96 Alabama Template

In the heart of tax paperwork, the Form 96 epitomizes the bridge between Alabama residents and the state's tax requirements. This mandatory document, created by the Alabama Department of Revenue, outlines the annual information returns that individuals, corporations, associations, or agents must submit. Its primary aim is to report payments totaling $1,500.00 or more, excluding interest coupons payable to bearer, which were made within a calendar year and are subject to Alabama income tax. The inclusion of specific identifiers such as the payer's social security number or Federal Employment Identification Number (FEIN), contact details, and a comprehensive summary of all attached Form 99s highlights the attention to detail required for compliance. Moreover, the form uniquely stands as a conduit for reporting voluntary withholdings of Alabama income tax. Employers, however, are offered a measure of relief as payments reported through Form A-2 are exempt from replication on Form 99. In an interesting nod to practicality, the Alabama Department of Revenue allows for the submission of federal Form 1099 copies in lieu of Form 99, underlining the state's effort to streamline tax reporting processes. All returns are due by March 15 of the year following the payment year, reinforcing the importance of timely compliance in maintaining the fiscal balance between the government and its constituents. Additionally, it is critical to note the differentiation between Form 99 and Form A-3; the latter is specifically designated for reconciling Alabama income tax withholdings, thus ensuring clarity and efficiency in tax administration. Through the meticulous structure and required adherence to submission deadlines, Form 96 not only mandates fiscal responsibility but also plays a pivotal role in the seamless operation of Alabama's tax collection efforts.

96 Alabama Example

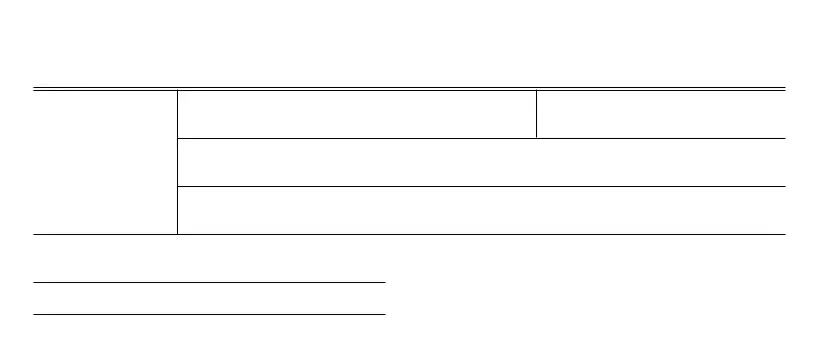

FORM 96 |

ALABAMA DEPARTMENT OF REVENUE |

CALENDAR YEAR |

|

|

|

1/00 |

Summary of Annual Information Returns |

_______________ |

(DATE RECEIVED)

07/09/2021

PAYER |

SOCIAL SECURITY NO. OR FEIN |

STREET ADDRESS OR P.O. BOX

CITY |

STATE |

ZIP CODE |

SIGNATURE

NUMBER OF FORM 99S ATTACHED _________

TITLE

Instructions

Information returns on Form 99 must be filed by every resident individual, corporation, association or agent making payment of gains, profits or income (other than interest coupons payable to bearer) of $1,500.00 or more in any calendar year to any taxpayer subject to Alabama income tax. If you have voluntarily withheld Alabama income tax from such payments, you must file Form 99 or approved substitute regardless of the amount of the payment. Employers filing Form

Returns must be filed with the Alabama Department of Revenue for each calendar year on or before March 15 of the following year.

Mail to: Alabama Department of Revenue |

NOTE: IF ALABAMA INCOME TAX HAS BEEN WITHHELD ON FORM 99 |

Individual & Corporate Tax Division |

DO NOT USE THIS FORM; USE FORM |

P.O. Box 327489 |

OF ALABAMA INCOME TAX WITHHELD. |

Montgomery, AL |

|

Form Specs

| Fact | Description |

|---|---|

| Form Name | 96 Alabama Department of Revenue Calendar Year Summary of Annual Information Returns |

| Relevant Date | Forms are focused on transactions in the calendar year and must be filed by March 15 of the following year. |

| Who Must File | Resident individuals, corporations, associations, or agents that paid $1,500 or more in gains, profits, or income (excluding interest coupons payable to bearer) to any taxpayer subject to Alabama income tax. |

