphasis on lodging receipts. Despite these differences, both forms are essential tools for local or state governments to collect taxes that fund public services and infrastructure.

Dos and Don'ts

When filling out the Alabama 2320 form for State Lodgings Tax Return, individuals must adhere to specific guidelines to ensure accuracy and compliance with the Alabama Department of Revenue's requirements. The following list highlights essential dos and don'ts that should be followed:

- Do verify your account number and the period covered before starting to ensure that your return is accurate and filed for the correct timeframe.

- Do check the appropriate boxes at the top of the form if your business has closed or if there's been an address change. This information is crucial for maintaining accurate records with the Department of Revenue.

- Do ensure that the gross lodging receipts are correctly entered and match your records. Accurate reporting is essential for compliance and avoiding penalties.

- Do deduct any allowable amounts carefully. Understanding what deductions are permitted can reduce your tax liability, but incorrect deductions can lead to errors on your return.

- Do not forget to list the county codes and names accurately. This is crucial for ensuring that your lodgings tax is correctly allocated.

- Do not overlook the discount, penalty, and interest sections. If applicable, these must be accurately calculated and entered.

- Do not leave the signature and date fields blank. A signature is required to validate the form, indicating that all the information provided is accurate to the best of your knowledge.

- Do not ignore the filing and payment options available, such as online filing or payment through Electronic Funds Transfer (EFT). These methods can be more convenient and may expedite the processing of your return.

Paying attention to these dos and don'ts can facilitate a smoother filing process, ensuring compliance with Alabama's tax regulations and helping to avoid common mistakes that could lead to penalties or additional scrutiny from the Alabama Department of Revenue.

Misconceptions

When it comes to the Alabama 2320 form, there are several misconceptions that can lead to confusion. It's important to clear these up to ensure that the filing process is as straightforward as possible.

- It's only for hotels: The Alabama 2320 form is not just for hotels. It's for any business that offers lodging services, including motels, inns, and even short-term rentals like those found on platforms such as Airbnb.

- Can be filed anytime: Some might think that this form can be filed at any point before the due date. However, it's crucial to file it by the deadline stated on the form to avoid penalties and interest charges.

- Filing only online: While online filing is an option and sometimes required, the form also mentions that it can be filed by telephone. This is especially useful for those who might have limited internet access or prefer not to use online services.

- Only state taxes are reported: Although this is a state lodging tax return, businesses must also report and remit county lodging taxes, for which rates and instructions are provided on the form.

- Only one tax rate applies: The form makes it clear that there are different tax rates for different counties. It's important to apply the correct tax rate for the county where the lodging service is provided.

- No deductions allowed: Some may wrongly believe that gross lodging receipts are taxed in full. However, the form allows for deductions, which need to be accurately calculated and reported.

- A change in business address doesn't need to be reported: The form specifically asks for an address change to be reported. This ensures that all communication and documentation are sent to the correct address.

- Penalties and interest are automatically calculated: While the form does include sections for penalties and interest for late filings, it's the responsibility of the filer to calculate and include these amounts if applicable.

- Credit for previous overpayments is automatically applied: If a business has overpaid in the past, it's up to them to claim this credit on the form. It's not automatically applied to the current period's tax due.

- Closing a business means you don't have to file: Even if a business has closed, the final lodging taxes due must still be reported and paid using this form. There's even a specific box to check for businesses that have closed.

Clearing up these misconceptions helps businesses accurately complete the Alabama 2320 form and remain in compliance with state and county tax laws. It's always best to read the form carefully and consult with a tax professional if there are any doubts or questions.

Key takeaways

Filling out and turning in the Alabama 2320 form appropriately is critical for those who operate lodgings in Alabama. Here are some key takeaways to help you manage this process smoothly:

- Electronic Filing and Payment: The form offers the option to file and pay online through the Alabama Department of Revenue's website. This method is not only convenient but might also be required, so it's worth checking the current requirements.

- Telephone Filing: For those who prefer or need to submit their returns by phone, the form provides a telephone number. This option adds flexibility for managing your lodging tax returns.

- Mandatory Fields: The form requires information such as your account number, the period covered, due date, and a detailed breakdown of lodging receipts and applicable taxes. Make sure all sections are filled out accurately to avoid delays or issues.

- Updates for Business Changes: If there have been any changes to your business, such as a closure, address change, or banking information update for Electronic Funds Transfer (EFT) payments, the form includes sections to report these updates ensuring your records are current.

- Understanding Tax Rates: It's essential to pay attention to the different tax rates that apply to your lodgings based on their location. The form lists counties with either a 4% or 5% lodging tax rate. Accurate reporting of gross lodging receipts and the appropriate application of the tax rate are critical for correct tax calculation.

By paying close attention to these key aspects when dealing with the Alabama 2320 form, lodging operators can ensure they remain compliant with state tax regulations. It offers a structured way to report and remit the taxes due properly, helping businesses avoid any potential penalties or interest for late or incorrect filings.

Check out Popular PDFs

Medicaid Prior Authorization Form for Medication - For certain drugs, additional justification, such as medical records or peer-reviewed literature, may be requested.

Bill of Sale With Witness Signature - Mandatory for all vehicles requiring title transfer that were owned by deceased individuals in Alabama.