Alabama 20C Template

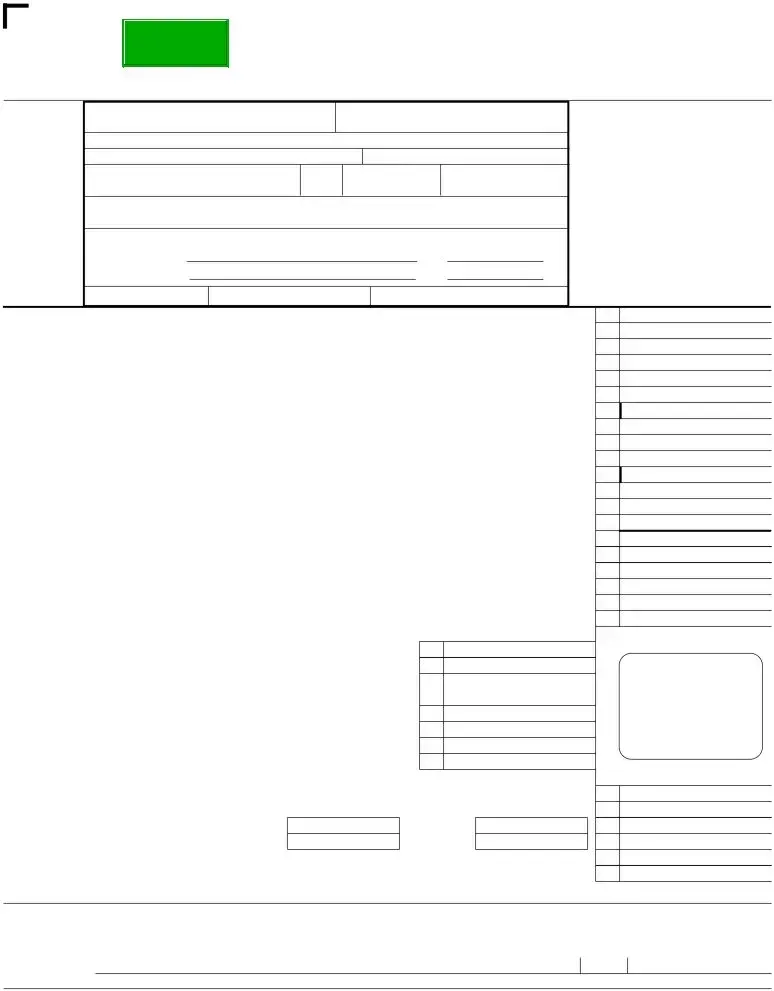

In an era where the intricacies of tax legislation become increasingly convoluted, the Alabama 20C form stands as a critical document for corporations navigating the murky waters of income tax filings within the state of Alabama for the fiscal year 2010. This document, sanctioned by the Alabama Department of Revenue, delineates the requirements and instructions for corporate entities to accurately report their income tax returns, relevant for the tax period starting January 1, 2010, and concluding on December 31, 2010, or for any other applicable tax year beginning within 2010. It caters to a broad spectrum of corporate structures, including single-state operators, multistate corporations engaging in initial apportionment or opting for separate accounting, and those filing amended or proforma returns. Furthermore, the form provides a comprehensive framework for adjustments, delineating the transition from federal taxable income to the Alabama-specific taxable basis through a series of deductions and additions, the apportionment of income in the context of multistate operations, and a meticulous calculation of Alabama net operating loss carryforward. These elements underscore the complexity and the meticulous detail required in conforming to Alabama’s corporate income tax mandates, reflecting the broader challenges faced by businesses in complying with state-level tax obligations while navigating federal directives.

Alabama 20C Example

FORM

20C

Reset Form

*2100012C* Alabama

Department of Revenue

Corporation Income Tax Return

•CY

•FY

•SY

•52/53 WK

6

6 2021

6

6

For the year January 1 – December 31, 2021, or other tax year beginning •_______________________, 2021, ending •_______________________, ________

Check

applicable

box:

•6 PL

•6 returnInitial

•6 returnFinal

•6 returnAmended

•6 auditFederal change

FEDERAL BUSINESS CODE NUMBER |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER |

|

Filing Status: (see instructions) |

|||

• |

|

|

• |

|

|

|

|

|

|

|

|

|

• 6 1. Corporation operating only in |

||

NAME • |

|

|

|

|

|

|

|

|

|

|

|

|

|

Alabama. |

|

ADDRESS • |

|

|

|

SUITE, FLOOR, ETC • |

|

|

|

|

|

|

|

|

• 6 2. Multistate Corporation – |

||

CITY |

|

STATE |

COUNTRY (IF NOT U.S.) |

|

|

||

|

|

|

Apportionment (Sch. |

||||

• |

|

• |

• |

• |

|

|

• 6 3. Multistate Corporation – |

CHECK ONLY ONE BOX. The taxpayer files the following form for federal purposes: |

•6 |

|

Percentage of Sales (Sch. |

||||

•6 1120 |

•6 |

•6 |

•6 990/990T |

Other |

• 6 4. Multistate Corporation – Separate |

||

|

|

|

|

|

|

|

|

This company files as part of |

•6 consolidated federal group |

•6 consolidated Alabama group |

|

|

Accounting (Prior written approval |

||

• Federal Parent Name: |

|

|

|

FEIN • |

|

|

required and must be attached). |

|

|

|

|

|

• 6 5. Proforma Return – files as part of |

||

• Alabama Parent Name: |

|

|

|

FEIN • |

|

|

|

|

|

|

|

|

Alabama Affiliated Group. |

||

|

|

|

|

|

|

|

|

•6 2220AL Attached |

•6 Schedule of Adjustments to FTI |

|

|

|

|

||

1 |

FEDERAL TAXABLE INCOME (see instructions) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