| Voluntary Withholding | If you have voluntarily withheld Alabama income tax on payments, Form 99 or an approved substitute must be filed regardless of the payment amount. |

| Exemption | Employers who file Form A-2 for salaries and wages need not report those payments on Form 99. |

| Federal Form 1099 | Instead of filing Form 99, copies of the federal Form 1099 can be filed with the Department. |

| Filing Deadline | Forms must be filed for each calendar year on or before March 15 of the following year. |

| Submission Address | Alabama Department of Revenue, Individual & Corporate Tax Division, P.O. Box 327489, Montgomery, AL 36132-7489 |

| Withholding Tax Form Indicator | If Alabama income tax was withheld using Form 99, do not use this form; instead, use Form A-3 for the annual reconciliation of Alabama income tax withheld. |

Detailed Guide for Writing 96 Alabama

Filing Form 96 with the Alabama Department of Revenue is a crucial step for individuals, corporations, associations, or agents that make certain types of payments within a calendar year. This form summarises annual information returns related to payments of $1,500 or more. Properly completing and submitting this form ensures compliance with state tax obligations and helps in the accurate reporting of income. Below, the steps are given to fill out the form correctly, ensuring all necessary information is reported to the Alabama Department of Revenue.

- Enter the date received in the designated space at the top right corner of the form.

- Provide the payer's Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the specified field.

- Write down the street address or P.O. Box of the payer.

- Fill in the city, state, and ZIP code related to the payer's address.

- Sign the form in the space provided.

- Enter the number of Form 99s attached.

- Specify the title (position) of the individual completing the form.

After completing Form 96, it should be mailed, alongside the required Form 99s or copies of federal Form 1099, to the Alabama Department of Revenue at the address provided on the form. It's important to note that if Alabama income tax has been voluntarily withheld on any of the payments reported, Form A-3, the "Annual Reconciliation of Alabama Income Tax Withheld," should be used instead of this form. Deadline for submission is March 15 of the year following the payments made during the calendar year. Timely and accurate submission of Form 96 and related documents is essential for compliance with Alabama state tax requirements.

Common Questions

What is Form 96 in Alabama?

Form 96, officially recognized by the Alabama Department of Revenue, serves as a Summary of Annual Information Returns. It acts as a consolidation form for reporting the number of Form 99s filed by an entity, which could be an individual, corporation, association, or agent. Form 99 is used to report payments of gains, profits, or income surpassing $1,500 in a calendar year to any taxpayer subject to Alabama income tax.

Who needs to file Form 96 in Alabama?

Any resident individual, corporation, association, or agent in Alabama making relevant payments exceeding $1,500 in any calendar year to a taxpayer falls under the obligation to file Form 96. This requirement ensues when such entities have filed multiple Form 99s within the year and need to summarize these filings. It is essential for these filers who have made substantial payments that are subject to Alabama income tax.

Is there an alternative to filing Form 99 for reporting income?

Yes, instead of directly filing Form 99 for reporting certain income payments, filers have the option to submit copies of federal Form 1099 to the Alabama Department of Revenue. This alternative is viable only if the forms report income subject to Alabama tax, adhering to the same guidelines and thresholds associated with Form 99 filings.

When is the deadline for filing Form 96?

The deadline for submitting Form 96 falls on March 15 of the year following the calendar year in which the payments were made. Timeliness in filing this form is crucial to ensure compliance with Alabama's tax reporting requirements, avoiding any potential penalties or interest for late submissions.

What should I do if Alabama income tax was withheld on Form 99 reported payments?

If Alabama income tax has been voluntarily withheld on the payments reported via Form 99, it is mandatory to use Form A-3, which is the Annual Reconciliation of Alabama Income Tax Withheld, instead of Form 96. Form A-3 provides a detailed reconciliation of Alabama income tax amounts withheld from payments, ensuring accurate reporting and compliance.

Where should Form 96 be mailed?

Completed Form 96 should be directed to the Alabama Department of Revenue, specifically to the Individual & Corporate Tax Division at P.O. Box 327489, Montgomery, AL 36132-7489. Mailing the form to the correct address is vital for the timely processing of your tax documentation.

What signature is required on Form 96?

The signature section of Form 96 requires the signature of the individual filing the form, along with the designation of their title. This authenticates the form and verifies the accuracy of the information reported. The signature ensures that responsible individuals or entities acknowledge their reporting obligations.