2 |

Federal Net Operating Loss (included in line 1) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

3 |

Reconciliation adjustments (from line 26, Schedule A) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

4 |

Federal taxable income adjusted to Alabama Basis (add lines 1, 2 and 3) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

5 |

Net nonbusiness (income)/loss – Everywhere (from Schedule C, line 2, col. E) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

6 Apportionable income (add lines 4 and 5) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

7 |

Alabama apportionment factor (from line 9, Schedule |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

8 |

Income apportioned to Alabama (multiply line 6 by line 7) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

9 |

Net nonbusiness income/(loss) – Alabama (from Schedule C, line 2, col. F) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

10 |

Alabama income before federal income tax deduction (line 8 plus line 9) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

11a Federal income tax deduction /(refund) (from line 12, Schedule E) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

|

b Small Business Health Insurance Premiums (see instructions) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

12 |

Alabama income before net operating loss (NOL) carryforward (line 10 less lines 11a and b) . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

13 |

Alabama NOL deduction (see instructions) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

14 |

Alabama taxable income (line 12 less line 13) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

15 |

Alabama Income Tax (6.5% of line 14) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

16 LIFO Reserve Tax Deferral (see instructions) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

17 |

Alabama Income Tax after LIFO Reserve Tax Deferral (line 15 less line 16) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

18 |

Nonrefundable Credits (from Schedule BC, Section E, line E3) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

19 |

Net tax due Alabama (line 17 less line 18) |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

20 |

Payments: |

20a |

|

|

|

a |

Carryover from prior year |

• |

|

|

20b |

|||

|

b |

Current year's estimated tax payments |

• |

|

|

|

|||

cCurrent year's Composite Payment(s)/Electing

|

Schedule |

|

20c |

• |

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . 20d |

|

|||

d |

Extension payment |

|

|

• |

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . 20e |

|

|||

e Payments prior to adjustment |

|

|

• |

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . 20f |

|

|||

f Refundable credits (from Schedule BC, Section F, line F3) |

• |

|

||||

. . . 20g |

|

|||||

g Total Payments (add lines 20a through 20f) |

|

• |

|

|||

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

|

||||

21 Reductions/applications of overpayments |

|

|

|

|

||

a Credit to subsequent year's estimated tax |

. . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|||

b |

Penny Trust Fund |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . .. . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

c |

Penalty due (see instructions) |

Late Payment Estimate |

• |

Other |

|

• |

d |

Interest due (see instructions) |

Estimate Interest |

• |

Interest on Tax |

• |

|

e Total reductions (total lines 21a, b, c and d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Total amount due/(refund) (line 19 less 20g, plus 21e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you paid electronically check here: 6

1•

2•

3•

4•

5•

6•

7 • |

% |

8•

9•

10•

11a •

11b •

12•

13•

14•

15•

16•

17•

18•

19•

UNLESS A COPY OF THE

FEDERAL RETURN IS

ATTACHED, THIS RETURN

WILL BE CONSIDERED

INCOMPLETE. (SEE ALSO

PAGE 4, OTHER

INFORMATION, NO. 5.)

21a •

21b •

21c •

21d •

21e •

22•

Please

Sign

Here

•6 I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

|

( |

) |

Signature |

Title |

Date |

Daytime Telephone No. |

ADOR

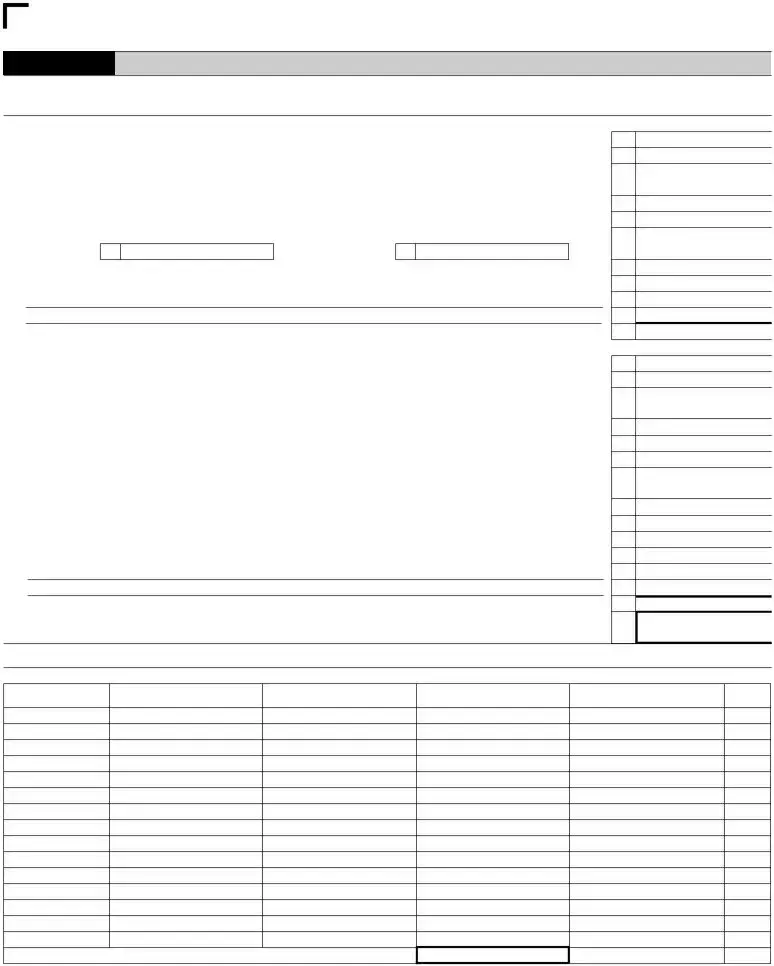

*2100022C* |

PAGE 2 |

ALABAMA 20C – 2021 |

|

Schedule A Reconciliation Adjustments of Federal Taxable Income to Alabama Taxable Income |

|

ADDITIONS

1 |

State and local income taxes |

1 |

• |

2 |

Federal exempt interest income (other than Alabama) on state, county and municipal obligations (everywhere) |

2 |

• |

3Dividends from corporations in which the taxpayer owns less than 20 percent of stock to the extent properly deducted on

|

federal income tax return (see instructions) |

3 |

• |

4 |

Federal depreciation on pollution control items previously deducted for Alabama (see instructions) |

4 |

• |

5 |

Net income from foreclosure property pursuant to |

5 |

• |

6Related members interest or intangible expenses or costs. From Schedule AB (see instructions).

|

Total Payments 6a • |

minus Exempt Amount 6b • |

equals 6c |

• |

7 |

Captive REITS: Dividends Paid Deduction (from federal Form |

. . . . . . 7 |

• |

|

8 |

Contributions not deductible on state income tax return due to election to claim state tax credit |

. . . . . 8 |

• |

|

9 |

• |

|

9 |

• |

10 |

• |

|

10 |

• |

11 |

Total additions (add lines 1 through 10) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . 11 |

• |

DEDUCTIONS

12 |

Refunds of state and local income taxes (due to overpayment or over accrual on the federal return) |

12 |

• |

13 |

Interest income earned on direct obligations of the United States |

13 |

• |

14Interest income earned on obligations of Alabama or its subdivisions or instrumentalities to extent included in

|

federal income tax return (see instructions) |

14 |

• |

15 |

Aid or assistance provided to the Alabama State Industrial Development Authority pursuant to |

15 |

• |

16 |

Expenses not deductible on federal income tax return due to election to claim a federal tax credit |

16 |

• |

17 |

Dividends described in 26 U.S.C. §78 from corporations in which taxpayer owns more than 20% of stock (see instructions) |

17 |

• |

18Dividend income – more than 20% stock ownership (including that described in 26 U.S.C. §951) from

|

corporations to the extent the dividend income would be deductible under 26 U.S.C. §243 if received from domestic corporations. . . . |

18 |

• |

19 |

Dividends received from foreign sales corporations as determined in 26 U.S.C. §922 (see instructions) |

19 |

• |

20 |

Amount of the oil/gas depletion allowance provided by |

20 |

• |

21 |

Additional Alabama depreciation related to Economic Stimulus Act of 2008 (see instructions) |

21 |

• |

22 |

Exemption of gain under |

22 |

• |

23 |

• |

23 |

• |

24 |

• |

24 |

• |

25 |

Total deductions (add lines 12 through 24) |

25 |

• |

26TOTAL RECONCILIATION ADJUSTMENTS (subtract line 25 from line 11 above).

|

Enter here and on line 3, page 1 (enclose a negative amount in parentheses) |

26 • |

|

||||||

|

Schedule B |

|

Alabama Net Operating Loss Carryforward Calculation |

|

|

||||

|

Column 1 |

Column 2 |

Column 3 |

|

Column 4 |

Column 5 |

Column 6 |

||

|

Loss Year End |

Amount of Alabama |

Amount used in years |

|

Amount used |

Remaining unused |

Acquired |

||

|

MM / DD / YYYY |

net operating loss |

prior to this year |

|

this year |

net operating loss |

NOL |

||

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

• |

• |

|

• |

• |

|

• |

|

•6 |

|

Alabama net operating loss (enter here and on line 13, page 1). |

• |

|

|

|

|

||||

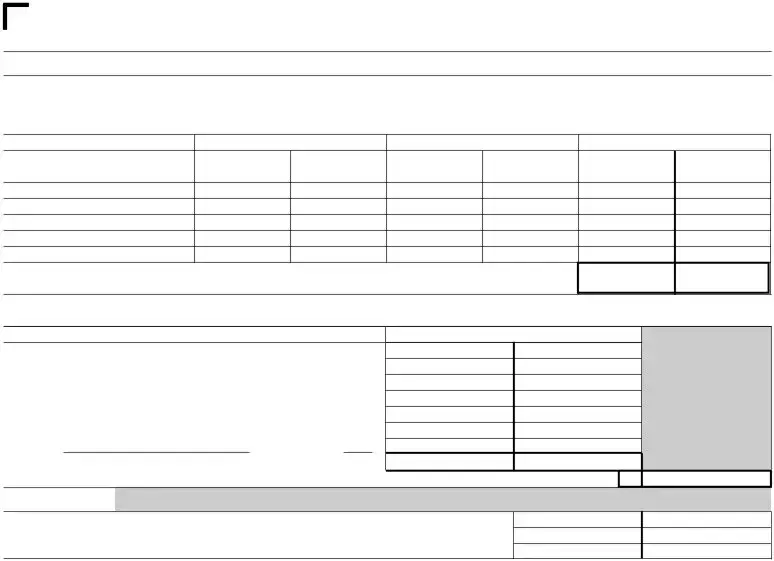

ADOR

|

*2100032C* |

PAGE 3 |

ALABAMA 20C – 2021 |

||

Schedule C |

Allocation of Nonbusiness Income, Loss, and Expense – Use only if you checked Filing Status 2, page 1 |