How do I know how many Form 99s to attach to Form 96?

The number of Form 99s to be attached to Form 96 is dependent on the total reports of payments you are required to summarize. Each Form 99 represents a separate payment or set of payments made to taxpayers that surpass the reporting threshold of $1,500. The total count should reflect all such instances during the calendar year.

Is there a penalty for not filing Form 96?

Failure to file Form 96 when required can result in penalties, which include late fees and accrued interest on the unreported amounts. These penalties serve to enforce compliance and emphasize the importance of timely and accurate tax reporting within the state of Alabama.

Can Form 96 be filed electronically in Alabama?

As of the latest update, the Alabama Department of Revenue encourages electronic filing for many of its forms. However, specific details regarding the electronic filing of Form 96 should be directly verified with the Department or through their official website, as electronic filing options can evolve to streamline tax processing and ensure efficient record-keeping.

Common mistakes

When people fill out the Form 96 for the Alabama Department of Revenue, there are several common mistakes that can lead to delays or issues with their submission. It's important to be mindful of these to ensure the process goes as smoothly as possible.

One of the most significant errors occurs when the payer's Social Security Number (SSN) or Federal Employer Identification Number (FEIN) is not correctly provided. This identification is crucial for the Alabama Department of Revenue to accurately process and attribute the information return. Similarly, incorrect or incomplete address information, including the street address or P.O. Box, city, state, and zip code, can lead to misdirected or unprocessed forms.

Not signing the form is another common oversight. A signature is required to verify the authenticity and accuracy of the information provided. Without it, the form may be considered incomplete. Additionally, the correct number of Form 99s attached must be clearly indicated. This detail helps the department ascertain that all relevant information returns are accounted for and processed together.

The instructions section on the Form 96 contains several pieces of critical information that are often overlooked or misunderstood:

- The requirement to file information returns on Form 99 for payments of $1,500.00 or more during the calendar year.

- The alternative option to file copies of the federal Form 1099 instead of Form 99 if it's more convenient.

- The due date for filing, which is on or before March 15 of the year following the calendar year in which the payments were made.

People also frequently miss that if Alabama income tax has been voluntarily withheld from payments, Form 99 or an approved substitute must be filed regardless of the amount of the payment. When Alabama income tax has been withheld, the appropriate form to use is Form A-3, not Form 96, which is a mistake often made due to a lack of attention to the specific instructions noted on the form.

It's crucial for individuals and entities filling out this form to read through the instructions carefully to avoid these common mistakes. Proper attention to detail ensures that the information is correctly reported to the Alabama Department of Revenue, facilitating a smoother process for both the payer and the department.

Documents used along the form

In the realm of submitting tax documents, the Form 96 for the Alabama Department of Revenue is a vital piece for ensuring proper reporting and compliance with state tax laws. When navigating the complexities of tax submissions, several other documents often complement the Form 96, ensuring that individuals, corporations, associations, or agents fully meet their reporting obligations. These supporting documents play diverse roles, from specifying tax withheld to reconciling tax payments, and their use is contingent upon the specific circumstances of the payer and the nature of the income being reported.

- Form 99: This is pivotal for reporting specific payments of gains, profits, or income other than interest coupons. It is designed for amounts of $1,500.00 or more unless Alabama income tax has been voluntarily withheld for lesser amounts. This form ensures the Alabama Department of Revenue has detailed records of taxable payments made within the state, being the direct complement to Form 96 for detailed reporting.

- Form A-3: Used as the Annual Reconciliation of Alabama Income Tax Withheld, this form is crucial for payers who have withheld state income tax throughout the year. It reconciles the total tax withheld from employees or other payees with the amount actually transmitted to the state, ensuring that withheld tax amounts are correctly reported and paid.

- Form A-2: Employers utilize this form to report salaries and wages paid to employees. It's specific to payroll reporting and is not required if the same payments are reported on Form 99. This separation underscores the difference in reporting requirements based on the type of income and the recipient.

- Form 1099: Alabama allows the use of federal Form 1099 copies in lieu of certain state-specific forms for reporting different types of income, such as contractor payments or rent. This provides a streamlined process for payers who are dealing with both federal and state reporting obligations, reducing the paperwork burden.