|

Identify by account name and amount, all items of nonbusiness income, loss and expense removed from apportionable income and those items which are directly allocable to Alabama. Adjustment(s) must also be made for any proration of expenses under Alabama Income Tax Rule

|

ALLOCABLE GROSS INCOME / LOSS |

RELATED EXPENSE |

|

NET OF RELATED EXPENSE |

|||

DIRECTLY ALLOCABLE ITEMS OF |

Column A |

Column B |

Column C |

Column D |

|

Column E |

Column F |

NONBUSINESS INCOME OR LOSS |

Everywhere |

Alabama |

Everywhere |

Alabama |

|

Everywhere |

Alabama |

1a • |

• |

• |

• |

• |

• |

|

• |

b • |

• |

• |

• |

• |

• |

|

• |

c • |

• |

• |

• |

• |

• |

|

• |

d • |

• |

• |

• |

• |

• |

|

• |

e • |

• |

• |

• |

• |

• |

|

• |

2 NET NONBUSINESS INCOME / LOSS |

Column E |

Column F |

|

Enter Column E total ((income)/loss) on line 5 of page 1. Enter Column F total (income/(loss)) on line 9 of page 1 |

• |

• |

|

|

|

|

|

Schedule |

Apportionment Factor – Use only if Filing Status 2 or Filing Status 5, page 1 with |

|

|

Amounts must be Positive (+) Values |

|

|

|

|

|

SALES |

|

|

ALABAMA |

EVERYWHERE |

1 |

Gross receipts from sales |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

|

2 |

Dividends |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

|

3 |

Interest |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

|

4 |

Rents |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

5 |

Royalties |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

6 |

Gross proceeds from capital and ordinary gains . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . • |

|

• |

|

7 |

Other • |

|

(Federal 1120, line • |

) • |

|

• |

8 |

Total Sales |

. . 8a • |

|

8b • |

||

9 |

Line 8a/8b = ALABAMA APPORTIONMENT FACTOR (Enter here and on line 7, page 1) . . |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|||

|

Schedule |

Percentage of Sales – Use only if you checked Filing Status 3, page 1 – See instructions |

||||

9

•

%

DO NOT USE THIS SCHEDULE IF ALABAMA SALES EXCEED $100,000. |

ALABAMA |

EVERYWHERE |

|

1 |

Gross receipts from sales |

• |

• |

2 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tax due (multiply line 1, Alabama by .0025) (enter here and on page 1, line 15) |

• |

|

ADOR

|

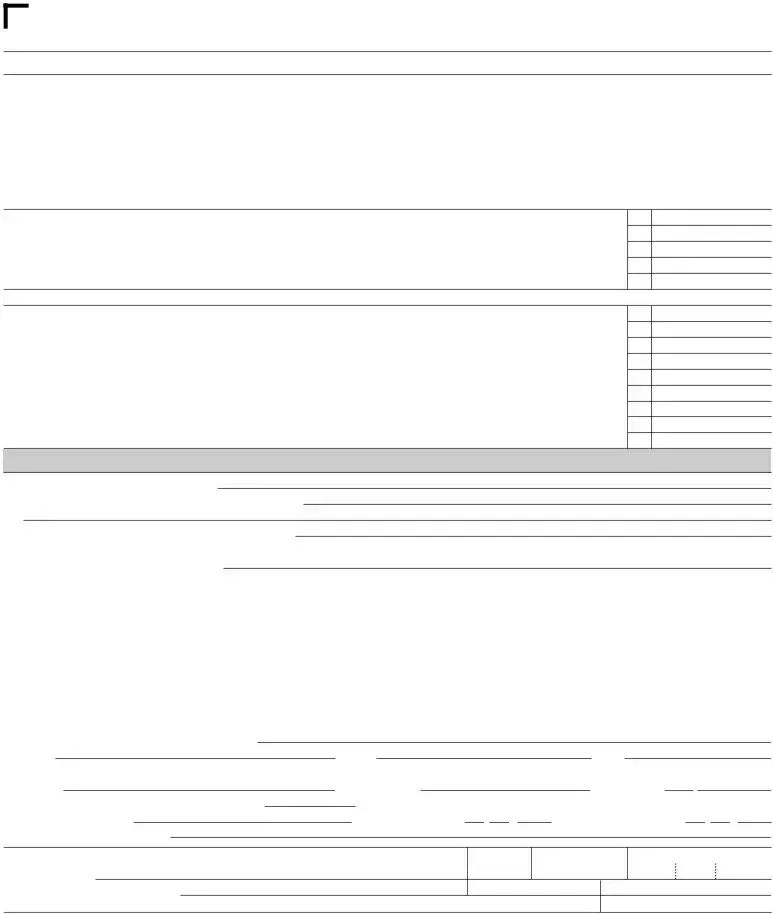

*2100042C* |

PAGE 4 |

ALABAMA 20C – 2021 |

||

Schedule E |

Federal Income Tax (FIT) Deduction/(Refund) |

|

Only method 1552(a)(1) can be used to calculate the Federal Income Tax Deduction.