- Form W-2: Although primarily a federal form used to report wages, tips, and other compensation paid to an employee, the Form W-2 is also essential for state tax reporting purposes. Copies of this form must be submitted to Alabama Department of Revenue to account for state income tax withheld throughout the calendar year.

- Form W-9: Often used in conjunction with Form 96 and others, Form W-9 is requested by businesses or entities to gather correct taxpayer identification information (such as SSN or FEIN) from U.S. persons (including residents and companies). While it is not submitted to the IRS or state tax departments, its accurate completion is essential for the preparer of forms like 1099 or 96, ensuring correct income reporting and tax withholding.

Together, these forms create a comprehensive picture of an entity's or individual's financial obligations and contributions over the fiscal year. The accuracy and completeness of these documents directly impact the reporting entity's compliance status and its financial health. As tedious as the process might seem, each form serves as a critical component in the larger framework of fiscal responsibility and governance. Thus, understanding the purpose and application of each can significantly demystify the often overwhelming world of tax reporting.

Similar forms

The 96 Alabama form, crucial for reporting annual information returns to the Alabama Department of Revenue, shares similarities with other documents used for tax reporting and information sharing purposes. While its unique aspects cater to specific Alabama Department of Revenue requirements, understanding its parallels with other forms can demystify its purpose and ensure proper usage.

Federal Form 1099 is the most direct comparison to the 96 Alabama form. Both serve the purpose of reporting income transactions beyond typical wages, such as freelance income or dividends. The essence of these documents lies in tracking payments made to individuals or entities to ensure proper declaration and taxation of miscellaneous income. The 96 Alabama form mirrors the federal Form 1099 in its function to report gains, profits, or other income to the tax authorities, but it specifically targets income subject to Alabama state income tax. The key similarity is their role in income reporting, albeit at different governmental levels.

Form A-2, another document used in the Alabama tax ecosystem, is used by employers to report salaries and wages paid to employees. While it serves a distinct purpose from the 96 Alabama form by focusing on direct employee compensation rather than miscellaneous income, both forms are integral to the overarching framework of income reporting within the state. The 96 Alabama form complements Form A-2 by covering income avenues not encompassed by traditional employment, ensuring a comprehensive accounting of all taxable income within the state's jurisdiction.

Form A-3, the Annual Reconciliation of Alabama Income Tax Withheld, is also closely related. This form is pivotal for reconciling the amount of state income tax withheld from employees' pay with the actual amounts due. Importance arises when comparisons are made between forms that record payments made (like the 96 Alabama form) and those that reconcile taxes withheld on those payments (like Form A-3). The connection underscores a broader system of tax reporting and reconciliation, where the recording of income and withholding are critical steps towards accurate tax filing and compliance.

In conclusion, the 96 Alabama form plays a vital role within a network of documents designed to ensure accurate reporting, withholding, and reconciliation of income and taxes. Its parallels with federal and other state-specific forms highlight the interconnectedness of tax reporting practices and the precision required to maintain compliance and fiscal responsibility.

Dos and Don'ts

When completing the Form 96 for the Alabama Department of Revenue, it's essential to follow certain guidelines to ensure the process is done correctly and efficiently. Here's a compilation of things you should and shouldn't do:

- Do: Ensure all information is accurate, especially the Payer Social Security Number or Federal Employer Identification Number (FEIN), and the total number of Form 99s attached.

- Do: File Form 99 or an approved substitute for every resident individual, corporation, association, or agent making payments of $1,500.00 or more in any calendar year to any taxpayer subject to Alabama income tax.

- Do: File the Form 96 with the Alabama Department of Revenue by March 15 of the year following the calendar year that the payments were made.

- Do: Consider attaching copies of federal Form 1099 as a substitute, if applicable.

- Do: Double-check the address and ensure it matches the current Alabama Department of Revenue Individual & Corporate Tax Division address to avoid any mailing issues.

- Don't: Use Form 96 if Alabama income tax has been withheld on Form 99; in such cases, Form A-3 (Annual Reconciliation of Alabama Income Tax Withheld) should be used instead.

- Don't: Forget to include your signature and title at the bottom of the form, as it validates the accuracy and completeness of the information provided.

- Don't: File the form late. Remember that late submissions may result in penalties and delays in processing.

- Don't: Overlook the importance of keeping a copy for your records. Having a copy can assist in resolving any future discrepancies or questions.