(a)If this corporation is an

(b)If this corporation is a

enter the amount of federal income tax paid during the year.

(c)If this corporation is a member of an affiliated group which files a consolidated federal return, enter the separate company income from line 30 of the proforma 1120 for this company on line 1. You must complete lines

Items excluded from Alabama Taxable Income must be added to adjusted total income on line 8b to calculate the Federal Income Tax deduction. (This includes any amounts listed on Schedule A lines 13, 14, 17, 18, and 19).

1 |

This company’s separate federal taxable income |

1 |

• |

|

2 |

Total positive consolidated federal taxable income |

2 |

• |

|

3 |

This company’s percentage (divide line 1 by line 2) |

3 |

• |

% |

4 |

Consolidated federal income tax (liability/payment) |

4 |

• |

|

5 |

Federal income tax for this company (multiply line 3 by line 4) |

5 |

• |

|

6 |

Federal income tax to be apportioned |

6 |

• |

|

7 |

Alabama income, page 1, line 10 |

7 |

• |

|

8a Adjusted total income, page 1, line 4 |

8a • |

|

||

8b Income excluded from Alabama Taxable Income (include any amounts listed on Schedule A lines 13, 14, 17, 18, and 19) |

8b • |

|

||

8c Adjusted Total Income including items excluded from Alabama Taxable Income (Add lines 8a and 8b) |

8c |

• |

|

|

9 |

Federal income tax ratio (divide line 7 by line 8c) |

9 |

• |

% |

10 |

Federal income tax apportioned to Alabama (multiply line 6 by line 9) |

10 |

• |

|

11 |

Less refunds or adjustments |

11 |

• |

|

12 Net federal income tax deduction / <refund> (enter here and on Page 1, line 11a) |

12 |

• |

|

|

Other Information

1.Briefly describe your Alabama operations. •

2.List locations of property within Alabama (cities and counties). •

3.List other states in which corporation operates, if applicable. •

4.Indicate your tax accounting method:

• 6 Accrual • 6 Cash • 6 Other •

5.If this corporation is a member of an affiliated group which files a consolidated federal return, the following information must be provided:

(a)Copy of Federal Form 851, Affiliations Schedule. Identify by asterisk or underline the names of those corporations subject to tax in Alabama.

(b)Signed copy of consolidated Federal Form 1120, pages

(c)Copy of the spreadsheet of income statements; all supporting schedules for all legal entities that file as part of the consolidated federal group including (but not limited to) a copy of the spreadsheet of income statements (which includes a separate column that identifies the eliminations and adjustments used in completing the federal consolidated return), beginning and ending balance sheets, Schedule

(d)Copy of federal Schedule

(e)Copy of federal Schedule(s) UTP.

6.Enter this corporation’s federal net income (see instructions for page 1, line 1) for the last three (3) years, as last determined (e.g.: per amended federal return or IRS audit).

|

2020 •___________________ |

2019 •_________________ 2018 •___________________ |

|

|

|

|

|

|

7. |

Check if currently being audited by the IRS. • 6 If so, enter the periods: •________________________________________________ |

|

|

|||||

8. |

Location of the corporate records: |

Street address: • |

|

|

|

|

|

|

|

City: • |

|

State: • |

|

|

ZIP: • |

|

|

9. |

Person to contact for information concerning this return: |

|

|

|

|

|

||

|

Name: • |

|

Email Address: • |

|

|

Telephone: • ( |

) |

|

10. |

Files Business Privilege Tax Return. • 6 |

FEIN: • |

/ |

/ |

|

/ |

/ |

|

11. |

State of Incorporation: • |

|

Date of Incorporation: • |

Date Qualified in Alabama: • |

||||

Nature of business in Alabama: •

Paid

Preparer’s

Use Only

Preparer’s signature

Firm’s name (or yours, |

• |

|

if |

• |

|

and address |

|

|

Date |

|

Preparer’s Tax Identification Number |

• |

Check if |

•6 • |

Tel. No. • ( |

) |

E.I. No. • |

|

|

ZIP Code • |

ADOR

ALABAMA 20C – 2021 |

|

PAGE 5 |

|

Alabama Department of Revenue |

Payment returns, mail with |

Alabama Department of Revenue |

|

mail to: |

Income Tax Administration Division |

payment voucher (Form |

Income Tax Administration Division |

|

Corporate Tax Section |

|

Corporate Tax Section |

|

PO Box 327430 |

|

PO Box 327435 |

|

Montgomery, AL |

|

Montgomery, AL |

Federal audit change |

|

|

|

returns, mail to: |

Alabama Department of Revenue |

|

|

|

Income Tax Administration Divisionn |

|

|

|

Corporate Tax Section |

|

|

PO Box 327451

Montgomery, AL

ADOR

Form Specs

| Fact Name | Description |

|---|---|

| Form Identifier | Alabama 20C Corporation Income Tax Return for the year 2010 |

| Purpose | Used by corporations to file their income tax returns in the state of Alabama |

| Applicability | Applicable to corporations operating only in Alabama, Multistate Corporations, and those filing consolidated returns |

| Governing Law | §40-18-33, Code of Alabama 1975, defines Alabama Taxable Income and its adjustments |

| Filing Status Options | Corporation operating only in Alabama, Multistate Corporation – Initial Apportionment, Multistate Corporation – Separate Accounting, etc. |

| Key Schedules | Includes Schedules A (Reconciliation Adjustments), B (Net Operating Loss Carryforward), C (Allocation of Nonbusiness Income), D-1 (Apportionment Factor), and more. |

| Tax Calculation Basis | Based on federal taxable income with specific additions, deductions, and Alabama apportionment factor for multistate corporations |

| Payment and Credits | Includes sections for tax payments, estimated tax payments, and credits, such as the Alabama Enterprise Zone Credit and Employer Education Credit |

Detailed Guide for Writing Alabama 20C

Filing the Alabama 20C Corporation Income Tax Return is an important step for corporations conducting business in Alabama. This process ensures your corporation complies with tax obligations and accurately reports its income, adjustments, and credits for the tax year. It's vital for the smooth operation of your business and to avoid any legal complications. Below is a step-by-step guide to assist you in completing the form correctly.

- Start by entering the tax year and the dates for the start and end of your corporation's fiscal year at the top of the form.

- Provide your Federal Business Code Number and Federal Employer Identification Number (FEIN) in the designated sections.

- Select your Filing Status by checking the appropriate box that applies to your corporation among the options provided.

- Complete the section with your corporation's Name, Address, City, State, Country (if not the U.S.), and 9-Digit ZIP Code.

- Indicate your State of Incorporation, Date of Incorporation, and Date Qualified in Alabama, along with the Nature of Business in Alabama.

- For corporations operating in multiple states, choose the applicable apportionment schedule—Schedule D-1 for initial or repeat filings, Schedule D-2 for specific sales percentage reporting.

- Enter your Federal Taxable Income as reported to the IRS, adjusting it with Federal Net Operating Loss (if any), and make necessary Reconciliation Adjustments as detailed in Schedule A attached to your form.

- If applicable, fill out Schedules B, C, D-1/D-2, E, and F based on your corporation’s specific income, apportionment, and credit details.

- Calculate your Alabama Income Tax due based on the Alabama taxable income and the state's tax rate provided in the instructions.

- Report any Tax Payments, Credits, and Deferrals your corporation is entitled to, such as estimated tax payments or credits from prior years.

- Sign and date the return. If prepared by someone other than the taxpayer, the preparer must also sign and provide their information.

- Attach a copy of the federal return if required. Failure to do so will result in your return being considered incomplete.

Once completed, review the entire form for accuracy. Remember, accuracy is crucial to prevent delays or issues with your tax return processing. Afterwards, submit the form and any attachments to the Alabama Department of Revenue by the designated deadline. If you're expecting a refund or owe taxes, ensure that these are accurately calculated and processed with your submission. Keeping a copy for your records is also advised.

Common Questions

What is the Alabama Form 20C and who needs to file it?

The Alabama Form 20C is a Corporation Income Tax Return form that must be filed by corporations operating within Alabama. It applies to companies for the tax year beginning in 2010 and for any other tax years as specified. This form is needed by corporations that operate exclusively in Alabama, as well as for multistate corporations that have business activities both within and outside of Alabama. Entities that file as part of a consolidated federal return, 1120-REIT filers, and Alabama affiliated groups should also use this form to report their income and calculate their tax obligations to the state.

How is the Federal Taxable Income adjusted to the Alabama basis on Form 20C?

To adjust the Federal Taxable Income to the Alabama basis on Form 20C, corporations should start with their Federal Taxable Income and make specific adjustments as per the instructions on Schedule A. These adjustments include adding back certain deductions taken on the federal return, like state and local income taxes or interests and dividends from certain types of investments. It also involves the removal of certain Alabama-specific deductions and incorporating adjustments for items like the Alabama net operating loss. The sum of these adjustments results in the Federal Taxable Income being tailored to meet Alabama’s taxation criteria.

When is the Alabama Form 20C due?

The due date for filing the Alabama Form 20C typically aligns with the federal return due date, which is the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the due date would typically be April 15th of the following year. If the due date falls on a weekend or legal holiday, the deadline is extended to the next business day. Corporations should ensure their return is postmarked by this date to avoid penalties for late filing.

What are the penalties for late filing or payment on the Alabama Form 20C?

Corporations that file their Alabama Form 20C late or fail to make the necessary payment by the due date may incur penalties. The penalty for late filing is usually a percentage of the tax due, and additional interest charges may accrate over time until the full amount owed is paid. Specific penalty rates and interest charges can vary, so corporations should refer to the latest Alabama Department of Revenue guidelines or consult directly with them for the most current information on penalties and how to minimize them.

Common mistakes

Filling out the Alabama 20C form, a Corporation Income Tax Return, requires careful attention to detail. Unfortunately, errors can occur which might lead to complications or delays in processing. Here are ten common mistakes to avoid:

- Incorrect or Missing Federal Employer Identification Number (FEIN): Essential for identification, the FEIN must be accurate. This mistake can cause significant delays.

- Choosing the Wrong Filing Status: Corporations must accurately identify whether they operate solely within Alabama, as a multistate corporation, or under another status. Incorrect status can affect tax calculations.

- Omission of the Federal Business Code Number: This number categorizes the nature of your business and is crucial for proper processing of your return.