Adhering to these recommendations can considerably streamline the filing process, ensuring compliance with Alabama's Department of Revenue requirements. It's always better to be thorough and cautious when dealing with tax documentation to prevent any potential issues that could arise from inaccuracies or omissions.

Misconceptions

Misconceptions about the Form 96 for Alabama can lead to confusion among those required to file it. Explained below are some common misunderstandings:

- The Form 96 is required for all payments: Actually, the form is specifically for reporting gains, profits, or income of $1,500.00 or more. Payments below this threshold or of different natures are not reported on this form.

- Interest payments must always be reported: Interest coupons payable to bearer are not required to be reported on Form 96, contrary to what some may believe.

- Only individuals need to file Form 96: This is not the case. In addition to individuals, corporations, associations, or agents are also required to file if they make qualifying payments.

- You cannot substitute Federal forms: A common misconception is that filers must use Form 96 uniquely. However, copies of federal Form 1099 can be filed with the Alabama Department of Revenue in place of Form 99, which is attached to Form 96.

- Form 96 is for reporting Alabama income tax withheld: Actually, if Alabama income tax has been voluntarily withheld, Form A-3, not Form 96, is the appropriate form to use for reconciliation of Alabama income tax withheld.

- Employers must use Form 96 for employee payments: Employers reporting salaries and wages through Form A-2 are not required to report the same payments on Form 99, which relates to Form 96.

- There is no deadline for filing Form 96: Filers must submit Form 96 by March 15 of the year following the calendar year in which the payments were made. Timelines are critical to avoid penalties.

- Any format of Form 96 is acceptable: The form, including any substitutes like Federal Form 1099, must meet the requirements set by the Alabama Department of Revenue. Submission of incorrectly formatted forms may result in them being rejected.

- All businesses in Alabama need to file Form 96: Only those making qualifying payments to taxpayers subject to Alabama income tax are required to file, which excludes many businesses not making such payments.

Understanding these points ensures that those making payments of $1,500 or more to individuals, corporations, or associations subject to Alabama income tax are well-informed about their filing responsibilities and avoid common mistakes when dealing with Form 96 and its related documents.

Key takeaways

When managing or submitting the Form 96 in the state of Alabama, individuals and businesses must keep several key points in mind to ensure compliance and accuracy in their tax-related duties. These key takeaways will guide you through the necessary steps and requirements for filling out and using this form effectively.

- Identify applicable payers: Form 96 is specifically designed for resident individuals, corporations, associations, or agents in Alabama who make payments of gains, profits, or income totaling $1,500.00 or more within a calendar year to a taxpayer.

- Reporting exceptions: Payments related to salaries and wages where Form A-2 is filed do not need to be reported on Form 99, which is associated with Form 96 for reporting purposes.

- Voluntary withholding: If Alabama income tax has been voluntarily withheld from payments that would otherwise be reported on Form 99 or an approved substitute, it is mandatory to file regardless of the payment amount.

- Alternative reporting: Copies of the federal Form 1099 can be filed with the Alabama Department of Revenue as an alternative to filing Form 99.

- Annual submission timeline: Information returns must be filed for each calendar year no later than March 15 of the following year, ensuring that all information reflects payments made during the calendar year.

- Correct form for tax withheld: If Alabama income tax has been withheld, Form 96 should not be used; instead, Form A-3, Annual Reconciliation of Alabama Income Tax Withheld, is the appropriate form.

- Submission address: Completed forms, along with any applicable documentation, should be mailed to the Alabama Department of Revenue, Individual & Corporate Tax Division, at the specified P.O. Box in Montgomery, AL.

- Record accuracy: Ensuring the accurate reporting of the payer’s information, including the Social Security Number or FEIN, address, and the total number of Form 99s attached, is crucial for compliance and to avoid potential penalties.

Adherence to these key points not only aligns with regulatory requirements but also facilitates a smoother process for payers fulfilling their tax obligations in Alabama.

Check out Popular PDFs

Montgomery County Revenue Business Privilege Tax Alabama Online Payment - Reminds corporations of the legal implications of document accuracy, underscoring the gravity of truthful tax filing under penalty of perjury.

Free Al - File an initial, amended, or final tax return for a decedent's estate, trust, or bankruptcy estate using Alabama Form 41.