- Failure to Attach Required Documents: For certain filing statuses, such as separate accounting or consolidated returns, additional documentation is required. Missing attachments can render the return incomplete.

- Miscalculating Deductions or Income: Both overestimating deductions or underreporting income can lead to incorrect tax liabilities.

- Reconciliation Adjustments Errors: Incorrectly reconciling federal taxable income to Alabama taxable income can result in an inaccurate tax amount.

- Incorrect Use of Schedules D-1 or D-2: These schedules are used for apportioning income; using the wrong schedule or misinterpreting the instructions can lead to incorrect apportionment factors.

- Not Using Accurate Amounts for Payments and Credits: Line 16 requires a detailed accounting of tax payments, credits, and deferrals. Errors here can affect the total tax due or refundable.

- Incorrect Calculation of Alabama Taxable Income: This involves several steps and requires accurate input of federal deductions and adjustments specific to Alabama.

- Forgetting to Sign the Document: An unsigned tax return is considered incomplete and will not be processed.

Each of these mistakes can potentially delay the processing of the 20C form or result in a miscalculation of the tax liability. It is advisable to review each section carefully, ensure that all required attachments are included, and double-check calculations. For the most up-to-date information and additional guidance, referring to the Alabama Department of Revenue's instructions can help avoid these common errors.

Furthermore, organizations should keep abreast of any changes to tax laws or forms that could affect how they should complete the 20C form. Utilizing professional tax preparation software or consulting with a tax professional can also help to minimize errors and ensure compliance with all tax regulations.

Documents used along the form

When filing the Alabama 20C form, a comprehensive approach towards taxation and reporting is vital to ensure accuracy and compliancy with the state's requirements. To support the main document, a number of additional forms and documents often accompany the 20C form, each serving a crucial role in painting the full financial and operational picture of the corporation. Below is an outline of these key documents, providing insight into their function and importance.

- Schedule A (Reconciliation Adjustments): This schedule is essential for adjusting federal taxable income to meet Alabama's distinct taxable income definitions. It includes specific additions and deductions as mandated by Alabama tax code, ensuring that the income reported aligns with state requirements.

- Schedule D-1 (Apportionment Factor Schedule): For multimillion or multistate corporations, this schedule is crucial. It helps determine the portion of income apportioned to Alabama, using factors like property, payroll, and sales within the state.

- Schedule E (Federal Income Tax Deduction/Refund): This document is used to calculate the deduction or refund of federal income tax as applicable to the corporation's Alabama taxable income, adjusting for any consolidated tax liabilities or payments.

- Schedule F (Credits/Exemptions): To capitalize on available tax credits and exemptions, corporations must complete this schedule accurately. It includes various credits such as the Alabama Enterprise Zone Credit and the Employer Education Credit, potentially reducing the corporation's tax liability.

- Form BIT-V (Payment Voucher): If the corporation owes taxes, this payment voucher must accompany the tax payment, providing a method for the Alabama Department Of Revenue to accurately process and credit the payment to the correct account.

- Federal Form 851 (Affiliations Schedule): For corporations that are part of a consolidated group filing a consolidated federal return, this form, along with a signed copy of the consolidated Federal Form 1120, is necessary. It identifies all corporations subject to tax in Alabama, ensuring proper apportionment and taxation within the consolidated entity.

Together, these documents contribute to a complete and correct filing of the Alabama 20C form, ensuring corporations meet their tax obligations accurately and effectively. It is imperative for businesses to understand the role and requirement of each, to maintain compliance and optimize their tax positions within the state of Alabama. Diligence in completing and including these accompanying forms will facilitate a smoother taxation process and help avoid potential issues with state tax authorities.

Similar forms

The Alabama 20C form, used for Corporation Income Tax Return, bears similarity to forms used in other states and at the federal level for income reporting and tax calculation purposes. This comparison highlights the parallels in structure and intent behind such documents, emphasizing the broader framework of tax compliance within the United States. These comparisons include forms like the Federal Form 1120 and the New York CT-3 form.

Federal Form 1120 - U.S. Corporation Income Tax Return, is a prime example of a document akin to the Alabama 20C form. Both are designed to calculate the income tax liability of corporations, requiring detailed financial information, including gross income, deductions, and taxable income. The Federal Form 1120 places a specific emphasis on federal taxable income and adjustments thereto, which is mirrored in the Alabama 20C's focus on adjustments to reconcile federal taxable income to Alabama taxable income. Additionally, both forms share a common purpose in enforcing tax compliance among corporations, albeit at different levels of governance.

New York State Form CT-3 - General Business Corporation Franchise Tax Return, also shares notable similarities with the Alabama 20C form. Each of these forms is tailored to the tax laws and requirements of their respective states while maintaining the overarching goal of assessing corporate tax based on income. The NY CT-3 and Alabama 20C both feature sections for calculating an apportionment percentage, deductions, and credits unique to state-specific tax allowances and policies. This parallel underscores the customized approach states take in aligning with federal standards while addressing local fiscal needs and policies.

Dos and Don'ts

Filling out the Alabama 20C form can be a detailed process. To ensure accuracy and compliance, here are some dos and don'ts to consider:

- Do ensure all information matches the records submitted to the IRS, including the Federal Employer Identification Number (FEIN) and Federal Taxable Income.

- Do thoroughly review the instructions for each section to understand what is required, especially for schedules that may or may not apply to your corporation's situation.

- Do attach a copy of the respective federal return as failing to do so will render the return incomplete and may delay processing.

- Do check the correct box for the filing status that applies to your corporation, whether it operates only in Alabama or as a multistate or consolidated entity.

- Don't overlook the reconciliation adjustments on Schedule A, which can impact your Alabama taxable income calculation.

- Don't leave the apportionment factor and percentage of sales (Schedules D-1 and D-2) incomplete if your corporation operates in and outside Alabama.

- Don't ignore notices for final IRS changes. If your corporation receives one, update your return accordingly and check the box indicating this change.

- Don't forget to sign the return. An unsigned return can lead to it being considered invalid.

Approaching the Alabama 20C form with thoroughness and attention to detail will help ensure that your corporation remains compliant with state tax obligations and avoids potential issues with the Alabama Department of Revenue.

Misconceptions

Understanding the Alabama 20C form, particularly for corporations operating within the state, involves navigating through a complex set of instructions and tax codes. Several misconceptions exist regarding the form's purpose, requirements, and the filing process itself. In an effort to clarify these misunderstandings, listed below are seven common misconceptions about the Alabama 20C form and explanations meant to provide clearer insight.

- Misconception 1: Only corporations with operations exclusively in Alabama need to file the 20C form.

This statement is not accurate. While the form is indeed for corporations, it catulates not just those operating solely within Alabama but also multistate corporations. These entities must report their income and determine their tax liability to Alabama based on the portion of their business conducted in the state.

- Misconception 2: Filing an Alabama 20C form is not necessary if a corporation files a consolidated federal return.

In fact, corporations that file consolidated returns federally may still need to file separate 20C forms for each eligible entity in Alabama. The requirement hinges on whether these entities have taxable income attributable to Alabama activities.

- Misconception 3: The 20C form only calculates income tax.

While it's true that the primary purpose of the 20C form is to calculate corporate income tax, it also encompasses considerations for payments, credits, and deferrals, adjustments related to net operating loss carryforwards, and specific deductions. Therefore, it serves a broader role than just income tax calculation.

- Misconception 4: There is no need to attach a copy of the federal return with the 20C form.

Contrary to this belief, failing to attach a copy of the federal return (unless certain conditions are met) will result in the Alabama Department of Revenue considering the 20C return incomplete. This requirement underscores the importance of federal-state correspondence in tax assessments.

- Misconception 5: All corporations pay the same rate of income tax in Alabama.

This is misleading as, though a standard rate is applied to calculate the tax on Alabama taxable income, variations can arise due to factors like apportionment, net operating losses, credits, and other adjustments specific to each corporation's situation.

- Misconception 6: Filing status options on the 20C form are limited to the current operating condition of the corporation.

This misunderstanding does not account for the range of filing statuses available to address different scenarios, including initial and final returns, amendments, and returns involving consolidated and proforma adjustments. The variety of options reflects the diverse conditions under which corporations may be filing.

- Misconception 7: The only important schedules are those dealing with income and tax payable.

While schedules related to income and tax calculation are crucial, others like Schedule E for Federal Income Tax Deduction adjustments, Schedule D-1 for apportionment factors, and Schedule A for reconciliation of federal taxable income to Alabama taxable income, are also vital. These schedules contribute to a comprehensive understanding of the corporation's tax obligations.

Clarity on these points can help corporations accurately fulfill their tax reporting and payment obligations to the Alabama Department of Revenue, ensuring compliance and preventing unnecessary complications or errors in their Alabama 20C form submissions.

Key takeaways

Filling out the Alabama 20C form, the corporation income tax return, is a critical process for businesses operating within the state. It requires meticulous attention to ensure accuracy and compliance with state tax laws. Here are several key takeaways to guide entities through this process:

- Understanding Filing Status: The Alabama 20C form outlines different categories under which a corporation might fall, such as operating solely within Alabama, being a multistate corporation, or filing as part of a consolidated federal return. Identifying the correct filing status is crucial for proper tax calculation and compliance.

- Reconciliation Adjustments: Corporations must adjust their federal taxable income to account for specific additions and deductions applicable under Alabama state tax law. This includes adjustments for state and local income taxes, dividends, interest on federal obligations, and depreciation differences, among others. Careful calculation in this section ensures the correct Alabama taxable income is reported.

- Apportionment and Allocation: Multistate corporations are required to apportion income to Alabama using a set formula that considers property, payroll, and sales factors. Additionally, corporations must allocate nonbusiness income and deductions properly between Alabama and other jurisdictions. This step determines the portion of income subject to Alabama taxes, impacting the overall tax liability.

- Documentation and Attachments: Completeness of the tax return involves attaching necessary documentation, including, but not limited to, copies of the federal return, reconciliation schedules, and apportionment data. Failure to attach required information might result in the tax return being considered incomplete, potentially leading to delays or complications with the Alabama Department of Revenue.

By carefully addressing these areas, corporations can ensure compliance with Alabama's tax code, accurately report their income, and minimize the risk of errors or audits. It's always recommended to consult with a tax professional or accountant familiar with Alabama's specific tax requirements to navigate the complexities of the 20C form.

Check out Popular PDFs

Alabama 8453 - Through requiring detailed personal and financial information, the Alabama 8453 form exemplifies a comprehensive approach to electronic tax filing, ensuring thorough scrutiny and verification of taxpayer data.

Alabama Irp - Utilize the MPG calculation section to determine average fleet efficiency, enhancing operational insights.